Financial wellness

Financial wellness

Financial Wellness Solutions.

Tailored for each plan.

Making retirement saving accessible for all by addressing the real-life challenges that stand in the way.

Helping participants overcome everyday financial challenges

We recognize that unexpected expenses and daily financial stress can make it difficult for participants to prioritize saving for the future. That's why we we offer holistic solutions and personalized support.

of participants taking T. Rowe Price’s Financial Wellness Assessment have less than six months of emergency savings.1

of U.S. retirement savers describe themselves as "very financially stressed."2

of participants rely a great deal on the company that manages their workplace retirement plan(s).3

Deliberately built to help participants prosper

Our financial wellness solutions put choice at the center, combining the flexibility and personalization that each plan needs. We also pair our proprietary solutions with benefit providers to create an integrated experience, bringing greater meaning to the participant’s holistic financial picture.

Financial foundations

- Emergency savings solutions

- Student debt management solutions

- Budgeting resources

Saving and investing

- Health Savings Accounts

- Personalized Retirement Manager

- Third-party advice solutions

Retirement transition

- Managed Payout Program

- Managed Lifetime Income

Financial foundations

Emergency savings solutions

Are unexpected expenses derailing your employees? We offer three options that give you the flexibility to create the best experiences for your employees while giving them the ability to prepare. Our in-plan emergency savings accounts are believed to be an industry first.

Student debt management

With $1.77T total student loan debt in the U.S., many employees are facing a tall financial hurdle when saving for their retirement. Our student debt management resources can help them take control of their money today—so they can look ahead to tomorrow.

Budgeting resources

We understand that retirement saving is part of an overall financial plan. Our interactive assessments and calculators help with budgeting along with SmartDollar, an optional, fee-based employee financial wellness benefit created to inspire lasting behavior change.

Saving and investing

Health Saving Accounts (HSAs)

HSAs offer a tax-advantaged way to save for qualified medical expenses that’s on an advanced technology platform. With an integrated web and mobile experience, participants can better strategize and prepare for today and tomorrow. We offer our integrated HSA solution through two providers:

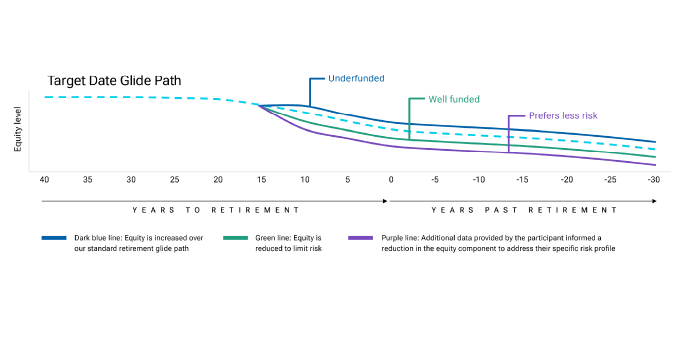

Personalized Retirement Manager

This service uses personal data to create a unique asset allocation tailored to a participant’s specific savings goals, preferences, and financial situation to help drive better retirement outcomes. The fully personalized glide path continues to adjust throughout a participant’s retirement savings journey.

Third-party advice solutions

We understand that the majority of plan participants want help making retirement saving and investing decisions. We also know that no two plans are alike. That’s why we offer connectivity to independent third-party advice providers Morningstar Investment Management LLC or Edelman Financial Engines.

