On the Horizon

On the Horizon

2026 Global Market Outlook: Minds, machines and market shifts

Balancing AI winners with broader opportunities and enduring risks

AI (artificial intelligence) is powering measurable change—and this will continue in 2026. But rapid capital deployment has led to stretched valuations in AI sectors, raising concerns about speculative bubbles and sustainability. Investors must balance excitement with disciplined analysis and risk management.

Meanwhile, the world continues to grapple with non-AI forces. Inflation remains stubborn in many developed economies, growth trajectories are diverging and geopolitical uncertainty—from trade tensions to the war in Ukraine—is adding further complexity to the global outlook.

Navigating this environment will require balancing exposure to enduring AI leaders with emerging opportunities in cyclical and international markets—while remaining vigilant to persistent macro risks. The age of speculation is giving way to real-world results, but investors must be mindful that old challenges—valuation, inflation, and geopolitical uncertainty—remain firmly in play.

We are facing a rapidly evolving investment landscape shaped by the impact of AI, expansionary fiscal policies, and shifting geopolitics.

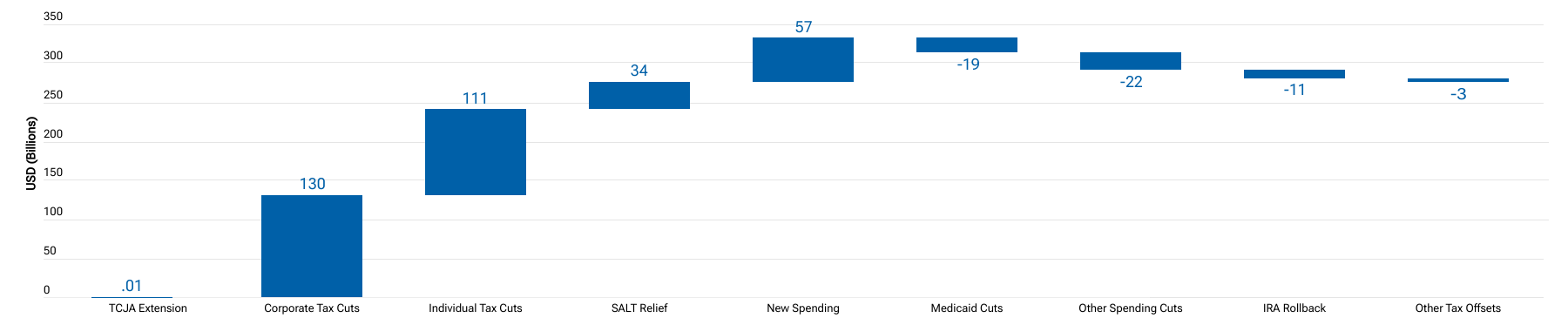

In the US, AI-driven investment and government stimulus are reigniting growth. However, with upside risks to inflation, the Fed faces a delicate balancing act. In Europe, as tariff-related front-loading fades, manufacturing may weaken - with the European Central Bank likely to ease policy. Japan faces rising inflation, though fiscal measures should support growth. Emerging markets have managed inflation and debt and shown tariff resilience. While the backdrop is favorable, trade policy remains a risk.

