Market Review

- Global Markets Monthly Update

- November 2022

- Key Insights

-

- Major equity indexes in the U.S. and Europe gained ground, supported by signs that inflation may be slowing and indications that the Federal Reserve could slow the pace of its rate increases.

- Yields on 10- and 30-year U.S. Treasuries decreased more than the yields on two‑year U.S. government bonds, further inverting the yield curve.

- Chinese stocks rallied amid signs that Beijing was preparing to moderate its zero-tolerance approach to the coronavirus, which has severely disrupted the country’s economy over the past year.

GET INSIGHTS FROM OUR EXPERTS

Receive timely market data and analysis to share with your clients.

The major U.S. equity indexes ended the month higher, supported by a lower-than‑expected inflation reading for October and indications that the Federal Reserve could slow the pace of its rate increases. Within the S&P 500 Index, value stocks outpaced their growth counterparts, but both posted gains. Every sector in the large‑capitalization index advanced. Materials led the way, while energy and consumer discretionary lagged.

Yields on 10- and 30-year U.S. Treasuries decreased more than the yields on two-year U.S. government bonds. (Bond prices and yields move in opposite directions.) These price movements further inverted the yield curve, a phenomenon that occurs when shorter-maturity bonds offer higher yields than longer-dated Treasuries—typically because of concerns about the near-term economic outlook.

Inflation Moderates in October but Remained Elevated

Stocks rallied after the U.S. Labor Department released consumer price data for October. The headline consumer price index (CPI) rose 0.4% in October, which was less than consensus expectation of roughly 0.6%. The annual inflation rate moderated to 7.7%—still well above the Fed’s target, but the slowest increase since January. Annual core inflation, which excludes volatile food and energy costs, retreated to 6.3% in October from the 40-year high of 6.6% registered in September.

Business Activity Appears to Contract in November

Early estimates of S&P Global’s widely watched purchasing managers’ indexes (PMIs) indicated that private sector activity contracted in November. The flash reading of the composite PMI, which includes services and manufacturing, slipped to 46.3 from the 48.2 registered in October. (PMI readings less than 50 indicate a contraction in activity.) Manufacturing PMI joined the services sector in contractionary territory in November, hitting a 30-month low.

Powell Says Fed May Slow the Pace of Tightening, Warns That Rates May Be Higher for Longer

As was widely expected, the Federal Open Market Committee (FOMC) announced a 75-basis-point rate increase at its early-November policy meeting. (A basis point is 0.01 percentage point.) Fed Chair Jerome Powell struck a hawkish tone in the post‑meeting press conference, commenting that it would be “very premature” to consider pausing rate hikes. Powell also noted that the FOMC had revised its estimate of the peak rate for this tightening cycle higher and stressed that the pace of rate increases was not as important as the terminal rate and how long rates stay at that level.

Equities rallied sharply on the final day of November, as the market reacted to a speech that Powell gave at the Brookings Institution. In his remarks, Powell reiterated that interest rates could remain higher for longer but indicated that the central bank could moderate the pace of rate increases as early as the FOMC’s mid-December 2022 meeting. These comments aligned with the minutes from the Fed’s early-November policy meeting, which said that a “substantial majority of participants” thought that slowing the pace of rate hikes would be appropriate.

Shares in Europe rose on signs that inflation may be slowing and that central banks might reduce the pace of policy tightening. In local currency terms, the pan-European STOXX Europe 600 Index ended sharply higher. Major market indexes in Germany, Italy, France, and the UK also posted substantial gains.

ECB Hikes Rates Again; Eurozone Inflation Slows; Sentiment Improves

Inflation in the eurozone slowed in November for the first time in 17 months, prompting markets to scale back bets on the size of the next interest rate hike. Lower increases in energy and services costs helped push consumer price growth down more than expected to 10% from a record high of 10.6% in October. Inflation decelerated in 14 of the bloc’s 19 member states.

European Central Bank (ECB) President Christine Lagarde told the European Parliament before the November inflation data were released that consumer price increases in the euro area had not yet peaked and could hit higher levels in the coming months. Minutes of the ECB’s October meeting showed that most policymakers voted in favor of a 0.75-percentage-point hike in key interest rates, reflecting concerns that inflation might become entrenched. Some policymakers indicated that more rate increases would probably be needed.

