- On Global Equities

- Active Stock Choices Are Key in Volatile Times

- Steering through complex dynamics within global equities

- 2022-08-05 20:20

- Key Insights

-

- We are using our experience separating the long‑term prospects of stocks from the short‑term narratives that are causing volatility in equity markets.

- Inflation and rising interest rates have resulted in marked underperformance for growth stocks. However, the power of companies that can compound long‑term earnings and cash flows should not be underestimated.

- Geopolitical and macroeconomic uncertainty will remain part of the near‑term environment, but long‑term stock prices are ultimately driven by fundamental earnings power and cash flow generation.

Markets have endured a tumultuous period over the last two years with an extraordinary period encompassing a pandemic, economic recovery, and now, military conflict in Europe. Stocks remain especially volatile given the shocking events occurring in Ukraine, adding uncertainty to an already complex backdrop of rising inflation and monetary tightening.

"We have always believed, and continue to believe, that fundamental analysis and maintaining our time horizon will deliver the best outcome for our clients."

While the geopolitical and economic backdrop is dominating market movements, we have managed client assets through periods of uncertainty before. We are using our experience separating the long‑term prospects of stocks from the short‑term narratives surrounding equities in what is a highly unusual period. We have always believed, and continue to believe, that fundamental analysis and maintaining our time horizon will deliver the best outcome for our clients.

Regime Shifts and the Growth Versus Value Debate

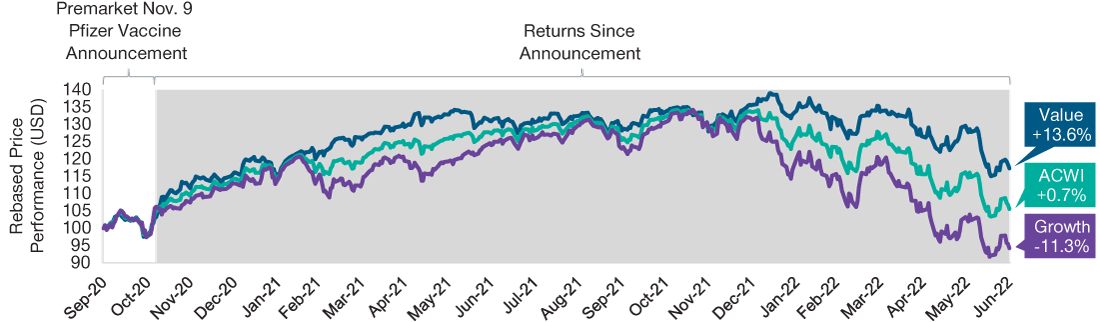

At a headline level, we believe 2022 marks a point of regime change for investors. A marked uptick in inflation and rising interest rates have contributed to equity market weakness and a very distinct change in investor sentiment. (Figure 1).

The emergence of inflation catalysts against a backdrop of supply chain constraints and tight labor markets is to be expected, but war has meant that inflation has accelerated faster than expected and is presenting a significant challenge for monetary policymakers.

Stocks Struggle as Inflation Rises and Monetary Policy Tightens

(Fig. 1) Headwinds for growth stocks as inflation and rising rates negatively impact sentiment

As of June 30, 2022.

Past performance is not a reliable indicator of future performance.

MSCI ACWI price returns September 30, 2020, through June 30, 2022. Figures noted in chart (+13.6%, +0.7%, -11.3%) are performance measured from the period after the Pfizer vaccine announcement and ending June 30, 2022. “Value” is represented by the MSCI ACWI Value Index. “Growth” is represented by the MSCI ACWI Growth Index.

Source: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

While the sources of rising inflation are embedded in a complex mosaic of temporary and structural forces, the investor reaction has been clear: a significant repositioning into areas of the market that might benefit from monetary tightening, accelerated further by the consequences of the Russia‑Ukraine conflict, most notably the rise in commodity prices and further supply chain disruption. The shift in focus comes at the expense of long duration growth stocks that have experienced exceptional levels of volatility.

"While we have witnessed adverse market conditions from time to time, the sheer size and speed of the market’s rotation has been exceptional."

