Decades-Long Passion for Helping Turn Retirement Dreams Into Reality

Celebrating 20 Years of Target Date Leadership

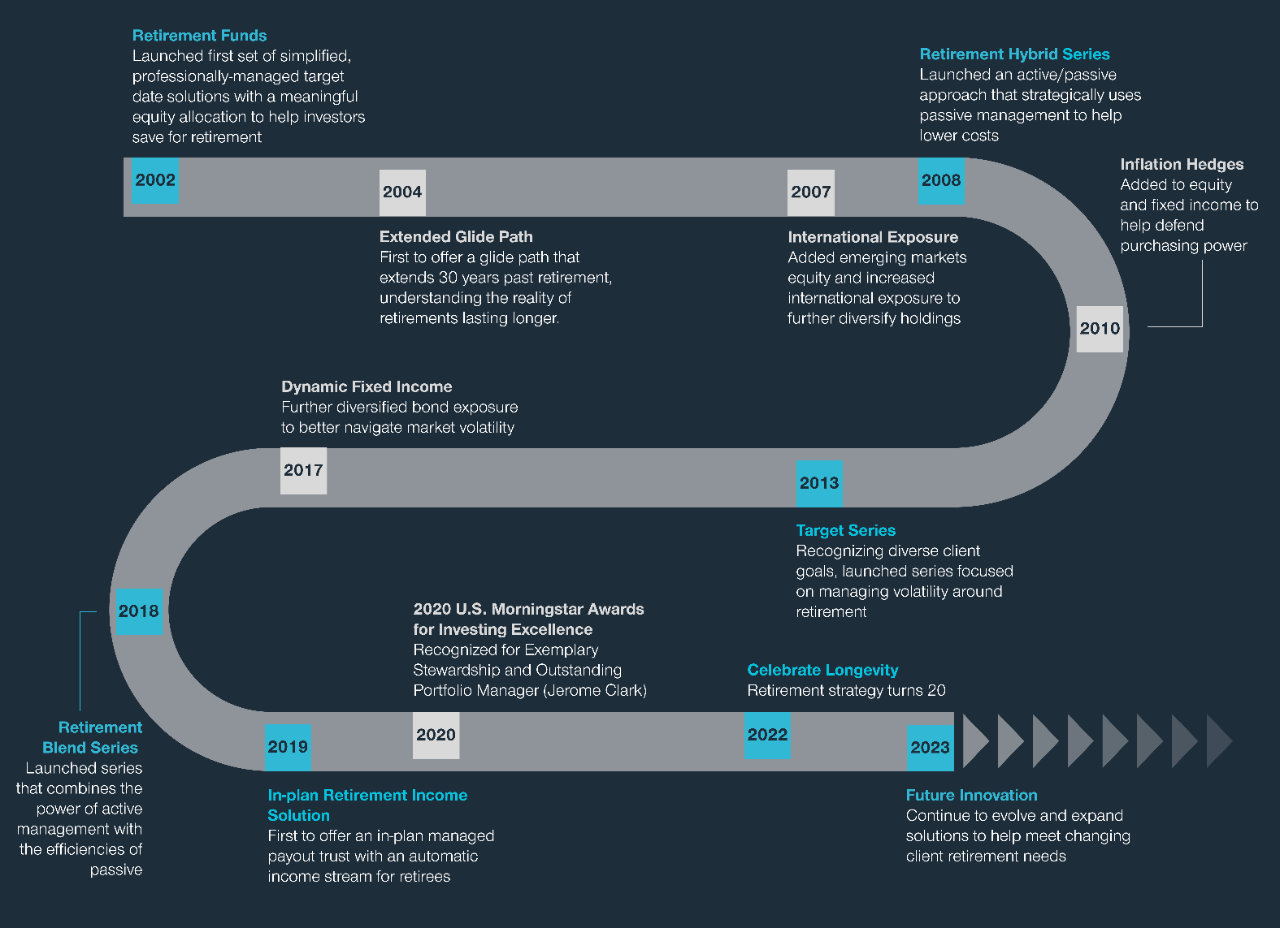

A History of Client-Driven Innovation

Even before launching our first Retirement Fund in 2002, we were dedicated to designing solutions to meet unique and evolving retirement goals. Steeped in research, informed by experience, and driven by an unwavering commitment to do what is best for our clients, our target date solutions are built to help put participants on their best path to retirement.