The European Commission forecast that the eurozone economy would contract in the final quarter of this year by 0.5% and by a further 0.1% in the first three months of 2023—a technical recession—due mainly to higher energy prices triggered by the war in Ukraine. However, some data raised hopes a recession might be less severe than feared. Germany’s Ifo economic institute said its business climate index rose to 86.3 in November from an upwardly revised 84.5 in October, while a European Union survey of businesses and households showed sentiment rose for the first time since February.

UK’s Hunt Raises Taxes but Delays Large Spending Cuts

UK finance minister Jeremy Hunt unveiled tax increases, spending cuts, and new fiscal rules in his Autumn Statement as part of an effort to repair the UK’s public finances and restore its credibility in international markets. The government will raise taxes by roughly GBP 25 billion and cut spending by about GBP 30 billion by 2027–2028 to plug a fiscal hole of GBP 55 billion. Much of the reduction in public spending is slated to occur after the next general election in 2024.

BoE Raises Rates Sharply; UK Inflation Soars

The Bank of England (BoE) increased its benchmark interest rate by 0.75 percentage point to 3.00%, the highest level since 2008, to contain surging inflation. Even so, the central bank’s governor, Andrew Bailey, signaled that borrowing costs may not rise by as much as the market expects. The BoE warned that the UK faces a “very challenging” two-year slump (starting in September) and predicted that inflation would stay above 10% for the next six months and above 5% in 2023. It also forecast that unemployment may rise to almost 6.5% by 2025 from 3.6% now.

The official estimate indicated that UK gross domestic product (GDP) in the third quarter shrank by 0.2% sequentially—the first quarterly decline since the start of 2021. Inflation reached a 41-year high of 11.1% in October, a significant increase from the 10.1% registered in September.

Japanese equities had a positive month but lagged their developed market peers, with the MSCI Japan Index gaining 2.97% in local currency terms and 9.68% in U.S. dollar terms. Risk appetite was buoyed by expectations that the U.S. Federal Reserve may slow the pace of interest rate increases, as well as hopes that Chinese authorities might pivot away from their zero-COVID policies. On the domestic front, the rate of core consumer price inflation rose to a 40‑year high, exerting fresh pressure on the Bank of Japan (BoJ). The Japanese economy unexpectedly contracted in the third quarter of the year, further weighing on sentiment.

The yield on the 10-year Japanese government bond rose to 0.25%, from 0.24% at the end of October. Meanwhile, the yen strengthened to around JPY 138.1 against the U.S. dollar, from about 148.7 the prior month. This was due primarily to the anticipation of a more dovish Fed, which would reduce the divergence between the U.S. central bank’s policy actions and the BoJ’s commitment to its ultra-loose monetary policy.

Consumer Inflation Rises at Fastest Rate in 40 Years

Japanese core consumer prices rose at their fastest rate in 40 years in October. Excluding fresh food, consumer inflation climbed 3.6% from a year ago, exceeding the BoJ’s 2% inflation target for the seventh straight month. Data showed that not only rising energy costs but a further uptick in food prices contributed to inflation. In response to the release, BoJ Governor Haruhiko Kuroda repeated his view that the central bank would retain its ultra-loose monetary policy to support economic activity but acknowledged that there could be a further acceleration in the rate of inflation.

Economy Unexpectedly Contracts in the Third Quarter

Japan’s GDP unexpectedly contracted an annualized 1.2% in the three months to the end of September 2022, weighed down by yen weakness. The country continued to struggle to regain momentum following the coronavirus pandemic, with concerns about a global economic slowdown posing a further headwind. Nevertheless, growing private sector demand, the continued reopening of the domestic economy, and the government’s stimulus measures should support a gradual pickup in economic growth.

Manufacturing Sector Contracts, Services Stagnant

Activity at Japan’s private sector firms declined in November, attributable to manufacturing sector weakness and some signs of stagnation across services sector firms, PMI data showed. The manufacturing sector saw a marginal downturn, due to falling output and new orders, as inflationary pressures contributed to weak demand conditions. Services business activity was unchanged from October, although the recovery of the tourism industry supported expansion in order books.

