Your clients may be paying more for capital preservation than is needed

In today’s 24/7 news cycle, filled with headlines about global recession risks, geopolitical turmoil, elevated inflation, and the Covid-19 pandemic, investment fears understandably have risen for many clients. So have cash balances. Money market fund assets have ballooned to over USD 4.5 trillion, up from USD 3.0 trillion at the end of 2018.1 Meanwhile, the U.S. Federal Reserve has begun raising interest rates, pushing bond prices lower and yields higher.

This volatile market environment may have prompted many clients to ask, “What should I do with my cash?” For many, the answer appears to be to move their balances into bank deposits, money market funds, or other short-term accounts with fixed nominal values, leaving them out of the market and on the sidelines.

There are other answers, however. Most clients typically know in advance when they will need to access cash for larger expenses, such as home purchases or college tuition payments. In our view, this creates flexibility for these investors to consider allocating short-term balances to assets with greater return potential than bank deposits or money market funds, potentially enabling them to lower the opportunity costs of being “out of the market.”

"By accepting a modest increase in interest rate and/or credit risk, your clients may be able to enhance returns while still retaining a considerable degree of market liquidity."

Fixed income markets include a variety of relatively low duration assets, such as short-term government or investment-grade corporate bonds. We believe these market segments can provide alternatives for your clients’ shorter-term balances. By accepting a modest increase in interest rate and/or credit risk, your clients may be able to enhance returns while still retaining a considerable degree of market liquidity.

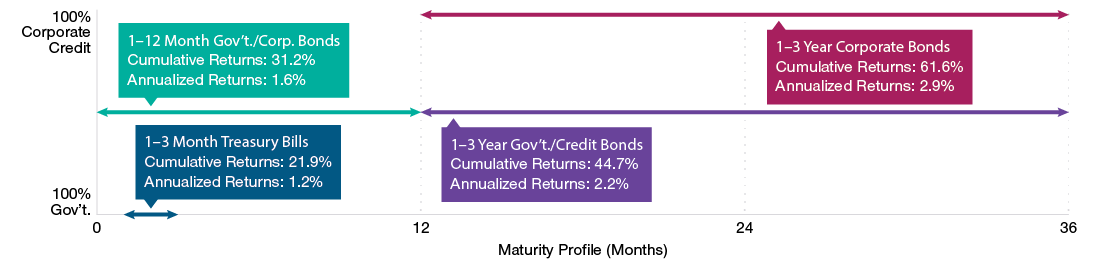

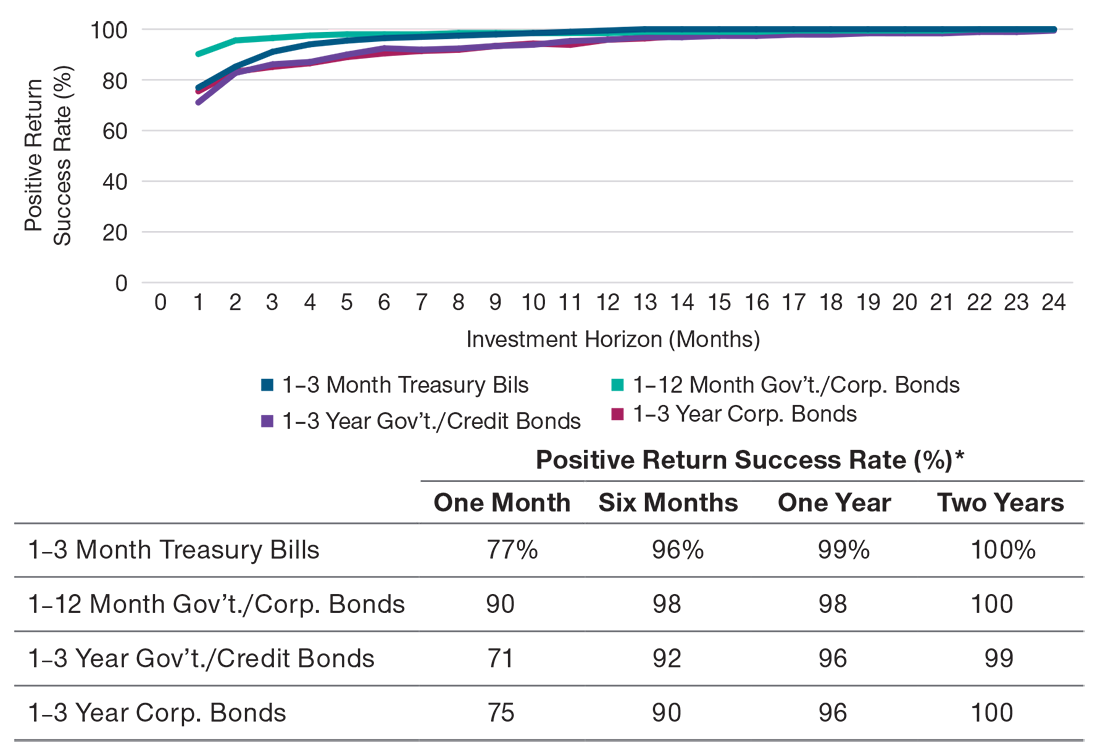

To assess the potential risks and benefits of low duration assets, we examined the historical performance of four specific low duration market segments over a 17-year period from April 1, 2005, through March 31, 2022 (Figure 1). We measured the annualized and cumulative returns for each market segment over that period and their success rates at delivering positive returns over rolling time periods ranging from one month to two years (Figure 2).2

Not surprisingly, we found that the more interest rate exposure a hypothetical low duration investor was willing to take, the more likely they were historically to be compensated with higher returns. The question, then, becomes what level of risk exposure offers higher potential returns while still providing some measure of capital preservation?

