How active ETFs can help reduce a portfolio's tax liability

September 2025, From the Field

- Key Insights

-

- Exchange-traded funds generally have a more favorable structure for tax efficiency than some other investments, such as mutual funds.

- International equities are having their best year in a long time—and some active managers have been on the right side of this change.

- Tax loss harvesting opportunities should be evaluated throughout the year, not just at year-end.

Taxes have the potential to diminish returns, but some investment products, like ETFs, present attractive opportunities to bring more tax efficiency to investor portfolios.

ETFs have historically been a generally more tax-efficient option for investors when compared to similar products, like mutual funds, thanks to their operational features. There are two main reasons why ETFs have historically boasted greater tax savings.

First, their unique creation and redemption process enables them to be flexible, cost-effective, and tax-efficient investment products. And second, ETFs have the ability to facilitate outflows in kind, which also enables them to remain tax efficient. While ETFs will sometimes generate a capital gain, they have historically done so at a lesser rate than mutual funds. Even actively managed strategies have proven to provide investor portfolios with opportunities to generate alpha in a tax-efficient manner when the right conditions arise. Whether it’s part of a tax-loss harvesting maneuver or other strategy, moving assets into an ETF may help your portfolio produce potentially tax-efficient returns in the future.

Just keep in mind that there are many factors impacting the tax treatment of an ETF, and these should always be taken into consideration. But for investors seeking a tax-efficient vehicle with the benefits of active management, active ETFs have the potential to add value to an investor’s portfolio.

To learn more, visit troweprice.com/exploreETFs.

With year-end approaching, advisors may be reviewing portfolios for potential capital gains distributions and opportunities to apply tax-smart strategies in eligible accounts. Decisions made now—such as harvesting losses or realizing gains ahead of distributions—can meaningfully influence a client’s after-tax outcomes.

One way to enhance long-term tax efficiency is by reallocating assets into exchange-traded funds (ETFs), which are generally more tax-efficient than mutual funds. Actively managed ETFs, in particular, allow investors to pair those structural tax advantages with professional oversight, flexibility, and the potential for added return. With established managers like T. Rowe Price offering active ETFs, investors can combine the benefits of convenience, cost-effectiveness, and capital gains efficiency in a single vehicle—making them a timely tool for this year’s tax planning season.

Why consider using an active ETF as we approach year-end?

1. ETFs have been more tax-efficient

In terms of capital gains tax, ETFs have historically been a more tax-efficient vehicle than some other investment structures, such as mutual funds. The main reason ETFs have been more tax-efficient is due to the ETF’s unique create/redeem mechanism and the ability for ETFs to facilitate outflows in kind. Even though ETFs may still generate a capital gain distribution, shareholder activity of buying and selling shares doesn’t create taxable events for the funds, unlike in mutual funds.

Opportunity exists in international equity markets for active ETF managers

From January 1, 2025, to June 30, 2025.

Past performance cannot guarantee future results.

Source: Morningstar Direct, rolling daily cumulative returns for the T. Rowe Price International Equity ETF and the MSCI EAFE Index Net. For illustrative purposes only. Investors cannot invest directly in an index. See Additional Disclosures for more information on the index.

