401(k) Plan Participants Report More Confidence

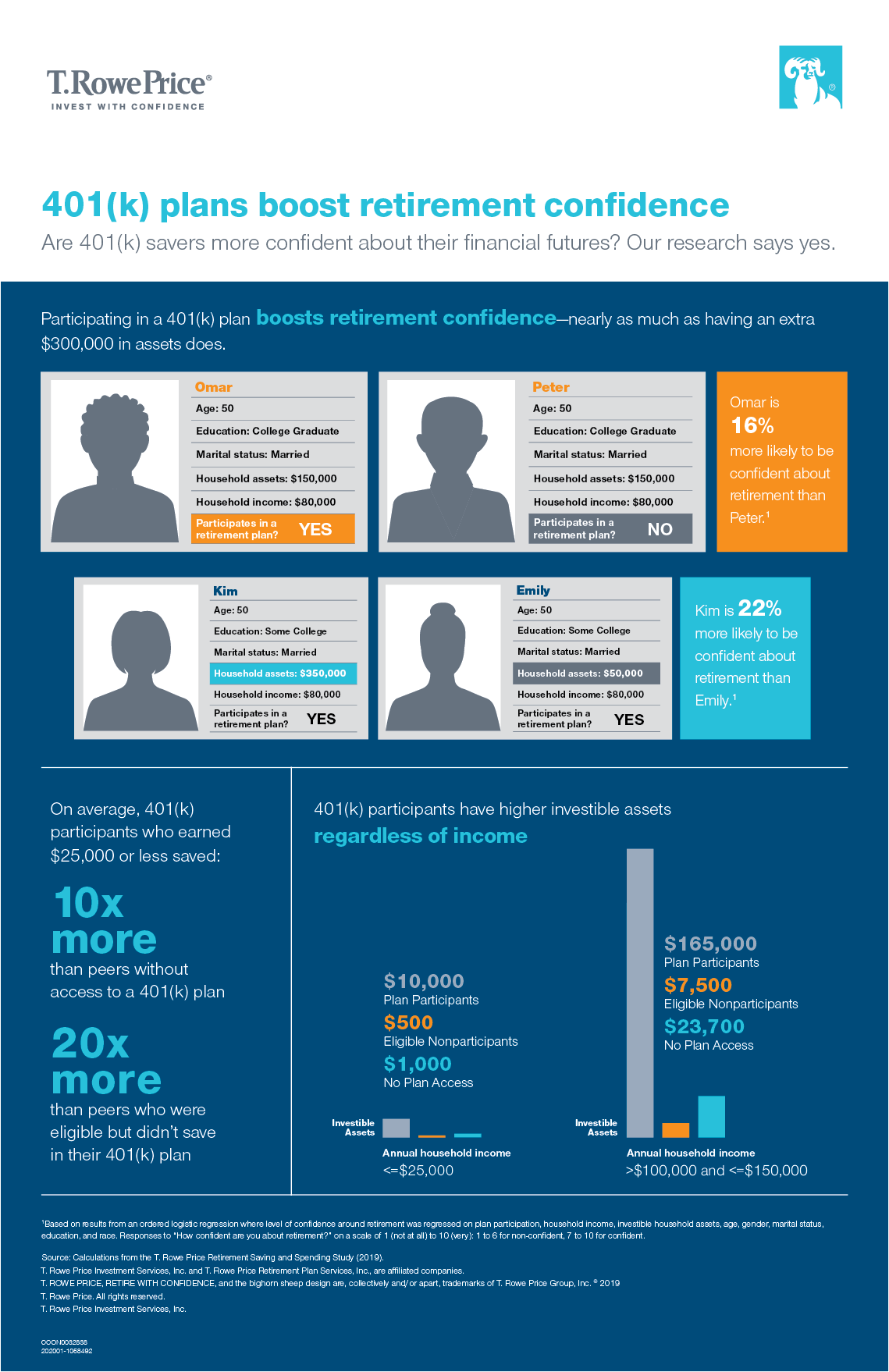

People who participate in 401(k) plans are 16% more likely to be confident about their retirement.

Key findings:

- People who participate in 401(k) plans are more confident about their financial futures than those who don't participate or don't have access to a plan—regardless of income or assets.

- Low-income households save more if they participate in a retirement plan.

- People who choose not to participate in workplace savings plans struggle more financially than those who don't have access to workplace savings plans.

