Investment Ideas for Fixed Income Markets

An Expected Fed Rate Cut as Fixed Income Markets Turn Attention to 2026

The T. Rowe Price Fixed Income Division held its Policy Week amid the Federal Reserve’s much anticipated final meeting of 2025 where the views of policymakers on the Federal Open Market Committee (FOMC) have differed recently. With few other market catalysts since our November Policy Week, most outlooks on conviction and valuations remained unchanged.

Analysis and Conviction Updates

Highlights from our Global Economics team included expectations for improving global growth from the current modest state. Expected improvement continues to be attributed primarily to the U.S. thanks to supportive fiscal spending, loose financial conditions, and ongoing momentum in AI-related investments from corporations. Global inflation continues to moderate with upside risks in the U.S. standing out among major regions thanks to tariff shocks and sticky services inflation. As a result, momentum behind monetary easing from major central banks has slowed substantially. Chief U.S. Economist Blerina Uruci stated that she believes FOMC Chair Jerome Powell’s policy cut delivered at the December 9 meeting will be the last of his tenure. This remains the most differentiated view relative to the market to come out of the economics meeting.

With little change in the economic backdrop and U.S. Treasury yield momentum now turned upwards, our Global Interest Rate & Currency Strategy (GIRCS) team maintained its out-of-consensus view that intermediate- and long-term Treasury yields are more likely to move higher from here than not. The balance of risks for short-term Treasury yields is more even in the committee’s opinion, supporting a slightly less differentiated view that the Treasury curve is likely to steepen over the coming months if growth improves and inflation remains above target.

In our Sector Strategy meeting, investment staff discussed the outlook for risk into year-end, which is expected to remain strong as very low supply and ongoing inflows should be supportive. As we move into the new year, expectations for a wave of issuance from industries like utilities are expected to turn spread performance softer. Against this backdrop, credit derivatives remain an attractive way for active managers to quickly adjust exposures to take tactical advantage of weakness that could be short-lived if the fundamental picture remains strong.

Bottom Line: Looking ahead to 2026, we believe taking an active approach in fixed income securities will be essential as global central bank policy could continue to diverge while themes like the AI arms race shape markets in rapid fashion. We believe having dedicated resources in global economics and fundamental analysis teams across countries, sectors, and currencies can help create distinct perspectives that can help inform our portfolio managers and investment staff through uncertainty and changing markets.

All investments are subject to market risk, including the possible loss of principal. Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk. As interest rates rise, bond prices generally fall.

Conflicts of Interest risk – The investment manager's obligations to a portfolio may potentially conflict with its obligations to other investment portfolios it manages.

Counterparty risk – Counterparty risk may materialise if an entity with which the portfolio does business becomes unwilling or unable to meet its obligations to the portfolio.

Custody risk – In the event that the depositary and/or custodian becomes insolvent or otherwise fails, there may be a risk of loss or delay in return of certain portfolio's assets.

Cybersecurity risk – The portfolio may be subject to operational and information security risks resulting from breaches in cybersecurity of the digital information systems of the portfolio or its third-party service providers.

ESG risk – ESG integration as well as events may result in a material negative impact on the value of an investment and performance of the portfolio.

Investment portfolio risk – Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Inflation risk – Inflation may erode the value of the portfolio and its investments in real terms.

Market risk – Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors.

Market Liquidity risk – In extreme market conditions it may be difficult to sell the portfolio's securities and it may not be possible to redeem at short notice.

Operational risk – Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

Sustainability risk – Portfolios that seek to promote environmental and/or social characteristics may not or only partially succeed in doing so.

Actual outcomes may differ materially from any forward-looking statements made. The statements made are as of December 2025, are those of the author, and are subject to change, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Other T. Rowe Price associates may have different views.

Further reading

T. Rowe Price Insights

T. Rowe Price Insights

Ahead of the Curve

Read the latest monthly insights from our Fixed Income CIO, Arif Husain

High Yield Education Hub

High Yield Education Hub

Your guide to everything global high yield

Explore the exciting world of global high yield and how it could add value to client portfolios.

Past investment ideas and themes

A Leap of Faith Now Needs the Bond Market…

Many view the rise of generative artificial intelligence (AI) as a key driving force behind the next industrial revolution, where the integration of AI, robotics, and increased interconnectivity permeates all industries, driving transformational changes in how humans live and work. While only time will tell the outcome of this bold experiment, current investors—and this generation as a whole—are facing seismic changes that will come with the broad proliferation of AI, and moving forward will require a significant “leap of faith.”

According to JP Morgan Research, USD 5 trillion of capital is needed by 2030 to fund massive infrastructure investments in AI-related semiconductors and data centers, which have demanding power requirements. Unlike the buildout of railroads in the 19th century that lasted decades after construction, and the durability of internet infrastructure put in place at the end of last century, AI requires constant maintenance, as the hardest working semiconductors in a data center may only last three to five years based on use. And yes, semiconductor-related technology will continue to advance, but this reality only feeds a taxing maintenance spend for AI, as there will be incentives to use only the data centers with the latest and most advanced semiconductors. All of this arguably creates a much less cyclical “super cycle” for today’s leading semiconductor companies.

Fortunately, as any good commercial lender appreciates, even with the uncertainty that comes with the current “leap of faith” in AI, the integrity of the project in the U.S. has been bolstered by the sheer scale of how much this expensive buildout has been funded from existing cash flows by its leading “hyperscaling” companies. But even these traditionally asset-light companies that generate large levels of free cash flows and have multi-trillion-dollar market caps have limits as to how much they can deploy if they are to maintain and grow their equity valuations from current levels. They, and AI infrastructure players in general, will need to borrow money in the investment-grade credit market to see this grand project through to a more mature maintenance-level state.

It is against the backdrop described above that the T. Rowe Price Fixed Income Division held its November Policy Week meeting, where the following expectations emerged for the foreseeable future:

- A resilient global economy, as the global AI arms race continues and fiscal policy dominates,

- One more rate cut from the Fed in December, but no cuts in the first half of next year as the jobs market remains rangebound while higher U.S. inflation potentially peaks at 3.5% next fall,

- Away from fed funds rate and shorter maturity U.S. Treasuries, higher U.S. rates and a steepening Treasury yield curve as the U.S. aggregate debt pile continues to grow,

- Caution on investment-grade (IG) debt against the backdrop of tight spreads and the rapid expansion of expected AI-related IG debt coming to market, and

- A weaker U.S. dollar that could be supportive of emerging market debt.

