- On Environmental, Social, And Governance

- Assessing the ESG Implications of Russia’s Invasion of Ukraine

- Pressure to reduce dependence on Russian gas could expedite Europe’s energy transition.

- 2022-03-15 17:57

- Key Insights

-

- Oil and gas price shocks, in addition to the current scare over security of supply from Russia, could accelerate progress on the European Green Deal.

- It is very difficult to switch energy supply quickly without incurring higher costs and hurting the economy. However, the European Union (EU) is arguably better positioned to do so today than ever before.

- The EU can accelerate the growth of renewable energy but will have to take a pragmatic approach to phasing out legacy fuels.

Russia’s invasion of Ukraine is proving deeply concerning on many fronts. First and foremost is the unfolding humanitarian crisis and the impact on the well‑being of those caught in the midst of the conflict. The initiation and escalation of the conflict has elevated geopolitical tensions and rattled global markets as investors seek to evaluate the immediate‑ and longer‑term implications. With global commodity prices soaring, and concerns over social and human impacts intensifying, Europe and the world could experience far‑reaching reverberations across the environmental, social, and governance (ESG) landscape.

Fast‑Tracking Europe’s Transition to Renewables

Governments around the world have been setting out an unprecedented number of punitive sanctions on Russia in recent weeks. By the same token, investors and corporates concerned about the impacts of the conflict, including human rights violations, are increasingly rolling out their own restrictive measures toward Russia. While we continue to assess the evolving crisis and the overall ESG implications, one thing has become clear: The current conflict has the potential to accelerate the energy transition, particularly in Europe.

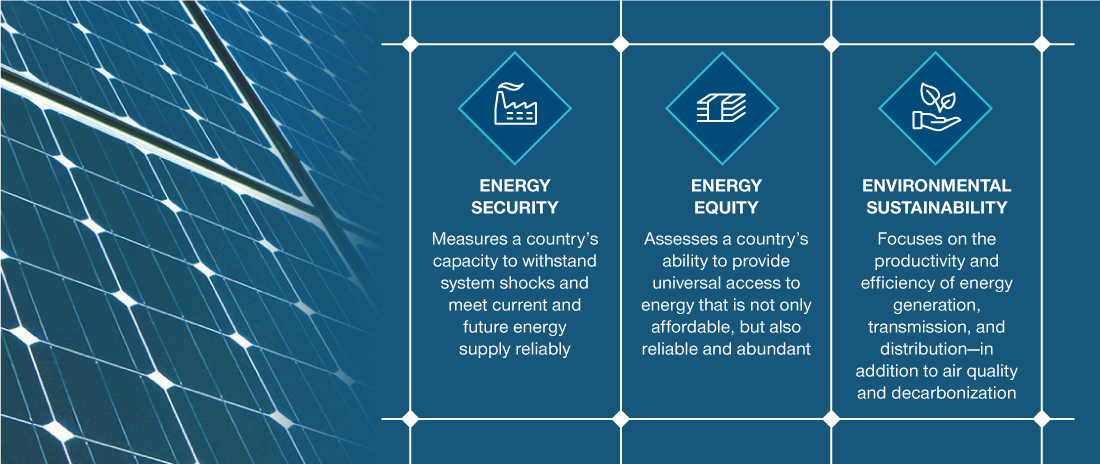

The stability of a nation’s energy systems is dependent on balancing three key—often conflicting—criteria, as defined by the World Energy Council’s World Energy Trilemma Index—which serves as an annual measurement of national energy system performances.1 These criteria include:

1. Energy Security: Measures a country’s capacity to withstand system shocks and meet current and future energy supply reliably.

2. Energy Equity: Assesses a country’s ability to provide universal access to energy that is not only affordable, but also reliable and abundant.

3. Environmental Sustainability: Focuses on the productivity and efficiency of energy generation, transmission, and distribution—in addition to air quality and decarbonization.

The Energy Trilemma: Striking a Balance

(Fig. 1) The stability of a country’s energy systems is dependent on balancing three key—and often conflicting—criteria

Source: The World Energy Council’s World Energy Trilemma Index.

As the World Energy Council highlights, managing and balancing the competing demands of this energy trilemma is a major challenge for countries worldwide. The first two criteria, covering energy security and energy equity, have previously served as arguments for Europe to delay the transition to renewables. The dependence on Russian energy was not treated as a major issue, with its cost advantage over renewables adding to its attraction. However, Russia’s decision to invade Ukraine has turned this on its head, potentially reducing the inherent tensions of the “energy trilemma” as a result of the conflict—making it a lot easier for Europe to promote the sustainable agenda through affordable and nationally produced renewables.

