Looking for income? Four bond solutions to consider

October 2025, From the Field

- Key Insights

-

- Against a backdrop of heightened uncertainty, we believe that fixed income is an attractive place for investors with a plethora of potential income opportunities on offer.

- With diverse sectors, there is flexibility for investors to find a bond solution that can help support their distinct needs and objectives.

- Investment-grade corporate bond strategies may appeal to investors seeking steady income, while those looking for diversification may find a global multi‑sector bond approach attractive.

Investors continue to face a range of market and economic challenges, including political uncertainty, persistent inflation, high fiscal deficits, and ongoing geopolitical tensions. These factors may fuel bouts of volatility and be challenging to navigate, but the good news is that investors can potentially generate an attractive income stream from bonds as yields remain elevated.

"...bonds may also help investors achieve specific objectives within their asset allocation construct...."

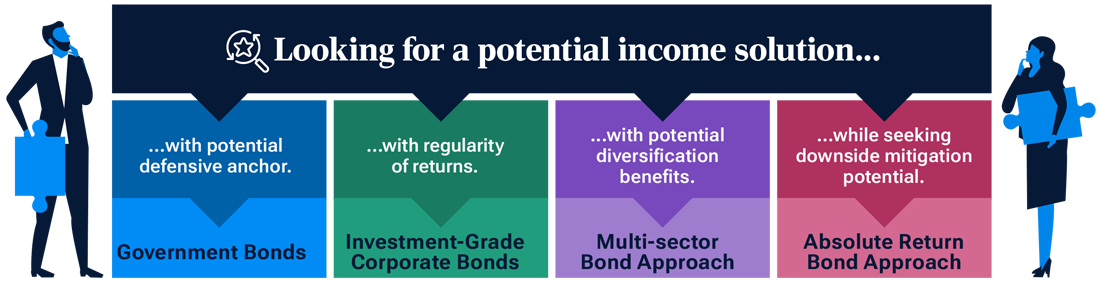

Another key benefit of a fixed income allocation is the diverse range of options on offer. This means that, in addition to potential income generation, bonds may also help investors achieve specific objectives within their asset allocation construct, such as stability, growth, or diversification.1 In this piece, we are delving into the characteristics of four different bond solutions and how they align with distinct investment goals.

Four bond approaches for today’s uncertain markets

As of October 2025.

For illustrative purposes only. This is not to be construed to be investment advice or a recommendation to take any particular investment action.Investments involve risks, including possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market.

See Appendix for varying risks associated with each fixed income sub asset class.

Source: T. Rowe Price.

Four bond approaches to help meet different investor needs

1. Government bond approach

Government bonds may appeal to investors seeking a stable income stream, liquidity, and a defensive anchor for their portfolios. In recent years, however, the defensive qualities of government bonds have been called into question, as fixed income and equity markets have tended to move in tandem. While correlations2 between the asset classes could continue to be volatile, if an extreme market event or significant downturn puts major selling pressure on risk assets, such as equity, we expect high quality government bonds to be an effective diversifier. Furthermore, government bonds generally have better liquidity compared with other fixed income segments. This means investors can potentially adjust and make changes to their portfolios more easily—a feature that could be especially valuable during periods of market stress.

"The ability to be nimble and respond to changing markets is essential...."

Within the government bond space, it’s important to recognize the current climate of high fiscal deficits across developed markets, which must be funded through increased debt issuance. This is likely to fuel volatility, making it critical to consider solutions that actively manage interest rate risk. The ability to be nimble and respond to changing markets is essential in this environment.

2. Investment grade corporate bond approach

Investment grade corporate bonds should benefit from both duration3 and credit spread components. During good times when the economy is growing and credit spreads are tightening,4 the asset class typically does well thanks to the credit element. By contrast, when times are tougher and the economy is weakening, the duration component may kick in as a shock absorber to help offset a widening of credit spreads. We believe this defensive attribute makes the asset class appealing for investors seeking stability as well as a regular income stream.

Even though credit spreads are tight at present, we believe that the yield on offer in the asset class is still appealing and offers a pickup over traditional government bonds. As of the end of September 2025, the average yield to worst offered by European investment‑grade corporate bonds was around 3.09%.5

3. Global multi sector bond approach

A global multi‑sector bond approach has the ability to find attractive income opportunities across a wide variety of fixed income sectors. This includes government, corporate, and securitized debt from both investment‑grade and high yield issuers across developed and emerging markets. The approach offers the potential to diversify return sources, which may appeal to investors seeking a more stable return and lower volatility through diversification. The ability to invest across a broad range of sectors and tactically adjust allocations to the market environment may be valued by an investor who is uncertain about what sector to buy or when to make a reallocation decision. The flexibility of a multi‑sector approach takes that burden away and can be seen as a “one‑stop shop” for a fixed income allocation. However, within this category, it’s important to choose an approach that is truly global in nature and not tilted toward specific sectors, which can lead to concentration risks.