While we have witnessed adverse market conditions from time to time, the sheer size and speed of the market’s rotation has been exceptional. The moves have resulted in a magnitude of underperformance for growth stocks that we did not anticipate, especially in such a short period.

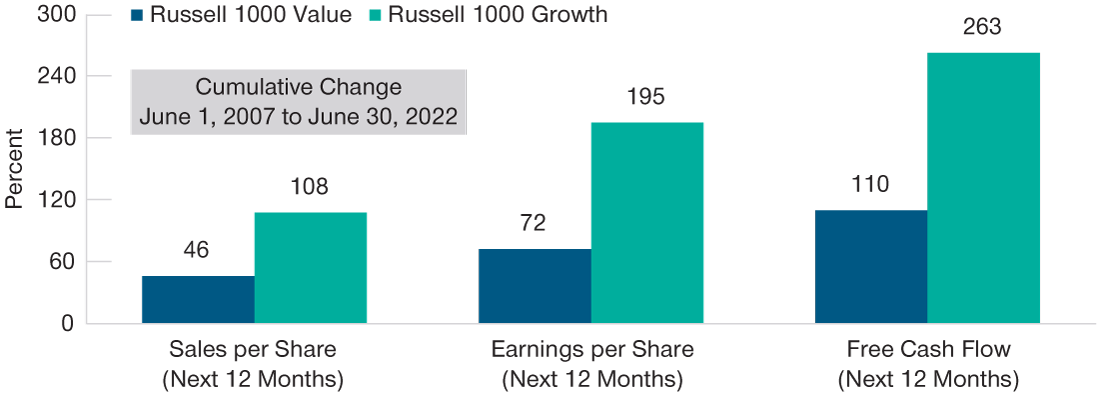

Since the global financial crisis (GFC), outperformance of growth stocks has been the dominant feature of equity markets, one accelerated by the coronavirus pandemic. While it is important to recognize that extended valuations and shifting inflation have played a part in the recent correction, it is also crucial to note that the outperformance of growth stocks has been built on a prolonged and persistent fundamental advantage—that of superior sales, earnings, and cash flow growth (Figure 2). Against a backdrop of valuations that have reset lower and the likelihood that inflation will peak as demand destruction takes hold, we believe that stocks delivering superior earnings over the next few years will be prized by investors.

Superior Sales, Earnings, and Cash Flow Growth Have Been Forgotten in the Value Rally

(Fig. 2) Markets should begin to reward growth stocks as better earnings come through

As of June 30, 2022.

Shows cumulative change in % terms.

Past performance is not a reliable indicator of future performance. Actual outcomes may differ materially from estimates.

Sources: FTSE Russell (see Additional Disclosures) and FactSet Research Systems Inc. All rights reserved.

Inflation Uncertainty

While we remain comfortable in our search for stocks with superior earnings prospects and more enthusiastic about valuations after the sell‑off, inflation has clearly emerged as an unpredictable risk in the near term. Alongside monetary tightening bringing down demand, supply chain normalization is crucial to easing pressure points, and while much of the world is learning to live with COVID‑19, the spread of the virus in China has ramifications for an extension of supply chain disruptions and inflation.

Despite legitimate concerns of policymakers and investors alike, we believe that inflation is likely to peak in the coming quarters as interest rates move progressively higher and as policymakers shift their focus away from economic support toward price stability. Demand destruction, together with a normalization of supply chains, may afford policymakers some leeway to move more slowly on monetary tightening into 2023, even with near‑term inflation figures implying aggressive action. This could provide a more positive backdrop for equity markets later in the year.

Balancing Risk and Capitalizing on Attractive Opportunities

In an environment of rapidly changing and powerful economic/geopolitical factors, we acknowledge heightened uncertainty and believe it is a period that requires pragmatism, not overconfidence. The setup for markets changed dramatically in the first half of 2022; we have responded by creating stronger portfolio balance across sectors and re-confirming each position in the portfolio. Our focus remains on asymmetric, idiosyncratic, bottom‑up stock picking, primarily in what we view as durable “special” growth compounders.

