- On U.S. Fixed Income

- Turmoil Creates Opportunity for Short Duration Bonds

- Fed hikes have pushed up yields on lower-risk bond allocations.

- 2022-08-15 20:33

- Key Insights

-

- This year’s bond market volatility has led to higher yields and a flatter curve that creates a particularly compelling case for shorter-maturity securities.

- The combination of increased yield cushion and lower interest rate risk in short-term bonds may provide a buffer against further rate volatility.

- We believe that our multi-sector approach to managing low-duration portfolios can tap in to parts of the market that historically offered one of the best returns per unit of risk.

Stubbornly high inflation and hawkish central banks around the globe have pressured fixed income asset classes, with many posting meaningful losses in the first half of 2022. However, this year’s significant shift higher in bond yields, particularly in shorter-maturity securities, can offer investors compelling yield with less interest rate risk. We believe that our multi-sector approach to managing low-duration1 portfolios can help diversify2 risk while tapping in to parts of the market that historically offered one of the best returns per unit of risk.

Fed Tightening Has Triggered Volatility

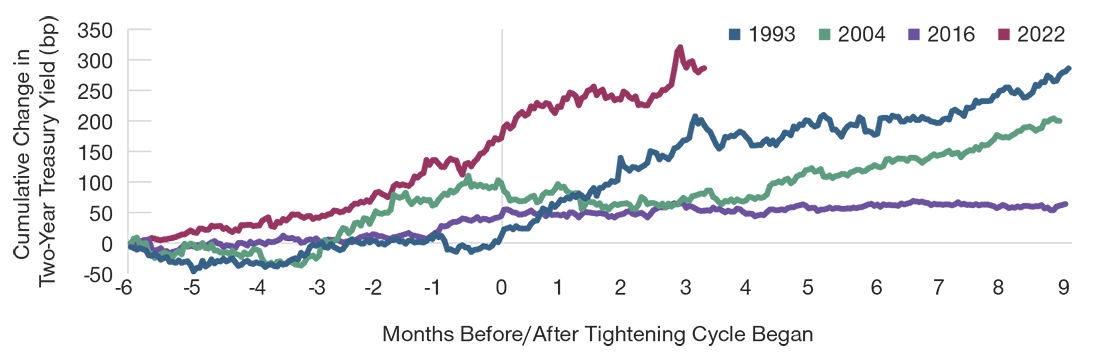

Rapid Move in Two-Year Treasury Yield

(Fig. 1) Yields have risen faster than in previous cycles

As of June 30, 2022.

Source: Bloomberg Finance L.P., analysis by T. Rowe Price. Bp= basis points. 1 basis point is 0.01 percentage point.

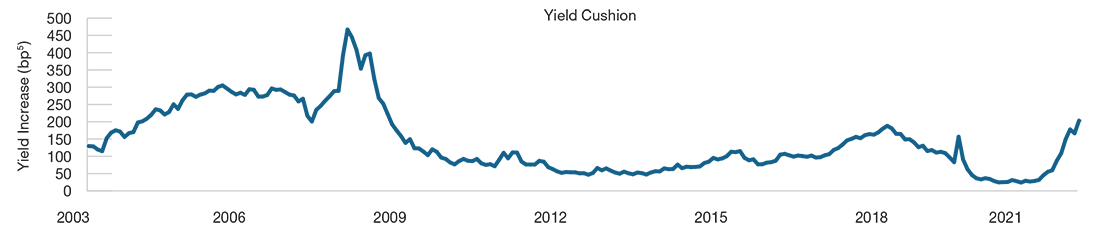

Yield Cushion Has Expanded in 2022

(Fig. 2) Yield move required to fully offset current yield*

Past performance is not a reliable indicator of future performance.

As of June 30, 2022.

Source: Bloomberg Finance L.P., analysis by T. Rowe Price.

* For the Bloomberg U.S. Corporate 1–3 Year Index. Index data is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index. Yield is based on prevailing yield-to-maturities over the time period.

After more than a decade of heightened stimulus measures that sent yields to multi-decade lows and suppressed volatility, the Federal Reserve is withdrawing liquidity and hiking interest rates in response to multi-decade-high inflation. Unsurprisingly, the central bank’s moves have been highly disruptive, as evidenced by performance across asset classes this year. In the U.S., the two-year Treasury yield ratcheted up to reach a two-year high of 3.43% in mid-June after the Fed sprang into action to stamp out inflation, a significantly sharper move than in previous tightening cycles.

The volatility in Treasury yields has also pressured credit spreads3 wider across fixed income sectors with credit risk. Historically, returns on Treasuries and credit sector performance have been negatively correlated,4 but that has not been the case for much of this year. As a result, losses on short duration corporate credit in the first half of 2022 exceeded those experienced in late 2008 when credit spreads widened out to over 700 basis points (bp).5 The downturn also shows how vulnerable short-term credit was in mid-2021 when credit spreads and Treasury yields were at historically low levels, offering little cushion when both started moving higher.