Beyond these considerations, the Fixed Income Division also deliberated on the quickly rising scale of complex IG debt that will be needed to fund the historically large AI infrastructure arms race referenced above that has just begun. Just as shopping mall or golf course developers must finance their projects with borrowed money and manage the associated interest expenses while waiting for the asset to eventually generate cash flows to repay the debt, the current AI buildout will increasingly rely on structured debt to fund its massive infrastructure investments, and these debt offerings may be highly complex given the relationships between the companies involved in the rapidly accelerating AI industry.

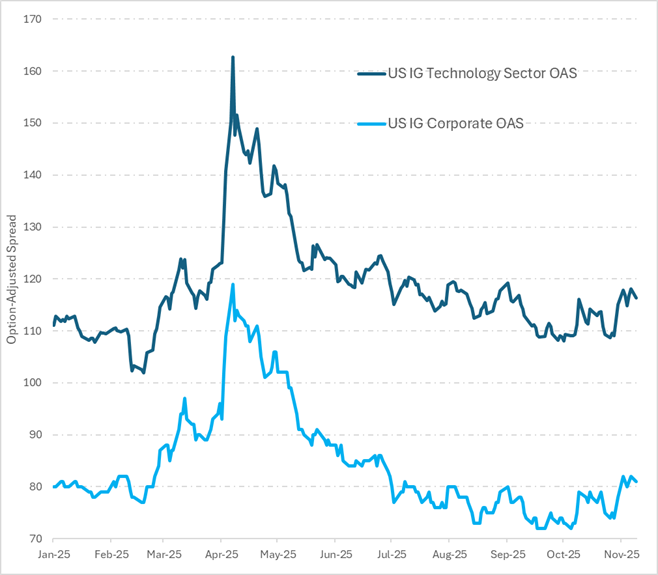

While uncertainty abounds with now more and increasingly complex AI debt-deal structures that will combine joint venture project finance, we believe there will be opportunity for asset managers who can analyze and understand the highly complex deal structures that may be present as companies issue debt in the IG corporate market to fund infrastructure spending. To this end, a yield premium has emerged based on the difference in spreads between the technology component of the Bloomberg U.S. Investment Grade Corporate Bond Index and the full Bloomberg U.S. Investment Grade Corporate Index.

Bottom Line—Just as the T. Rowe Price Fixed Income Division avoided the esoteric and complex deal structures that ultimately helped trigger the global financial crisis of 2008, today’s fixed income platform remains predicated on fundamental research, enjoys close collaboration for greater perspective with T. Rowe Price’s dedicated technology equity team, and is prepared to navigate the uncertainty and opportunity that accompany today’s historic AI buildout.

Past performance is not a guarantee or a reliable indicator of future results.

Source: Bloomberg Finance L.P.

All investments are subject to market risk, including the possible loss of principal. Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk. As interest rates rise, bond prices generally fall.

Capital risk: The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Counterparty risk: An entity with which the portfolio transacts may not meet its obligations to the portfolio.

Geographic concentration risk: To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk: A portfolio's attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk: Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Conflicts of interest risk: The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk: Operational failures could lead to disruptions of portfolio operations or financial losses.

Actual outcomes may differ materially from any forward-looking statements made. The statements made are as of November 2025, are those of the author, and are subject to change, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Other T. Rowe Price associates may have different views.

Vigilant Active Management

The “Chinese bamboo tree story” is a well-known parable about a plant that spends years developing a strong underground root system, showing no visible growth above ground, before suddenly shooting up 90 feet in just six weeks. This story powerfully illustrates the importance of patient perseverance. In the wake of the T. Rowe Price Fixed Income Division’s October Policy Week and recent capital market events, the story serves as a reminder that vigilant active management—grounded in a strong foundation—can help address the following two key considerations:

Maintaining credit selection discipline amid credit markets that are not providing much room for error and are beginning to rumble—Public and private credit markets have been wide open during the year-to-date period, which continues a trend of recent years that was only briefly interrupted this past spring. Corporate fundamentals have remained sound in conjunction with resilient U.S. and global economies. Meanwhile, fluidity between private and public credit markets has given companies access to the credit they need not only to sustain themselves, but also to expand organically or through mergers and acquisitions. As a result, investment-grade and high yield credit spreads had revisited historically low levels before most recently moving modestly wider; but spreads remain well below historical averages. Through this cycle of ever tighter credit spreads, the firm’s fixed income security selection process in credit has been not only prudently maintained but enhanced with the intent of ensuring credit exposure that could weather an eventual turn in the credit cycle. As a result, while the Fixed Income Division largely views the various global credit sectors that make up its opportunity set with “neutral” conviction coming out of Policy Week, the ongoing work of focusing on sourcing the best fundamental relative value from these various sectors continues.

It is against the backdrop of dedicated sector teams persistently scouring their markets to seek the best relative value while also not losing sight of fundamentals where the bamboo tree story comes into play. Consider, for example, just as the durable roots of the bamboo tree remain hidden in its early years, the ongoing credit selection process we referenced above also forms a strong—but largely invisible—foundation. This is especially true in robust credit markets, where overall positive conditions can make it difficult to distinguish the impact of careful credit selection, as a rising tide tends to lift all boats. But just as a theoretical bamboo tree can suddenly powerfully appear as if out of nowhere, sound security selection also quickly becomes positively pronounced amid a turning point in the credit cycle.

It is yet to be determined whether the recent credit blowups that auto parts supplier First Brands and subprime auto lender Tricolor (no T. Rowe Price fixed income products have exposure to either credit) experienced represent a “canary in the coal mine” as being indicative of more broad-based trouble in credit overall and potentially a turn in the cycle. Whether it does or doesn’t, certain private credit firms and banks have already been impacted by this news.

Away from the U.S., a heightened central bank policy rate of 15% in Brazil is suddenly acting as kryptonite for several heavily indebted companies in the country, with any refinancing or new bond issuance coming with significantly higher interest rates. Beyond Brazil, there is some room for pause more broadly in emerging market credit markets in recent weeks, in our view. Ultimately, whether the current moment in global credit markets turns for the better or worse from here, still stretched valuations in credit markets also mean that fixed income portfolios with “strong root structures” built on disciplined, thorough security selection—without shortcuts that could have been obscured during the recent bull market—are especially worth considering.