For office use only: 202509-4838002

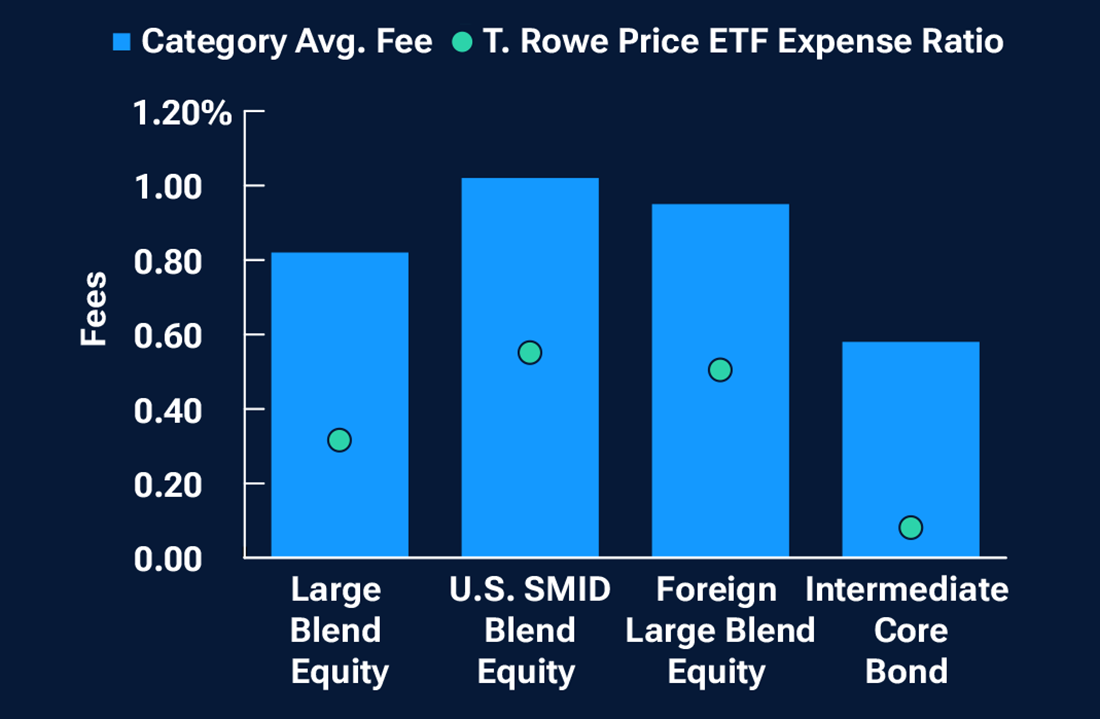

Fee comparison of T. Rowe Price active ETFs

| Mutual Fund Category | Category Avg. Fee | T. Rowe Price Active ETF Solution | Expense Ratio | Difference |

|---|---|---|---|---|

| Large Blend Equity | 0.82% | TCAF | 0.31% | 0.51% |

| U.S. SMID Blend Equity | 1.02% | TMSL | 0.55% | 0.47% |

| Foreign Large Blend Equity | 0.95% | TOUS | 0.50% | 0.45% |

| Intermediate Core Bond | 0.58% | TAGG | 0.08% | 0.50% |

As of August 22, 2025.

Source: Morningstar Direct. Category Average Fee is based on all mutual funds in the category. All data calculated and reported by Morningstar, illustrated by T. Rowe Price. See Additional Disclosures.

Keep in mind, there are many factors that will impact the tax efficiency of an ETF and should always be taken into consideration (e.g., trading activity, issuer procedures, time in market). For investors who want the structural tax advantages of ETFs along with the benefits of active management—such as research-driven security selection, flexibility to adapt to markets, and risk management—active ETFs have the potential to add value to an investor’s portfolio.

“…active ETFs have the potential to add value to an investor’s portfolio.”

Figure 1 illustrates the percentage of all active and passive U.S.-listed mutual funds and ETFs that made capital gain distributions in each of the past five calendar years. It’s a myth to say that an ETF will never generate a capital gain. But structurally speaking, ETFs have done so at a much lower rate than mutual funds—even actively managed strategies. Some of T. Rowe Price’s Active Equity ETFs, for example, have distributed little (or in some cases, even zero) year-end capital gains over the past three years.

2. Active international ETF strategies have added alpha in 2025

One area where the benefits of active management have been clear is in international equity markets, which have experienced a significant shift in 2025, driven by geopolitical dynamics and changes in U.S. policy. Non-U.S. markets (primarily Europe), emerging markets, and Japan, have outperformed U.S. markets, which were previously dominated by large-cap growth stocks. With a potential regime change away from U.S. exceptionalism, some global investors have actively sought new opportunities. Active managers are well positioned to help identify quality companies and regions that emerge from this shift. For example, the T. Rowe Price International Equity ETF (TOUS) has exceeded the returns of the MSCI EAFE Index Net by over 4%1 over the last year (Figure 2).

