December 2023 / GLOBAL MARKET OUTLOOK

2024 Global Market Outlook

Tectonic shifts create new opportunities

Introduction: A world transformed

The economic distortions of the past few years have produced tectonic shifts in the global investment landscape. The massive fiscal stimulus and near‑zero interest rates seen during the pandemic have given way to tighter monetary policies and sharply higher bond yields.

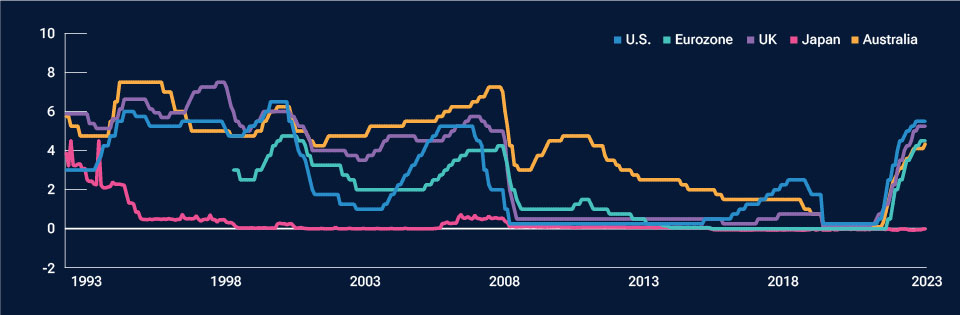

While the U.S. Federal Reserve and other major central banks have made progress against inflation and policy rates appear close to their peaks (Figure 1), our analysis is that the Fed is likely to hold rates steady in 2024.

Monetary policy effects typically are felt with a lag, so global economic growth remains at risk. The eurozone already is in recession, and China’s post‑pandemic recovery has been disappointing. However, the U.S. economic outlook is more encouraging, as corporations and consumers both have proven less sensitive to higher rates compared with other major global economies. Fiscal stimulus has added further support.

Short‑term interest rates appear close to cyclical peaks

(Fig. 1) Central bank policy rates.*

As of November 30, 2023.

*U.S. = federal funds rate upper limit; eurozone = European Central Bank main refinancing rate; UK = Bank of England official bank rate;

Japan = Bank of Japan overnight call rate; Australia = official cash rate, end of period.

Sources: Haver Analytics/Federal Reserve Board, European Central Bank, Bank of England, Bank of Japan, Reserve Bank of Australia. T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Bond volatility moves to the long end

Uncertainty is likely to keep fixed income volatility high in 2024. But if major central banks remain on hold, volatility is likely to move to the long end of the yield curve, as opposed to the sharp moves seen at the short end as central banks tightened. Surging U.S. Treasury issuance also could keep upward pressure on longer‑term yields.

Attractive yields should support below investment‑grade (IG) corporates, with improved credit quality helping keep defaults relatively low. Shorter‑term IG corporates also appear to offer opportunities. Careful attention to issuer fundamentals will be critical.

Looking beyond the tech giants

The global equity rebound in 2023 was dominated by a handful of mega‑cap U.S. technology stocks. But positive fundamentals in some regional markets and innovations in other key sectors should help expand the opportunity set in 2024.

Health care innovation is one area that could offer opportunities, as could the energy sector, thanks to capital investment in both traditional and renewable energy sources. Commodity‑related sectors appear to have bottomed and could be attractive hedges if inflation proves stickier than expected.

Emerging market (EM) equities are attractively valued relative to developed markets. We see selective opportunities in China, despite sluggish economic growth. Within the developed markets, structural and cyclical factors should be supportive for Japanese equities.

Explore our three themes:

1. Navigating macroeconomic fog

Key global economies—the U.S. economy in particular—have demonstrated surprising resilience to higher interest rates. But headwinds are likely to mount in 2024.

2. Rethinking fixed income

We think the Fed will be slower to cut rates in 2024 than markets seem to expect. High yield and shorter‑term investment‑grade corporate bonds could offer opportunities.