An earnest, yet methodical, approach toward incorporating generative AI into fixed income investment processes—As is the case with most corporations globally, T. Rowe Price and its Fixed Income Division are actively exploring and implementing AI-driven efficiencies into our investment process wherever productivity gains are to be made. While many now pursue such efficiency improvements, we believe few have a truth-based fundamental research platform at the foundation of this now urgent push to incorporate AI broadly into business practices and processes. The reference to “truth” is on purpose as many of us already know that not all content generated by AI is necessarily accurate. Ironically, an example of this is the idea that all bamboo trees spend several years developing underground root systems before suddenly experiencing rapid above-ground growth, which can be the depiction returned when posed to an AI chat application. However, this characterization is inaccurate or at least exaggerated, as bamboo can grow rapidly and consistently from the outset and often will be visible above ground relatively quickly. The widely cited narrative, which finds its way into AI-generated responses, more accurately describes the Chinese bamboo tree parable, but is not botanically precise. In this context, T. Rowe Price is committed to incorporating AI into select investment and business processes but will do so according to our own fundamentally clear standards.

Bottom Line—In an environment that’s seeing increasing policy uncertainty, active management in global fixed income takes on heightened importance. Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its rigorous and collaborative global bottom-up research effort, T. Rowe Price’s Fixed Income Division is well positioned to actively manage the array of global strategies that compose its investment platform through the uncertain times ahead.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

Risks: All investments are subject to market risk, including the possible loss of principal. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Conflicts of Interest risk – The investment manager's obligations to a portfolio may potentially conflict with its obligations to other investment portfolios it manages.

Counterparty risk – Counterparty risk may materialise if an entity with which the portfolio does business becomes unwilling or unable to meet its obligations to the portfolio.

Custody risk – In the event that the depositary and/or custodian becomes insolvent or otherwise fails, there may be a risk of loss or delay in return of certain portfolio's assets.

Cybersecurity risk – The portfolio may be subject to operational and information security risks resulting from breaches in cybersecurity of the digital information systems of the portfolio or its third-party service providers.

ESG risk – ESG integration as well as events may result in a material negative impact on the value of an investment and performance of the portfolio.

Investment portfolio risk – Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Inflation risk – Inflation may erode the value of the portfolio and its investments in real terms.

Market risk – Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors.

Market Liquidity risk – In extreme market conditions it may be difficult to sell the portfolio's securities and it may not be possible to redeem at short notice.

Operational risk – Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

Sustainability risk – Portfolios that seek to promote environmental and/or social characteristics may not or only partially succeed in doing so.

Additional Disclaimers: Actual outcomes may differ materially from any forward-looking statements made. The statements made are as of 15 October 2025, are those of the author, are subject to change, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Other T. Rowe Price associates may have different views. The specific securities identified and described are for informational purposes only and do not represent recommendations.

“Real” Conviction

Following the negative asymmetric yield experience of 2022, yield trends for nominal intermediate- to long-maturity U.S. Treasuries have regained symmetry as the market seeks to identify their next durable trend; but overall, nominal yield levels have still been volatile. Consider the dizzying yield journey of the bellwether 10-year U.S. Treasury for the past one year that began the period at 3.74%, tested 4.79% in mid-January, then settled in a range around 4.4% from mid-April to late July before oscillating in a range between 4.0% and 4.2% since then. It is against this challenging backdrop and a bias that U.S. rates, in conjunction with concerns centered on seemingly unsustainable U.S. deficit spending, will eventually be heading materially higher that the T. Rowe Price Fixed Income Division held its September Policy Week.

Interestingly, through the holistic assessment of Policy Week that follows detailed analysis across the various components of global fixed income markets, currencies and related economies, not much had changed since the Fixed Income division’s Policy Week meetings in the summer. Fundamentals remain sound across investment grade and below investment grade credit sectors and related spreads remain historically tight, supported by a global economy that continues to plod positively forward amid:

- Front loading (ahead of elevated tariffs) activity carrying the Eurozone economy for now that should then gain additional support with expansionary fiscal policy kicking in next year.

- China showing some signs of bolstering its consumption economy as the country’s exaggerated (and tariff free…) industrial production continues to move its overall economic needle forward.

- A slowing U.S. economy transitioning toward a greater manufacturing focus that is now supported by expansionary fiscal policy in the form of the One Big Beautiful Bill (OBBBA) and a Federal Reserve rate cut (with high market expectations for two more 25-basis-point cuts coming before year end).

Beyond strong fundamentals that are also supported by favorable equity earnings trends across the S&P 500, the continuing overlap between public and private markets also means that corporate America is technically well supported from a funding perspective as the domestic IPO market heats up.

Away from corporate credit, the sharp year-to-date falling trend in the U.S. dollar, while still modestly atrophying, found near term traction in recent weeks as Policy Week unfolded. As a result, conviction levels remain broadly neutral or better across most spread sectors, apart from the mortgage-backed securities sector that is beset with some near-term technical pressure. Interestingly, from a real time perspective, the future fortunes of the U.S. dollar are being revisited for another potential leg down with more Fed rate cuts potentially coming.

Overall, while the surface appears serene across spread sectors, the division’s respective credit and emerging markets debt sector teams remain vigilant regarding security selection to prepare for a a turn in the current “goldilocks” environment for credit. In addition to an emphasis on security selection within spread sectors, our sector teams highlighted the utility of the high yield and investment grade synthetic corporate markets that allow us to actively manage corporate exposures while also having an attractive liquidity profile that allows the team an opportunity to pivot if market conditions change.

In assessing the current tight spreads environment, particularly in long maturity corporate credit, getting the call right on where intermediate to long U.S. rates are headed is a focus as sharply higher yields could represent a “trip wire” for the current credit cycle. While the passing of OBBBA confirmed that the U.S. administration would continue running concerning levels of deficit spending well into the future, U.S. 10-year Treasury yields have rallied nevertheless from a high of 4.6% in late May to 4.13% as this note is being written. As a result, while the Fixed Income Division reevaluated its negative view on U.S. sovereign duration during its September Policy Week, an overall bearish view remains. Near term, this posture has been reinforced as the U.S. 10-year yield, after testing just below the 4% yield range on September 11, has since risen to the higher yield level referenced above.

