- From the Field

- A new solution to income with T. Rowe Price’s latest ETF offering

- Discover TCAL, T. Rowe Price's new ETF aiming to maximize income and preserve principal.

- 2025-05-06 12:29

-

David Giroux, CFA, Co-portfolio Manager, Capital Appreciation and Income Fund, Head of Investment Strategy and Chief Investment Officer, T. Rowe Price Investment Management

Farris Shuggi, CFA, Co-portfolio Manager, Capital Appreciation and Income Fund, Head of Quantitative Equity, T. Rowe Price Investment Management - Key Insights

-

- T. Rowe Price’s new Capital Appreciation Premium Income ETF (TCAL) aims to deliver a solution that maximizes income, preserves principal, and limits losses.

- The fund seeks income generation through premiums from options writing and dividends via the fund’s equity holdings.

- TCAL, as an active ETF, provides investors a tax-efficient, convenient, and cost-effective approach from a leading portfolio team.

During shifting markets, many investors may reexamine their equity allocations or search for opportunity for cash sitting on the sideline. Consider the new Capital Appreciation Premium Income ETF, or TCAL. Built for investors seeking both competitive income and capital preservation, TCAL is designed to deliver a high level of current income through a combination of call option premiums and equity dividends, while also seeking to preserve principal through risk‑aware active management.

A strong foundation

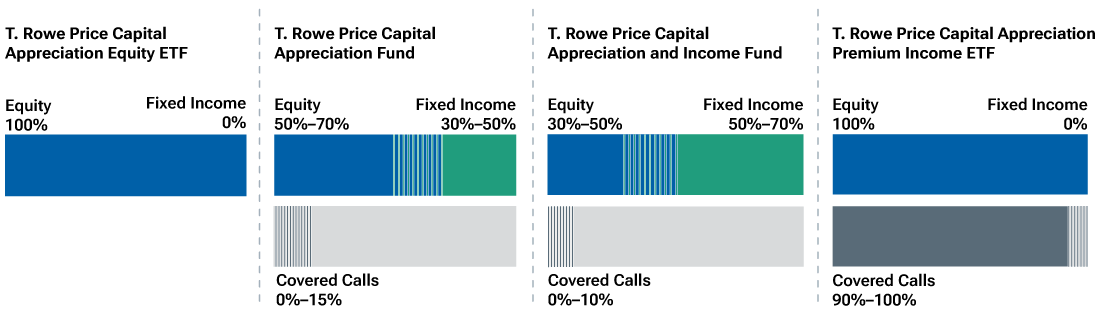

The Capital Appreciation Premium Income ETF is a new member of the Capital Appreciation suite. The full suite represents a set of investments managed or comanaged by David Giroux and a team of tenured portfolio managers who draw on similar approaches and principles:

- Looking for opportunities (like durable inefficiencies) in the market that can be exploited to enhance returns and

- Seeking to deliver outcome‑focused solutions.

The Capital Appreciation franchise

(Fig. 1) A comparison of asset allocations for the four funds in the Capital Appreciation suite

Past performance is not a guarantee or a reliable indicator of future results.

Source: Morningstar’s Manager Research Group. See Additional Disclosures.

“The Capital Appreciation Premium Income ETF has its roots in a covered call option writing strategy we’ve deployed in CAF [Capital Appreciation Fund] for more than 15 years,” says Giroux, TCAL co‑portfolio manager and a six‑time nominee and two‑time winner of the Morningstar Fund Manager of the Year award1 who has also managed CAF for almost two decades. “We recognize the growing importance of income for investors, and we think TCAL offers a better way to pursue income without sacrificing diversification or taking on excess risk.”

“…TCAL aims to offer a better way to pursue income without sacrificing diversification or taking on excess risk.”

TCAL Co‑portfolio Manager Farris Shuggi explains: “We believe our experience implementing covered call option writing strategies gives us a competitive edge. We take our tested investment process of identifying less volatile, higher‑quality stocks with characteristics such as strong capital allocation and great risk‑adjusted returns, and then we aim to maximize income by capturing call premiums for the names we own.”

“We think markets tend to overestimate the future risk or volatility of specific stocks, and therefore writing call positions tends to be overcompensated for realized risk over time,” adds Shuggi. “This creates an inefficiency we can exploit by taking a selective approach and writing options on stocks we believe to be less volatile. And by capturing the premium when we write the option, we offset some of the downside risk for those names.”

