Discover the possibilities of an active technology ETF

November 2025, From the Field

- Key Insights

-

- Artificial intelligence, e-commerce, and digital payments are areas of increased opportunity within the global technology sector.

- Passive technology exchange-traded funds (ETFs) are limited by market concentration within the sector, while active and thematic funds offer greater flexibility.

- The T. Rowe Price Technology ETF (TTEQ) provides strategic exposure to technology‑enabled companies with an active approach designed to outperform the fund’s benchmark index.

Artificial intelligence (AI) has the potential to become the most significant productivity enhancer for the global economy since electricity. It is estimated that electricity contributed a 30.6% increase in labor productivity for global gross domestic product over 32 years1 compared with a hypothetical baseline where this technological advancement never happened.2 AI most likely will surpass that.

Historically, productivity-enhancing technologies are often associated with speculative stock market bubbles. Investors must navigate these responsibly by capturing the upside and mitigating the downside. Active management can make a big difference in these situations.

It’s tempting to compare this infrastructure cycle with the telecom bubble of the late 1990s, but there are many meaningful distinctions. Most notably, this current cycle is funded by the most profitable companies in history—the hyperscalers. These companies operate as natural monopolies, and only at their scale has it even been possible to invent, develop, and finance the significant changes driven by AI. The paradox is that while AI was only possible due to the hyperscalers’ enormous power and scale, AI also initiates the very transition that could potentially disrupt the existing businesses of these natural monopolies. This implies that the infrastructure investments are both offensive and defensive and could continue longer than the market expects.

AI remains a transformative force that is reshaping global markets. So far, the majority of economics associated with this infrastructure boom have accrued to the digital semiconductor and hardware industries, though software and digital advertising companies are also seeing stronger revenue growth as AI spending cascades through the technology ecosystem.

The AI investment cycle is fueling both digital and physical investment booms—from semiconductors and software to power infrastructure and data centers. Demand still exceeds supply, supporting elevated returns across the value chain. The focus for investors is to participate responsibly, manage concentration and valuation risk, and stay adaptable as market dynamics evolve and the next phase of AI adoption unfolds.

Additional growth areas include e-commerce and digital payments

As AI transforms the technology landscape, it is driving one of the most powerful investment cycles in decades. The AI chip market still has a lot of growing to do: AMD estimates that the AI data center total addressable market will rise from around USD 200 billion in 2025 to USD 1 trillion in 2030.3 With a disciplined investment framework and research process, T. Rowe Price is well positioned to navigate this evolving AI landscape and capture opportunities across every stage of the AI investment cycle. This is where active management truly matters.

Additional areas of opportunity include:

- Global e-commerce

This industry is growing as online retail gains more market share from offline retail. This trend is global, and T. Rowe Price’s extensive equity research team helps identify linchpin companies worldwide that will benefit from it. - Digital payments

These companies bring a software approach to financial services, resulting in lower costs and higher profitability and opening parts of the global payments industry that were previously inaccessible due to high costs.

There are technology-enabled companies all around globe—including Amazon, Visa, Adyen, Shopify, Alibaba, Sea, PDD Holdings, Mercado Libre, Coinbase, Robinhood, and NU Holdings—that benefit from these two megatrends.

Shifts in the passive ETF landscape bring more opportunity for active investors

The Global Industry Classification Standard (GICS) underwent several changes in 2018, including renaming the telecommunication services sector to communication services. This shift reclassified companies such as Meta and Alphabet from the information technology (IT) sector into this new category. This had several implications:

- Confusion among investors who want to allocate to “technology stocks.”