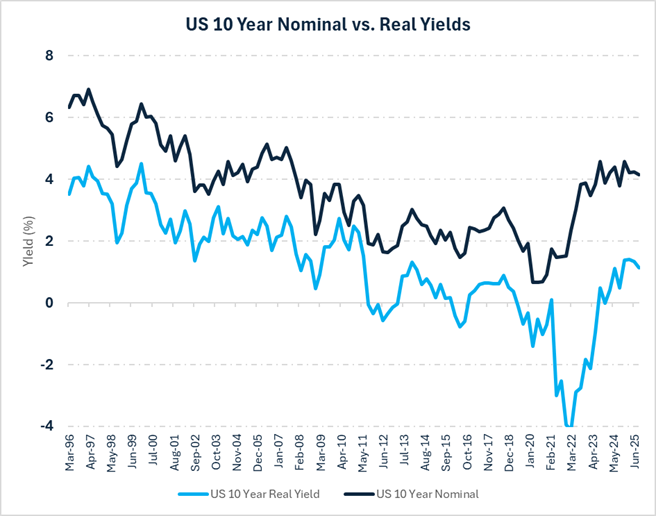

One other way to evaluate what has become a complex U.S. nominal rate environment is to reduce its noise by instead focusing on real yields, which adjust for inflation. Such a simplified view is provided in the chart on the right. As illustrated, U.S. 10-year real yields (U.S. 10-year nominal yields less U.S. CPI) in the range of 2% arguably represented a gravity point for where U.S. nominal yields ultimately landed heading into and then just beyond the Global Financial Crisis. After that, this theoretical 2% real yield range guide was shattered by an era of quantitative easing and peak globalization. Today’s world is markedly different with deglobalization trends that are being exacerbated with heightened tariff policy that now may have U.S. Treasury rates now seeking a new and higher baseline for real yields. This phenomenon may also help drive U.S. 10-year and longer maturity nominal yields higher going forward.

Against the backdrop described above, being short U.S. duration, positioning for a steeper 2s/10s U.S. Treasury yield curve, allocating to select inflation linked global sovereign debt, and potentially revisiting a short U.S. dollar posture all warrant consideration. And in terms of keeping it “real” in the current environment, T. Rowe Price Multi-Asset Division’s proactive move years ago to add and now be overweight real assets seems warranted as signals from gold miners suggest that U.S. Treasury real yields may not fully capture the future realities of a changing world.

Bottom Line – In an environment where indeed the world has changed as the U.S. pursues a materially unique go forward path relative to its approach for the past 80 years, active management in global fixed income takes on heightened importance. Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, we firmly believe that the T. Rowe Price Fixed Income is well positioned to actively manage the array of global strategies that compose its investment platform through the uncertain times ahead.

Chart One

As of September 22, 2025

Past performance is not a guarantee or a reliable indicator of future results.

Source: Bloomberg Finance L.P.

One Big Beautiful Bill allows the totality of “Trump 2.0” to now crystallize

The notion that capital markets loathe material uncertainty has been on full display year-to-date. In anticipating tax cuts and deregulation that would come with a second Trump presidency, global investors warmly embraced the notion that U.S. equity market dominance that had existed for well over a decade would continue in perpetuity as 2025 began. But investors learned soon after that the totality of “Trump 2.0” would extend beyond providing additional succor for arguably overstretched U.S. and global equity markets and would also disrupt the Bretton Woods global financial system that has largely been in place since the end of World War II.

Going forward, for example, the U.S. appears to no longer serve as a free de facto global policeman supporting the global establishment. Beyond this realization, a much more impactful announcement came on “Liberation Day” in early April. Draconian tariffs of a scale not seen since the Great Depression were also a primary part of a plan that seemed to lacked coherence. Global capital market participants were quick to deduce, for example, that such a rapid and growth-debilitating change could cause a recession in the world’s largest economy without some type of fiscal policy offset.

It wasn’t enough for this administration to claim that their use of tariff policy in 2018 did no harm to the U.S. economy in its attempt to rebalance a global trading system that was out of kilter. Those tariffs were limited and specifically measured and, importantly, followed the stimulative Tax Cuts and Jobs Act of 2017. And while a general expectation for more tariffs existed in early 2025, what was introduced on April 2 was arguably way beyond any market expectations. Worse yet, such an announcement came before what was then an uncertain fiscal package in terms of its composition as well as its likelihood of passing Congress. We all now know the rest: Markets were quick to understand and price in that delayed and materially less debilitating tariffs would allow for the vital passage of the One Big Beautiful Bill (OBBB). This has now happened, which has allowed President Trump to reignite tariff risk into the global financial system. In contrast to early April, however, heightened tariff risk is now incorporated into an arguably coherent overall agenda message that Trump delivered to NBC News during a wide-ranging interview on July 10.

It is against this backdrop that the T. Rowe Price Fixed Income Division held its July Policy Week where the following highlights emerged:

The OBBB is growth positive overall for the U.S., but—This historic and stimulative legislation comes at a time when the U.S. economy has demonstrated surprising resiliency relative to heightened uncertainty. And while questions exist about the state of U.S. labor markets, on its surface, with an unemployment rate of 4.1%, America is fully employed as expansive fiscal policy is introduced. This runs counter to classic Keynesian orthodoxy, which speaks to global regime change and questions around future levels of inflation.

Inflation has been benign, but—Thanks to regional housing market weakness, domestic real estate prices that exploded during the pandemic and ultimately helped drive materially higher levels of Owners’ Equivalent Rent (OER)—which represents approximately 26% of total U.S. CPI—are now receding. This dynamic is helping inflation to remain benign even as the Federal Reserve and many market participants (including the T. Rowe Price Fixed Income Division) remain worried about future levels of inflation.

Questions around future U.S. rate levels—T. Rowe Price’s Head of Fixed Income, Arif Hussain believes that “…the passing of the OBBB has confirmed our skepticism around austerity since the U.S. primary deficit is projected to increase under the new law… The tax cuts will keep the U.S. fiscal deficit elevated for the foreseeable future and put pressure on the long end of the U.S. Treasury curve.” Potentially exacerbating Arif’s view is the qualitative consideration that if the U.S. is indeed no longer the world’s global policeman, then questions exist around future foreign demand for what is expected to be heightened U.S. coupon issuance going forward. Against this backdrop, the 10-year and longer portions of the U.S. Treasury market may be deeply pressured, while there may be attractive opportunities in inflation-linked bonds that have languished year-to-date amid benign inflation trends.