3. Broadening equity horizons

Equity investors will need to cast wider nets in 2024. We see opportunities in Japan, emerging markets, health care, and artificial intelligence.

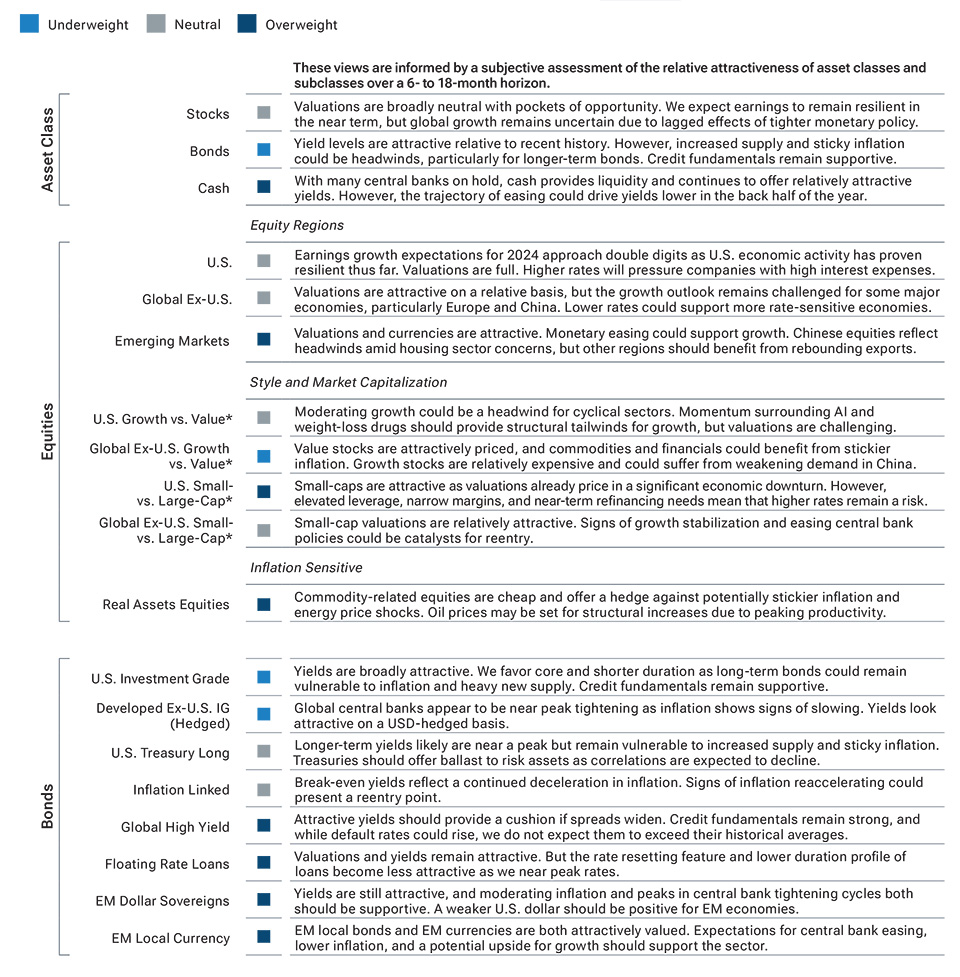

2024 tactical allocation views

*For pairwise decisions in style and market capitalization, boxes represent positioning in the first asset class relative to the second asset class. The asset classes across the equity and fixed income markets shown are represented in our multi-asset portfolios. Certain style and market capitalization asset classes are represented as pairwise decisions as part of our tactical asset allocation framework.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. Information and opinions, including forward‑looking statements, are derived from proprietary and nonproprietary sources deemed to be reliable but are not guaranteed as to accuracy.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been independently verified. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

Additional Disclosure

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

December 2023 / GLOBAL MARKET OUTLOOK