- 2024 U.S. Retirement Market Outlook

- Help improve retirement outcomes with targeted personalized experiences

- Targeted experiences can drive behavioral change and improve retirement outcomes.

- Personalization

-

Consumers increasingly expect personalization in all aspects of their lives. The retirement experience is no different. Data from our recordkeeping platform show that tailored and targeted experiences can drive behavioral change and help improve retirement outcomes. Some participants are also seeking personalized investment solutions. As employees continue to express a need for comprehensive financial wellness programs through the workplace, personalized solutions can help workers navigate and balance both their short‑term and long‑term financial goals.

Data show that, for plan participants, personalized experiences can help drive behavioral change and improve retirement outcomes. We discussed retirement income under our first theme, a very personal experience—given different needs and preferences—that requires a personalized solution. But personalization is not limited to products. It also includes services and communications, which intersect with financial wellness.

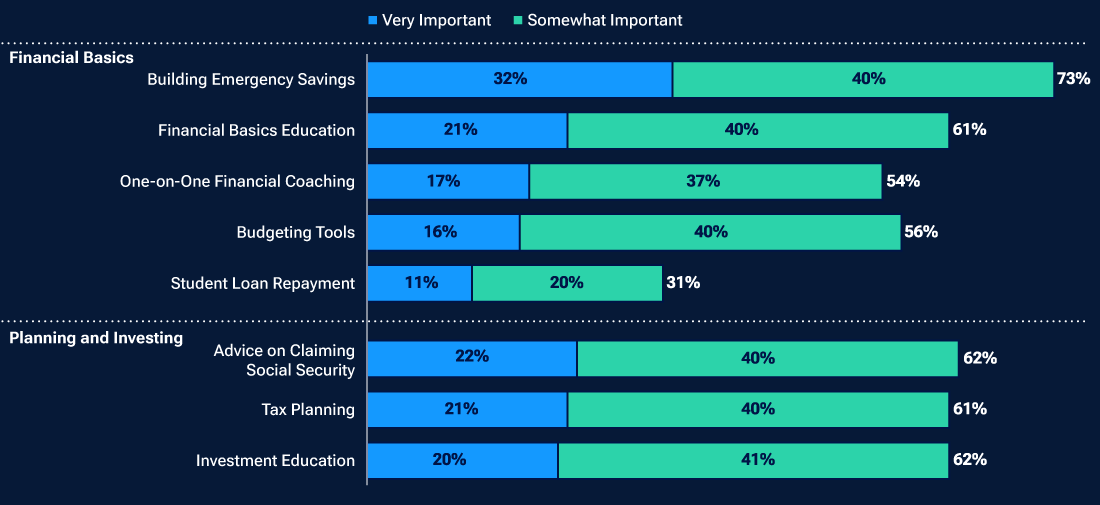

Throughout their working years, participants may face challenges as they aim to save for retirement while also balancing day‑to‑day household finances and juggling competing financial goals. These include repaying student loans or other debt, starting a family, purchasing a home, or saving for a child’s education, among others. Our research has shown that access to workplace financial wellness programs and services that can help them manage these priorities is important to participants (Figure 3).

As employees continue to express interest in financial wellness programs, plan sponsors and their consultants and advisors have taken notice. Offering comprehensive and tailored experiences that can help workers navigate both their short‑term and long‑term financial goals could be impactful.

Strong demand in an evolving landscape

Employee populations are typically diverse, and needs often vary across generations and various participant demographics. An analysis of plan data can help plan sponsors identify vulnerable populations who are disproportionately affected by financial stressors. This analysis can then drive plan design decisions as well as communication or engagement strategies that tailor financial wellness offerings to meet these employees’ needs.