Japan Tourism Agency Aims for Recovery in Inbound Tourism by 2025

The Japan Tourism Agency announced a plan outlining its goals for 2025, at which point it aims to have inbound tourism recover to levels seen before the coronavirus pandemic. The agency expects travel demand to rise in line with increased global air traffic. Furthermore, events to be held during that year, including the World Athletics Championships in Tokyo and the Expo 2025 in Osaka, are expected to give visitor numbers a boost. Yen weakness boosts the attractiveness of Japan to foreigners as it means that their purchasing power is higher.

Chinese stocks rallied amid signs that Beijing was preparing to moderate its zero-tolerance approach to the coronavirus that severely disrupted the country’s economy over the past year. The MSCI China Index climbed 29.71% and the China A Onshore Index advanced 10.97%, both in U.S. dollar terms.

Several Cities Implemented Restrictions to Curb Spread of Coronavirus

Several Chinese cities imposed broad restrictions on movement and introduced mass testing as daily coronavirus cases approached all-time highs. Although no cities were locked down, the restrictions obstructed economic activity and weighed on China’s growth outlook, despite officials’ efforts to make their virus response more targeted. Eight districts in Zhengzhou, home to Apple’s largest iPhone manufacturing site, were locked down for five days starting on November 25 as officials reported that the virus’s spread reached a “critical phase” in the region, Bloomberg reported. The district around Apple iPhone production facilities were not subject to lockdown. However, tensions ran high after workers at a plant operated by Foxconn, a key Apple supplier, clashed with security personnel over unpaid wages and poor working conditions.

Data pointing to surprisingly strong growth in China’s industrial sector also supported investor sentiment. Profits at industrial companies rose 5.4% in November from a year ago, their fastest pace in eight months. November’s gain came after industrial profits fell for three straight months, including a 9.9% drop in October. Despite the reversal, a statistics bureau official cautioned against a sustained recovery in the industrial sector and noted that “current downward pressure on the economy is very big,” Reuters reported.

Measures to Support the Economy Announced

Hopes for stepped-up stimulus rose after the People’s Bank of China announced a 25-basis-point cut to the reserve requirement ratio (RRR) for banks. The central bank also pledged that monetary tools would be used “in a timely and appropriate manner” to maintain reasonably ample liquidity, Bloomberg reported.

Separately, China’s financial regulators unveiled a sweeping support package consisting of 16 new measures to salvage the country’s ailing real estate market, including extending loans to developers and homebuyers. Several state-run banks agreed to increase lending to some of China’s debt-laden developers after the package was announced.

Economic Data Reflect Headwinds

China’s exports and imports both unexpectedly fell in October from a year ago, which was the first decline in two years, reflecting the slowing global economy and rising headwinds on China’s growth outlook. Producer prices also fell 1.3% in October from a year earlier, the first decline in nearly two years and a sign that global inflationary pressures could be easing.

China’s official PMI readings for manufacturing and nonmanufacturing activity in October both missed forecasts and landed below 50, the level separating growth from contraction. The private Caixin PMI readings also remained in contractionary territory, although manufacturing PMI rose slightly last month.

Brazil

Stocks in Brazil, as measured by MSCI, posted a 2.84% loss in U.S. dollar terms. Financial markets in Brazil struggled with lingering political and economic uncertainty despite the late‑October presidential election victory of former president Lula da Silva over the incumbent Jair Bolsonaro, albeit by a narrow margin.

Toward the end of the month, Bolsonaro filed a protest with the country’s electoral court, arguing that votes from certain voting machines with malfunctions should be invalidated. However, T. Rowe Price sovereign analyst Richard Hall believes that Bolsonaro lacks public and institutional support for an election challenge.

Meanwhile, Lula’s rhetoric raised worries about an erosion of fiscal discipline and structurally higher inflation during his administration, which begins on January 1, 2023. Reuters reported that Lula’s advisors and members of his transition team began talking with legislators about the possibility of increasing government spending in the portion of the 2023 budget that is excluded from a cap intended to keep expenditure growth in line with inflation.

In addition, Lula decided to delay the announcement of his cabinet members until after he returned from a UN Climate Change Conference held in Egypt November 6–18. The delay was extended further—at least through the end of November—as Lula underwent and recovered from throat surgery.