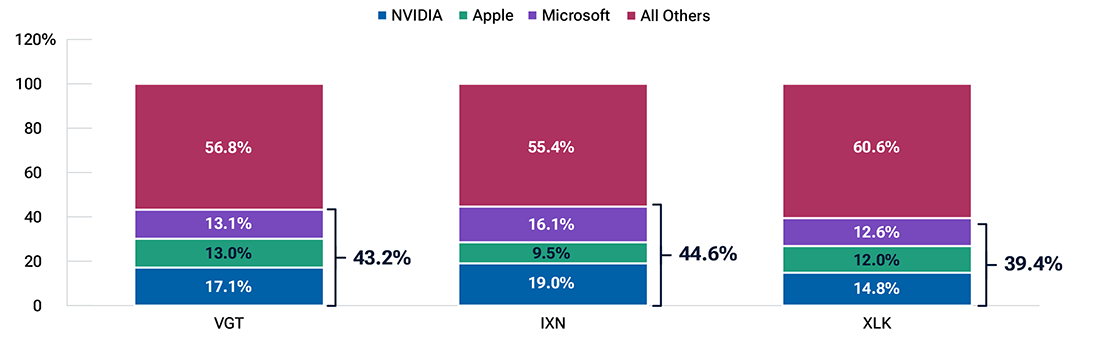

- Concentration issues in the IT sector, as nearly half of the index is now dominated by just three companies: Apple, Microsoft, and NVIDIA. Pure IT exchange-traded funds (ETFs), such as the Technology Select Sector SPDR® Fund, the Vanguard Information Technology Index Fund, and the iShares Global Tech ETF, must now face this incredible concentration problem (Figure 1).

- Active and thematic ETFs do not follow traditional GICS sector classifications.

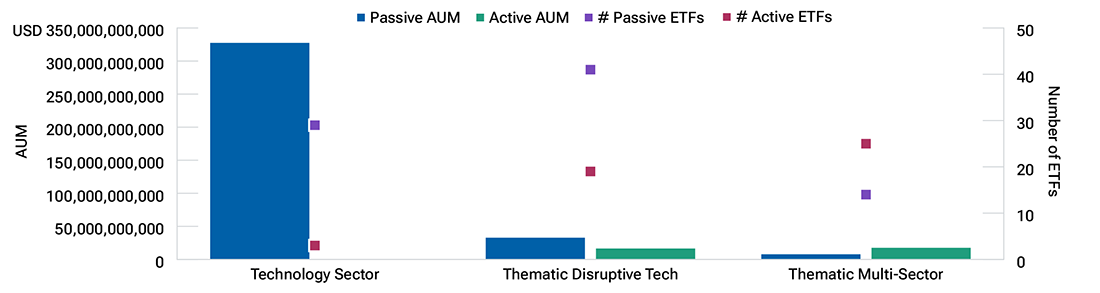

- While most technology-oriented ETF assets are still in the IT sector, new categories such as thematic disruptive tech and thematic multi-sector capture a broader technology landscape and include many active ETFs (Figure 2).

- These newer ETF categories give investors greater flexibility to choose investments that better suit their views on “technology” stocks.

Passive tech ETFs face extreme market concentration

As of September 30, 2025.

The ETFs shown are for illustrative purposes only and represent the two largest U.S. information technology ETFs (VGT, XLK) and the largest global information technology ETF (IXN). VGT is the Vanguard Information Technology Index Fund. IXN is the iShares Global Tech ETF by BlackRock. XLK is the Technology Select Sector SPDR® Fund by State Street Global Advisors. For more information on the ETFs, visit the fund companies’ websites. Refer to each fund’s prospectus for more information. All investments involve risk, including possible loss of principal. When valuations fall and market and economic conditions change, it is possible for both actively and passively managed investments to lose value. Please see the Additional Disclosure for the objectives of the ETFs included above.

The specific securities identified and described are for informational purposes only and do not represent recommendations.Source: Financial data and analytics provider FactSet. Copyright 2025 FactSet. All Rights Reserved. Percentages reflect percent of equity.

The majority of technology ETF assets and products are in the IT sector category

As of September 30, 2025.

Source: ETF Action.

A sector ETF invests specifically in the stocks within a particular industry; a technology sector ETF may track tech stocks. Thematic ETFs focus on specific themes. Within this category, a disruptive technology fund can invest in securities that cover trends and innovations, namely those with the potential to change an existing industry or service or to create a new one. Thematic multi-sector funds invest in a mix of sectors.

Are the “Qs” investing in what you think they are?

For many years, the Invesco QQQ ETF Trust (QQQ), also known as the Qs, has been strongly associated with technology stocks. With over USD 400 billion of assets under management (AUM) at 20 basis points,4 the Qs are the standard against which all technology investments, public and private, are measured. However, despite its significant emphasis on technology, it is not a technology ETF.