Importantly, timing matters when considering the look ahead for U.S. rates, as competing forces are influencing them. Anticipation of future Fed rate cuts is supportive of yields. The T. Rowe Price global economics team, for example, views current monetary policy in the U.S. as being too restrictive and sees potential for two 25-basis-point rate cuts coming from the Fed before year-end. Beyond cuts potentially being delivered by Fed chair Jerome Powell before he leaves his post at the end of this year, some market participants are already anticipating a more dovish Fed chair next year, which again supports rates.

Meanwhile, with the ink barely dry on the OBBB, President Trump is again escalating tariff policy risk, which can still drive higher future levels of inflation and rates. In addition, as referenced above, the unorthodox nature of adding material fiscal policy at a time of U.S. economic resiliency and full employment potentially harkens back to the 1960s, when the U.S. last breached its theoretical efficiency frontier. Back then, it took time for such policy to drive higher inflation and rates, and while this time is indeed different, caution is warranted regarding future U.S. rate levels.

A positive global growth environment—China’s economy is potentially achieving stable momentum as its exports continue to grow despite trade tension while its fiscal policy appears modestly supportive for growth. Europe, in contrast, is slowing near term economically as front loading (ahead of elevated tariffs) economic activity recedes in future months. This near-term economic malaise, meanwhile, gets significant help from an expansive and historic fiscal policy boost related to necessary elevated defense and infrastructure spending in the wake of a radically different foreign policy approach from the Trump administration.

A domestic and global “Goldilocks” investment environment is supportive of global spread sectors—In an environment where spreads that materially widened in early April to retrace to again benign and historically tight levels, spread sector valuations appear broadly neutral at this time, as absolute yields remain attractive while fundamentals remain sound.

A stable to appreciating U.S. dollar right now gives way to more U.S. dollar weakness—A highly uncertain time for U.S. policy and some periodic questioning of owning U.S. assets has helped weaken the U.S. dollar by almost 10% year to date. Nevertheless, the passing of the OBBB may be a near-term catalyst for the dollar to consolidate and potentially appreciate from a near-term perspective. Medium to longer term, however, U.S. intent to indeed bring domestic manufacturing back for the purpose of expanding exports would be bolstered with a weaker domestic currency that has experienced a prolonged period of strength since the 2008 global financial crisis.

Bottom Line—In an environment where, indeed, the world has changed as the U.S. pursues a materially unique forward path relative to its approach for the past 80 years, active management in global fixed income takes on heightened importance. Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, T. Rowe Price Fixed Income is well qualified to actively manage the array of global strategies that compose its investment platform through the uncertain times ahead.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

All investments are subject to market risk, including the possible loss of principal. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments.

Actual outcomes may differ materially from any forward-looking statements made. The statements made are as of July 2025, are those of the author, are subject to change, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Other T. Rowe Price associates may have different views.

Retracement and what’s next…

Delayed and recalibrated U.S. tariff policy in conjunction with resilient U.S. economic and corporate fundamentals have allowed risk assets to largely retrace to levels that existed in late February before the worries of a looming Liberation Day began to be fully priced into markets. As seen in Chart 1, the option-adjusted spread for the Bloomberg U.S. High Yield Index has tightened as equity markets have rallied. Helping this retracement in risk asset narrative further in recent weeks have been:

- Constructive (but still not conclusive) trade talks between the U.S. and China.

- Benign U.S. inflation data, which quells concerns for tariff policy serving as a catalyst for driving higher prospective near-term U.S. inflation for now. More on this topic below.

- Recent successful U.S. Treasury auctions, which followed tepid demand for recent long-maturity sovereign debt auctions in Japan as well as in the U.S.

Away from capital markets, despite the constructivism referenced above, all is not necessarily well. Consider oil prices, for example, that had been rising in the weeks leading up to Israel’s recent attack on Iran, now look to remain elevated for an indeterminate amount of time from late May levels as this conflict has potential to extend longer than current consensus projects.

Meanwhile, social unrest is unfolding in the U.S. as integral fiscal policy is being hammered out in the form of a “Big Beautiful Bill” (BBB) in Washington, D.C., which looks to only add to concerns around debt sustainability for the world’s largest economy. While tariff concerns have abated somewhat since early April, tariff-driven revenue still remains an important part of the Trump administration’s fiscal agenda as the administration, and its Department of Government Efficiency, has fallen short of identifying large-scale savings in government spending.

It is against this mixed environment of capital market retracement versus other developing material concerns that the T. Rowe Price Fixed Income Division held its June Policy Week with a focus on identifying what’s next for the global economy as well as for global fixed income markets. Highlights from this month’s Policy Week include:

A tepid global economy driven by the following highlights

A possible technical recession in the U.S.: In the first half of 2022, the U.S. economy experienced a technical recession when it posted two straight quarters of negative gross domestic product (GDP) growth, but still avoided a recession as defined by the National Bureau of Economic Research. The firm’s economics team expects a similar outcome in the U.S. during the first half of this year as a slowing U.S. economy is expected to get fiscal relief but on a lagged basis that carries into next year. The team also believes that that markets are too complacent about the near-term downside risks to growth from U.S. tariff policy. This perspective highlights the importance of Congress getting the BBB passed before their August recess.

China muddles through: Expected 4.5% GDP growth masks a mixed economic story in China. Export activity, for example, while appearing resilient on its surface, is compositionally changing as China diverts trade from uncertain U.S. trade policy to other destinations. Away from trade, overall economic momentum in China remains soft as weak housing markets continue to dampen overall consumer activity. And while fiscal policy remains reactive, it is stimulative nevertheless, which introduces hope for China’s economy next year.

Eurozone: While lifting the region’s first-half growth profile, front-loaded trade activity ahead of punitive U.S. tariffs will abate and could lead to a weaker growth trajectory in the second half of the year. Beyond 2025, stimulative fiscal policy such as the large-scale defense and infrastructure spending measures introduced by Germany earlier this year serves as an economic tailwind in future years.

Chart 1

As of June 12, 2025

Source: Bloomberg Index Services Limited.

Past performance is not a guarantee or a reliable indicator of future results.

A broad global easing cycle now slows down

U.S. tariff policy will likely be inflationary going forward, potentially driving current benign inflation data higher. Even with this view, our global economics team still expects two 25-basis-point rate cuts by the Federal Reserve before year-end as a neutral fed funds rate in a less globalized world is likely to be in the 3.75% range.

