Case for global equities: Enhancing opportunity, diversification, and risk management

October 2025, From the Field

- Key Insights

-

- Rotating market leadership emphasizes the value of global breadth, enabling investors to identify opportunities across regions and sectors, enhance diversification, and reduce concentration risk as growth drivers shift.

- High U.S. market concentration driven by mega‑cap technology and the AI boom highlights the need for active managers to broaden their global research and allocations to capture new sources of return.

- Global equity allocations broaden the investment universe, combining U.S. leadership with international and emerging market opportunities to enhance portfolio resilience and position investors for long‑term growth potential.

The case for global equity allocation is gaining renewed momentum. By investing globally, investors gain access to a broader opportunity set across sectors, countries, and regions—reducing concentration risk and unlocking new avenues for growth and diversification. Broader exposure and lower concentration risk helps provide a form of “portfolio insurance” against shifts in investment styles or market momentum. This buffer is particularly valuable when markets are narrowly focused on a limited group of themes or companies, as is the case today.

"Year‑to‑date, several non‑U.S. markets have outpaced the U.S., underscoring the benefit of accessing a broader opportunity set."

Rotating leadership favors broader exposure

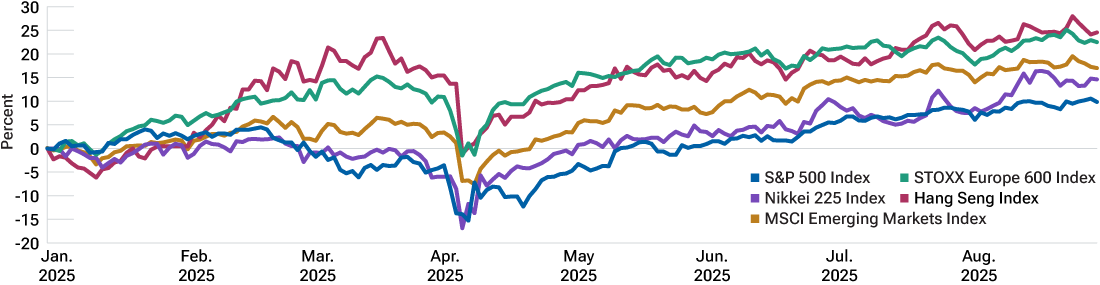

Year‑to‑date, several non‑U.S. markets have outpaced the U.S. (Figure 1), underscoring the benefit of accessing a broader opportunity set. Looking back, the 2008 global financial crisis (GFC) through to the onset of COVID‑19, markets were shaped by a backdrop of low interest rates, subdued inflation, and modest growth—conditions that supported asset performance. Combined with elevated U.S. federal government spending, these dynamics fueled strong returns and led to increasing market concentration in the U.S.

U.S. markets have trailed international and emerging markets in 2025

As of August 31, 2025.

Past performance is not a guarantee or a reliable indicator of future results.

Source: FactSet.

In the post‑COVID environment, the market landscape has shifted meaningfully. Interest rates and inflation are structurally higher, while government spending is becoming more globally distributed, supporting growth across regions. For example, Germany’s recent commitment of nearly EUR 1 trillion of additional borrowing for infrastructure and defense investment is already creating ripple effects across Europe. Against this backdrop, we see a broadening opportunity set for investors beyond the U.S., with compelling prospects increasing in international and emerging markets.

"Maintaining global breadth can help mitigate concentration risk, strengthen diversification, and expand potential return and alpha sources as leadership rotates."

Maintaining global breadth can help mitigate concentration risk, strengthen diversification, and expand potential return and alpha sources as leadership rotates. Importantly, because market regime transitions often unfold quickly and asymmetrically, portfolios that rely predominantly on U.S. equities for risk exposure may be more vulnerable to drawdowns and factor or sector shocks. It also may mean that they forgo exposure to differentiated sources of growth elsewhere.

Deglobalization driving less correlation between markets

After years of steadily increasing correlations among global equity markets, we are now seeing greater divergence and wider dispersion in returns across regions. Analysis since 2015 reveals that in the past three years (calendar years 2022, 2023, and 2024), the average correlation between nearly every major stock index has declined compared with the period from 2015 to 2020 (Figure 2). Following a sustained rise in correlations after the GFC, factors such as deglobalization, geopolitical tensions, and the fragmentation of global supply chains have shifted market dynamics. This regional divergence and reduced synchronicity among equity markets represent a significant change for portfolio construction and global equity investing.

Deglobalization driving less correlation between markets

(Fig. 2) Shifting market dynamics have reduced synchronicity among equity markets

| Correlation matrix | Correlation period 2015–2020 | Correlation period 2022–2024 | Direction |

|---|---|---|---|

| S&P 500 versus MSCI EAFE Index | 0.88 | 0.85 | Decreased |

| S&P 500 versus MSCI Europe Index | 0.86 | 0.82 | Decreased |

| S&P 500 versus MSCI Japan Index | 0.80 | 0.85 | Increased |

| S&P 500 versus MSCI Emerging Markets Index | 0.75 | 0.63 | Decreased |

| S&P 500 versus MSCI China All Shares Index | 0.60 | 0.17 | Decreased |

Source: FactSet. Analysis by T. Rowe Price.

Evaluating opportunities and risks: U.S., international, and global equities

U.S.

- + Deep markets, high‑quality companies, strong governance, innovation.

- – Stock market dominated by large tech firms, which can amplify sector‑specific risk.

- – High valuations, sector concentration, less exposure to global growth.

- – Trade at a premium to international and global markets.

International

- + Access to undervalued markets, diversification, high‑quality companies.

