Know what you own: Investors have more options than ever in active ETFs

October 2025

- Key Insights

-

- Since 2020, active exchange-traded funds (ETFs) have gained an increasing share of the growing ETF space.

- As a result of weighting methodologies and infrequent rebalancing, we believe some key U.S. growth indices do not fully reflect some of the traditional characteristics of growth stocks.

- The outperformance of the T. Rowe Price Blue Chip Growth ETF* relative to passive alternatives in recent years offers a case study in the possible advantages of actively managed ETFs.

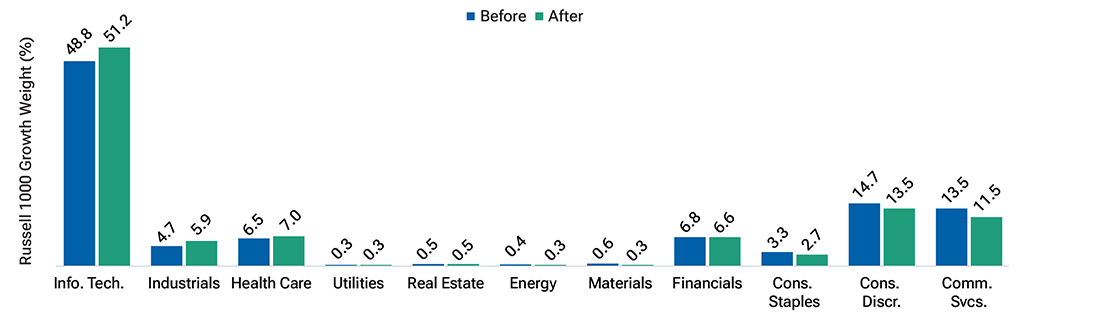

The most recent Russell reconstitution in June resulted in several weighting decisions that, in our view, have led the Russell 1000 Growth Index to be less reflective of the traditional characteristics of the growth style in some key respects—potentially presenting a dilemma for passive investors.

Active investing strategies have played an integral role as part of investors’ playbooks, and recent index adjustments demonstrate the important role that active management can play in helping funds stay true to their investment style. Though exchange-traded funds (ETFs) have long been synonymous with passive funds, the active ETF marketplace is growing rapidly.

*This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment. For example:

- You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

- The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price difference may be greater for this ETF compared to other ETFs because it provides less information to traders.

- These additional risks may be even greater in bad or uncertain market conditions.

- The ETF will publish on its website each day a “Proxy Portfolio” designed to help trading in shares of the ETF. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the ETF’s actual portfolio.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF secret, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF’s performance. If other traders are able to copy or predict the ETF’s investment strategy, however, this may hurt the ETF’s performance.

For additional information regarding the unique attributes and risks of the ETF, please see the Important Information as well as the fund’s prospectus.

Active ETFs continue to rise in popularity

Exchange-traded funds, in many investors’ minds, are passive funds. It is easy to understand why: According to Morningstar, 92%1 of ETF assets are passive strategies. However, the USD 10.7 trillion2 ETF market is changing, and actively managed ETFs are quickly becoming the fastest‑growing category.

In 2024, active ETFs took in USD 286 billion,3 which represents about 25% of the total ETF industry cash flow. This is impressive, given that they only account for 8% of the overall ETF market. In addition to flows, we’ve seen a tremendous number of active ETFs hitting the market. In 2023 and 2024 alone, actively managed ETFs accounted for 77% of new ETF launches. We believe a critical juncture has been reached between supply and demand for actively managed ETFs, and these offerings are only just beginning their journey.

Is your “growth” truly growth?

We define secular growth companies as those that we believe can sustain double-digit earnings growth over an extended period of time. For the indices that track growth markets—and the passive investors that utilize these strategies—shifting growth leadership and valuations can present challenges in maintaining fidelity to important growth criteria; following a passive investment strategy typically means that investors are indentured to the methodology and rules of an index, as well as consensus expectations for growth, with limited discretion to adjust.

The Russell 1000 Growth Index experienced significant shifts in weight from the June 2025 reconstitution

| Top 5 Increases | |||

| Company | Sector | Change in Weight | Post-Reconstitution Weight |

|---|---|---|---|

| Apple | Info. Tech. | 0.95% | 10.27% |

| NVIDIA | Info. Tech. | 0.91 | 12.55 |

| Microsoft | Info. Tech. | 0.90 | 12.53 |

| GE Aerospace | Industrials Bus. Svcs. | 0.72 | 0.92 |

| Abbvie | Health Care | 0.65 | 1.12 |

| Top 5 Decreases | |||

| Company | Sector | Change in Weight | Post-Reconstitution Weight |

|---|---|---|---|

| Alphabet | Comm. Svcs. | -2.01% | 4.08% |

| Amazon.com | Cons. Discr. | -1.48 | 5.18 |

| Salesforce | Info. Tech. | -0.61 | 0.10 |

| Qualcomm | Info. Tech. | -0.42 | 0.14 |

| Progressive | Financials | -0.41 | 0.03 |

Source: FactSet.