TCAL primarily invests in the securities of high-quality, low-beta, U.S. large-cap companies, using a covered call option writing strategy to seek to preserve principal and mitigate downside risk.

- Investment selection: TCAL favors the stock of companies that are less volatile, are higher quality, and pay healthy dividends. It aims to avoid companies that could be riskier, like poor capital allocators or those facing persistent headwinds, such as shifts in consumer behaviors or disruptive competition. By writing call options on the stocks of these companies and capturing a premium, we seek to further offset downside risk for those names, supporting the preservation of capital.

- Income generation: The fund offers two powerful sources of current income in call option premiums and equity dividends. TCAL’s approach to writing covered calls on individual securities seeks to maximize income compared with most competitor approaches that overwrite an entire index. Put another way, because single stocks are more volatile than an index, the premium received to write individual calls provides higher income. It’s our belief that most competitors don’t take this approach because of the significant operational complexity, whereas the Capital Appreciation team’s experience and expertise in the process can provide a competitive edge.

- Risk mitigation: The fund incorporates risk analysis at every step of the investment process. TCAL’s experienced portfolio managers combine a deep understanding of individual companies with proprietary quantitative tools to uncover opportunities where the risk/reward setup looks compelling.

Navigating uncertainty

Investors often look for opportunities to keep the value of their investments intact and ways to generate more income, and this becomes especially important during volatile markets. TCAL seeks to deliver high distribution yield, uncorrelated with interest rates, and to preserve investor principal over time. This is done using covered calls to generate cash flows in addition to dividends received via the fund’s equity investments.

“TCAL seeks to deliver high distribution yield, uncorrelated with interest rates, and to preserve investor principal over time.”

TCAL is part of the Capital Appreciation suite and may be an option for more risk-averse investors looking for current income while preserving their original investment. The entire suite shares a common investment philosophy, a commitment to rigorous, bottom-up fundamental research, and an emphasis on managing downside risk. Each portfolio offers a different approach to seeking capital appreciation and income:

- Capital Appreciation Fund I Class (TRAIX)—closed to new investors) has more of a growth‑oriented strategy. Under Giroux’s leadership, the Capital Appreciation Fund finished 2024 beating its Morningstar peer group average for 17 consecutive years,2 setting a singular record for the most consecutive calendar years a U.S. equity or multi‑asset fund has done so under the same portfolio manager.

- Capital Appreciation and Income I Class Fund (PRCHX) seeks total return through a combination of income and capital appreciation.

- Capital Appreciation Equity ETF (TCAF) emphasizes capital growth with controlled risk through an all-equity portfolio. TCAF is an exchange‑traded fund (ETF) that is fully invested in equities, primarily in the United States.

- Capital Appreciation Premium Income ETF (TCAL) seeks to deliver regular distributions while aiming for capital preservation with potential for capital appreciation. TCAL is fully invested in equities, primarily in the United States, with covered call options written over most or all of the portfolio.

T. Rowe Price active ETFs offer investors the investment expertise and research capabilities of the organization, along with the advantages of the ETF structure: convenience, tax efficiency, and cost-effectiveness.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to asset allocation viewpoints.

-

1 Established in 1988, the Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. The Fund Manager of the Year award winners are chosen based on research and in-depth qualitative evaluation by Morningstar’s Manager Research Group. To qualify for the award, managers’ funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning their interests with shareholders’. Managers’ funds must currently have a Morningstar Analyst Rating™ of Gold or Silver. David Giroux won the award for Allocation Funds in 2012 and Allocation/Alternative Funds in 2017.

Morningstar’s Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc., including, but not limited to, Morningstar Research Services LLC. Morningstar’s Manager Research Group produces various ratings including the Morningstar Analyst Rating for funds and the Morningstar Quantitative Rating for funds. The Analyst Rating is derived from a qualitative assessment process performed by a manager research analyst, whereas the Morningstar Quantitative Rating uses a machine-learning model based on the decision-making processes of Morningstar’s analysts, their past ratings decisions, and the data used to support those decisions. In both cases, the ratings are forward-looking assessments and include assumptions of future events, which may or may not occur or may differ significantly from what was assumed. The Analyst Ratings and Quantitative Ratings are statements of opinions, subject to change, are not to be considered as guarantees, and should not be used as the sole basis for investment decisions.2 As of December 31, 2024. Based upon a T. Rowe Price analysis of calendar year returns for all equity and multi-asset funds domiciled in the U.S. with greater than or equal to 17 consecutive years of beating their Morningstar peer group average while under the management of the same portfolio manager. Analysis excludes any portfolios managed by David Giroux in the same manner as the Capital Appreciation strategy. The Morningstar Category system was introduced in 1996, but it includes funds that began operations earlier. The Capital Appreciation Fund is in Morningstar’s Moderate Allocation Category.