- – May underperform without U.S. exposure; can be heavily weighted to slow‑growth regions.

- – International equities can be heavily weighted to financials or cyclicals.

Global

- + Global equity approach balances sector and style exposures, mitigating drawdowns from regional or sector‑specific downturns, but can limit gains when particular themes are being established.

- + Combine the strengths of both, adaptable to shifting market leadership, balanced sector and country exposures.

- + Global portfolios can tilt toward undervalued regions when appropriate, potentially enhancing long‑term returns.

- – May underperform individual countries and regions at different times.

| VALUATION COMPARISON SNAPSHOT (as of August 2025) | |

|---|---|

| S&P 500 P/E Ratio: | 22.2x |

| MSCI EAFE P/E Ratio: | 15.1x |

| MSCI EM P/E Ratio: | 13.3x |

| MSCI ACWI (Global Equities) | 18.9x |

| INDEX RETURNS (annualized, 10 years ended August 2025) | |

|---|---|

| MSCI ACWI (Global Equities): | 11.7% |

| S&P 500 (U.S. Equities): | 14.6% |

| MSCI EAFE (International Developed): | 7.9% |

| MSCI EM (Emerging Markets): | 7.4% |

As of August 31, 2025.

Past performance is not a guarantee or a reliable indicator of future results.

Source: FactSet.

Active management in a concentrated U.S. market

Index concentration at the top of the U.S. market has created a more challenging environment for active managers. The rise of the so‑called Magnificent Seven has concentrated a disproportionate share of benchmark‑relative risk in a small group of mega‑cap stocks, limiting flexibility in portfolio construction. To succeed, active managers need to develop deeper insights into how artificial intelligence (AI)—the most disruptive technological force shaping markets today—is playing out. While the AI cycle is led by U.S. firms, expanding research coverage globally provides essential context to investment decisions. For example, Taiwanese electronics and networking equipment companies play essential roles in AI infrastructure. Meanwhile, China‑based innovators in generative AI and large language models and technology and social platforms, as well as leading technology firms in Japan, highlight how international activity intersects with AI leadership in the U.S.

Recent negotiations between a South Korean firm and a U.S. semiconductor company over high‑bandwidth memory supply demonstrate how global partnerships reinforce U.S. leadership in AI infrastructure. Examining these relationships helps investors uncover industry trends and view change from multiple perspectives. Such developments can both strengthen U.S. market concentration and expand opportunities for investors globally.

"Markets outside the U.S. provide differentiated growth drivers."

Recognizing these global linkages is crucial for investors. They explain not only the durability of U.S. market leadership but also where new opportunities may emerge. Broadening the investable universe—particularly into non‑U.S. and emerging markets—can restore diversification benefits that have become more limited, enhance active share, and position portfolios to potentially capture excess returns beyond concentrated U.S. benchmarks.

Global markets provide more balance, diversification, and differentiated growth drivers

(Fig. 3) Sector concentration at a glance: Key differences across leading equity indices

| Benchmark Sector Weights | ||||

|---|---|---|---|---|

| Sector | Russell 1000 Index | MSCI EAFE Index | MSCI ACWI Index | MSCI EM Index |

| Weight (%) | Weight (%) | Weight (%) | Weight (%) | |

| Communication Services | 9.63 | 5.22 | 8.48 | 9.95 |

| Consumer Discretionary | 10.69 | 9.63 | 10.11 | 12.71 |

| Consumer Staples | 5.10 | 7.82 | 5.75 | 4.35 |

| Energy | 3.03 | 3.33 | 3.52 | 4.17 |

| Financials | 14.16 | 24.51 | 16.96 | 23.77 |

| Health Care | 8.80 | 11.11 | 9.12 | 3.50 |

| Industrials & Business Services | 9.61 | 19.36 | 11.52 | 6.88 |

| Information Technology | 32.21 | 8.04 | 26.77 | 24.76 |

| Materials | 2.13 | 5.58 | 3.15 | 5.86 |

| Real Estate | 2.26 | 1.90 | 1.97 | 1.58 |

| Utilities | 2.38 | 3.49 | 2.65 | 2.46 |

| Total | 100.00 | 100.00 | 100.00 | 100.00 |

As of July 31, 2025.

Source: FactSet.

Global opportunities beyond the U.S.

Markets outside the U.S. provide differentiated growth drivers. Japan offers high‑quality manufacturing, advanced automation, and rising shareholder returns. Europe adds exposure to leading industrials, improving financials, luxury brands, and world‑class pharmaceutical firms. Emerging markets, such as India and Brazil, deliver fast‑growing economies supported by favorable demographics and rising consumer demand.

Broadening allocations internationally enables investors to capture themes underrepresented in U.S. markets—including deglobalization, infrastructure and defense spending, and consumer expansion—while also improving sector diversification. Non‑U.S. markets have lower technology weightings and greater exposure to value‑oriented and defensive sectors, adding more balance to portfolios (Figure 3).

Adopting a global equity approach also significantly expands the investment universe from 503 stocks in the S&P 500 Index to more than 2,509 stocks in the MSCI All Country World Index—over three times the size of the MSCI EAFE Index alone.

5X

There are five times the number of companies in the MSCI All Country World Index versus the S&P 500 Index.

For long‑term investors, combining U.S. growth leadership with international and emerging market opportunities offers the potential to reduce concentration risk, enhance diversification, and build more resilient portfolios that can adapt to shifting market leadership.

Jennifer O'Hara Martin

Global Equity Portfolio Specialist

Jennifer O'Hara Martin

Global Equity Portfolio Specialist

Drugging the undruggable: How biotech innovation is creating opportunities for investors

Contact us

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of October 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202510-4828729