retirement savings | august 7, 2023

Why Purposeful Asset Allocation is Key for Long-Term Success

Planning your asset allocation for retirement.

Key Insights

Asset allocation and diversification are key components of your portfolio. You’ll want to find the asset mix that is appropriate for your investing horizon and risk tolerance.

Keep a long-term perspective, and make adjustments over your investing horizon as you approach retirement or when your circumstances change.

If the idea of managing a properly allocated and diversified portfolio seems overwhelming, consider investment solutions that do it for you, such as balanced or target date options.

Judith Ward, CFP®

Thought Leadership Director

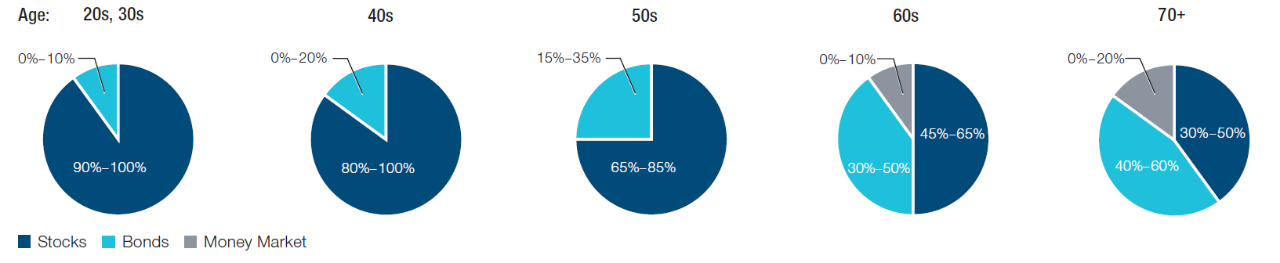

Allocating investments across the primary asset classes (stocks, bonds, and cash) provides an appropriate balance between short-term stability and long-term growth potential. Asset allocation is a primary driver of a portfolio’s performance over time. In general, the longer your time horizon, the more of your portfolio you should hold in stocks. As investors get closer to and are in retirement, adding bonds can help dampen short-term ups and downs of the market while still providing growth opportunity over a retirement that could last decades. T. Rowe Price’s sample retirement portfolios offer a good starting point. These portfolios include ranges of the primary asset classes to accommodate investors’ risk preferences while considering allocations appropriate for various ages and time horizons. (See Figure 1.)

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

(Fig. 1) Sample Asset Allocation by Age for Retirement

These allocations are age-based only and do not take risk tolerance into account. Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed retirement age of 65 and a withdrawal horizon of 30 years. The model allocations are based on an analysis that seeks to balance long-term return potential with anticipated short-term volatility. The model allocations reflect our view of appropriate levels of trade-off between potential return and short-term volatility for investors of certain age ranges. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash.

Limitations:

While the samples have been designed with reasonable assumptions and methods, the samples are hypothetical only and have certain limitations.

- The samples do not take into account individual circumstances or preferences, and the sample displayed for your age may not align with your accumulation time frame, withdrawal horizon, or view of the appropriate levels of trade-off between potential return and short-term volatility.

- Investing consistent with a sample allocation does not protect against losses or guarantee future results.

Please be sure to take other assets, income, and investments into consideration when reviewing illustrations that do not incorporate that information.

Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

Time horizon is a key consideration.

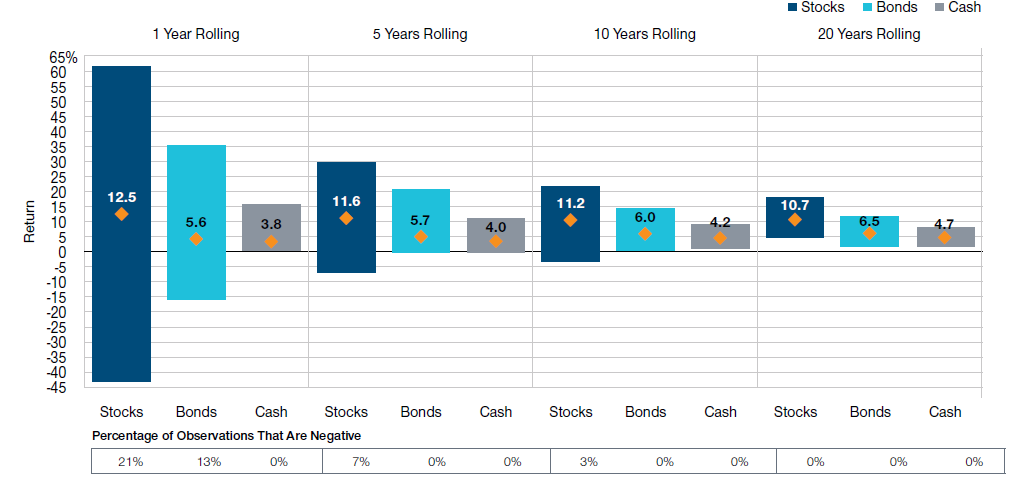

Historically, stocks have offered the highest returns of any major asset class over longer periods of time. While stocks also come with higher bouts of short-term volatility, retirement investors who are many years from retirement will likely have enough time to recover when the stock market dips. The longer your holding period, the more you may benefit from stocks. Bonds have had lower returns, on average, but less variability—especially over intermediate horizons. Cash has offered the lowest average returns but with the least amount of variability.