Retirement transition

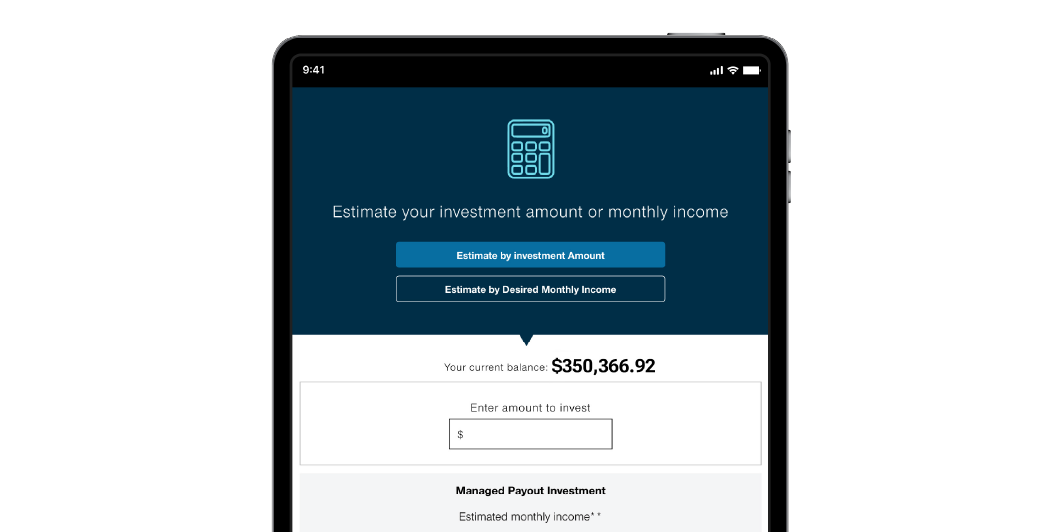

Managed Payout Program

Figuring out how to convert a lifetime’s worth of savings into income can be a challenge for many participants in or nearing retirement. To ease the transition, some of our target date trust suites include a managed payout unit class (or Income Class), which provides predictable monthly payments to retirees.

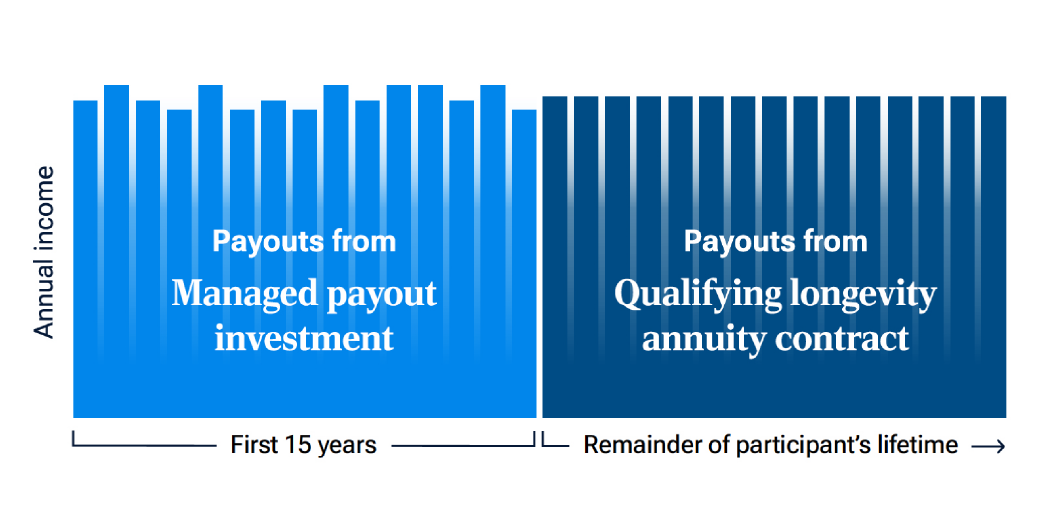

Managed Lifetime Income

A retirement income solution that’s built to last. This solution combines a managed payout investment with a qualifying longevity annuity contract (QLAC) to generate a consistent income stream throughout retirement. It’s a good option for those concerned about outliving their retirement savings.

Contact us — we're here to help

Find your sales representative

Our sales representatives around the country are ready to help answer your questions.

Are you a plan sponsor?

Please contact your T. Rowe Price representative.

If you are having technical issues, call your T. Rowe Price representative, or call tech support at 1-800-639-8552 to report or resolve the issue.

Are you a plan participant?

Call our 24-hour automated Plan Account Line. Representatives are available Monday to Friday, 7 a.m. to 10 p.m. ET.

Important Information

1Source: T. Rowe Price, as of December 31, 2024.

2Source: T. Rowe Price, 2025 Global Retirement Savers Study. Base: U.S. (n=3,001). Q: How would you rate your overall level of financial stress on a scale from 0 to 10, where 0 is not stressed at all and 10 is extremely stressed? 1Percent reflects ratings 7–10.

3Employee Benefit Research Institute (EBRI). 2024 Retirement Confidence Survey. Published April 2024.

202512-4741272