In over 70% of the one-month periods we examined, each of the four low duration market segments produced positive returns. Moreover, as the investment horizon was increased, the frequency of positive cumulative returns trended toward 100%. At the two-year horizon, positive return success rates were at or near 100%; but even at the one-year horizon they were greater than 96%.

Based on our analysis, we conclude that investors who do not require immediate liquidity should consider accepting the risk of drawdowns, which we believe are likely to be slight, in the interim in exchange for potentially higher returns over time.

Low Duration Assets Include a Range of Risk and Return Characteristics

(Fig. 1) Maturity profiles and historical returns for various market segments*

When Aligned With Expected Cash Needs, Low Duration Assets Provided a High Degree of Capital Preservation

(Fig. 2) Positive return success rates over various time horizons*

T. Rowe Price’s Low Duration Model Portfolios offer experienced portfolio managers, thoughtful strategic designs, and tactical asset allocation expertise in one package.

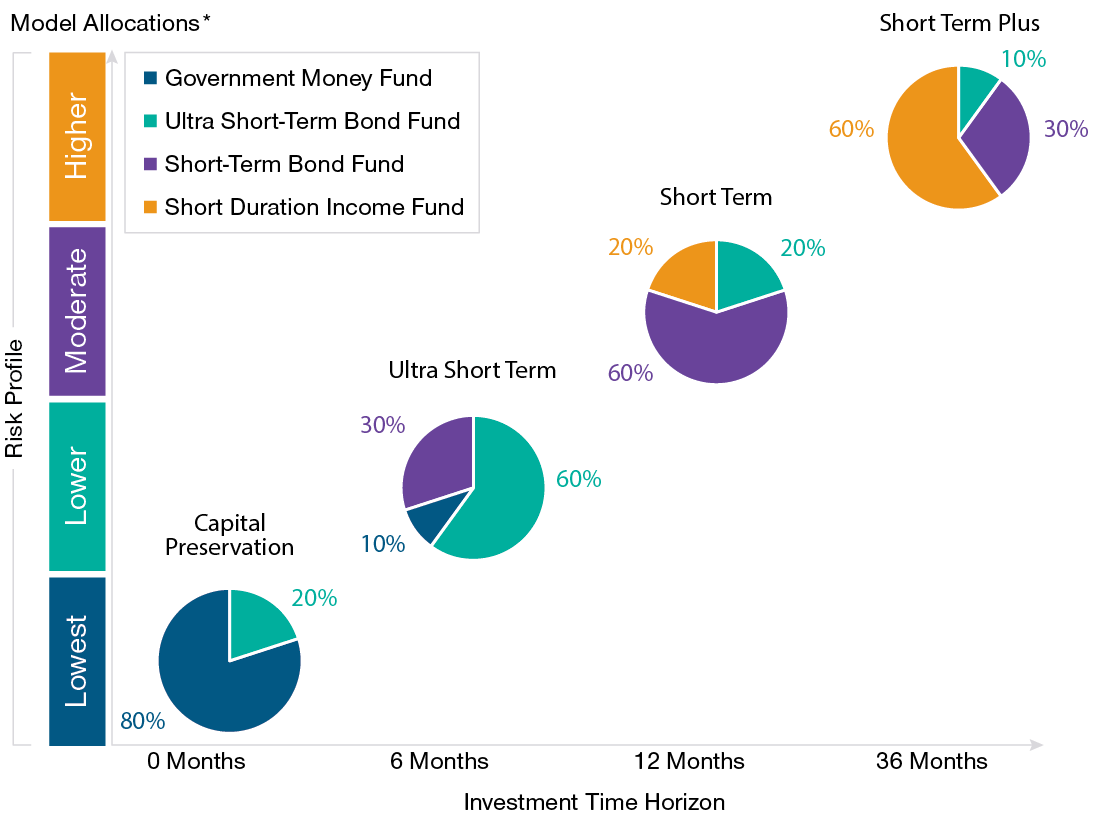

To help you answer the question when clients ask what they should do with their cash, T. Rowe Price has developed a set of Low Duration Model Portfolios designed to align investors’ expected cash flow needs with defined time horizons (Figure 3). T. Rowe Price has used this same process to manage cash on the firm’s balance sheet since 2018.

"We believe that by blending actively managed strategies for various market segments, investment professionals may be able to achieve better outcomes for their clients...."

Our Low Duration Model Portfolios seek to provide income over targeted investment horizons ranging from six to 36 months. We believe that by blending actively managed strategies for various market segments, investment professionals may be able to achieve better outcomes for their clients than are reflected in the index performance data used in this analysis. We believe these models offer the opportunity to reduce the cash drag of a portfolio, without overly relying on duration and below investment‑grade credit risk often embedded in other yield-enhancing options.

We believe our model portfolios and related services can serve as “force multipliers” that will make it easier for you to offer well‑resourced, institutional‑quality investment solutions while leaving you more time to spend with clients and grow your practice. Our financial intermediary specialists would be happy to provide additional information on T. Rowe Price model portfolio services upon request.

T. Rowe Price Low Duration Model Solutions

(Fig. 3) Seeking to do more with liquid short-term balances