3. Lower fees for an active approach

Just as active ETFs can add value through performance, they can also help reduce the overall cost of investing. When considering a move from mutual funds to ETFs, actively managed ETFs may also offer investors a way to reduce overall portfolio expenses in the process. Reduced expenses can help with the overall long-term outcome. ETF operational costs are often streamlined relative to active mutual funds with fewer shareholder services, client statement reporting, and other expenses. Well-established firms may have additional pricing advantages. By leveraging the global scope and scale of our firmwide resources, T. Rowe Price active ETFs are competitively priced relative to their peer groups. For example, illustrated in Figure 3 are some examples where T. Rowe Price active ETFs offer competitive fees relative to category averages.

Tax loss harvesting opportunities should be evaluated throughout the year

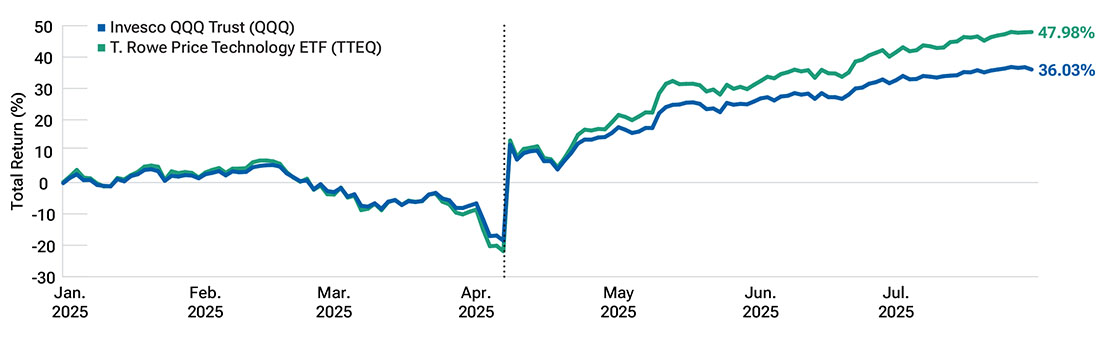

The April 2025 market downturn impacted technology ETFs

As of July 31, 2025

Source: Morningstar Direct.

QQQ, the Invesco QQQ Trust, Series 1, is the largest passive technology ETF by assets under management, as tagged by VettaFi’s ETF Database.

TTEQ, the T. Rowe Price Technology ETF, is an actively managed technology ETF.

Beyond structural efficiency and lower expenses, advisors can apply active ETFs in tactical ways as well. One of the most important tools—especially in volatile years—is tax loss harvesting. This should be an ongoing, disciplined part of an advisor’s portfolio management process.

“One of the most important tools—especially in volatile years—is tax loss harvesting.”

The sharp market pullback in March and April of 2025—followed by a powerful rally to new all-time highs—was especially evident in the technology sector, where some of the largest ETFs in the category fell as much as 25% at the April lows. With ongoing uncertainty around tariffs, the ever-shifting landscape of true artificial intelligence beneficiaries, and intensifying competition from China, advisors had an opportunity to reposition into active strategies better equipped to navigate these headwinds.

An active technology ETF like the T. Rowe Price Technology ETF (TTEQ) not only offers the flexibility to adapt to changing market conditions but has also delivered strong results—outperforming many passive peers since the April lows (Figure 4).

Are there tax loss harvesting opportunities this year?

Given the market swings of 2025, it’s worth asking: Where do tax loss opportunities exist today? Categories for consideration will depend on an investor’s holding period and individual portfolio allocations, and investors should always consult their financial professional and tax advisor.

Year-to-date, there have been limited opportunities for tax loss harvesting. However, taking a trailing 12-month view, we see some potential areas to explore. For example, the municipal market has generally been performing well this year (Figure 5). Municipals provide federally tax-exempt income, and interest may be exempt from state and local taxes, making these vehicles attractive to investors who anticipate higher taxes in the future.