The specific securities identified and described are shown for illustrative purposes only and do not necessarily represent securities purchased or sold by T. Rowe Price. This information is not intended to be a recommendation to take any particular investment action and is subject to change. No assumptions should be made that the securities identified and discussed were or will be profitable.

Taking a closer look at the Russell 1000 Growth Index (Fig. 1), we believe recent reweighting decisions involving several large and consequential securities call into question the index’s style characteristics. While Alphabet and Amazon were the two largest reductions in the 2025 rebalance, a company we view as having less impressive growth prospects, Apple, saw the largest increase in weighting and now represents more than 10% of the index. Passive investors are anchored to these weightings—derived from formulas that we believe may, at times, miss the mark on style categorization—while active strategies are able to fine-tune their approach, factoring in characteristics that are specific and more applicable to a given industry and company.

As active managers, we have an advantage in that we can be more nimble than passively managed strategies; however, perhaps more importantly, we can also confidently deviate from consensus when we feel convicted, due to our deep commitment to fundamental research and analysis. Our analysts—one of our main competitive advantages as a firm—are industry specialists across capitalization and investment styles. Their firsthand access to company operations and strong relationships with management teams allow for independent judgments about company business models and long-term growth prospects, helping guide patience in a position or exit timing, as necessary.

TCHP has outperformed since 2023

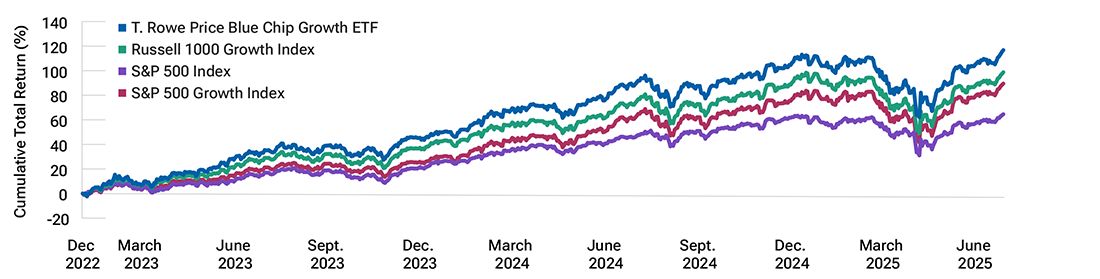

The T. Rowe Price Blue Chip Growth ETF (TCHP) has outperformed passive alternatives like the Russell 1000 Growth Index and the S&P 500 Index since the start of 2023 when growth began to reassert leadership in the marketplace. We view this time period—where we outperformed amid both upward and downward trending market environments—as an excellent case study in our advantages broadly as an active manager, but also more specifically as a firm.

In 2022, U.S. equity markets experienced a broad-based, acute sell-off driven by investor concerns that rising inflation, Russia’s invasion of Ukraine, the Federal Reserve’s decision to raise interest rates at a faster-than-expected pace, and slowing global growth would lead to a recessionary environment. During this time, we focused more intensely on our fundamental research process and stayed true to our growth targets. Given the growth rallies that followed positive incremental news around inflation in the second half of 2022, it was our belief that, once inflation began to moderate in a sustained manner, many of our high-conviction holdings could experience a hard rebound. We chose to stay true to our approach, maintain a long-term focus, and not abandon our growth criteria and were rewarded for doing so when the market eventually rotated in early 2023.

We believe this is an excellent example of why it may be a better option for investors, especially during periods of market volatility, to use an active manager who stays true to the fund style objectives. T. Rowe Price active ETFs seek to outperform benchmark indices through the added value of our investment management expertise and global research capabilities.

For years, investors interested in active ETF strategies lacked options, especially within the U.S. large‑cap growth category. Before June 2020, there was only one active large-cap growth ETF industrywide. Investors now have several active U.S. large-cap growth ETFs from T. Rowe Price to choose from: Growth ETF (TGRT), Growth Stock ETF (TGRW*), and Blue Chip Growth ETF (TCHP).

We have long believed that we could deliver the benefits of our core investment approach in the form of an ETF. Managed through rigorous fundamental research and a forward-looking strategic perspective, T. Rowe Price active ETFs enable us to package this expertise for clients who may prefer the ETF structure.

For more information, please call 1-877-561-7670 or visit troweprice.com/ExploreETFs.

Cumulative performance from December 31, 2022, through June 30, 2025

Past performance cannot guarantee future results. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

Source: FactSet.