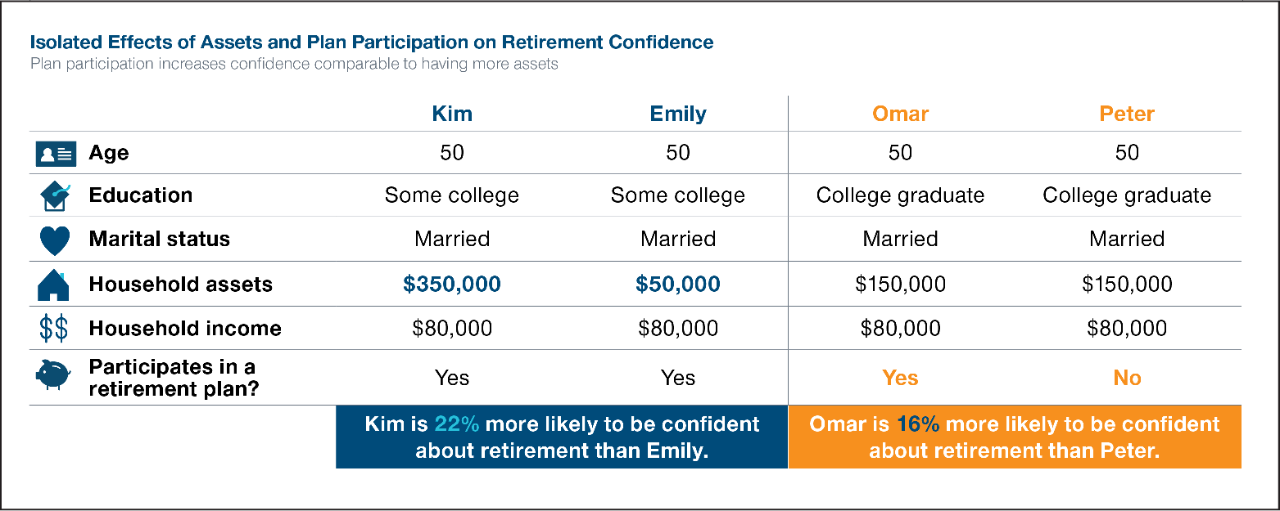

Plan participation leads to greater retirement confidence

Our research found that people who participate in a 401(k) plan are 16% more likely to be confident about their retirement than those who don't participate (even though they are eligible) or don't have access.1

1Based on results from an ordered logistic regression where level of confidence around retirement was regressed on plan participation, household income, investible household assets, age, gender, marital status, education, and race. Responses to "How confident are you about retirement?" on a scale of 1 (not at all) to 10 (very): 1 to 6 for non-confident, 7 to 10 for confident.

The Kim and Emily example shows that the effect of plan participation on confidence is only slightly less than having $300,000 more in assets.

“Among those making $25,000 or less, 401(k) participants saved 10 times more on average than peers without access to a plan and 20 times more than those who have access to a 401(k) but choose not to participate.” -- Sudipto Banerjee, Ph.D.

