Savings at Work video series

This seven-part series talks about the financial foundations needed for a retirement journey.

.png)

Part 1: Introduction

An introduction to our seven-part series on putting your savings to work.

Part 2: Know Where You Stand

Before participants plan, they’ll need to take stock of where they're at now.

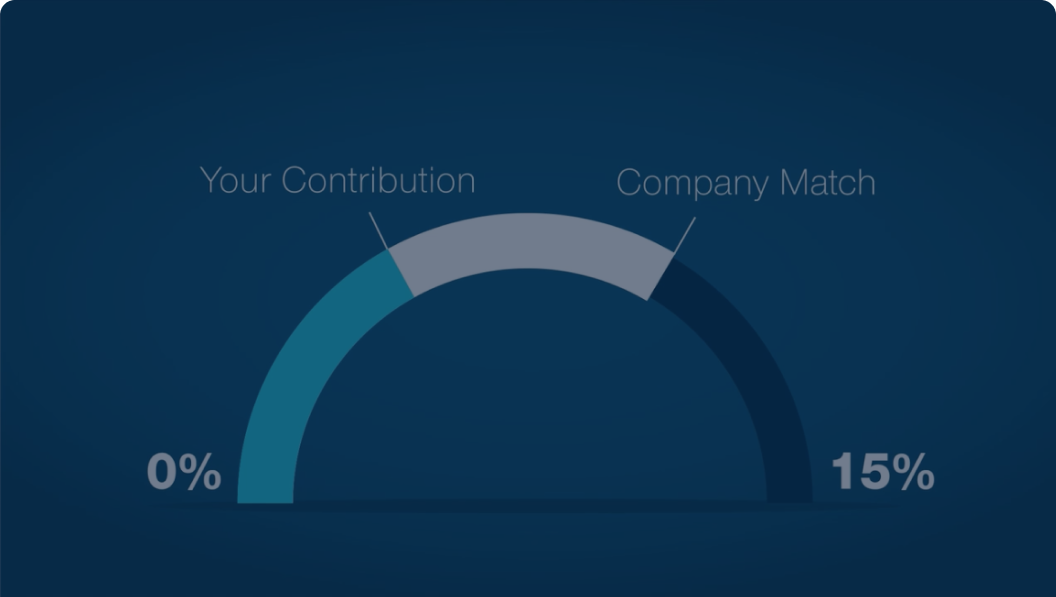

Part 3: Save Enough

How much should one be contributing toward their retirement savings?

Part 4: Contribution Type

Considering the characteristics of Roth vs pre-tax contributions.

Part 5: Invest Appropriately

Help participants invest and watch their money grow.

Part 6: Emergency Savings

Life is full of surprises, but an emergency fund sets people up for success.

Additional Categories

Building a strong financial foundation

Help employees develop essential financial habits, like budgeting and managing debt, to build long-term financial security.

Retirement savings & investment strategies

Provide guidance on how to start saving for retirement, optimize contributions, and make informed investment decisions.

Preparing for retirement & decumulation

Support employees as they transition into retirement by educating on Social Security, healthcare costs, and strategies for managing their savings.

Account management & security

Ensure employees take full advantage of their retirement plan benefits while safeguarding their accounts against fraud and security risks.

Live employee webinars

Promote T. Rowe Price’s monthly webinars, which help participants feel more confident and make better financial decisions to support their retirement goals.

LRN: 202411-4032054