"In an environment of rapidly changing and powerful economic/geopolitical factors, we acknowledge heightened uncertainty and believe it is a period that requires pragmatism, not overconfidence."

As interest rates have moved meaningfully and supply chain stress proves tougher than expected, the outlook for some of our higher‑valuation companies has deteriorated. This includes some of our tech and internet retail companies that are suffering from factors including recession fears, cost inflation, and challenges obtaining inventory. Amid a huge shift in market sentiment, we strive for setting a higher bar for higher‑valuation, longer‑duration growth stocks but retaining those truly advantaged, disruptive businesses we believe can deliver outsized market share gains and accelerating economic returns over the medium term. We are also seeking to capitalize on market capitulation,1 where we believe “baby out with the bathwater” scenarios can create attractive entry points for truly special, long‑term growth businesses.

As commodity supply/demand dynamics have tightened, we have reduced our underweight, primarily via diversified exposure within materials, to help the portfolio in an environment of higher inflation and to help ensure we are maintaining appropriate portfolio balance. Within materials, we are diversified across metals, chemicals, and packaging, but overall we remain underweight commodities while maintaining an energy underweight.

Elsewhere, our faith in our ability to find good stock ideas in emerging markets remains steadfast. The prospects of higher U.S. interest rates and the subsequent knock‑on impact of funding costs for emerging markets have seen the asset class underperform materially versus developed markets. Countries with higher levels of debt have been impacted most, as was the case during 2013’s “taper tantrum,” despite the reality that the debt structure of most countries has changed materially over the course of the past two decades.

We believe comparisons of corporate earnings growth versus developed markets in 2023 should help, but we have increasingly seen more examples of self‑help by individual companies. During a period of crisis, there are a growing number of examples of companies focusing more intensely on cost control, efficient capital expenditure, and improving shareholder returns. We feel that valuations are also attractive and remain at a discount relative to developed markets.

At this stage of the equity cycle when overall economic growth is more scarce, being able to find profit growth is essential, in both a defensive and an offensive portfolio strategy. Irrespective of the near‑term rotation in markets, fundamental growth in earnings and cash flow remains the most powerful driver of stock prices over the long term, in our view.

While it is important to debate risks and to understand the fundamentals underpinning potential periods of change, we remain focused on idiosyncratic, fundamental stock drivers recognizing, but not being driven by, top‑down macro factors.

Complexity Levels Remain High, But Experience Can Guide Us

After an outstanding period for equity investors since the GFC, higher inflation, tightening liquidity conditions, armed conflict, and the unwinding of pandemic‑era extremes imply higher risks and ongoing market fluctuations going forward. The challenge that many investors have today—separating long‑term expected returns from short‑term narratives and concerns—is not new.

There are obvious concerns around the terrible events happening in Ukraine, but outside of these geopolitical concerns, we believe the world will be more like its pre‑pandemic self than not. While some of the forces that have supported economic recovery have shifted, our base case remains that supply chains will normalize as we learn to live with COVID‑19 and that inflation will peak and eventually ease to a more manageable level.

Importantly, volatility historically has proven to present opportunities, and while we live in highly unusual times, we continue to apply our investment process as we have during other crises. Indeed, we are observing a broader opportunity set than we have for some time. Innovative, high‑growth companies are trading, in our view, at much more reasonable valuations, while idiosyncratic stock ideas not tied to broader market direction are also a focus.

Geopolitical and macroeconomic uncertainty will remain part of the near‑term environment, but long term, stock prices are ultimately driven by fundamental earnings power and cash flow generation. We believe that focusing on this is the best way to help navigate through one of the most complex market environments investors have experienced.

Find this article interesting?

Subscribe to get email updates including article recommendations relating to global equities.

-

1 Market Capitulation refers to when a significant proportion of investors become more negative and sell over a short period of time, causing the price of a security or a market to drop sharply amid higher trading volume.

-

Additional Disclosures

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of August 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Growth stocks are subject to the volatility inherent in common stock investing, and their share price may fluctuate more than that of a income-oriented stocks. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.