- On Economics

- The World Faces a Highly Variable Inflation Outlook

- The U.S. and UK face a tougher challenge than the Nordics and eurozone.

- 2023-06-27 07:22

- Key Insights

-

- History shows that persistent inflation can be avoided if countries adopt inflation targeting measures while deregulating product and labor markets.

- Our analysis suggests that countries in the Nordic area and the eurozone are best placed to avoid persistent inflation today.

- The more favorable inflation dynamics of the Nordics and eurozone suggest the bonds of these countries will likely provide a better medium‑term real yield return.

The inflation spike of the past two years has been the worst since the 1970s. Back then, its persistence caused central banks to tighten monetary policy for extended periods, fueling bouts of asset price volatility. In response, many countries introduced reforms designed to make future inflation surges easier to bring down. Did these reforms work—or could we be facing a repeat of 1970s‑style persistent inflation?

Inflation Targeting Policies Have Been Effective in the Past

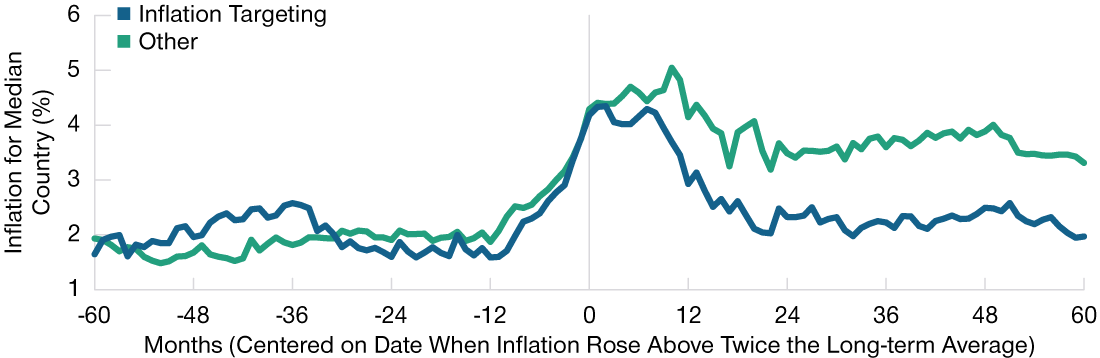

(Fig. 1) Countries that adopt them bring inflation down more quickly

As of March 31, 2023.

The blue line shows median inflation outturns in countries that had adopted inflation targeting before the inflation surge. The green line shows outturns for countries with alternative monetary policy regimes.

Long‑term average inflation is defined as the 5‑year average at time t=‑12 and has been scaled to 2% for illustrative purposes.

Sources: Cobham, David. “A comprehensive classification of monetary policy frameworks in advanced and emerging economies,” IMF, OECD, Haver, T. Rowe Price.

The reforms introduced following the experience of the 1970s included changes to product market regulations to foster more price competition for goods and services, monetary reforms that granted independence to central banks and set inflation as the sole target for monetary policy, and measures to encourage greater labor market participation and reduce second‑round wage inflation. The current bout of inflation is the biggest test these reforms have faced since their introduction.

To test how well they are likely to stand up to the challenge, we studied 89 inflation surges across 40 countries from 1970–2019. Our aim was to better understand which economic factors raise the risk of second‑round effects and greater inflation persistence. We define an inflation surge as an episode in which inflation is at least double its five‑year average value in a particular country.

Our analysis shows that countries that adopted inflation targeting, deregulated labor and product markets, and had both high unemployment relative to history and high labor force participation relative to trend rates saw inflation return to previous long‑term averages within 16–22 months. Countries that did not adopt these measures, and that had low unemployment and low labor force participation rates, were more likely to see inflation persist over a longer period (Figure 1).

"...the Nordic and eurozone regions are the least likely to experience persistent above‑target inflation...."

