retirement savings | january 18, 2024

Reasons Why You Should Aim to Save 15% for Retirement

A disciplined savings plan can set you up for future success.

Key Insights

For a successful retirement, you should aim to save at least 15% of your income annually over the course of your career.

Saving steadily and increasing your contributions periodically should help you hit that target over time.

Many retirement plans offer automatic savings and auto-increase options that can help you reach your savings goal.

Judith Ward, CFP®

Thought Leadership Director

Contributing as much as you can and starting early will have the greatest impact on reaching your retirement savings goal. Most investors will rely on a combination of Social Security benefits and personal savings to fund a retirement that could last decades. Our analysis shows that, to accumulate enough money to retire, you should generally have saved about three times your salary by age 45, seven times your salary by age 55, and 11 times your preretirement salary by age 65. This multiple may vary based on your income and marital status. Reaching this goal will require a savings rate of around 15% over the course of your working career.

We understand the challenges individuals face in setting aside enough for retirement, and while it’s important to set your retirement savings goal at 15%, it’s OK if you can’t save the full amount today. Simply getting started and then steadily increasing your contributions can help get your savings strategy on track. (See “Saving Early Makes a Difference”)

Why now is the right time to review your portfolio.

Market volatility, major life events, and the rising cost of living can impact your investment strategy.

Get a free portfolio review:

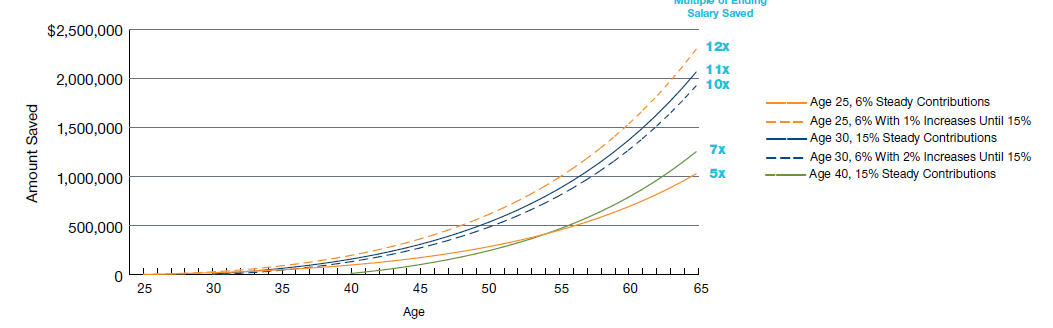

Saving Early Makes a Difference

Starting early and steadily increasing your contributions up to the 15% target can help you reach your retirement savings goal.

Assumptions: Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45 and then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45 and then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45 and then 3% a year to age 65. Annual rate of return is 7%. All savings are assumed to be tax-deferred. Multiple of ending salary saved divides final ending portfolio balance by ending salary at age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration in assessing your retirement savings adequacy.

Fortunately, there are ways to fund a steady increase in your contributions without significantly compromising your lifestyle. Consider these four steps:

1. Take advantage of your workplace plan. Many companies provide matching contributions in workplace retirement plans such as 401(k)s. At a minimum, make sure you are contributing enough to earn the full company match. You don’t want to leave any money on the table that could count toward your 15% total.

2. Automate your investing. Typically, 401(k) contributions are automatically deducted from your paycheck. If you don’t have a workplace plan, or want to invest beyond it, you can set up an individual retirement account (IRA) and have contributions automatically deducted from your paycheck or a bank account on a regular basis. If you have irregular income, automate your reminders so that you can make saving for retirement a priority. Directing money from your paycheck or bank account to fund your savings goals can help keep you from spending it on other things. When you make saving a priority, you’re more likely to achieve your long-term goals.

What’s more, automating your investing allows your assets to benefit from any compounded growth. And an automated approach helps take the emotion out of investing. The result is a disciplined savings process that reduces the chance that you’ll make impulsive changes.

3. Increase your contributions each year. Many workplace plans offer a service that will automatically increase your retirement contributions by one or two percentage points each year. Sign up for this service to start working toward that 15% target. If auto-increase options aren’t available or you’re investing outside your 401(k) plan, then schedule gradual increases into your savings plan. If you’re saving in an IRA, you may need to supplement your investments with a taxable account, since IRAs have contribution limits that may make it difficult to achieve a 15% savings rate.

4. Buckle down and budget. A budget, or spending plan, can provide a framework to track your expenses and accommodate your savings goals. Once you understand how you’re spending your money, you can find opportunities to reduce expenses and increase your retirement savings. There are apps and other resources that can help make this easier for you—or you can use a spreadsheet, if that’s more your style.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Keep in mind that these steps alone won’t be enough to ensure a financially secure retirement—but they can help get you closer to meeting your savings goal. And remember, it’s OK if you can’t save 15% today. One of the most important things you can do is to start saving what you can right now. Once you get started, you can work toward saving what you’ll need to fully fund your retirement.

Important Information

This material has been prepared by T. Rowe Price for general and educational purposes only. This material does not provide recommendations concerning investments, investment strategies, or account types. It is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making. T. Rowe Price, its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

All investments involve risk, including possible loss of principal.

View investment professional background on FINRA's BrokerCheck.

202401-3322204

Next Steps

See if you're on track with your retirement savings.

Contact a Financial Consultant at 1-800-366-5910.