Combining these asset classes allows you to manage that trade-off of growth potential with short-term volatility.

Investing in the stock market requires a long-term perspective. If you focus on the short term, it’s easy to let emotions influence your investment decisions, as the market fluctuates frequently.

While market downturns can lead to short-term losses, the picture changes with a long-term perspective. As the chart below (Figure 2) shows, the variability of returns for stocks is reduced over longer holding periods.

Bottom line: Remaining invested through downturns and corrections allows you to take advantage of long-term growth potential.

(Fig. 2) Asset Class Returns by Holding Period

Observation period: January 1945 to December 2022.

Bars represent the range of results, while diamonds reflect the average return within each duration.

Past performance cannot guarantee future results.

Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Cash is represented by the 3-month Treasury bill. Source for Bloomberg index data: Bloomberg Index Services Ltd. Copyright © 2023, Bloomberg Index Services Ltd. Used with permission. Analysis by T. Rowe Price. It is not possible to invest directly in an index. Charts are shown for illustrative purposes.

S&P: The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price’s product is not sponsored, endorsed, sold, or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the “S&P 500 Index.”

Diversifying within asset classes is beneficial.

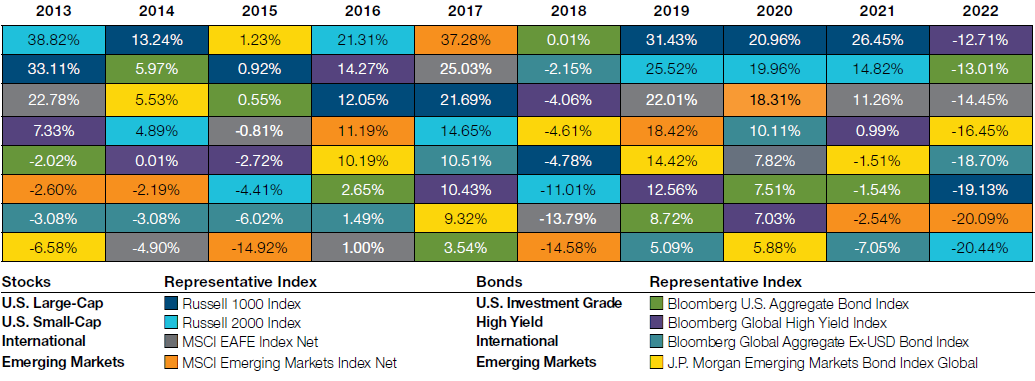

Portfolios also should be diversified within each asset class. Diversification involves investing in different types of stocks (small-cap, large-cap, international, etc.) and bonds (international, high yield, and investment grade) so that your portfolio is never too dependent on any one asset type.

The Investors Can Benefit From Diversification table (Figure 3) illustrates how quickly the performance of different investment sectors can change from year to year. A sector that is on top one year could be at the bottom the next, for example. Broad diversification across sectors provides exposure to those that are leading without being derailed by those that are lagging. Of course, diversification cannot assure a profit or protect against loss in a declining market. We suggest considering the following diversification targets within your stock and bond allocations:

Within Stocks: 60% U.S. large-cap, 25% developed international, 10% U.S. small-cap, 5% emerging markets

Within Bonds: 45% U.S. investment grade, 10-30% U.S. Treasury, 10% nontraditional bond, 0-10% high yield, 10% international, 0%-10% emerging markets

How much should you save?

In addition to an appropriate asset allocation, investors will need to determine how much to save for retirement. This has a substantial impact on your retirement success. Most investors should save at least 15% of their income, which includes company contributions that may be available through a workplace plan such as a 401(k). If 15% isn’t possible right now, start at a lower rate and plan to increase the amount each year.

FTSE/Russell—Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE® and Russell®” are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company that owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data, and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.

MSCI—MSCI and its affiliates and third-party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. None of the MSCI data are intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

J.P. Morgan—Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023 J.P. Morgan Chase & Co. All rights reserved.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making.

The views contained herein are those of the authors as of June 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Past performance cannot guarantee future results. All investments involve risk. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202306-2932728

Next Steps

Explore the appropriate asset allocation for your investing goals.

Contact a Financial Consultant at 1-800-401-1819.