Outside of monetary policy, U.S. interest rates have fluctuated across the yield curve. Long-term rates are caught between the opposing forces of weaker growth and the possibility of higher inflation. For now, 10-year U.S. Treasury yields appear range-bound in the 4.25% to 4.50% range. Over the longer term, 10-year U.S. Treasury yields could revisit the 5% range and beyond with the potential confluence of inflationary tariff policy, elevated U.S. Treasury supply later this year, and fiscal stimulus coming from BBB legislation moving through Congress that comes at a time when the U.S., arguably, remains at full employment.

Beyond the U.S., the global monetary policy easing cycle, illustrated on the right, may begin to slow as uncertain U.S. trade policy creates room for pause from certain policymakers. Consider the European Central Bank (ECB), for example, which has raised its bar for further rate cuts by adopting a wait-and-see approach from here. Even so, our economics team still expects two more 25-basis-point rate cuts before year-end from the central bank’s current 2.15% policy rate, which has been reduced from its 4.50% stance that existed this time last year.

Regarding spread sectors, resilient fundamentals and tight spreads have driven a mostly neutral stance across from the Fixed Income Division. Nevertheless, global spread sectors remain attractive on a fundamental and on an absolute yield basis.

Chart 2.

Sources: IMF, CB Rates. Analysis by T. Rowe Price.

For illustrative purposes only.

Bottom line in terms of what’s next

While global markets have seemingly moved on from tariffs being a primary risk (even though tariff risk remains) to now focusing on prospective expansionary fiscal policy in the U.S. that is coming at a time of full employment, it is interesting to see a continuing year-to-date trend in U.S. dollar weakness that has followed Moody’s downgrade of U.S. Treasuries on May 16.

Against the uncertain environment described above, active management in global fixed income takes on heightened importance. Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, T. Rowe Price’s Fixed Income Division is qualified to actively manage the array of global strategies that compose its investment platform through the uncertain times ahead.

“Modus vivendi” emerges at a critical time, while risk remains

The April 2 “Liberation Day” led to market turmoil after President Donald Trump’s announcement of draconian tariffs, threatening the post-WWII global economic order and sparking fears of potential collapse. U.S. Treasury yields rose, while the dollar fell, signaling foreign investor retreat, as noted by Minneapolis Fed President Neel Kashkari. Global investors, heavily weighted in U.S. equities, faced uncertainty about Treasury market functionality, causing capital markets to crater. Fortunately, the subsequent developments helped markets recover to pre-announcement levels:

Delayed and recalibrated tariffs—President Trump’s pivot toward delaying tariffs and leaving the opening for unilateral trade negotiations was the immediate succor that markets sorely needed in the wake of early April capital market distress.

Treasury market disruption was technical, not fundamental—While questions remain, hindsight indicates that much of the U.S. Treasury market’s early April dysfunction may have been more technical in nature, with extreme equity volatility temporarily paralyzing certain hedge funds that had grown important in the normal functioning of U.S. Treasury markets. To this end, Treasury Secretary Scott Bessent has argued in recent weeks that the current Supplementary Leverage Ratio (SLR) rule that requires banks to hold 25% of their balance sheets in liquid assets has also eroded their ability to act as intermediaries in the U.S. Treasury market. Against this backdrop, it is reasonable to assume that some type of SLR reform will be part of forthcoming federal budget legislation.

The U.S. economy and S&P 500 earnings have been resilient so far—Despite major market volatility and heightened headline risk, U.S. economic forecasts still largely point toward a slowing, but not recessionary, U.S. economy, while the latest S&P 500 earnings trends have been fundamentally sound.

Modus vivendi emerges between the U.S. and China in Geneva—With roots in the 19th century as a temporary or provisional arrangement between two parties that allows them to coexist even if underlying disagreements remain, modus vivendi appeared to be on display with recent high-stakes trade talks between the U.S. and China. Heading into their Switzerland meetings, there were signs for optimism. The early April U.S. call for 145% tariffs on China imports being reduced to a still severe 80% level was floated by President Trump as a foundation for the Geneva talks to begin. Subsequently, markets, for now, appear quite constructive on a temporary outcome where U.S. tariffs on imports from China are reduced from 145% to 30% while China tariffs on U.S. goods are also slashed from 125% to 10%. Ultimately, it now appears that when global trade negotiations end, U.S. tariffs are likely to be in a range of 10% to 20%. And while this sounds like an extraordinarily positive development relative to where markets first landed after Liberation Day, the fact remains that these tariffs still represent not only a major increase, but also a headwind for growth as well as a catalyst for higher inflation.

In the wake of the April volatility, several key highlights emerged from the Fixed Income Division at T. Rowe Price Associates.

Slower global growth and diverging economic outcomes as the U.S. potentially heads for a “technical” recession—In the wake of uncertain U.S. trade policy, real-time survey data now point toward a broad-based slowing of the U.S. economy. A key for the U.S. economy will be labor markets that now appear less resilient than they were at the start of the Fed’s hiking cycle in 2022, even though the domestic unemployment rate remains at 4.2%. Interestingly, it was in 2022 that the U.S. economy posted two consecutive quarters of negative gross domestic product growth (a “technical” recession) but avoided recession due to the overall resilience of U.S. labor markets and strong fiscal policy, among other considerations. Today, due to trade policy uncertainty, a similar setup for a technical recession exists. But in contrast to 2022, the economic “buffers” that saved the U.S. economy then are less supportive now. As a result, much is dependent on the federal budget legislation being drafted in Congress right now that is expected to extend and potentially add to the 2017 tax cuts (Tax Cuts and Jobs Act) delivered by the first Trump administration. Beyond avoiding a U.S. recession, the timing of this new legislation that is expected before the August recess is crucial as it will impact the U.S. economy on a delay and is likely to powerfully factor into U.S. midterm election outcomes in 2026.

Beyond the U.S., trade policy has distorted the economic trends of the world’s other major economies. Consider the export-dependent eurozone economy, where economic activity accelerated in front of anticipated tariffs. This demand “pull forward” now represents a headwind for prospective growth for the rest of the year. Against this backdrop, the European Central Bank is expected to be easing its monetary policy rate by 25-basis-point increments for the rest of the year toward a floor of 1.25%.

