Retirement Ecosystem

Retirement Ecosystem

Flexible solutions. Built on our target date expertise.

Discover the power of choice and personalization for participant retirement investing.

Our Retirement Ecosystem

We understand that no one solution will meet the needs of all participants. So, we offer a choice of simple, cost-effective solutions to match their specific goals—all built on the foundation of our target date capabilities.

- Personalized Retirement Manager

- Managed Payout Program

- Managed Lifetime Income

-add transcript-

Personalized Retirement Manager

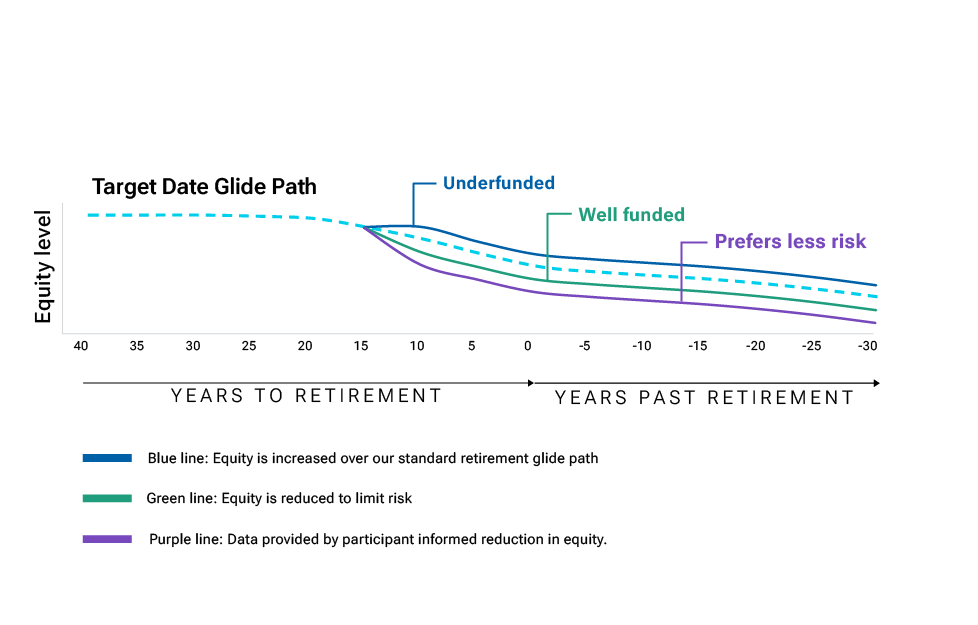

For participants approaching retirement, Personalized Retirement Manager uses personal data to create a unique asset allocation tailored to their specific goals, preferences, and financial situation.

Drive better outcomes with personalized retirement portfolios.

Managed Payout Program

For participants wanting predictable monthly income in retirement, the Managed Payout Program adds a managed payout unit class to some of our target date trust suites.

Create a true one-stop shop for retirement investing by combining the convenience of managed payouts with a familiar, age-based, diversified retirement portfolio.

Managed Lifetime Income

For participants concerned about outliving their retirement savings and maintaining liquidity, Managed Lifetime Income combines a managed payout investment with a qualifying longevity annuity to generate consistent income.

Provide confidence through guaranteed1 income, along with the same investment management team and cost structure as our target date solutions.

Retirement income insights

items

A five-dimensional framework for retirement income needs and solutions

A new tool to help DC plan sponsors evaluate retirement income solutions for their participants.

Age, evolving allocation preferences, and the case for personalized solutions

Personalized strategies can meet the diverse needs of aging investors.

Make it personal: The next chapter for target date solutions

With advances in technology, target date solutions can evolve to address individual needs as investors approach retirement.

Drawdown with annuities can balance retirement income and liquidity

Plan sponsors are exploring annuities to help recreate a paycheck-like experience in retirement.

Keeping participants focused on the future

Our entire participant experience is designed to help those nearing retirement. In addition to our Retirement Ecosystem solutions, we offer tools and services that are:

Personalized

- Distribution center

- Education, including our award-winning SmartVideos

Retiree-focused

- Preretiree workshops

- Confidence Check-in® conversations

- Confidence Number

Interactive

- Retirement income planner

- Social Security Optimizer

1 Guarantee subject to the claims-paying ability of the issuer.

T. Rowe Price Personalized Retirement Manager is a discretionary managed account service provided by T. Rowe Price Associates, Inc., a registered investment adviser, and is intended for citizens or legal residents of the United States or its territories. T. Rowe Price Associates, Inc., and T. Rowe Price Retirement Plan Services, Inc., are affiliated companies. For additional information about the service, including fees and expenses, please review the Price Associates Form ADV Brochure, Brochure Supplement(s), and PRM Plan Sponsor Investment Advisory Agreement.

The T. Rowe Price Retirement Trusts (Trusts) are not mutual funds; rather, the Trusts are operated and maintained so as to qualify for exemption from registration as mutual funds pursuant to Section 3(c)(11) of the Investment Company Act of 1940, as amended. The Trusts are established by T. Rowe Price Trust Company under Maryland banking law, and their units are exempt from registration under the Securities Act of 1933. Investments in the Trusts are not deposits or obligations of, or guaranteed by, the U.S. government or its agencies or T. Rowe Price Trust Company and are subject to investment risks, including possible loss of principal. For additional information on the common trust funds being offered, including a trust factsheet, please call T. Rowe Price.

The Trust’s Income Class pursues an asset allocation strategy designed to support a stream of regular monthly payments throughout retirement along with some portfolio growth. While the Trust endeavors to minimize depletion of investment principal over time, in a year when the portfolio return of the Trust is less than what is scheduled to be distributed under the managed payout program that year, the payout you receive can include investment principal.

Managed Lifetime Income is a plan distribution option that is a combination of a T. Rowe Price common trust fund that makes regular payments for 15 years and an annuity contract issued by an insurance company that is unrelated to T. Rowe Price Associates, Inc., but that T. Rowe Price Associates, Inc., assumes fiduciary responsibility for selecting the annuity provider to use for lifetime income payments.

The Retirement Income Balanced Trust pursues an asset allocation strategy designed to support a stream of regular monthly payments for the first 15 years along with some portfolio growth. Payouts from the trust are managed with principal depletion in mind but with the expectation a principal balance will remain once the annuity contract begins payments after year 15 and can be reinvested.

T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

202510-4848085