- On U.S. Equities

- Seeking Growth Stories That Can Be Stronger for Longer

- Understanding innovation and disruption could create opportunities.

- 2021-08-13 15:35

- Key Insights

-

- Our nuanced understanding of technology‑driven innovation and disruption is critical in seeking companies that may deliver strong earnings and cash flow growth for longer.

- With the market bidding up high‑growth names, we are finding opportunities in what we regard as steady growers that trade at reasonable prices.

- Among secular growers, we are finding opportunities exposed to e‑commerce where we see the potential for innovation to extend growth runways.

The economic shock and uncertainty stemming from the coronavirus pandemic appeared to narrow many investors’ focus to the short term, with popular growth stocks faring especially well at the height of the pandemic and cyclical stocks that tend to exhibit greater sensitivity to the economy rallying after the announcement of vaccines effective against the coronavirus.

Although the fund’s holdings in the industrials sector and the travel and leisure industries give it some cyclical exposure, we generally have remained focused on high‑quality companies that we believe have what it takes to be good stocks over a longer time horizon. We buy and hold names where we believe that the market, with its tendency to focus on the short term, may undervalue a company’s potential to sustain strong earnings or cash flow growth over a longer holding period.

"Given the fund’s emphasis on trying to harness the power of long‑term compounding, we have found that a nuanced understanding of potential innovation and disruption is critical."

Given the fund’s emphasis on trying to harness the power of long‑term compounding, we have found that a nuanced understanding of potential innovation and disruption is critical.

We seek business models that potentially can sustain strong earnings and free cash flow growth because of favorable characteristics, such as high barriers to entry, pricing power, strong management teams that we trust to allocate capital effectively, and what we regard as limited risk of innovation‑driven disruption. At the same time, we also invest heavily in companies that we believe should benefit from key secular growth trends driven by innovation. Here, we prefer names that we think have underappreciated opportunities to boost their profit margins and/or expand their addressable market over time, thereby potentially extending their growth runways.

Seeking Potential Compounders

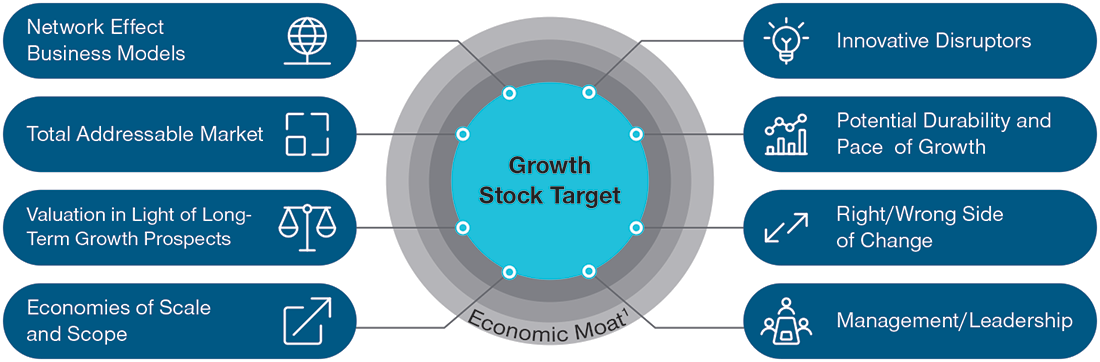

(Fig. 1) The qualities favored by our investment process

Source: T. Rowe Price.

For illustrative purposes only.

1 Economic moat refers to the defensibility of a company’s business model, a quality that can have implications for the potential durability of its market share and profitability.

Growth at a Reasonable Price

Amid the recent tug of war between growth and value regimes, quality names that we believe offer the prospect of steady, if not necessarily heady, earnings increases in the coming years have lagged high‑flying companies that have been growing their revenues at robust rates and the cyclical stocks that tend to do well earlier in an economic cycle. This dislocation, in our view, could create opportunities for growth investors who have a longer time horizon.

Our investment case for holdings that fall into the growth‑at‑a‑reasonable‑price (GARP) bucket does not hinge solely on a shift in market sentiment, nor will we speculate as to the timing or possible macro‑level developments that could catalyze such a rotation. Rather, our stock selections and position sizing are rooted in our deep understanding of these companies’ business models, the idiosyncratic ways in which their management teams may be able to unlock value for shareholders, and the competitive dynamics within their industries.

Within health care, we are finding companies that we believe trade at reasonable valuations and have the potential to sustain rates of earnings and free cash flow growth that meet our targets. Some of our favorite ideas in the sector could offer exposure to an increase in volumes as individuals seek medical consultations and elective procedures that they may have deferred during the pandemic. However, this recovery cycle is not the only possible upside catalyst underpinning our health care investments. We believe that the medical device companies we own, for example, could benefit over the long term from innovation‑driven product cycles and exposure to growing end markets.