With its consumer economy still frozen due to its distressed residential property market, China’s export economy has also been beset by U.S. trade policy from a near-term perspective. Beyond these near-term headwinds for China, the country’s ability to adapt to changing economic and policy conditions, in conjunction with more policy response to come, highlight China as a potential driver for the global economy heading into 2026. Additional optimism for China also derives from a 30% tariff ceiling that now seemingly exists for global trade, while worries about a full-blown and near-term economic decoupling between the U.S. and China have abated.

U.S. trade policy introduces a near-term (and material) domestic inflationary impulse while being a deflationary influence for many other parts of the world—Even with trade talk progress between the U.S. and China, it’s likely the U.S. will place tariffs well above 10% on all imports, which is a material increase from the start of the year. Against this backdrop, U.S. trade policy could drive U.S. core inflation sharply and temporarily upward in the months to come. This temporary inflation shock appears to put the Fed in a tough spot as the central bank’s ability to appropriately calibrate policy to anticipated economic weakness becomes untenable without clarity on U.S. trade policy and its impact on inflation and the labor market. It is with this regard to this near-term “handcuffing” of the Fed that hopes for the U.S. economy now appear to disproportionately rest on fiscal policy. But while inflationary for the U.S., more restrictive U.S. trade policy arguably represents a deflationary influence for emerging markets. Uncertainty about tariffs, for example, can lead to a pullback in global demand, which can negatively impact commodity prices and other export markets on which emerging economies are more reliant.

Sector highlights and Fed watch—Spread sector valuations were at historically tight levels, but credit spreads notably widened after the Liberation Day announcement. However, spread levels have retraced since the initial blowout in early April as volatility subsided and the U.S. and China made progress in unilateral trade negotiations. Through this lens, many of our fixed income investment professionals have a generally neutral view across most global credit sectors in terms of valuations. A generally strong fundamental backdrop, a benign default environment, and continued attractive yield are also helping spur interest in credit.

Meanwhile, even though progress has been made between the U.S. and China from a trade policy perspective, Federal Reserve Governor Adriana Kugler believes that the Trump administration’s tariff policies are still likely to boost inflation and weigh on economic growth. Our global economics team also agrees with Kugler and believes that even with a sharp pickup in tariff-driven inflation, the Fed will still cut its policy rate twice in 25-basis-point increments before year-end. This move would get the fed funds rate closer to where the central bank’s new “neutral” policy rate may be in a less globalized world.

Strategy highlights that tie into global fixed income investing—Divergent economic and inflation outcomes are one byproduct of uncertain trade policies that are setting the tone for global capital markets year to date. As referenced above, U.S. trade policy that is likely to elevate domestic inflation for the rest of this year is just as likely to be deflationary for other parts of the world, including emerging markets, which would benefit respective fixed income markets. Meanwhile, new initiatives such as a material spike in German defense and infrastructure spending along with other developments may help accelerate additional evolution in international credit markets, highlighting the importance of active management in the global fixed income landscape as market dynamics change quickly.

Bottom line—Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, T. Rowe Price fixed income is qualified to actively manage the array of global strategies that compose its investment platform through an investment environment that looks to be volatile in the months ahead.

Confirmation bias and the challenge of a “tariffs first" approach

In November 2021, The World Economic Forum proactively leaned into behavioral finance when it penned its article, “24 cognitive biases that are warping your perception of reality,” as a reminder that human brains are “hard-wired to make all kinds of mental mistakes…” that can impact human judgment. Among the vulnerabilities highlighted was confirmation bias; in other words, the tendency to latch on to news or ideas that myopically confirm existing beliefs even when uninformed. Such a behavioral perspective appears to have been on display in recent months. For example, in the lead-up to President Trump’s inauguration, markets quickly reflected growing optimism surrounding deregulation and tax cuts on an already sound U.S. economy. In the weeks that have passed since, and especially in the wake of President Trump’s “Liberation Day” announcement, markets have grappled with increased uncertainty and the complexities of this “tariffs first” approach that, in our view, escalates execution risk for an ambitious agenda when you consider the following:

- Tariffs weren’t first during Trump 1.0—The first Trump administration (Trump 1.0) didn’t pursue tariff policy until after the tax cuts of 2017. As a result, when capital markets and the U.S. economy needed Federal Reserve (Fed) assistance in late 2018 when the S&P 500 dropped approximately 19%, Fed Chair Jerome Powell was able to provide policy help.

- Tariffs during Trump 1.0 were limited in comparison—Trump 1.0 tariffs were limited and targeted, focusing on specific products and regions, unlike today’s broader proposals.

- Trump 2.0 introduced tariffs first—Tariff policy under the second Trump term (Trump 2.0) has been the economic focus of the first 90 days of the administration, and in its current form it is more encompassing and punitive from a historical perspective. In addition to a baseline tariff of 10% being unilaterally applied across the world, reciprocal tariff enhancements also exist, which may be bilaterally negotiated down on a country-by-country basis. While the Trump 1.0 tariffs were generally absorbed by corporations, American consumers could see more inflationary effects with the announced tariff policy even if some reciprocal tariffs are negotiated down. Interestingly, even with the possibility of worst-case tariffs potentially being reduced, in contrast to the relatively benign impact of tariffs during the Trump 1.0 years, when corporations absorbed much of the related costs, the impact of Trump 2.0 tariffs could be more significant. As proposed, these tariffs would represent one of the largest tax increases in American history. Note: The Trump administration announced a 90-day pause for tariffs on all countries except China on April 9.

“Sequencing” risk for the U.S. economy

To the extent that tariff policy could represent a material cost hike for U.S. consumers, a resilient and consumer-driven U.S. economy now suddenly faces headwinds and rising concerns surrounding recession. Meanwhile, today’s Fed, in contrast to 2018, faces aggressive tariff policy that, while restrictive to growth, also introduces heightened inflationary pressures from a near-term perspective. As a result, the Fed’s typical reaction function to economic weakness may be diminished, potentially increasing the need for domestic stimulative fiscal policy.

The good news is that ambitious budget legislation is being worked on in Congress. Part of this encompassing legislation intends to not only permanently extend the Tax Cuts and Jobs Act of 2017 but also seeks to add an additional USD 1.5 trillion in tax reductions along with other economic inducements. However, this legislation needs to pass quickly (before Congress’s August recess) as such policy will likely have a lagging impact on the economy.

