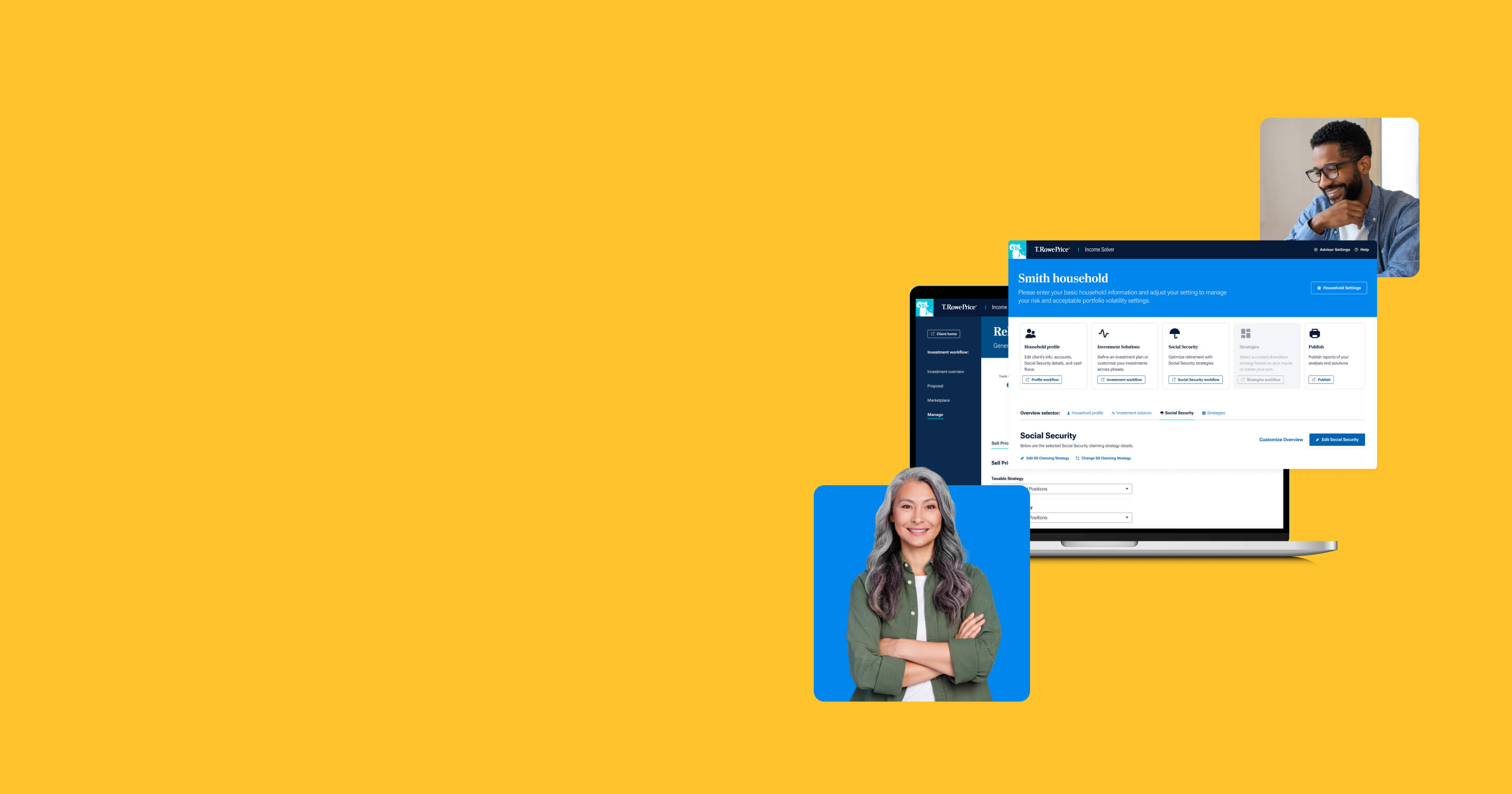

Extend retirement income up to 7 years with Income Solver®

Outsmart conventional planning with Income Solver—an industry-recognized software that simultaneously optimizes withdrawals, Social Security, and investments into a comprehensive retirement income plan for your clients.

Income Solver is offered by Retiree Inc., a wholly owned subsidiary of T. Rowe Price Group, Inc.

Let's build a confident practice together: Discover how Retiree Inc.'s Income Solver Software can differentiate your practice and help improve your client's retirement plans.

Rally on or running out of steam?

Join Sébastien Page, T. Rowe Price’s head of Global Multi-Asset and CIO; moderator Christina Noonan, multi-asset portfolio manager; and our special guest David Giroux, CIO of T. Rowe Price Investment Management, as they share perspectives on where markets may head next.

Gain an edge with our best thinking on investments, markets, and retirement

Market shifts. Global news. Retirement trends. Our experts distill the latest movements in the financial world into actionable insights.

Oil and Gas: The Persistent Role for Fossil Fuels

T. Rowe Price experts explore how oil, gas, and innovation drive energy markets and why understanding cycles matters.

Explore what's ahead, what's most important, and how our investment teams are responding now.

Go beyond indexes with Active ETFs

Along with convenience, cost effectiveness, and tax efficiency, our ETFs offer the agility of active management to adapt to changing markets.

Discover investments you can be confident in

Support your clients' goals with a global range of actively managed strategies.

Capital Appreciation Fund

The fund seeks long-term capital appreciation by investing primarily in common stocks. It may also hold fixed income and other securities to help preserve principal value.

QM U.S. Bond ETF

The fund seeks to provide a total return that exceeds the performance of the U.S. investment-grade bond market.

Explore all products and vehicles with our Investment Research Tool.

Set your practice apart

Discover new ways to refine and grow your practice—including client acquisition, client engagement, and business management resources.

Your investment process.

Our expertise.

Refine holdings, build models, adjust portfolios, or inform investment decisions with proven multi-asset expertise from an industry leader. We're ready to help you pursue better outcomes for your clients.

Contact us

Important Information

Risk Considerations: All investments are subject to market risk, including the possible loss of principal. The value approach carries a risk that the market will not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Past performance cannot guarantee future results.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

202601-5130867