"The flexibility of a multi-sector approach takes that burden away and can be seen as a “one-stop shop”...."

4. Absolute return bond approach

Absolute return approaches aim to deliver positive returns regardless of the market conditions. These nontraditional fixed income strategies are typically benchmark agnostic and can cast a broader net, with the potential to invest in a wide range of geographies, sectors, and security types. They often have greater flexibility, including the ability to implement short positions, which may help to generate a potential positive return in falling markets. However, investors should be aware that strategies within this category can vary significantly. For those seeking potential portfolio diversification, it’s important to look under the hood for an absolute bond fund manager that has either a low or negative correlation with key market indexes, such as the S&P 500. These correlation characteristics, together with the ability to tactically respond to shifting market dynamics, give investors the potential to realize returns in a variety of different market environments, including periods of equity volatility and risk aversion.

The current challenges financial markets face—including political and economic uncertainty—may be unsettling for investors. But with bond yields still at elevated levels, we believe that fixed income offers potential attractive income generation. The diversity of the asset class also means that investors can choose a sector or approach that can help meet their specific objectives.

Kenneth A. Orchard, CFA

Head, International Fixed Income

Kenneth A. Orchard, CFA

Head, International Fixed Income

Higher U.S. long-term yields, steeper curve: Why my thesis still holds

Explore why longer-maturity U.S. Treasury yields could still increase.

Contact us

1 Diversification cannot assure a profit or protect against loss in a declining market.

2 Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

3 Duration measures a bond’s sensitivity to changes in interest rates. Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar maturity, high quality government security.

4 Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing spreads indicate improving creditworthiness.

5 As of September 30, 2025. Yield to worst of the Bloomberg Euro Aggregate—Corporate Bond Index. Source: Bloomberg Finance L.P. Yield to worst is a measure of the lowest possible yield on a bond whose contract includes provisions that would allow the issuer to redeem the securities before they mature. Past performance is not a guarantee or a reliable indicator of future results.

Additional Disclosures

For U.S. investors, visit troweprice.com/glossary for definitions of financial terms.

Risks: Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk. As interest rates rise, bond prices generally fall. Investments in high yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Absolute return bond approaches may employ sophisticated investment strategies that are speculative in nature, and not all vehicles are available to all types of investors. Derivatives may be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions; risks can include leverage risk, liquidity risk, index risk, and counterparty risk.

ICE BofA Global High Yield Index (THE “INDEX”) IS A PRODUCT OF SOURCE ICE DATA INDICES, LLC (“ICE DATA”), AND IS USED WITH PERMISSION. ICE® IS A REGISTERED TRADEMARK OF ICE DATA OR ITS AFFILIATES AND BOFA® IS A REGISTERED TRADEMARK OF BANK OF AMERICA CORPORATION LICENSED BY BANK OF AMERICA CORPORATION AND ITS AFFILIATES (“BOFA”) AND MAY NOT BE USED WITHOUT BOFA’S PRIOR WRITTEN APPROVAL. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. INCLUSION OF A SECURITY WITHIN AN INDEX IS NOT A RECOMMENDATION BY ICE DATA TO BUY, SELL, OR HOLD SUCH SECURITY, NOR IS IT CONSIDERED TO BE INVESTMENT ADVICE. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. ROWE PRICE, OR ANY OF ITS PRODUCTS OR SERVICES.

Important Information

This material is being furnished for informational and/or marketing purposes only and does not constitute an offer, recommendation, advice, or solicitation to sell or buy any security.

Prospective investors should seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services.

Past performance is not a guarantee or a reliable indicator of future results. All investments involve risk, including possible loss of principal.

Information presented has been obtained from sources believed to be reliable, however, we cannot guarantee the accuracy or completeness. The views contained herein are those of the author(s), are as of October 2025, are subject to change, and may differ from the views of other T. Rowe Price Group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

All charts and tables are shown for illustrative purposes only. Actual future outcomes may differ materially from any estimates or forward‑looking statements provided.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

Issued in the USA by T. Rowe Price Investment Services, Inc., distributor and T. Rowe Price Associates, Inc., investment adviser, 1307 Point Street, Baltimore, MD 21231, which are regulated by the Financial Industry Regulatory Authority and the U.S. Securities and Exchange Commission, respectively.

© 2025 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202510-4888806