Flatter Yield Curve Should Benefit Short-Term Bonds

The repricing of yields has led to a significantly flatter yield curve, so investors can receive nearly the same yield in short-term bonds as they would from longer-maturity credits—at a fraction of the interest rate risk. Furthermore, these increased yields can help buffer the impact of rising rates and offer more cushion than a year ago.

Figure 2 shows the yield cushion, or the increase in yield required to fully offset the current yield, turning total return negative. For context, in late July, the Bloomberg U.S. Corporate 1–3 Year Index had a yield cushion of 200 bp compared with only 60 bp at the beginning of the year. This could serve as a tailwind to total returns going forward.

Multi-Sector Approach Adds Flexibility

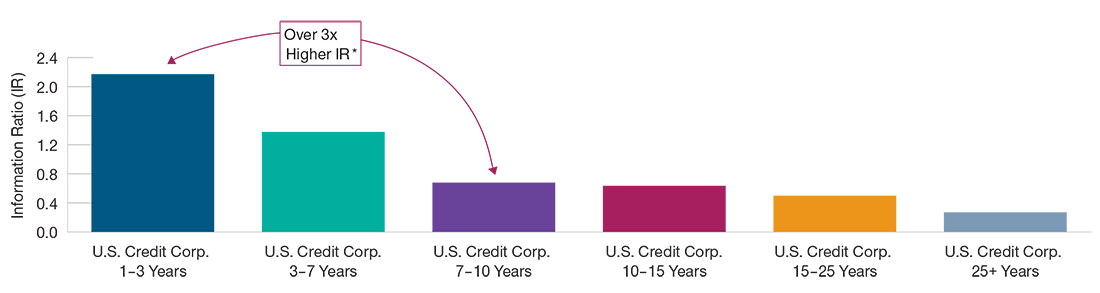

Higher Risk-Adjusted Return Historically

(Fig. 3) Information ratio of rolling excess return*

Past performance is not a reliable indicator of future results.

As of June 30, 2022.

Source: T. Rowe Price analysis of Bloomberg indexes. Corp.= Corporate.

* Average 1-year rolling return since 2002.

A broad multi-sector approach to managing a low-duration portfolio that also incorporates an actively managed liquidity allocation can help to limit risk by diversifying across sectors and seeking to maintain ample liquidity even when historical correlations break down. Our multi-sector capability gives us the flexibility to add exposure to the fixed income sectors where we identify securities with higher risk-adjusted yield potential.

For example, in investment-grade corporate credit, short-maturity debt has provided meaningfully higher risk-adjusted returns than longer-term bonds. This theme is consistent across other short-maturity bonds with credit risk. From December 2002 through June 2022, the information ratio6 of the average one‑year rolling excess return7 of investment‑grade corporates in the one‑ to three‑year maturity range was more than three times higher than the same measure for 7- to 10‑year investment‑grade corporate bonds.

Liquidity to Navigate Market Uncertainties

Across our low-duration funds, we balance our diversified multi-sector portfolios with an actively managed liquidity allocation consisting of very short-term debt instruments and principal paydowns from securitized products such as mortgage- and asset-backed securities. Our thoughtful approach to liquidity management should afford the portfolios with incremental yield while aiming to maintain an ample source of organic liquidity to navigate market uncertainties—a key consideration in an environment of rapid central bank tightening and volatility.

In light of the public attention on high gasoline prices, the Fed’s focus seems to have shifted from its traditional core inflation target toward lowering headline inflation, which includes prices of food and energy. We are closely monitoring how crude oil prices, which moderated somewhat in July, might affect the central bank’s path of monetary policy tightening.

-

1 Duration measures a bond’s sensitivity to changes in interest rates.

2 Diversification cannot assure a profit or protect against loss in a declining market.

3 Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar-maturity, high-quality government security.

4 Correlation measures how one asset class, style, or individual group may be related to another. A perfect positive correlation means that the correlation coefficient is exactly 1. This implies that as one security moves, either up or down, the other security moves in lockstep in the same direction. A perfect negative correlation means that two assets move in opposite directions, while a zero correlation implies no relationship at all.

5 A basis point is 0.01 percentage point.

6 The information ratio is a measure of risk-adjusted return calculated as the difference between the segment return and the broad index return, divided by the tracking error (the standard deviation of the difference).

7 Return above that of a comparable-maturity Treasury security.

-

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Yield and share prices will vary with interest rate changes. Mortgage-backed securities are subject to credit risk, interest-rate risk, prepayment risk, and extension risk.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of August 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.