China 2026: A new cycle emerges

From the Field

- Key Insights

-

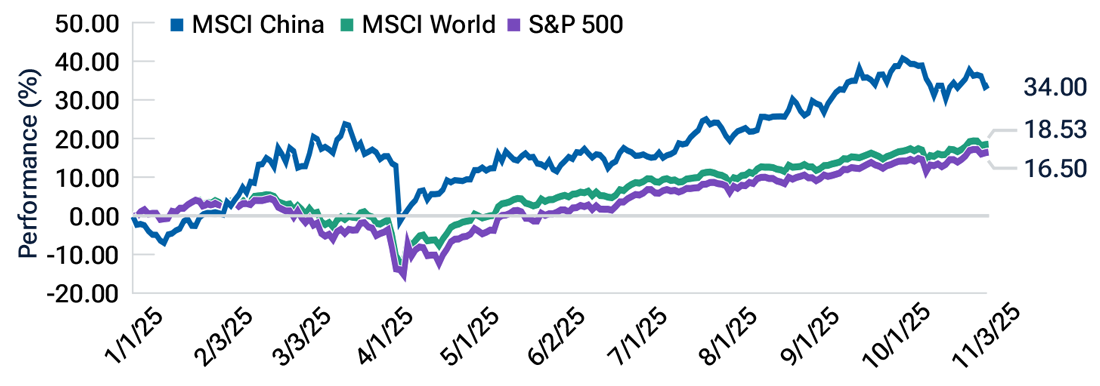

- Contrary to expectations at the start of the year, China’s stock market has outperformed the U.S. and the rest of the world in 2025.

- Policy continues to favor productivity and innovation, while corporate balance sheets are healthier and earnings visibility is improving.

- We remain focused on identifying durable businesses positioned to benefit from the next phase of China’s economic evolution.

Chinese equities have outperformed the S&P 500 Index and most developed markets on a year‑to‑date basis, defying all the volatility linked to U.S. tariff headlines. The MSCI China Index has posted over 30% year‑to‑date gains, supported by policy pivot, emergence of new growth drivers, and better‑than‑expected geopolitical developments. Performance leadership has been concentrated in technology, industrials, and select consumer names, underscoring growing conviction in domestic growth resilience. Despite external noise, 2025’s market behavior highlights a clear message: Fundamentals—not geopolitics—remain the dominant driver of China’s equity performance.

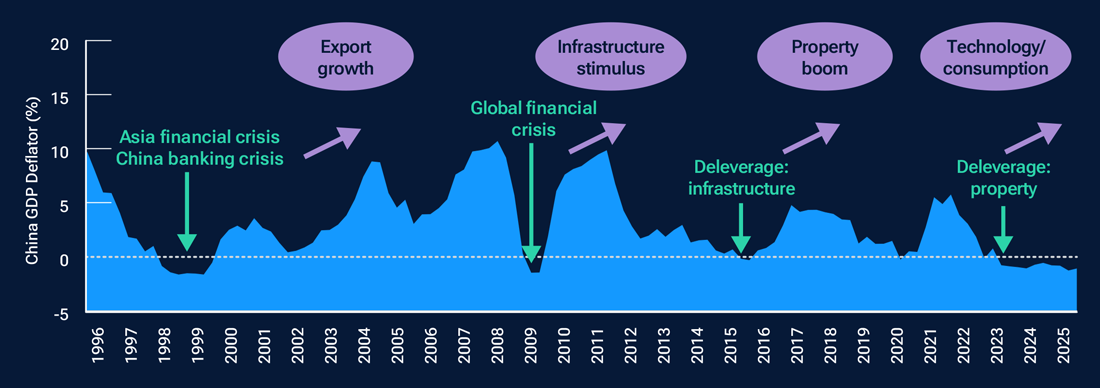

Domestic backdrop—Policy pivot from deleveraging to expansion

The September 2024 policy pivot marked the close of China’s property‑market deleveraging cycle and the start of a new expansion phase. Over 2025, the impact has become evident: Credit conditions normalized, fiscal spending shifted toward productivity and innovation, and private sector sentiment improved. Monetary settings remain accommodative, with liquidity ample and targeted credit support for small enterprises and strategic industries, establishing a stronger foundation for sustainable growth through 2026.

Contrary to expectations at the start of the year, China has outperformed the U.S. and the rest of the world in 2025

As of November 3, 2025.

Past performance is not a guarantee or a reliable indicator of future results.

Source: Bloomberg Finance L.P.