Additional Disclosures

©2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

-

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Risks

Capital Appreciation Fund: The fund is subject to the inherent volatility of common stock investing. The value approach carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Because of the fund’s fixed-income holdings or cash position, it may not keep pace in a rapidly rising market.

Capital Appreciation and Income Fund: The fund is subject to the inherent volatility of common stock investing. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall.

Capital Appreciation Equity ETF: The ETF is subject to the inherent volatility of common stock investing. The fund’s value and growth investing styles may become out of favor, which may result in periods of underperformance. The fund is “nondiversified,” meaning it may invest a greater portion of its assets in a single company and own more of the company’ voting securities than is permissible for a “diversified” fund. The fund’s share price can be expected to fluctuate more than that of a comparable diversified fund.

Capital Appreciation Premium Income ETF: The ETF is subject to the inherent volatility of common stock investing. The use of derivatives exposes the fund to additional volatility and potential losses. A derivative involves risks different from, and possibly greater than, the risks associated with investing directly in the assets on which the derivative is based, including liquidity risk, valuation risk, correlation risk, market risk, interest rate risk, leverage risk, counterparty and credit risk, operational risk, management risk, legal risk, and regulatory risk. The fund will write calls on instruments the fund owns or otherwise has exposure to (covered calls) in return for a premium. Under a call writing strategy, the fund typically would expect to receive cash (or a premium) for having written (sold) a call, which enables a purchaser of the call to buy the asset on which the option is written at a certain price within a specified time frame. Writing call options will limit the fund’s opportunity to profit from an increase in the market value and other returns of the underlying asset to the exercise price (plus the premium received).

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of May 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

ETFs are bought and sold at market prices, not net asset value (NAV). Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. Dividends are not guaranteed and are subject to change. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (troweprice.com/en/intellectual-property) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

202504-4440044

Get the full story.

We’re ready to share our latest thinking, but industry regulations require you to register or sign in to continue reading this article. Thank you for understanding.

Just one more step.

To continue, you are required to read and accept our Terms & Conditions. Thank you for understanding.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Risks

Capital Appreciation Fund: The fund is subject to the inherent volatility of common stock investing. The value approach carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Because of the fund’s fixed-income holdings or cash position, it may not keep pace in a rapidly rising market.

Capital Appreciation and Income Fund: The fund is subject to the inherent volatility of common stock investing. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall.

Capital Appreciation Equity ETF: The ETF is subject to the inherent volatility of common stock investing. The fund’s value and growth investing styles may become out of favor, which may result in periods of underperformance. The fund is “nondiversified,” meaning it may invest a greater portion of its assets in a single company and own more of the company’ voting securities than is permissible for a “diversified” fund. The fund’s share price can be expected to fluctuate more than that of a comparable diversified fund.

Capital Appreciation Premium Income ETF: The ETF is subject to the inherent volatility of common stock investing. The use of derivatives exposes the fund to additional volatility and potential losses. A derivative involves risks different from, and possibly greater than, the risks associated with investing directly in the assets on which the derivative is based, including liquidity risk, valuation risk, correlation risk, market risk, interest rate risk, leverage risk, counterparty and credit risk, operational risk, management risk, legal risk, and regulatory risk. The fund will write calls on instruments the fund owns or otherwise has exposure to (covered calls) in return for a premium. Under a call writing strategy, the fund typically would expect to receive cash (or a premium) for having written (sold) a call, which enables a purchaser of the call to buy the asset on which the option is written at a certain price within a specified time frame. Writing call options will limit the fund’s opportunity to profit from an increase in the market value and other returns of the underlying asset to the exercise price (plus the premium received).

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of May 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

ETFs are bought and sold at market prices, not net asset value (NAV). Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. Dividends are not guaranteed and are subject to change. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (troweprice.com/en/intellectual-property) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

202504-4440044