While short-term municipal ETF returns are positive, other categories, to include intermediate, long duration, and high yield municipal ETFs, show negative one-year trailing negative returns. Similarly, many municipal mutual funds have positive performance year-to-date but carry losses over the past year.

Since municipal funds are typically held in taxable accounts, harvesting those losses can be especially valuable to offset capital gains elsewhere in the portfolio. The T. Rowe Price Intermediate Municipal Income ETF (TAXE), an ETF that may hold up to 20% in high yield, could be a compelling option for advisors to diversify a portfolio, go active, and preserve exposure to tax-free income.

While it may be top of mind at year-end, tax considerations should be part of an ongoing portfolio review. Active ETFs offer many benefits, including tax efficiency, lower costs, and the potential to outperform the benchmark. While individual circumstances will vary, ETFs can be a useful tool for investors looking to reposition their portfolios.

Kevin Signorelli

Head of ETF Solutions

Kevin Signorelli

Head of ETF Solutions

Christopher Murphy, CIMA®

Head of ETF Specialists

Christopher Murphy, CIMA®

Head of ETF Specialists

Strategies to Consider

ETF vs. Mutual Fund vs. SMA: Which is best for your investment plan?

Understanding the differences between these three types of investment vehicles can help you decide which one may best align with your goals.

Contact us

1 As of June 30, 2025. Average annual one-year return.

Additional Disclosures

For U.S. investors, visit troweprice.com/glossary for definitions of financial terms.

© 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For important terms, please see the following: https://www.troweprice.com/personal-investing/funds/benchmark-definitions.html

MSCI EAFE Index is an equity index that captures large and mid cap representation across developed markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

QQQ, the Invesco QQQ Trust, Series 1, is an exchange-traded fund based on the Nasdaq-100 Index®. The Fund will, under most circumstances, consist of all stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually.

T. Rowe Price International Equity ETF (TOUS)

Average Annual Returns

| 1 year | 3 years | 5 years | Since inception | |

| Market price | 22.31% | — | — | 15.42% |

| NAV | 22.18% | — | — | 15.30% |

| Benchmark | 17.73% | 15.97% | 11.16% | 13.62% |

| Value1 | 4.45% | — | — | 1.68% |

Data are as of June 30, 2025.

Benchmark: MSCI EAFE Index Net.

Inception Date: June 14, 2023.

1 Value is the performance difference between the net asset value (NAV) and benchmark total returns.

T. Rowe Price International Equity ETF (TOUS) gross expense ratio: 0.50%. The gross expense ratio reflects the fund expenses as stated in the fee table of the fund’s prospectus prior to the deduction of any waiver or reimbursement.

T. Rowe Price Technology ETF (TTEQ)

Average Annual Returns

| 1 year | 3 years | 5 years | Since inception | |

| Market price | — | — | — | 16.28% |

| NAV | — | — | — | 15.92% |

| Benchmark | 16.17% | 17.35% | 13.65% | 9.88% |

| Value1 | — | — | — | 6.04% |

Data are as of June 30, 2025.

Benchmark: MSCI All Country World Index Net.

Inception Date: October 23, 2024.

1 Value is the performance difference between the net asset value (NAV) and benchmark total returns.

T. Rowe Price Technology ETF (TTEQ) gross expense ratio: 0.63%. The gross expense ratio reflects the fund expenses as stated in the fee table of the fund’s prospectus prior to the deduction of any waiver or reimbursement.

Performance data quoted represents past performance and does not guarantee future results; current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than their original cost. To obtain the most recent month-end performance, visit troweprice.com. Market returns are based on the midpoint of the bid/ask spread as 4 p.m. ET and do not represent returns an investor would receive if shares were traded at other times.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of September 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

ETFs are bought and sold at market prices, not net asset value (NAV). Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

Risk Considerations: Past performance cannot guarantee future performance. All investments are subject to market risk, including the possible loss of principal. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. As with all equity investments, the share price can fall because of weakness in the broad market, a particular industry, or specific holdings. Fixed income investing involves risks, including, but not limited to, interest rate risk and credit risk. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. Diversification does not guarantee protection against losses. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202509-4768712