Income Solver®:

Turn complexity into confidence

What could your clients do with 7 more years of retirement income? Build a comprehensive plan that seeks to optimize withdrawals, Social Security, and investments all at the same time with Income Solver. Our innovative software can help you add up to $1 million to your client's retirement income, according to our recent study.

The Income Solver advantage

Income Solver uses a proprietary methodology that optimizes withdrawals, Social Security, and investments all at the same time. This helps you deliver personalized retirement income plans that can add years of longevity to client portfolios—allowing your clients to more fully enjoy the retirement they've earned.

Note: Join a live demonstration of Income Solver and receive complimentary 14-day trial access to the platform. To see pricing or purchase an individual subscription plan for Income Solver, you must log in or register for a secure advisor account. Additional verification may be required.

Find potential income that a conventional approach can miss

Don't let your clients rely only on conventional wisdom when it comes to their retirement income planning. Learn how the Income Solver approach projected more years of funded retirement and thousands of dollars in tax savings over other approaches in our study.

Income Solver benefits

Streamline

Integrates with your current financial planning software and uses existing client data to generate custom strategies.

Differentiate

Leverages a proprietary methodology to deliver comprehensive, personalized income plans that set your practice apart.

Grow

Helps you expand and deepen your retirement planning offer to boost client acquisition, engagement, retention, and asset consolidation potential.

Discover key features

Income Solver’s robust features align with the three pathways for delivering better retirement income advice: personalized withdrawal strategies, Social Security optimization, and active investment management.

Generate, analyze, and compare withdrawal strategies

Income Solver’s customizable strategy framework allows you to:

- Offer withdrawal strategies customized to client needs—with robust analyses of cash flow, taxes, and investments for comparison

- Monitor and facilitate risk and rebalancing

- Manage clients’ long-term tax burden with Roth conversions and coordinate liquidation order to mitigate Medicare surcharges, Required Minimum Distributions, and Social Security taxation