External macro environment—Stability after volatility

Globally, conditions have stabilized following the tariff disruptions of early 2025. China’s measured policy response and diversified trade links helped cushion the impact. After several rounds of dialogue, tensions cooled, and the Donald Trump‑Xi Jinping summit resulted in a further reduction of tariffs and an extension of the trade truce for one year. Furthermore, reciprocal state visits in 2026 should foster a more predictable diplomatic environment. For investors, this shift likely translates to lower external volatility and greater scope for domestic fundamentals to drive equity returns.

Structural growth drivers

As underpinned in the recently concluded Fourth Plenum meetings, China’s next expansion will be powered by innovation and domestic demand. The success of DeepSeek showcased China’s growing capabilities in artificial intelligence (AI) despite semiconductor constraints, joining electric vehicles and biotechnology as areas of global competitiveness. Policy alignment around these industries—supported by digital‑infrastructure investment and entrepreneurial incentives—should help sustain productivity growth over the medium term.

Simultaneously, consumption continues to broaden. Scalable platforms and leading brands are capturing discretionary spending through technology and user engagement, while traditional industries are achieving higher profitability under the anti‑involution framework, which targets excessive competition.

The government’s anti‑involution agenda has begun to reshape industrial behavior. Capacity discipline and consolidation are improving pricing power in materials, manufacturing, and telecom infrastructure. These adjustments are expected to underpin a healthier profit cycle focused on efficiency and capital discipline.

New drivers emerge post each cycle

As of September 30, 2025.

1 The GDP deflator is a comprehensive measure of the prices of domestically produced goods and services in an economy.

Source: Bloomberg Finance L.P.

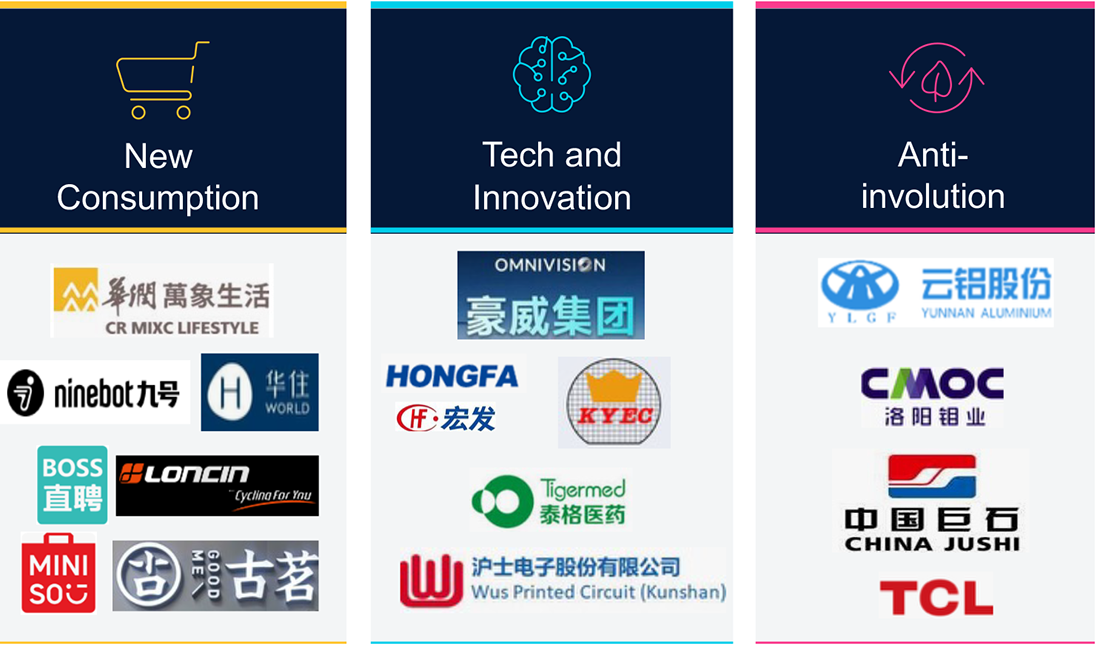

Market trends and themes in China

Source: T. Rowe Price. The specific securities identified and described are for informational purposes only and do not represent recommendations. The trademarks shown are the property of their respective owners. T. Rowe Price is not endorsed, sponsored, or otherwise authorized by or affiliated with any of the trademark owners represented by these trademarks.

How is the China Evolution Equity Fund positioned to capture opportunities emerging in China

"Domestic consumption remains a core pillar of China’s long-term structural growth story."