QQQ mirrors the performance of the Nasdaq-100 Index®, which includes 100 of the largest nonfinancial firms listed on the Nasdaq stock market. Sectors such as consumer staples, health care, industrials, materials, utilities, and energy compose approximately 15% of the portfolio (Figure 3). At the individual stock level, companies such as Costco, T-Mobile, PepsiCo, and Linde may be among the top 20 holdings—making up over 5%. Investors looking for pure exposure to technology companies may want to consider whether the Qs can consistently deliver this over time.

A disciplined, strategic approach can identify critical opportunities

Our fundamentally driven investment strategy sets the active T. Rowe Price Technology ETF (TTEQ) apart from passive alternatives. We can tactically recognize change, disruption, and extreme outcomes for companies, which we believe provides the opportunity for positive returns.

The portfolio of QQQ, widely considered a tech ETF, includes non‑tech sectors

As of September 30, 2025.

Sources: FactSet and Lens.

QQQ is the largest technology ETF traded in the United States, by assets under management, tagged by VettaFi’s ETF Database. Due to rounding, percentages may not add up to 100.00%.

Our framework seeks companies that:

- Sell mission-critical, linchpin technologies. These are technologies that make their users’ lives dramatically better.

- Innovate in secular growth markets. We want to invest in companies that are gaining share in fast-growing end markets.

- Have improving fundamentals. We look for revenue that is accelerating, operating margins that are expanding, or free cash flow conversion that is improving. We are focused on improving fundamentals over the next 12 to 18 months.

- Have reasonable valuations. TTEQ is valuation-aware. We aim to avoid cheap, yet broken, technology stocks. However, we also aim to avoid overpaying for exceptional companies where the stock price cannot compound in line with its underlying growth because of its starting valuation.

Our investment framework, alongside the analysis, insights, and industry expertise of T. Rowe Price’s exceptional team of in‑house analysts covering technology firms worldwide, results in a portfolio distinctively poised to identify standout tech companies with improving fundamentals.

Advantages of the T. Rowe Price Technology ETF

- Portfolio design. Technology‑related companies make up an increasing share of diversified market cap‑weighted benchmarks. TTEQ’s strategic design brings exposure to one of the largest and fastest‑growing subsectors across the globe.

- Broadened industry exposure. TTEQ can invest in enduring technology‑enabled companies, beyond those just classified in core “information technology,” including those in consumer discretionary, communication services, or financial services.

- Broadened geographical exposure. TTEQ will primarily invest in U.S. companies, but it will also have exposure across both developed and emerging markets. Many investors often overlook the importance of mission-critical, linchpin international companies. We believe the growth potential of technology markets outside the U.S. is frequently underestimated, with numerous innovative companies in Latin America, Europe, and Asia completely transforming their regional economies. Our global research capabilities give us a differentiated edge in accessing this broader set of alpha opportunities.

- Concentrated, yet diversified. Given the immense size of the mega-cap companies in most technology benchmarks today, investors may find themselves overly concentrated in these select few names. TTEQ generally aims to limit individual position sizes to 10% or less and intends to manage a portfolio comprising 40 to 50 stocks.

- Framework-based approach: Passive investing is simply a rebalancing strategy, where the passive portfolio is adjusted to align with the underlying index at specific time intervals or based on rules regarding portfolio concentration. Conversely, TTEQ employs a framework-based strategy and is designed to outperform the index.

- Access to private companies: While TTEQ primarily invests in publicly traded companies, it is leveraging the ETF structure to its fullest and may also hold private companies; for example, TTEQ purchased OpenAI in October 2025.

The role TTEQ can play in a portfolio

Core exposure to long-term growth

For more aggressive investors, technology ETFs like TTEQ can provide a dedicated and strategic exposure to technology and technology-related companies at the forefront of growth.

Sector diversification

Rather than investing in a handful of individual tech stocks, TTEQ investors are exposed to a wider range of technology companies through a single ETF with its expanded technology universe industry exposures.

Tax loss harvesting

Given the volatility and single stock dispersion within the sector, technology ETFs are a useful tool for tax loss harvesting.