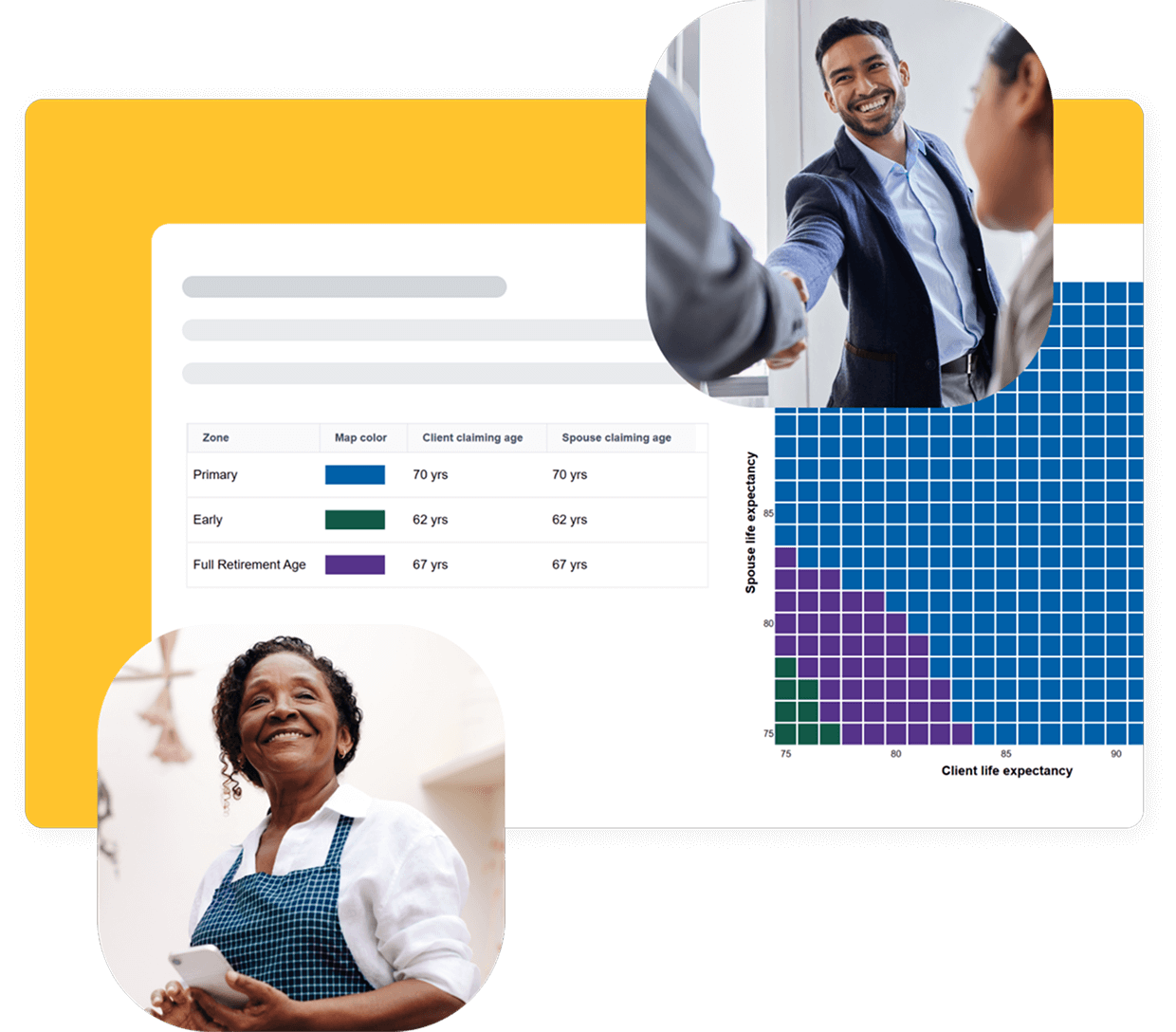

Optimize Social Security benefits

Every Income Solver license includes SSAnalyzer®, a top-rated Social Security planning tool that lets you:

- Generate optimal strategies to maximize total lifetime benefits

- Compare and conduct in-depth analysis to help clients understand strategy options

- Show the best claiming strategy across all possible life expectancies with The Social Security Zone™

Seamlessly integrate active investment management and asset location

Coordinate and rebalance investments across multiple accounts and leverage tax treatments with features like:

- An investment product marketplace with access to model portfolios, annuities, and more

- Household-based rebalancing with asset location and automation of asset allocation changes and custom time-segments

- An “Easy Button” for one-click trade recommendations aligned to a strategic withdrawal sequence

Choose the best Income Solver plan for your practice

Explore customizable licensing plans that fit your business needs.

Basic Pro

A single-license plan for financial professionals who want to get started with DIY training and support.

Complete Pro

A single-license plan for financial professionals looking to maximize impact with white-glove onboarding, premium training, and ongoing support.

Custom Team

A multi-license plan for teams and organizations ready to scale their retirement income planning offer.

Connect with one of our specialists to learn more about group pricing and support options.

Recognized by industry and media leaders

T. Rowe Price acquired Retiree Inc. in 2023—leveraging their 15-year track record of creating industry-leading retirement income planning solutions.

Deployed in thousands of firms nationwide, Income Solver has ranked in the top three “Retirement Distribution Planning Tools” every year since 2023 in the T3 Technology Surveys by Independent Advisors.1,2,3

Complement Income Solver with practice management resources

This interactive program—featuring presentations, workbook, client handouts, and more—is designed to help you build out a retirement income planning offer to meet evolving client needs and differentiate your practice.

Discover our free tools and resources for financial professionals

Social Security Analyzer™

Powerful yet easy-to-use, SSAnalyzer is the top-ranked tool for optimizing clients’ Social Security claiming strategies.

Advisor Dashboard

Access your personalized Advisor Dashboard for reports, tools, and analytics—including our proprietary Art of Clean Up® analysis.

Retirement income solutions

Simplify the path to retirement income. Our retirement investment solutions and services can help clients feel confident, prepared, and in control of their future.

Contact us

Important Information

1Veres, B., & Bruckenstein, J. 2023 T3/Inside Information Advisor Software Survey [PDF]. https://t3technologyhub.com/wp-content/uploads/2023/03/2023-T3-and-Inside-Information-Software-Survey.pdf

2Veres, B., & Bruckenstein, J. 2024 T3/Inside Information Advisor Software Survey [PDF]. https://t3technologyhub.com/wp-content/uploads/2024/04/2024-T3_Inside-Information-Software-Survey-V-4-22-24.pdf

3Veres, B., & Bruckenstein, J. 2025 T3/Inside Information Software Survey [PDF]. https://t3technologyhub.com/wp-content/uploads/2023/03/2023-T3-and-Inside-Information-Software-Survey.pdf

The software and related information should be used only as a general guideline and not as the ultimate sources of information about Social Security claiming strategies. Retiree Inc. shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused, or alleged to be caused, directly or indirectly, by information contained in this report. Retiree Inc. and its affiliates do not provide tax advice and no analysis, supplemental information, or output by the software should be considered tax advice. For answers to any specific tax questions related to Social Security you should consult a qualified tax professional. Retiree Inc. is a subsidiary of T. Rowe Price Group, Inc. and is not affiliated with or endorsed by the Social Security Administration.

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not intended to suggest that any particular investment action is appropriate for you. Please consider your own circumstances before making an investment decision.

The trademark shown is the property of its respective owner. Use does not imply endorsement, sponsorship, or affiliation of T. Rowe Price with any of the trademark owners.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

Income Solver is offered by Retiree Inc., a wholly owned subsidiary of the T. Rowe Price Group, Inc.

© 2026 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, RETIRE WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (https://www.troweprice.com/en/intellectual-property) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners

202512-5080440