— Tomasz Wieladek, Chief European Economist

Nordic and Eurozone Regions Least Likely to Suffer Persistent Inflation

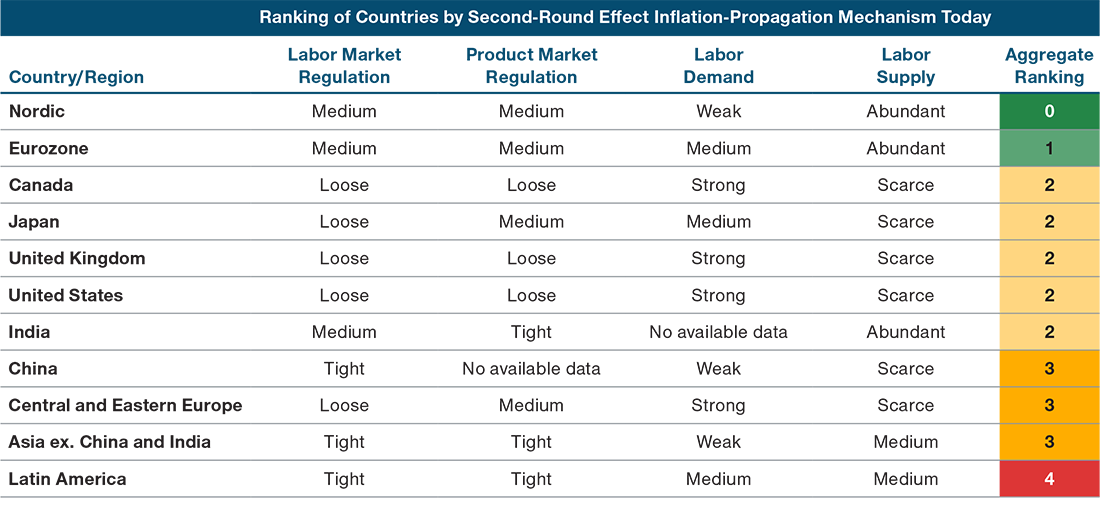

(Fig. 2) Emerging markets most at risk

As of March 31, 2023.

Note: We use unemployment rate relative to long‑term average as our indicator of labor demand and the labor force participation rate as a deviation from trend as an indicator of labor supply. A high unemployment rate relative to long‑term average indicates weak labor demand, while a high labor force participation rate relative to trend indicates abundant labor supply. A higher number on the aggregate ranking reflects stronger propagation and second‑round inflation risks.

Sources: IMF, OECD, Haver, T. Rowe Price.

What does this imply for the path of inflation in different countries today? We ranked countries and regions across four factors: labor market regulation, product market regulation, labor demand, and labor supply (Figure 2). We found that the Nordic and eurozone regions are the least likely to experience persistent above‑target inflation because of strong labor supply (i.e., high labor force participation). Japan, the U.S., and the UK are more likely to experience above‑target inflation because of low labor force participation relative to trend. Emerging markets are most at risk of persistent inflation as these countries tend to have highly regulated product and labor markets in addition to labor market imbalances. Latin America, a region with a history of hyperinflation, has the highest risks of inflation persistence, according to our analysis. These results also hold true when Argentina is excluded, a country where year‑on‑year inflation was more than 100% in March.

"In emerging markets, monetary policy may have to remain restrictive for longer...."

— Aadish Kumar, International Economist

These differences in expected inflation persistence will have consequences for monetary policies in these countries and regions. The Nordic area and eurozone, for example, should be able to cut policy rates earlier than other developed markets. In emerging markets, monetary policy may have to remain restrictive for longer to get inflation back under control.

Over the past year, bonds have sold off significantly in response to the inflation surge across the world. Our analysis suggests that inflation will be least persistent in the Nordic countries and the eurozone. This means that long‑term bonds in these regions are likely to experience the largest rally, since central banks there will be able to cut policy rates faster. Sovereign bonds of these countries with the most favorable inflation dynamics will likely provide a better medium‑term real (inflation‑adjusted) yield return and also will offer the potential for a larger capital gain. Conversely, we would favor inflation‑linked bonds as a hedge against higher inflation in those developed markets more likely to experience persistent inflation, such as the UK.

In those emerging markets with the highest risk of high inflation persistence, our preference is to invest in hard currency‑denominated bonds. Several of these countries also face significant fiscal policy challenges and sometimes populist governments. In those countries, there is a risk of fiscal dominance, which means that central banks will be pressured to not hike interest rates to the levels necessary to return inflation back to their targets in the medium term. In these circumstances, local currency bonds are likely to underperform, which is why we prefer hard currency bonds instead.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to global equities.

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of June 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any forward‑looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Fixed‑income securities are subject to credit risk, liquidity risk, call risk, and interest‑rate risk. As interest rates rise, bond prices generally fall. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202306‑2941546