Blue Chip Growth ETF (TCHP)

TOP 10 HOLDINGS

| Sector | % of Fund | |

|---|---|---|

| NVIDIA | Information Technology | 14.07 |

| Microsoft | Information Technology | 13.83 |

| Apple | Information Technology | 7.77 |

| Amazon.com | Consumer Discretionary | 7.16 |

| Meta Platforms | Communication Services | 6.67 |

| Alphabet | Communication Services | 4.57 |

| Visa | Financials | 3.15 |

| Carvana | Consumer Discretionary | 3.09 |

| Broadcom | Information Technology | 3.07 |

| Netflix | Communication Services | 2.94 |

As of June 30, 2025.

Holdings are shown at the issuer/company level as of the date indicated and are subject to change.

The total of the values may not add up to the top 10% of total net assets due to rounding.

Performance

| Year-to-date | One year | Annualized Three years | Annualized Since Inception* | |

|---|---|---|---|---|

| Market Price | 7.69% | 17.12% | 27.33% | 12.92% |

| NAV | 7.83 | 17.11 | 27.24 | 12.89 |

| Russell 1000 Growth Index | 6.09 | 17.22 | 25.76 | 16.39 |

| S&P 500 Index | 6.20 | 15.16 | 19.71 | 15.44 |

As of June 30, 2025.

* Inception Date 8/4/2020.

The fund’s expense ratio as of the most recent prospectus was 0.57%.

Performance data quoted represents past performance and does not guarantee future results; current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than their original cost. To obtain the most recent month-end performance, visit troweprice.com. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would receive if shares were traded at other times.

Investors should note that the fund’s short-term performance is highly unusual and unlikely to be sustained.

The gross expense ratio reflects the fund expenses as stated in the fee table of the fund’s prospectus prior to the deduction of any waiver or reimbursement.

Christopher Murphy, CIMA®

Head of ETF Specialists

Christopher Murphy, CIMA®

Head of ETF Specialists

James A. Norungolo, CFA

Investment Specialist

James A. Norungolo, CFA

Investment Specialist

Redefining derivative income investing: How TCAL's active, lower-risk approach stands out from peers

David Giroux, Justin Olsen, and Farris Shuggi explain TCAL’s key differentiators compared with peer group constituents.

1As of December 2024.

2As of January 2025. Source: ETF Action

3Source: Morningstar

Additional Disclosure

For U.S. investors, visit troweprice.com/glossary for definitions of financial terms.

© 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

FactSet. Financial data and analytics provider FactSet. Copyright © 2025 FactSet. All Rights Reserved

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®” are a trademark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

S&P© 2025, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of (S&P 500 Index) in any form is prohibited except with the prior written permission of S&P Global Market Intelligence (“S&P”). None of S&P, its affiliates or their suppliers guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such information. In no event shall S&P, its affiliates or any of their suppliers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of S&P information.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe.

Important Information

Consider the investment objectives, risks, and charges and expenses carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, call 1-800-564-6958 or visit troweprice.com. Read it carefully.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions that will reduce returns.

* T. Rowe Price semi-transparent equity ETFs publish a daily Proxy Portfolio, a basket of securities designed to closely track the daily performance of the actual portfolio holdings. While the Proxy Portfolio includes some of the ETFs holdings, it is not the actual portfolio. Daily portfolio statistics will be provided as an indication of the similarities and differences between the Proxy Portfolio and the actual holdings. The Proxy Portfolio and other metrics, including Portfolio Overlap, are intended to provide investors and traders with enough information to encourage transactions that help keep the ETF’s market price close to its NAV. There is a risk that market prices will differ from the NAV. ETFs trading on the basis of a Proxy Portfolio may trade at a wider bid/ask spread than shares of ETFs that publish their portfolios on a daily basis, especially during periods of market disruption or volatility, and, therefore, may cost investors more to trade. The ETF’s daily Proxy Portfolio, Portfolio Overlap, and other tracking data are available at troweprice.com.

Although the ETF seeks to benefit from keeping its portfolio information confidential, others may attempt to use publicly available information to identify the ETF’s investment and trading strategy. If successful, these trading practices may have the potential to reduce the efficiency and performance of the ETF.

Risk Considerations

All investments are subject to market risk, including the possible loss of principal. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Because growth stocks have higher valuations and lower dividend yields than slower-growth or cyclical companies, the fund’s share price could decline further in market downturns than non-growth-oriented funds. The fund’s growth investing style may become out of favor, which may result in periods of underperformance.

Past performance is not a guarantee or a reliable indicator of future results. All charts and tables are shown for illustrative purposes only.

The views contained herein are those of authors as of October 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

This material is provided for general and educational purposes only and not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you. T. Rowe Price group of companies, including T. Rowe Price Associates, Inc., and/or its affiliates, receive revenue from T. Rowe Price investment products and services.

T. Rowe Price Investment Services, Inc., Distributor. T. Rowe Price Associates, Inc., and T. Rowe Price Investment Services, Inc., are affiliated companies.

© 2025 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202509-4808447