- On U.S. Equity

- Offense and Defense—Health Care Offers Exposure to Both Worlds

- Few sectors offer defensive characteristics and attractive growth potential.

- 2023-07-05 23:23

- Key Insights

-

- Amid a more uncertain market environment, we believe health care is one of the few sectors that offer defensive attributes as well as attractive growth opportunities.

- Socioeconomic trends and the coronavirus pandemic are driving significant spending in health care—underpinning a potentially exciting period of innovation, consolidation, and optimization.

- The multifaceted, complex, and innovative nature of health care makes it a rich landscape for differentiated insights and fundamental, bottom-up stock selection.

Following a challenging year in 2022, during which both equity and fixed income markets delivered negative returns, financial markets have, so far, rebounded confidently in 2023. However, many of the root causes of recent uncertainty have not gone away, as inflationary pressure, elevated interest rates, mixed macroeconomic signals, and geopolitical concerns all persist. These risks create a more uncertain environment and make appealing growth opportunities harder to find. Given this market backdrop, there are few sectors that offer both important defensive characteristics and also the opportunity to achieve target investment growth thresholds. We believe health care is one such sector.

Health Care Is a Rare Investment Dichotomy

Health care has historically displayed relative resilience during periods of market uncertainty. This is due to the general inelasticity of demand for many health care products and services. Whatever might be happening in the wider economy, in good times and in bad, people still get sick, ensuring constant demand for hospital care, medical insurance, consumable products, and treatments for chronic conditions. This resilience was again displayed in what was a difficult 2022 market environment, in which the health care sector outperformed the broader S&P 500 Index by 15.8%.1

"…health care continues to offer attractive growth potential in the form of game-changing advancement in drug therapies and medical devices"

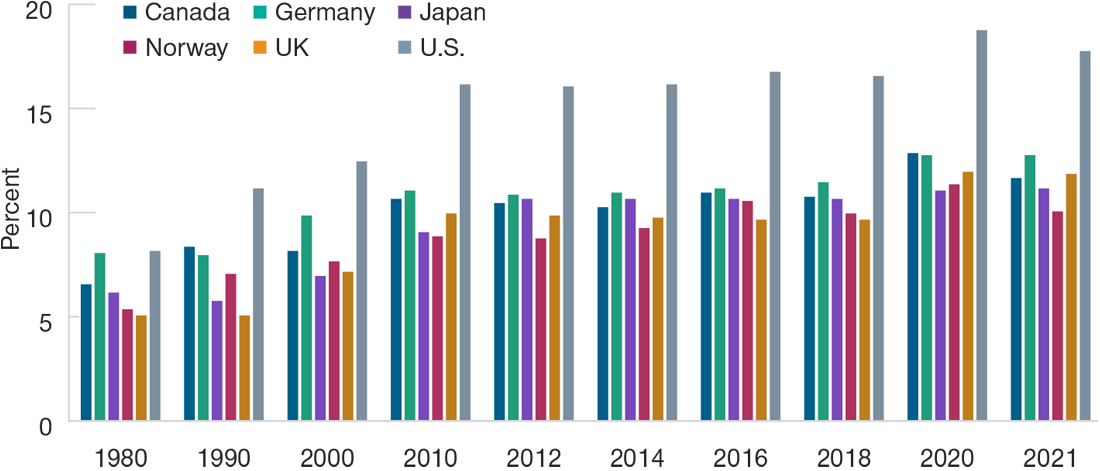

The U.S. Is a World Outlier in Terms of Health Care Spending

(Fig. 1) Percentage of national GDP spent on health care

As of June 2023 (latest data available to December 31, 2021).

Current expenditure on all health care functions, as a share of national gross domestic product (GDP).

Source: OECD Health Statistics.

At the same time, health care continues to offer attractive growth potential in the form of game‑changing advancement in drug therapies and medical devices. The most attractive companies in these fields not only command strong pricing power due to the innovative nature of their products, but patents and regulatory approvals also create clear barriers to entry.

Structural Growth in Spending

Structural socioeconomic trends also support continuing growth in health care spending. People are living longer, and the elderly population is growing, leading to increased consumption of health care products and services.

Advancements in technology and biological discovery are also resulting in increased health care provision, and the development of new treatments for unmet clinical needs has the potential to affect large patient populations.

The coronavirus pandemic served as a wake‑up call for global governments as national health systems—and hospitals in particular—came under immense strain. The U.S. was no exception, as the need for sufficient equipment in intensive care units and other health settings to avoid potentially catastrophic delays in diagnosing and treating patients was laid bare. The need for greater operational efficiency was also highlighted, most notably the technology infrastructure required to monitor population health more effectively, both in acute situations and longer term.

To strengthen the resilience of global health systems, significant, ongoing investment is required. Governments have been jolted into action by the pandemic, and we are seeing increased capital flows being allocated toward health care across a range of industries. This is positive for the sector and supportive of a potentially exciting period of innovation, consolidation, and optimization in this pivotal area of society.

A Complex and Multifaceted Landscape

From an investment perspective, we believe the health care universe is a rich landscape for differentiated opportunities—multifaceted, complex, innovative, and with a generally low historical correlation to global macro conditions. Within the broad diversity of the health care sector, three areas, or subsectors, currently look especially attractive, in our view, and, thus, warrant closer inspection.