Mexico

Mexican stocks, as measured by MSCI, gained 6.07% in U.S. dollar terms.

The central bank raised its key interest rate by 75 basis points to 10.00% from 9.25%. The decision was not unanimous: Four policymakers approved the move, but one dissenter preferred a smaller 50-basis-point increase.

The post-meeting statement was modestly dovish, as policymakers highlighted supply-side pressures that are beginning to fade and the progress that they have already made in the current tightening cycle. They now see inflation risks as only biased to the “upside” rather than “significantly to the upside” in their previous policy meeting. They also noted that October inflation was below the September peak but highlighted that core consumer prices and inflation expectations are still rising. Notably, the statement left out references to downside risks for growth, as third‑quarter economic activity has been better than expected. As a result, policymakers no longer see a negative output gap as a factor for seeking to tamp down inflation.

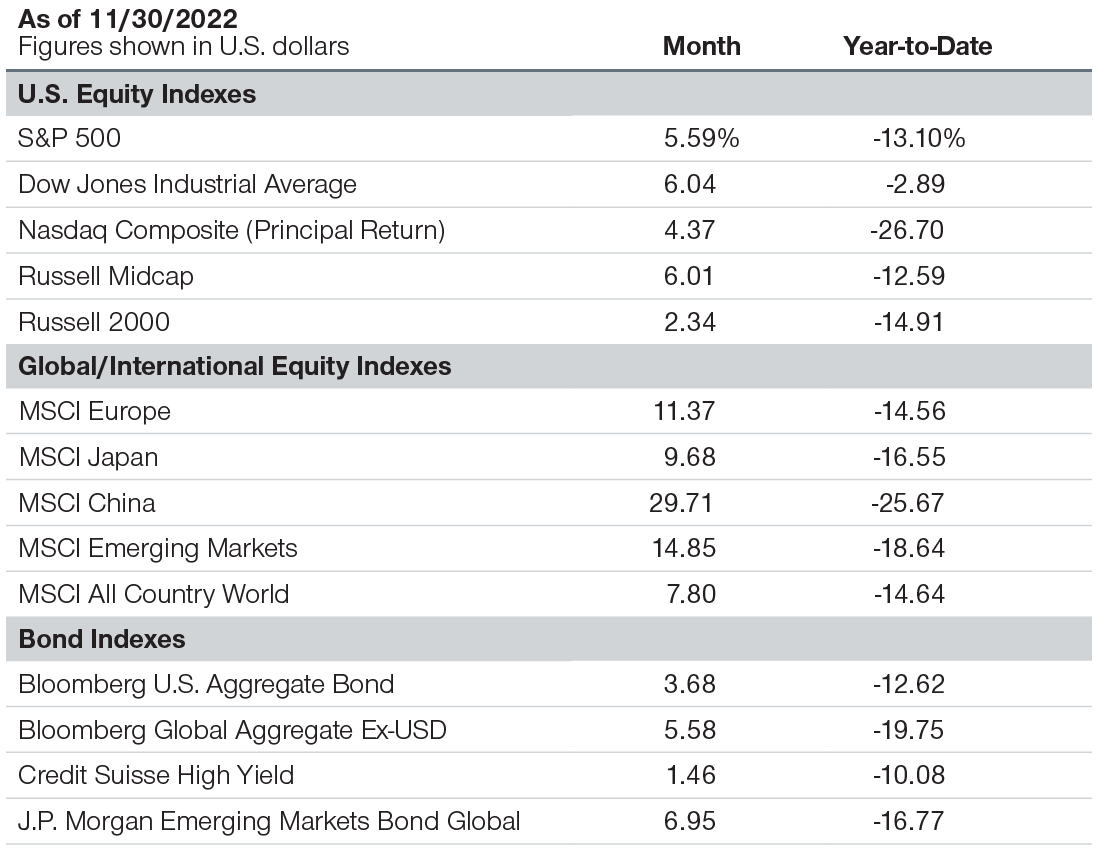

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended November 30, 2022. The returns include dividends and interest income based on data supplied by third‑party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

THE IN-DEPTH MARKET DETAILS YOU NEED

Subscribe to regular email updates and inform your client conversations.

-

Additional Disclosures

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2022 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2022, J.P. Morgan Chase & Co. All rights reserved.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202212-2616143