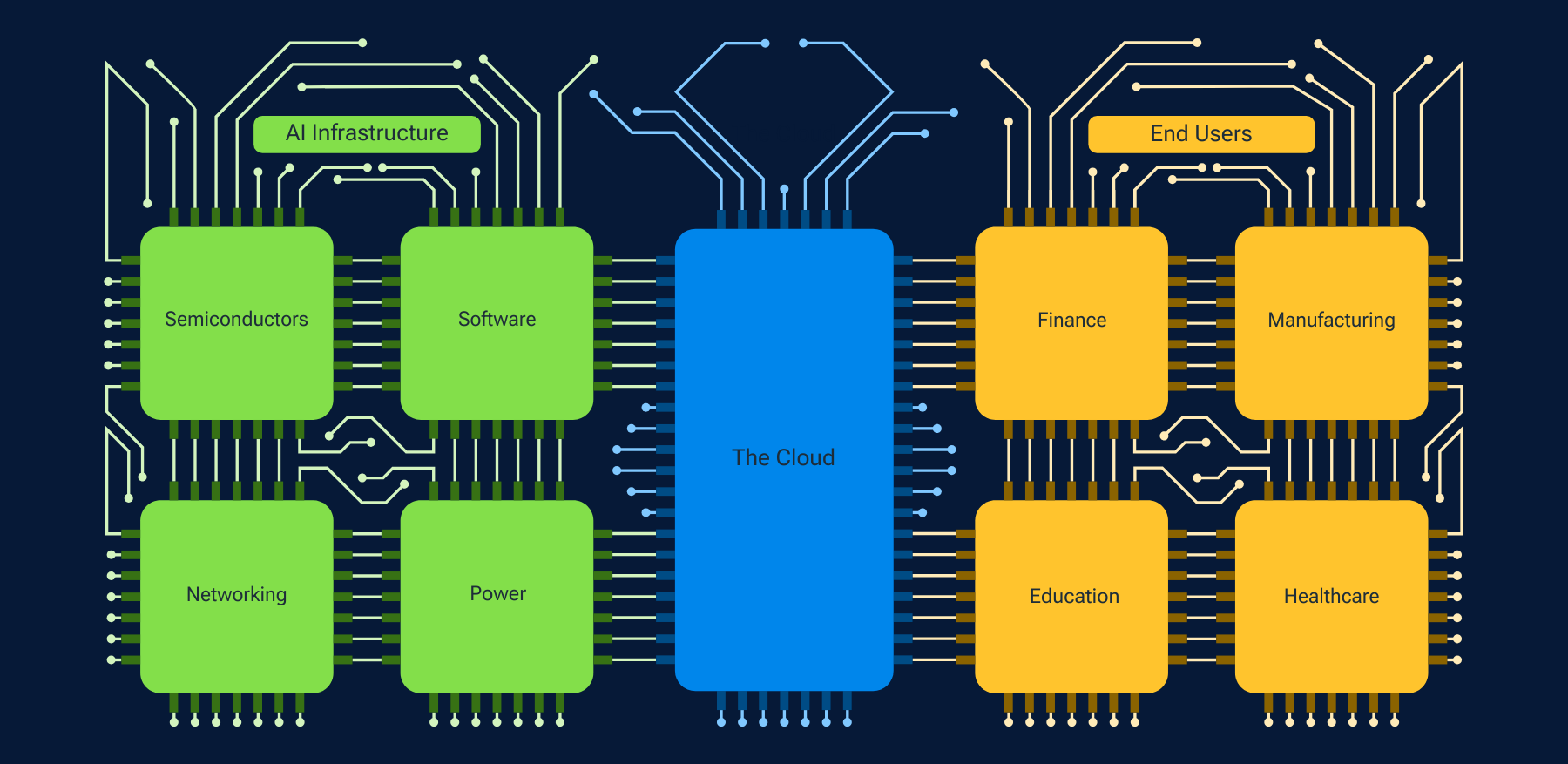

Equity markets are broadening, both within AI-related sectors and beyond. AI enters a new phase with clear signs of monetization. Hardware and hyperscalers will still lead the way, but the evolution from digital AI, like software, to physical AI infrastructure is unlocking opportunities across materials, energy, and industrials. International and small-cap equities are increasingly appealing, supported by fiscal stimulus and improving cyclical conditions.

In fixed income, we expect higher yields and steeper curves reflecting ambitious fiscal agendas. High yield bonds and bank loans offer compelling income, but credit selection is key. Inflation-protected bonds and select emerging markets provide tactical opportunities.

Private markets are being revitalized. Stable rates and high demand for capital—especially for AI infrastructure—are fueling a wave of dealmaking and bespoke credit solutions. While fundamentals are robust, idiosyncratic risks must be tightly managed.

2026 will require agility. The age of speculation is giving way to real-world results, but old challenges—valuation, inflation, and geopolitics —remain. Navigating this new era calls for adaptability, a global lens, and a focus on both innovation and resilience.

Investment Risks:

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. The risks of international investing are heightened for investments in emerging market and frontier market countries.

Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Small-cap stocks have generally been more volatile in price than the large-cap stocks. Investing in private companies involves greater risk than investing in stocks of established publicly traded companies. Risks include potential loss of capital, illiquidity, less available information and difficulty in valuating private companies. They are not suitable, nor available, for all investors.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency.

Some or all alternative investments such as private credit, may not be suitable for certain investors. Alternative investments are typically speculative and involve a substantial degree of risk. In addition, the fees and expenses charged may be higher than the fees and expenses of other investment alternatives, which will reduce profits. As interest rates rise, bond prices generally fall. Investments in high yield bonds involve greater risk of price volatility, illiquidity, and default than higher rated debt securities.

Inflation-Linked Bonds (Treasury Inflation Protected Securities in the U.S.): In periods of no or low inflation, other types of bonds, such as US Treasury Bonds, may perform better than Treasury Inflation Protected Securities (TIPS).

Important Information

This material is being furnished for informational and/or marketing purposes only and does not constitute an offer, recommendation, advice, or solicitation to sell or buy any security.

Prospective investors should seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services.

Past performance is not a guarantee or a reliable indicator of future results. All investments involve risk, including possible loss of principal.

Information presented has been obtained from sources believed to be reliable, however, we cannot guarantee the accuracy or completeness. The views contained herein are those of the author(s), as of November 14, 2025, are subject to change, and may differ from the views of other T. Rowe Price Group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

All charts and tables are shown for illustrative purposes only. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

USA—Issued in the USA by T. Rowe Price Investment Services, Inc., distributor and T. Rowe Price Associates, Inc., investment adviser, 1307 Point Street, Baltimore, MD 21231, which are regulated by the Financial Industry Regulatory Authority and the U.S. Securities and Exchange Commission, respectively.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

202511-4975467