Tactical sector rotation

For a long time, investors have incorporated technology ETFs into their sector rotation strategies, utilizing market sentiment or economic cycles as important indicators to enter or exit certain equity market sectors. Technology ETFs historically have given investors access to high-growth-potential stocks while also providing the usual benefits of ETFs, such as diversification, tax advantages, convenience, and cost efficiency. However, considering the swiftly changing, complex, and often volatile nature of the technology sector, an active management approach can be the most effective strategy to gain exposure to this crucial part of the global economy.

Investors are often drawn to the high innovation and rapid growth of the technology sector, but volatility and uncertainty make thorough research and stock selection essential. The T. Rowe Price Technology ETF is ideal for investors seeking long-term capital growth with exposure to global technology, as it targets a mix of companies across developed and emerging markets. The fund balances investments between large, established firms and smaller, emerging companies poised to benefit from technological advancements, offering a blend of growth potential and stability.

Christopher Murphy, CIMA®

Head of ETF Specialists

Christopher Murphy, CIMA®

Head of ETF Specialists

Dominic Rizzo, CFA

Portfolio Manager

Dominic Rizzo, CFA

Portfolio Manager

Jennifer O'Hara Martin

Global Equity Portfolio Specialist

Jennifer O'Hara Martin

Global Equity Portfolio Specialist

Know what you own: Investors have more options than ever in active ETFs

Explore how active ETFs are changing the landscape, offering more flexibility and growth potential.

Contact us

1 Sources: Crafts (2021), NBER, BEA, Haver, IMF, J.P. Morgan Private Bank. Data as of December 31, 2023.

2 Sources: Crafts (2021), NBER, BEA. Data as of December 31, 2023.

3 Sources: AI chip market—AMD. There is no guarantee that any forecasts made will come to pass.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

VGT, the Vanguard Information Technology Fund, tracks an index of stocks of large, medium-sized, and small U.S. companies in the information technology sector, as classified under the Global Industry Classification Standard. This GICS sector is made up of companies in the following three general areas: internet services and infrastructure companies, including data centers and cloud networking and storage infrastructure; companies that provide information technology consulting and services, technology hardware, and equipment, including manufacturers and distributors of communications equipment, computers and peripherals, electronic equipment, and related instruments; and semiconductors and semiconductor equipment manufacturers.

IXN, the iShares Global Tech ETF, has exposure to electronics, computer software and hardware, and information technology companies. It has targeted access to technology stocks from around the world.

XLK, the Technology Sector SPDR® fund, is composed of companies primarily involved in such industries as software and service, IT consulting services, semiconductor equipment, and computers and peripherals.

Important Information

Consider the investment objectives, risk, and charges and expenses carefully before investing. For a prospectus, or if available, a summary prospectus containing this and other information, call 1-800-638-7890 or visit troweprice.com. Read it carefully.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of November 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

The specific securities identified and described are for informational purposes only and do not represent recommendations.

ETFs are bought and sold at market prices, not net asset value. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Risk Considerations: Past performance is not a guarantee of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only. Technology companies: A fund that focuses its investments in specific industries or sectors is more susceptible to adverse developments affecting those industries and sectors than a more broadly diversified fund. International investing: Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas or due to changes in the exchange rates between foreign currencies and the U.S. dollar. Emerging markets: Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and other developed markets.

Please see below for the top 10 holdings of the T. Rowe Price Technology ETF, as of October 31, 2025.

| Security Name | Ticker | TTEQ Wt % |

|---|---|---|

| NVIDIA CORP | NVDA US | 11.61 |

| MICROSOFT CORP | MSFT US | 7.42 |

| APPLE INC | AAPL US | 7.03 |

| BROADCOM INC | AVGO | 6.34 |

| TAIWAN SEMICONDUCTOR SP ADR | TSM US | 5.74 |

| ADVANCED MICRO DEVICES | AMD US | 4.50 |

| META PLATFORMS INC CLASS A | META US | 3.33 |

| AMAZON.COM INC | AMZN US | 3.11 |

| ALPHABET INC CLASS A | GOOG | 3.09 |

| ASML HOLDINGS | ASML | 2.96 |

T. Rowe Price Investment Services, Inc., distributor.

© 2025 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202511-4969774