"...instances where the market misdiagnoses the risk of disruption sometimes can create a compelling setup for growth investors."

In choosing our GARP holdings, we remain especially attuned to the risk that disruptive innovation could siphon off a company’s profit pools or erode its margins—challenges that could compress the valuation multiple that investors are willing to pay for that business. At the same time, instances where the market misdiagnoses the risk of disruption sometimes can create a compelling setup for growth investors.

Along these lines, we are finding opportunities among established payment technology companies whose stocks have underperformed, in part because of the slow recovery in international markets where restrictions to curb the spread of the coronavirus have weighed on economic activity. Concerns that these legacy players could face disruption from digital‑first, cloud‑native competitors have also contributed to these stocks’ underperformance. We plan to monitor these companies’ key business metrics and execution closely for signs of weakness. However, we believe that the headwinds stemming from these competitive threats could be muted by ongoing innovation and the secular trend toward online payments. If these payment technology companies live up to our expectations for earnings and cash flow growth, we see the potential for the market to assign them higher valuation multiples.

Selectivity in Secular Growers

We tend to invest heavily behind key secular growth trends, many of which involve the technology‑driven disruption of established industries and are unlikely to come as a surprise to many investors:

- The digitalization of the enterprise and broader economy, enabled by advanced semiconductors and the rise of cloud‑based software that is sold as a service;

- Online media taking share of the attention and advertising markets from cable television and other traditional outlets;

- Rising adoption of e‑commerce and online payments; and

- The automotive industry’s transition from the internal combustion engine to electric vehicles.

In these cases, we believe that our edge comes not from investing behind the themes themselves but from leveraging our in‑depth understanding of individual companies and industries as we seek to identify compelling ideas where we have a differentiated view from the broader market.

Consider the software industry. The appeal of the software‑as‑a‑service (SaaS) model is well understood, at this point: Customers benefit from the flexibility to scale their usage up and down and the lower information technology infrastructure and support costs that come with cloud‑based delivery, while the software companies themselves have enjoyed steadier cash flows due to the recurring nature of their subscription‑based revenues.

But not all SaaS companies are created equal. We prefer names that offer high‑quality solutions with broad use cases and management teams with a strong commitment to innovation and a record of execution. We are valuation disciplined, as a compelling story does not necessarily make for a compelling stock when the shares trade at levels that we believe price in five or more years’ worth of revenue growth. The rapid pace of innovation taking place in certain segments of the software industry also means that investors must remember that disruptors can become the disrupted. This caveat is especially true for providers of security software, an area where product cycles historically have been shorter because the threat vectors and competing products are constantly evolving.

"Among the secular growth themes behind which we tend to invest, e‑commerce and digital payments strike us as particularly appealing."

Among the secular growth themes behind which we tend to invest, e‑commerce and digital payments strike us as particularly appealing. The coronavirus pandemic accelerated the uptake of online shopping in previously difficult‑to‑penetrate markets such as groceries, and we believe that this trend has significantly more room to run.

The innovation taking place in this area also has the potential to create a lot of value for shareholders, in our view. We are finding opportunities among the emerging stack of modular e‑commerce solutions that help businesses to sell their products online. Meanwhile, we believe image‑ and video‑intensive platforms have an opportunity to further monetize their massive userbases by pushing into the emerging fields of interactive and social commerce. At scale, e‑commerce operations lend themselves to ancillary opportunities in online payments and targeted advertising, while the data generated by buyers and merchants on these platforms eventually could form the basis of various fintech products, among other possibilities.

Companies that can sustain a high level of earnings and cash flow growth for an extended period are a rare breed. We believe that our rigorous fundamental research into public and private companies and deep understanding of disruptive innovation may give us an edge in identifying investment opportunities where the market does not fully appreciate the potential durability of a company’s growth story.

We believe that the disruption of the automobile industry has the potential to create opportunities for well‑positioned companies that are on the right side of change. In our view, the transition away from the internal combustion engine may occur at a faster pace than many expect, as traditional auto companies and upstarts roll out their lineups of electric vehicles (EVs). Meanwhile, a supportive regulatory environment in many countries, the buildout of infrastructure to charge the batteries that power EVs, and an increasing emphasis on the need to reduce carbon emissions should act as tailwinds on the demand side. We continue to monitor opportunities throughout the EV supply chain as well as innovations related to autonomous driving and technologies that could help to reduce carbon emissions from heavy‑ and medium‑duty trucks.

-

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Growth stocks are subject to the volatility inherent in common stock investing, and their share price may fluctuate more than that of a income‑oriented stocks. Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of August 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any forward‑looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2021 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.