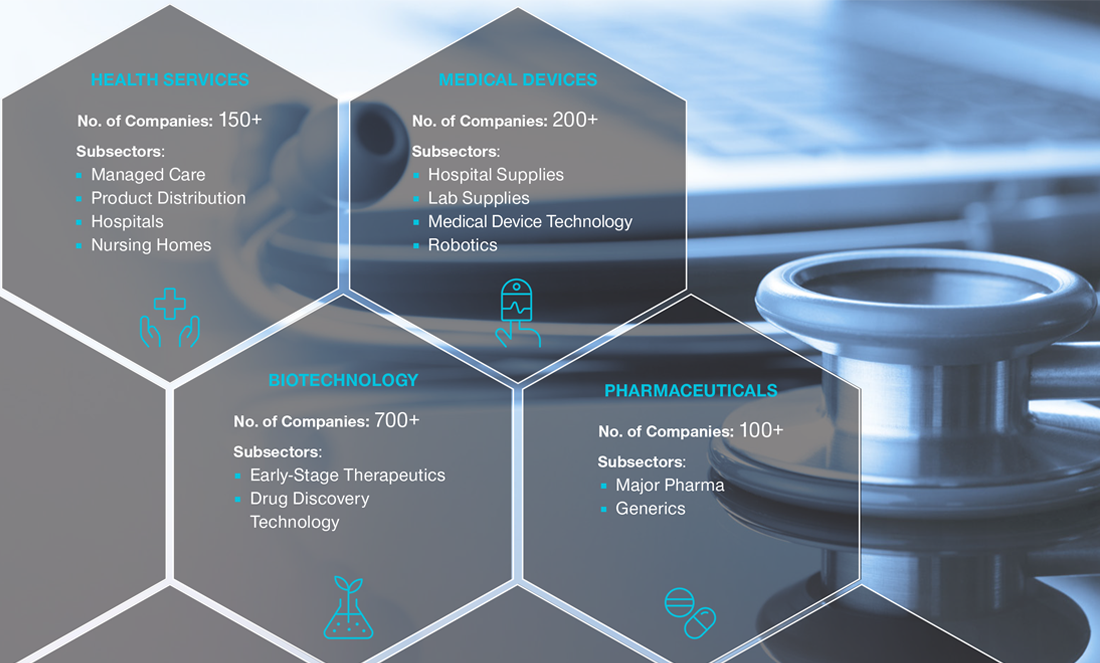

Health Care Subsectors Offer a Range of Investment Opportunities

Areas of particular interest

As of March 31, 2023.

Healthcare subsector characteristics apply to the U.S. market. For illustrative purposes only.

Source: T. Rowe Price.

Managed care—Within the health services sector we particularly like managed care companies, which are the providers of U.S. health insurance. These businesses are attractive, in part, due to their more defensive attributes but also because the market underappreciates the significant value that these companies can create. By contracting with a range of providers, such as hospitals, doctors, laboratories, and other specialist facilities, they can offer reduced health insurance rates to plan members while still maintaining quality of care. From an investment perspective, many of these companies are currently trading at valuation multiples that appear to substantially underestimate their durable growth potential.

Medical devices—A number of these companies are changing health outcomes through innovation, from insulin delivery for diabetic patients to robotic surgery. The influence of surgical robots in operating rooms, for example, is growing rapidly. Enhanced dexterity allows surgeons to operate in very tight spaces that would have previously only been accessible via open surgery. Surgical robots also help provide surgeons with greater precision and control of instruments, both of which lead to improved outcomes, faster recovery times, shorter hospital stays, and generally lower readmission rates. The percentage of surgeries conducted with robots is still relatively small, meaning the growth potential is significant.

Therapeutics—These companies are at the forefront of developing new drugs or therapies to improve patient care and health outcomes. Biotechnology, for example, is transforming the way diseases are treated. Research and development progress is ongoing, and commercial success is also a feature, despite the more challenging macro conditions impacting more cyclical sectors. Some of the companies reporting excellent clinical data updates are attracting investor attention and being rewarded with large share price moves. Larger pharma companies are also seeking opportunities to acquire biotech companies for their products and technologies. These fundamental trends arguably have only been strengthened by the emergence of the coronavirus pandemic.

Election Year Uncertainty Is a Risk

The outlook for health care is not without risks, however. One of the key near‑term risks is the U.S. presidential election in 2024. Election years are typically a source of considerable uncertainty for the health care sector. Not only is the eventual presidential winner unknown, often the candidates who are running are not known until late in the race. The potential variance in health care policies, not only between the Republican and Democratic parties, but also between candidates within each party, can be significant, creating major uncertainty, particularly within the managed care industry, in the lead‑up to the election.

Looking Forward

The macroeconomic environment looks set to be challenging through the remainder of 2023 and beyond. Health care, however, tends to be less cyclically sensitive, and its defensive characteristics should help the sector weather any slowdown in the broader economy.

The diversity of health care also makes it a particularly rich landscape from a stock selection perspective—we see exciting opportunities from innovation in the areas of therapeutics and medical devices, to the rapid adoption of new technology and care delivery models, to the defensive growth characteristics of the managed care industry.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to global equities.

-

1 S&P Health Care Sector (Total Return) Index vs. S&P 500 (Total Return) Index, period January 1, 2022, to December 31, 2022.

Past performance is not a reliable indicator of future performance.

Source: Financial data and analytics provider FactSet. Copyright 2023 FactSet. All Rights Reserved.

Growth stocks are subject to the volatility inherent in common stock investing, and their share price may fluctuate more than that of a income-oriented stocks. Health sciences firms are often dependent on government funding and regulation and are vulnerable to product liability lawsuits and competition from low-cost generic product. All investments are subject to market risk, including the possible loss of principal.

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of July 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202311-3223783