1. Consumption and services

Domestic consumption remains a core pillar of China’s long‑term structural growth story. Rising household incomes, firmer consumer sentiment, and policy support for urban services are creating a more resilient spending base.

(i) Platforms: China Resources MixC, H World, Kanzhun, and Tencent Music are examples of scalable franchises with competitive moats1 that have had recurring revenue streams. Their integrated ecosystems and ability to capture consumer traffic—both online and offline—supported them through multiple market cycles.

(ii) Product cycles: Ninebot and Loncin illustrate the strength of China’s innovation‑led consumption. Their capacity to commercialize new designs rapidly and connect with younger demographics positions them for product‑cycle expansion in both domestic and export markets.

2. Technology and innovation

Technology remains an important driver of productivity and structural equity performance. China’s innovation ecosystem—spanning AI, semiconductors, advanced manufacturing, and clean energy—is entering a phase of accelerated commercial adoption.

(i) Artificial Intelligence: With mainland China and Taiwan at the center of the global AI supply chain, we focus on companies that have demonstrated value‑share gains with credible technology migration plans and defensible cost advantages. Beyond software and model development, we see opportunities in “tech” components—such as copper‑clad laminates and substrates—where surging AI demand may strain capacity, tightening supply, which may support profitability across hardware ecosystems.

(ii) Advanced driver-assistance systems (ADAS): China’s ADAS industry is now scaling rapidly, echoing the electric vehicle adoption curve of recent years. As regulatory standards evolve and consumer expectations shift toward safety and automation, domestic suppliers of sensors, controllers, and integration software are gaining global relevance. These firms are likely to play an important role in China’s next major industrial S‑curve.

3. Anti‑involution

In our view, traditional industries are becoming more attractive as the government’s anti‑involution campaign aims to restore balance to supply/demand dynamics. The focus on consolidation, capacity discipline, and return on capital is reshaping the competitive landscape across LCD panels, aluminum, copper, and telecom towers. These sectors are generating stronger cash flows, improving payout ratios, and demonstrating pricing resilience after years of margin compression.

While the strength of these businesses is not solely policy‑driven, the shift toward rational competition and efficiency has created a healthier, more attractive industrial base. We view these companies as natural complements to growth‑oriented holdings, offering potential for cyclical stability, income generation, and exposure to China’s ongoing focus on capital efficiency.

Across consumption, technology, and industrial rationalization, we see an equity market evolving toward quality, innovation, and disciplined capital allocation. This evolution is broadening the range of investment opportunities and may offer long‑term investors both structural growth and diversification benefits as China’s stock market matures.

Summary

"We expect a stable to moderately improving macroeconomic backdrop in 2026."

We expect a stable to moderately improving macroeconomic backdrop in 2026. Valuations remain supportive, and, more importantly, we are finding structural growth stories that we believe can outperform. Policy continues to favor productivity and innovation, while corporate balance sheets are healthier and earnings visibility is improving.

We are seeing opportunities emerging across technology, consumption, and rationalizing traditional sectors. As China advances from deleveraging toward disciplined expansion, we remain focused on identifying durable businesses positioned to benefit from this next phase of the country’s economic evolution.

Wenli Zheng

Portfolio Manager

Wenli Zheng

Portfolio Manager

Equity markets to broaden despite continued AI resilience

There are growing opportunities in non-tech sectors and across regions

Contact us

1 Moats mean barriers to entry.

Note: At October 31, 2025 the China Evolution Equity Fund had the following holdings in the companies mentioned in this material: China Resources Mixc Lifestyle, 4.13%; Ninebot 1.90%; H World Group Ltd, 2.13%; Kanzhun Ltd., 2.76%; Loncin Motor Co. Ltd., 1.49%; Miniso Group Holding Ltd., 1.49%; Guming Holdings Ltd., 0.68%; Omnivision Integrated Circuits Group Inc., 2.60%; Hongfa Technology Co. Ltd., 2.84%; King Yuan Electronics Co. Ltd., 2.77%; Hangzhou Tigermed Consulting Co. Ltd., 1.19%; Wus Printed Circuit (Kunshan) Co. Ltd., 2.37%; Yunnan Aluminium Co. Ltd., 2.79%; CMOC Group Ltd., 3.58%; China Jushi Co. Ltd., 1.77%; TCL Technology Group Corporation, 2.02%.

Investment Risks:

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Diversification cannot assure a profit or protect against loss in a declining market.

Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Additional Disclosures

For U.S. investors, visit troweprice.com/glossary for definitions of financial terms.

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

MSCI and its affiliates and third‑party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of December 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2025 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202512-5001345