A Wealth of Opportunity

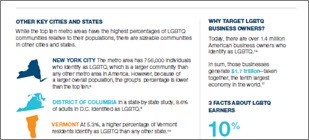

America’s high-asset LGBTQ community represents one of the greatest untapped markets in financial services. They’re 16 million strong. They control about $917 billion6 (roughly the GDP of Switzerland, Luxembourg, and Hungary combined7). And they’re growing.

So we researched LGBTQ financial needs and perspectives. The findings? LGBTQ investors are self-reliant, open to advice, and they feel underserved by financial services firms.

We’re here to provide you with actionable insights as the face of wealth continues to change. Use the resources on this page to help support the equality economy.

What's the Equality Economy?

As the number of LGBTQ, gender-fluid and ally individuals grows there also grows a greater demand for inclusivity and a strong preference to do business with companies known to be LGBTQ-friendly—and businesses are responding. Nearly all Fortune 500 companies have adopted pro-LGBTQ policies in order to address the needs of the group we are calling The equality economy, the ever increasing pool of LGBTQ individuals and allies who value diversity and expect equality for LGBTQ friends and family.

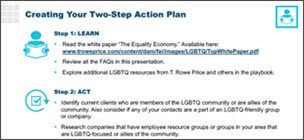

Take advantage of emerging business opportunities with this two-step action plan:

Learn

White Paper

Understand the community and learn how to connect with LGBTQ investors.

Program Overview

Get a sense of the massive size of this opportunity and get an overview of the tools and resources we’ve provided for you to act on it.

Playbook

Identify LGBTQ groups in your area and get insights into how you can work together.

LGBTQ Advice: Three Insights From Our Survey on LGBTQ Financial Needs

LGBTQ Investors are Self-Reliant…

Much of this community grew up in an era when marriage equality and same-sex benefits weren’t universal. This created a cultural mindset that they have to look out for themselves when it comes to planning for long-term financial security. With respect to LGBTQ financial planning issues, our research shows that 80% of LGBTQ adults are actively investing assets to provide for long-term needs.

They’re Ready to Listen to You…

This community places a high value on the advice of experts. With respect to LGBTQ financial planning, more than half of LGBTQ investors (54%) currently work with a financial professional and 47% use social media to seek out different perspectives to inform financial decisions. While they’re willing to listen and learn from the experts, 71% ultimately want to make investment decisions for themselves.

Yet They Feel Underserved (For Now).

Despite their willingness to work with financial professionals, our survey found low affinity for the financial services industry. This group has a strong preference to work with a firm that is known to be supportive of the LGBTQ community, but they feel underserved. Fewer than 10% could identify any investment firm as particularly LGBTQ friendly.

Take the Next Steps

The LGBTQ community is large and continues to grow as cultural and legal changes make it possible for more individuals to live authentic lives. Through our research study, we've gained a better understanding of the dynamic needs of LGBTQ investors as they navigate these changes. By drawing on this new understanding, you can position yourself and your practice to anticipate and meet those needs.

Whether you identify as LGBTQ, are an ally, have friends or family that are LGBTQ, or work with businesses with LGBTQ employees, we believe the onus will be on the financial professionals like you to display your commitment to the community in order to best grow your practice in a way that creates a better future–one where everyone prospers.

White Paper

Understand the community and learn how to connect with LGBTQ investors.

Playbook

Identify LGBTQ groups in your area and get insights into how you can work together.

Conversation Starter

Helps you identify concerns of the LGBTQ community on working with financial institutions and financial professionals.

Opportunity Size Tool

Pinpoint the size and location of LGBTQ wealth management opportunities around you.

Seminar in a Box

Get to work with this turnkey kit. It includes everything you need to take the next step (including a presentation and speaker notes).

Contact Us

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

Broker-Dealer

800.564.6958

AdvisorServices@troweprice.com

RIA & Regional Bank

800.564.6958

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Build strong client relationships by focusing on family dynamics.

70% of heirs change financial professionals when they inherit. Consider what you need to secure business for generations to come.

In October 2016, Community Marketing & Insights surveyed a diverse group of 1,300 adults aged 21 and over who identify as LGBTQ. All participants have household incomes of at least $50,000 and investable assets of $25,000 or more, with a few exceptions. To compensate for younger adults not having as many assets, the research somewhat oversampled Millennials to include younger LGBTQ people, typically aged 28–31. Additionally, all coupled participants indicated that they share in the financial decision-making in their household. The survey has a margin of error or ±2.68% at a 95% level of confidence.

1 https://assets2.hrc.org/files/assets/resources/CEI-2017-Final.pdf?_ ga=2.127271181.1460064740.1519744789-235034912.1519744789

2 http://www.prnewswire.com/news-releases/lgbt-inclusive-advertising-is-driving-busi ness-yet-consumers-demand-authenticity-according-to-ogilvy-survey-300481056.html

3 http://glaad.org/files/aa/2017_GLAAD_Accelerating_Acceptance.pdf

4 https://www.jwtintelligence.com/2016/03/gen-z-goes-beyond-gender-binaries-in-newinnovation-group-data

5 http://news.gallup.com/poll/201731/lgbt-identification-rises.aspx

6 https://www.advocate.com/commentary/2018/1/02/lgbt-economy-americas-future

7 World Bank. As of 06/22/2018.

8 Forrester Data: Consumer Technographics North American Online Benchmark Survey (Part 2), 2017.