- From the Field

- Breaking down health care expenses in retirement

- 2024-02-21 11:53

- Key Insights

-

- Given that health care costs are incurred over time, it makes more sense to view them as an ongoing regular budget item instead of a lump sum needed at the start of retirement.

- Health insurance premiums account for between 73% and 81% of retirees’ annual health care expenses and, for the most part, are predictable and can be paid from monthly income. However, out‑of‑pocket expenses can vary and should be paid from savings.

- Traditional financial planning principles and basic budgeting can help address many of the financial unknowns about health care costs in retirement.

A recent survey1 from T. Rowe Price finds that health care costs are the top spending concern of retirees. This comes as no surprise as some studies predict that a 65‑year‑old couple may need up to $351,0002 to cover health care costs in retirement. But these estimates don’t provide an accurate picture of what most retirees will encounter.

Such daunting numbers give an impression that it will be difficult for most retirees to afford health care in retirement. We believe that planning for health care costs in retirement can be made simpler by using the available assets and income that retirees have. But we need to approach calculating health care costs differently.

When trying to plan for future health care expenses in retirement, consider these three things:

1. Health care is not a one‑time, bulk expense. In our view, approaching health care costs as an annual expense makes it easier to plan for them. Any type of expense incurred over a 20‑ to 30‑year period can look daunting when summed up. We might balk at the thought of prepaying an $86,000 cable bill in retirement,3 but that’s not how we pay for cable. Similarly, estimating cumulative future health care costs is not useful because we don’t prepay for health care.

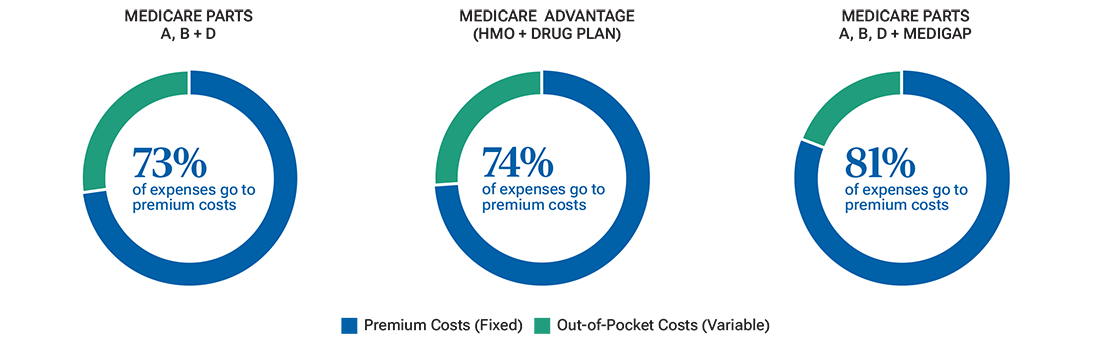

A look at the share of premiums in total annual health care costs

(Fig. 1) Average percentage share of individual health insurance premiums (ages 65 and above)

Source: T. Rowe Price estimates based on 2024 Medicare premiums and data from the Health and Retirement Study (HRS).

2. Think about premiums and out‑of‑pocket expenses differently. Premiums are relatively stable, but out‑of‑pocket expenses are not. Usually, retirees pay a fixed monthly premium, but out‑of‑pocket expenses can vary from month to month.

Medicare premiums with prescription drug coverage account for between 73% and 81% of annual health care costs for the majority of retirees, regardless of the type of Medicare coverage they have.

As Figure 1 shows, Medicare premiums with prescription drug coverage account for between 73% and 81% of annual health care costs for the majority of retirees, regardless of the type of Medicare coverage they have.

Given that month‑to‑month premiums are fixed and premiums make up the bulk of annual health care expenses, most of the annual health care expenses are predictable. So they can be budgeted for and paid from monthly income.

Out‑of‑pocket expenses are highly variable

(Fig. 2) Different percentiles of annual out‑of‑pocket expenses for individuals

ages 65 and above under different types of Medicare coverage

| MEDICARE PARTS A, B + D | MEDICARE ADVANTAGE (HMO + DRUG PLAN) | MEDICARE PARTS A, B, D + MEDIGAP | |

|---|---|---|---|

| Low Cost (1 in 4 retirees will pay less than) | $200 | $100 | $300 |

| Medium Cost (half of retirees will pay less than) | $700 | $700 | $900 |

| High Cost (1 in 4 retirees will pay more than) | $2,100 | $1,900 | $1,900 |

| Very High Cost (1 in 10 retirees will pay more than) | $5,100 | $3,800 | $4,200 |

Source: T. Rowe Price estimates based on 2024 Medicare premiums and data from the HRS. All costs are rounded up to the nearest hundred.

On the other hand, out‑of‑pocket expenses can vary greatly from individual to individual and from month to month. Figure 2 illustrates how out‑of‑pocket expenses can vary.

It is clear from Figure 2 that out‑of‑pocket expenses are highly variable, and they are the primary source of uncertainty in health care expenses. We believe maintaining an account (like a savings account) with enough liquid savings to meet the annual out‑of‑pocket expenses, and replenishing it annually, might be a good way to address the uncertainty of out‑of‑pocket expenses.

3. Don’t get caught up on one large number. Most of the estimates regarding retiree health care expenses assume a single type of coverage, which may differ from yours. Also, the astronomical health care cost numbers often correspond to a few unfortunate people who experience very high expenses for a prolonged period. Most retirees won’t be in that situation.

According to our estimates, half of retirees with traditional Medicare (Parts A and B), a prescription drug plan (Part D), and Medigap will spend less than $900 per year on out‑of‑pocket expenses. Only 1 in 10 will likely spend more than $4,200 per year on out‑of‑pocket expenses. Also, it’s not necessarily true that someone spending $4,200 in out‑of‑pocket expenses this year will keep doing so for the rest of his or her life.

What you can do to prepare

Prior to retirement (and filing for Medicare), consider:

- Comparing the premiums and out‑of‑pocket costs of different Medicare coverage options. Include prescription drug plans in the comparison, and choose the option that best suits you.

- Calculating your monthly premiums based on the type of coverage you choose and budgeting for that amount from your monthly income.

- Keeping enough liquid cash to meet your out‑of‑pocket expenses for the year. This amount can be based on past years’ expenses.

It’s hard not to be intimidated by extreme estimates regarding future health care expenses. But recognize that your actual health care expenses will be a combination of regular, predictable expenses that you can budget for and, for most people, a smaller component of variable expenses that you can manage from your savings.

We analyzed nationally representative data on retiree health care expenses and 2024 Medicare premiums to estimate annual health care expenses for different types of Medicare coverage and to break down the costs between insurance premiums and out‑of‑pocket expenses.4 We also provided guidelines on how retirees can plan to meet their annual health insurance premiums and out‑of‑pocket expenses.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to retirement income.

-

1Source: T. Rowe Price Retirement Savings and Spending Study (RSS), 2023.

2Fronstin, Paul and Jake Spiegel, “Projected Savings Medicare Beneficiaries Need for Health Expenses Increased Again in 2023,” EBRI Issue Brief, no. 549 (January 18, 2024).

3Assuming a $150 monthly cable expense with 3% annual inflation over 30 years.

4Health and Retirement Study public use dataset. Produced and distributed by the University of Michigan with funding from the National Institute on Aging (grant number NIA U01AG009740). Ann Arbor, MI.

-

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are those of the author as of February 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments involve risk. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2024 T. Rowe Price. All rights reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

202402-3381703