“... an example of T. Rowe Price's continuing efforts to provide the best products, services, and fees to its clients and plan participants.”

–Client satisfaction survey, Chatham Partners, 2021

“The client wanted access to quality funds. T. Rowe Price's target date funds are outstanding.”

–Win-Loss Study, Chatham Partners, 2020

Contact your T. Rowe Price representative to find out how we can take your plan to the next level.

Important Information

Some strategies mentioned are available only to certain retirement plans and may not be available to all investors.

Diversification cannot assure a profit or protect against loss in a declining market.

Morningstar Awards 2020©. Morningstar, Inc. All Rights Reserved. Morningstar presents the Exemplary Stewardship Award to an asset manager that has shown an unwavering focus on serving the best interests of investors. Morningstar’s manager research analysts conduct in-depth qualitative analyses in order to select nominees and, subsequently, vote to determine the award winner. To qualify for the award, the firm must have received a Parent pillar rating of "positive" or, if one or more of its strategies have been rated under the enhanced ratings methodology launched in November 2019, “High.” The Parent pillar rating measures the quality of the firm's care of investors' capital. The firms must demonstrate an investor-focused corporate culture and an alignment of interest between investors and the people who control the destiny of the investment strategies.

The Morningstar Awards for Investing Excellence winners are chosen based on research and in-depth qualitative evaluation by Morningstar's manager research group. Each year, Morningstar recognizes an Outstanding Portfolio Manager, an individual or team who has produced exceptional returns over the long term. Morningstar’s manager research analysts conduct in-depth qualitative analyses in order to select nominees and subsequently, vote to determine the award winner. To qualify for the award, the manager's strategy must currently earn a Morningstar Analyst Rating™ of Gold or Silver for at least one vehicle and/or share class. For more information about Morningstar Awards, visit https://go.morningstar.com/Morningstar-Awards.

Effective January 1, 2021, Jerome Clark stepped down as co-portfolio manager and cochairman of the funds' Investment Advisory Committee and transitioned from his role as portfolio manager to a new role within the firm.

©2022 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

202210-2520845

All investments involve risk, including possible loss of principal.

The principal value of the Retirement Funds and the Target Funds (collectively, the “target date funds”) is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the fund. If an investor plans to retire significantly earlier or later than age 65, the funds may not be an appropriate investment even if the investor is retiring on or near the target date. The target date funds’ allocations among a broad range of underlying T. Rowe Price stock and bond funds will change over time. The Retirement Funds emphasize potential capital appreciation during the early phases of retirement asset accumulation, balance the need for appreciation with the need for income as retirement approaches, and focus on supporting an income stream over a long-term postretirement withdrawal horizon. The Target Funds emphasize asset accumulation prior to retirement, balance the need for reduced market risk and income as retirement approaches, and focus on supporting an income stream over a moderate postretirement withdrawal horizon. The target date funds are not designed for a lump-sum redemption at the target date and do not guarantee a particular level of income. The key difference between the Retirement Funds and the Target Funds is the overall allocation to equity; although they each maintain significant allocations to equities both prior to and after the target date, the Retirement Funds maintain a higher equity allocation, which can result in greater volatility over shorter time horizons.

The T. Rowe Price Retirement Trusts (Trusts) are not mutual funds. They are common trust funds established by T. Rowe Price Trust Company under Maryland banking law, and their units are exempt from registration under the Securities Act of 1933. Investments in the Trusts are not deposits or obligations of, or guaranteed by, the U.S. government or its agencies or T. Rowe Price Trust Company and are subject to investment risks, including possible loss of principal. For additional information on the common trust funds being offered, including a trust fact sheet, please call T. Rowe Price.

The Trust’s Income Class pursues an asset allocation strategy designed to support a stream of regular monthly payments throughout retirement along with some portfolio growth. While the Trust endeavors to minimize depletion of investment principal over time, in a year when the portfolio return of the Trust is less than what is scheduled to be distributed under the managed payout program that year, the payout you receive can include investment principal.