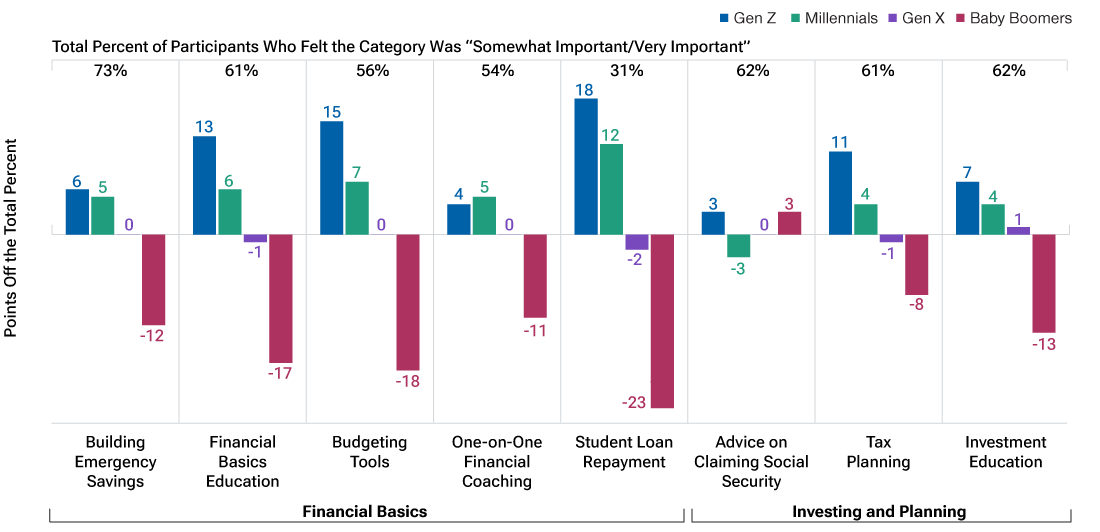

The workforce currently consists of four generations, each with different financial priorities. Based on our research, Gen Z and millennials attach more importance to the availability of financial education, products, and services through their employer than older generations, especially baby boomers (Figure 4). Meanwhile, younger baby boomers and older Gen Xers who are nearing retirement might benefit from personalized communications and services on topics such as catch‑up contributions, claiming Social Security, and tax‑aware retirement income planning, among others.

Participants need help with financial basics, planning, and investing

(Fig. 3) Importance of workplace financial solutions to participants.

Source: T. Rowe Price Retirement Savings and Spending Study, 2022.

Numbers may not total due to rounding.

Personalized and targeted communications can impact outcomes. For example, leveraging our recordkeeping data, T. Rowe Price creates informed videos to motivate participants and help drive action. According to our 2023 Reference Point report, which benchmarks large retirement plans on our recordkeeping platform, participants who watched these videos were twice as likely as others to increase their deferral rates and add or update their account beneficiaries.

Personalized communications and services should be relevant and align with targeted audiences. We have found that the evolution of our services for Spanish‑speaking participants over the years—from translating communications to providing educational meetings in Spanish, and now providing a Spanish portal that tailors content and incorporates cultural preferences—has increased activity. An analysis of digital engagement data outlined in our Participants Reactions to Jobs and the Economy report shows that 8.6% of visitors to our Spanish retirement plan portal in the second quarter of 2023 completed an action compared with 4.6% of visitors who did not visit the portal.

What’s next?

More and more, participants need help sorting out options that best fit their individual situations across all stages of the retirement journey. How do I balance saving versus paying down debt? How much should I contribute? Should I make Roth or pretax contributions? Should I invest on my own or use default investments? At what age should I claim Social Security? How do I draw down my assets? The list goes on.

"...ongoing advances in technology are starting to allow a cost‑effective delivery of sophisticated and personalized solutions."

In the past, addressing these concerns on an individual basis would require an expensive one‑on‑one consultation with a financial professional. However, ongoing advances in technology are starting to allow a cost‑effective delivery of sophisticated and personalized solutions.

These advancements have resulted in partnerships with fintech companies that are expected to accelerate as DC providers seek to differentiate their services and provide integrated and streamlined solutions to their clients. For example, to complement our current retirement capabilities, T. Rowe Price recently purchased a fintech firm that offers innovative personalized retirement income planning software.

Younger generations expect more help with financial wellness from employers

(Fig. 4) Importance of workplace financial solutions to participants.

Source: T. Rowe Price Retirement Savings and Spending Study, 2022.

Our assessment about the growth‑potential of financial wellness solutions is shared by consultants and plan advisors as well. In our 2023 DC Consultant Study, financial wellness programs were identified as the top area for future growth in non‑investment services among consultants. Many are planning to provide full proprietary financial wellness solutions for their clients. We expect plan sponsors to adopt these solutions and offer them to their participants as well.