While the recent jump in the cost of oil and gas might be short‑lived, the security of supply scare won’t be. Russia accounts for 12% of global oil production and 18% of global natural gas production.2 Given its proximity, the EU’s dependence on Russian oil and gas supplies is much higher. In 2020, more than half of Russia’s oil exports and about 85% of its natural gas exports went to Europe.3

Crucially, this price shock—together with the security of supply scare from Russia—could potentially facilitate progression of the goal of the European Commission’s European Green Deal to achieve EU climate neutrality by 2050. The EU countries that have been most averse to passing the deal include some of those most vulnerable to Russia. Key developments include Germany’s recent decision to freeze the approval process for the Nord Stream 2 pipeline, which was set to double the volume of Russian gas to Germany.

It is very difficult to switch energy supply quickly without incurring higher costs and hurting the economy. However, the EU is arguably well positioned to do so today given the availability of economical non‑fossil fuel alternatives, more innovation in energy consumption patterns, concerns that foreign energy reliance could be used as a weapon, and consumer awareness of the climate and security crises.

This gives the EU another very strong reason to push the energy transition harder and faster. This will likely mean increased investing in renewables, but, perhaps more importantly, it could also mean investing in energy efficiency (such as smart appliances and green buildings), electrification, and other innovations.

Russia’s Natural Gas Exports by Destination, 2020

(Fig. 2) Europe is heavily reliant on Russian gas

As of December 13, 2021.

Percentages may not total 100 due to rounding.

The Organization for Economic Co-operation and Development (OECD) is an international policy forum that works to build policies to improve the economic and social well-being of people around the world.

Source: Graph by the U.S. Energy Information Administration, based on Russian export statistics and partner country import statistics from Global Trade Tracker and on delivery statistics from Gazprom.

Increasing Pragmatism Toward Legacy Fuels

While some countries have already started to reconsider their path to reducing reliance on Russian oil and gas following Russia’s invasion of Ukraine—they are going to have to be pragmatic about it. The EU’s energy problem has shifted from cyclical “energy inflation” to a more structural “energy insecurity” problem. Under the “energy inflation” scenario, it’s possible to weather the storm—with options such as subsidizing citizens, using CO2 tax proceeds, or charging windfall taxes to energy companies. A shift to “energy insecurity” mode means a change in behaviors, including a possible slowdown in the planned phase‑outs of legacy fuels such as coal, nuclear, and gas. For example, the German government had been opposed to the addition of nuclear energy as a transition fuel in the EU taxonomy, but recent reports suggest that Russia‑Ukraine events may have led them to reconsider.

"While some countries have already started to reconsider their path to reducing reliance on Russian oil and gas...they are going to have to be pragmatic about it."

The International Energy Agency (IEA) has recently suggested that the EU could reduce its reliance on Russian gas supplies by more than one‑third within a year. However, stepping back from Russian gas raises salient questions over whether there is an alternative to gas for building the base for electricity supply—until non‑fossil fuel alternatives can deliver.

In the immediate term, the EU could ramp up its utilization of liquified natural gas (LNG) regas capacity, in addition to other pipeline imports. As already mentioned, higher utilization of nuclear power, including extending the life of existing nuclear plants, is also a possible option to help reduce Europe’s dependence on Russian gas. Another decidedly non‑ESG option would be to keep coal plants open for longer. The situation would have to be extremely serious for the EU to go down this route, but it’s certainly not impossible.

In the long term, EU countries could look at general electrification across heating and transport, energy‑efficiency measures, and an increase in renewables and storage. The IEA has said that accelerating energy‑efficiency improvements in buildings and industry could reduce gas use by nearly 2 billion cubic meters within a year.

"There will undoubtedly be short‑term disruption, but the long‑term outlook for clean energy looks more positive."

Ultimately, the extent to which corporations and investors are setting out sanctions is likely to intensify as the situation worsens. Added to this, from an ESG‑integration point of view, is the potentially accelerative impact the developments could have on Europe’s energy transition. This could still take years to play out. There will undoubtedly be short‑term disruption, but the long‑term outlook for clean energy looks more positive. Reducing the EU’s reliance on Russia—as a major player in global commodity markets—would be no small feat. Nevertheless, there are multifarious ways in which Europe can become less dependent on Russia for gas and other raw materials. The EU can certainly ramp up the growth of renewables and other fossil‑free alternatives but will have to be thoughtful about changing the pace of phasing out legacy fuels—until renewables, hydrogen, and storage technology can reliably and economically deliver. If the problem has changed, the solution must change too.

-

1 The annual World Energy Trilemma Index ranks the energy performance of 128 countries, based on global and national data—looking at energy security, energy equity, and environmental sustainability. worldenergy.org/transition‑toolkit/world‑energy‑trilemma‑index.

2 International Energy Agency (based on 2020 production levels).

3 BP Statistical Review of World Energy (2021).

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. There is no assurance that any environmental or social objective will be achieved. Commodities are generally subject to high volatility in prices. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.