Vice President, Retirement Thought Leadership

Participants benefit from years of saving and healthy financial habits

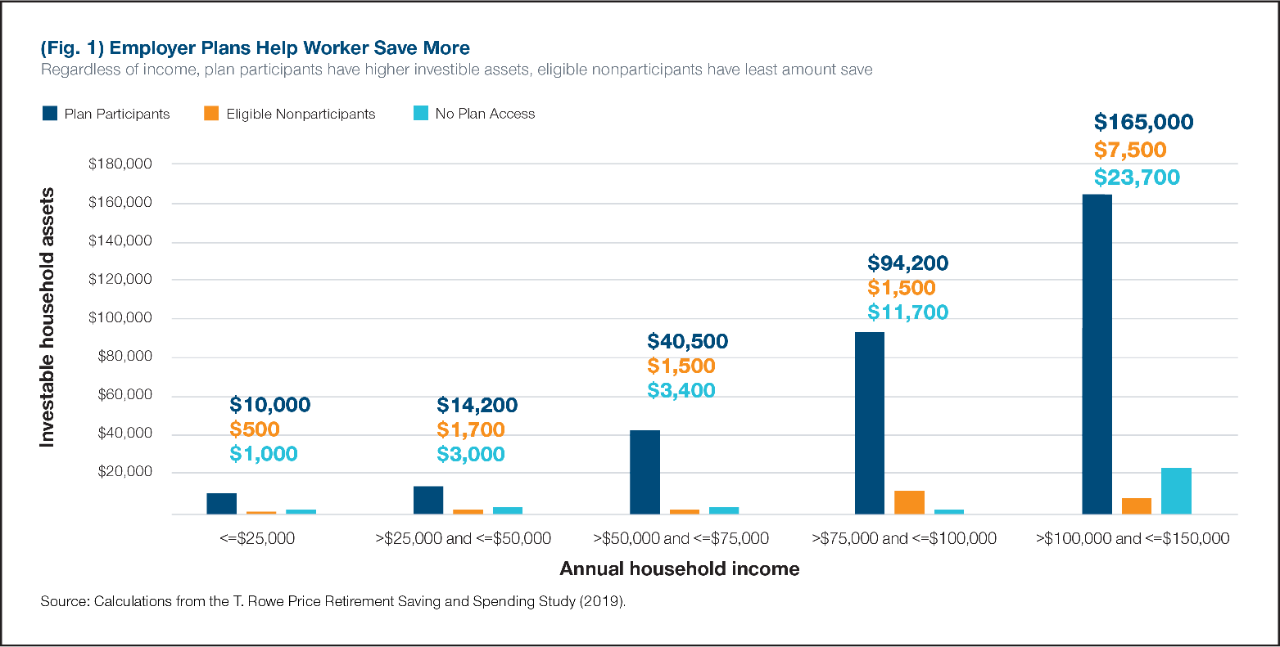

Retirement plans play a pivotal role in setting a savings foundation in place. Even low-income participants are able to accumulate more savings than their non-saving peers (people who are eligible but don’t participate or those without plan access).

We looked at participants, eligible nonparticipants, and those without plan access who are within the same income range and examined their savings behavior.

401(k)s facilitate higher savings, even among low-income households

Even low-income participants accumulate substantially greater savings than their non-saving peers. Among those making $25,000 or less, 401(k) plan participants saved 10 times more on average than peers without access to a plan and 20 times more than those who have access to a 401(k) plan but choose not to participate.

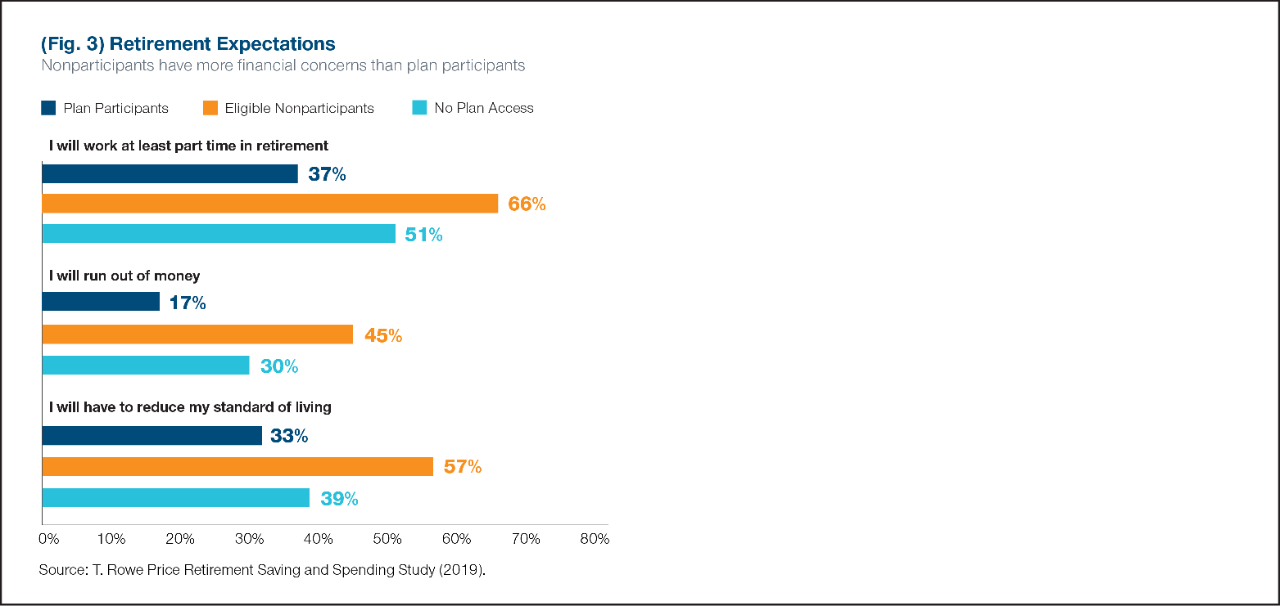

Eligible nonparticipants have more financial concerns about retirement

Individuals who were eligible for but not saving in a retirement plan reported more financial concerns about retirement, saying that they were worried about running out of money, needing to reduce their standard of living, and having to work at least part-time in retirement.

About Our Study

The Retirement Saving and Spending Study was conducted by NMG Consulting and included a sample of 3,016 retirement plan participants, 250 eligible non-plan participants, and 603 individuals without access to workplace savings plans. The survey was conducted online from June 13–25, 2019.