A growing emphasis on personalization and holistic financial wellness services is also being reflected in the investment solutions offered to retirement plan participants. While target date strategies remain the most prevalent default vehicle that benefits millions of Americans investing for retirement, some participants are seeking more personalized solutions as they move closer to, and through retirement.

As a result, employers and financial professionals are increasingly offering investment advice to plan participants in the form of personalized managed portfolios that also consider an individual’s circumstances beyond age, such as other savings and investments they might have, debt, spousal savings, etc. We expect demand to likely grow for these individualized investment advice and professional portfolio management solutions.

Considerations for plan sponsors, consultants, and advisors

Access to data enables personalization: Employees grapple with a range of factors that impact their ability to save for retirement. Having access to participant‑level data can help recordkeepers, consultants, and advisors unmask hidden distortions within averages and offer relevant services to participants. Being open to data connectivity, especially for partnerships with fintech firms that offer personalized products and services, could also provide opportunities for enhanced integrated solutions.

Personalized solutions help keep assets in plan: Many employers express a preference to keep retiring participants in plan. Employers enjoy a unique trust, but to retain participants after retirement, they may need to offer personalized solutions that are otherwise only available in the retail market.

Find informal forums for more open conversations: Employers can use less formal settings to foster discussions about personal financial struggles or needs. For example, employee forums, such as business resource groups, formed around employees’ personal identity or interests, can drive more personal discussions. This can often give employers ideas about what their employees are struggling with and how to help them. Having retirement preparation conversations in these settings could be very useful as some participants may be more likely to engage and act if they can relate to the messenger.

T. Rowe Price Sources

2023 Defined Contribution Consultant Study: This study included 45 questions and was conducted from February 14, 2023, through March 31, 2023. Responses are from 32 consulting and advisory firms with more than $6.7T in assets under administration.

2021 Defined Contribution Consultant Study: This study included 51 questions and was conducted from September 20, 2021, through November. Responses are from 32 consulting and advisory firms with more than $7.2T in assets under administration.

2023 Retirement Savings and Spending Study: The Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2023 survey was conducted between July 24, 2023, and August 13, 2023. It included 3,041 401(k) participants, full‑time or part‑time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute with a balance of $1,000 or more. The survey also included 1,176 retirees who have retired with a Rollover IRA or left‑in‑plan 401(k) balance.

2022 Retirement Savings and Spending Study: The Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2022 survey was conducted between June 24, 2022, and July 22, 2022. It included 3,895 401(k) participants, full‑time or part‑time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute with balance of $1,000 or more. The survey also included 1,136 retirees who have retired with a Rollover IRA or left‑in‑plan 401(k) balance.

Reference Point 2023: This annual benchmarking tool examines trends and highlights and shares commentary to help inform plan design. Data are based on the large‑market, full‑service universe—T. Rowe Price total—of T. Rowe Price Retirement Plan Services, Inc., retirement plans (401(k) and 457 plans), consisting of 652 plans and approximately 2 million participants.

Participant Reactions to Jobs and the Economy, Q2 2023: Analysis of the plans in T. Rowe Price’s recordkeeping database from January 2017 through June 2023. The analysis focused on the effects of inflation on plan participant saving and investing behavior.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to retirement.

-

Investment Risks:

The principal value of target date strategies is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These products typically invest in a broad range of underlying mutual funds that include asset classes such as stocks, bonds, and short-term investments and are subject to the risks of different areas of the market. A substantial allocation to equities both prior to and after the target date can result in greater volatility over short term horizons. In addition, the objectives of target date funds typically change over time to become more conservative.

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency.

Personalized solutions are subject to risks including possible loss of principal. There is no assurance that any investment objective will be met.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Passive investing may lag the performance of actively managed peers as holdings are not reallocated based on changes in market conditions or outlooks on specific securities.

Derivatives may be used in absolute returns strategies, and they can be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions; risks include currency risk, leverage risk, liquidity risk, index risk, pricing risk, and counterparty risk.

Diversification cannot assure a profit or protect against loss in a declining market.

-

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision‑making.

Any tax‑related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are as of November 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2023 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

202312‑3295796