April Fixed Income Policy Week

In the wake of capital market volatility that immediately followed President Trump’s “Liberation Day” announcement and against the backdrop described above, the T. Rowe Price Fixed Income Division held its April Policy Week. Highlights from the week’s meetings include:

From a sum of the parts perspective, concerns exist for the global economy—An important component within Policy Week is to identify strengths and weaknesses among the major economies of the world, with highlights provided below:

- U.S. economy—Is currently viewed as neutral in the near term. While headwinds continue to form, U.S. service and manufacturing Purchasing Managers’ Indexes (PMIs) remain above 50 (anything 50 and above is viewed as being expansive) while the unemployment rate remains constructive at 4.2%. Medium term, the U.S. economy is also viewed as neutral in anticipation of stimulative fiscal policy being delivered in the next few months. While neutral, prospective concerns remain for the U.S. economy as the Fed is unlikely, in our view, to be able to deliver the four 25-basis-point rate cuts the market had quickly priced in before year-end. After all, the brewing trade war has been started by the U.S., meaning that the U.S. will experience elevated inflation risk relative to the rest of the world, which handcuffs the Fed to some extent. Additional concern exists regarding potential fiscal policy being an effective offset to the recent growth weakness that is expected to result from heightened tariffs as well as the diminished contribution of the Biden administration’s fiscal policies.

- Eurozone economy—Heightened tariff risk is expected to have a negative and immediate impact on manufacturing PMIs in the near term. While near-term growth prospects appear weakened, the European Central Bank (ECB) is a deflation beneficiary of diminished global trade prospects. This leaves the ECB, in contrast to the Fed, free to methodically reduce its 2.65% policy rate toward the 1.25% range by year-end. Meanwhile, aggressive fiscal policy recently introduced by Germany to address defense and infrastructure needs may be a future tailwind for the eurozone economy. As a result, while our view is weaker for Europe’s economy in the near term, it is more constructive from a medium-term perspective.

- China economy—Escalating tariff risk with the U.S. now serves as a near-term headwind to what had been promising recent trends in its Manufacturing PMIs, which moderates our view in the near term. The outlook for China is more constructive over the medium term as its fiscal policy, which has been moderately expansionary in recent months, is likely to expand in the event of a worsening trade war with the U.S. And to the extent that it is deemed necessary, China may also seek a controlled devaluation of its currency as a countermeasure to its worsening trade relationship with the U.S.

U.S. Inflation—Interestingly, as referenced above, the U.S. has the worst near-term inflation expectations among the world’s primary economies directly as a result of a brewing trade war of its own making. To this end, the core consumer price index in the U.S. is currently forecast to increase, which is being driven by an anticipated tariff shock. Our fixed income investment professionals acknowledged that this inflation path is uncertain due to questions about how much of the increased costs that corporations will absorb as well as unknowns around potential bilateral trade deals that could alter the future path of tariff policy.

The Fed and 10-year Treasury rate perspective—Uncertainty regarding tariff policy and its inflationary impact is likely to have the Fed cautious from a near-term policy perspective. Nevertheless, with the Fed’s existing policy rate being restrictive, based on internal consensus views on the neutral fed funds rate, our U.S. economist continues to expect two 25-basis-point rate cuts in the second half of 2025 as the economy has showed signs of slowing. Between uncertainty stemming from tariffs as well as prospective fiscal policy, much remains unknown as to where domestic inflation settles by year-end.

And while future policy easing is anticipated, 10-year and longer-maturity U.S. rates are expected to rise from current levels as questions exist on who will buy elevated U.S. Treasury supply that is expected to follow the eventual resolution of the U.S. debt ceiling. Moreover, rising inflation and expansive fiscal policy may put upward pressure on longer-term Treasury yields.

While credit markets remain open and supported at higher spread levels, “cracks” are forming—As Treasury yields have climbed in recent days, so have credit spreads, with some sectors approaching spread levels not seen since 2009. Often, rising spreads can bring opportunities for active managers, supported by fundamental credit analysis, to identify mispriced issuers in credit sectors.

Neutral on the U.S. dollar—In the wake of what has been a materially weaker U.S. dollar in recent weeks, the expectations for accommodative fiscal policy point toward a near-term neutral view on the U.S. dollar. One additional point of caution in the current environment is that the phenomenon of higher U.S. Treasury yields and a weaker U.S. dollar is a potential indicator of foreign capital flight, which has occurred in recent days.

Bottom line—Through disciplined investment processes, anchored by our Policy Week in conjunction with expanding quantitative capabilities and global bottom-up research efforts, T. Rowe Price’s fixed income investment professionals are qualified to actively manage the array of strategies through an investment environment that looks to be volatile in the months ahead.

Addressing “Triffin’s Dilemma” is disruptive, but fundamentals remain sound for now…

Testifying before Congress in 1959 and 1960, Belgian-American economist Robert Triffin argued that there was a long-term crisis brewing for the country serving as host to the world’s reserve currency. In Triffin’s view, while the post-World War II Bretton Woods system that established the U.S. dollar, backed by gold, as the world’s reserve currency was an appropriate arrangement to get the economy back on its feet, it should have only been a temporary global currency framework. Importantly, what Triffin understood is that the world’s reserve currency is held by other nations as foreign exchange (FX) reserves to support international trade. And as the global economy continued growing there would be an insatiable natural demand for the reserve currency. To meet this voracious demand required the host of the reserve currency to run persistence trade deficits to make the arrangement work. Inevitably, the longer the trade imbalance persisted, the more severe the credit quality degradation of the reserve currency host over time would be. This paradox, known as “Triffin’s Dilemma,” exposed the inherent contradictions in a global system where one currency served as both a national and global reserve currency.

The flaws of the global financial system identified within Triffin’s Dilemma over 60 years ago has, among other considerations, driven the current U.S. debt-to-gross domestic product (GDP) profile to higher levels than seen coming out of World War II, which raises questions around sustainability. In terms of why this story matters now is that in analyzing Treasury Secretary Scott Bessent’s remarks at the Economic Club of New York on March 6, it appears that the Trump administration is seeking to address Triffin’s Dilemma as part of its ambitious agenda where Bessent noted, “The United States also provides reserve assets, serves as a consumer of first and last resort, and absorbs excess supply in the face of insufficient demand in other country’s [sic]domestic models. This system is not sustainable.”

Resilience in Fundamentals Despite Market Uncertainty

Radical change often represents uncertainty. Regime change to a system that largely has been in place for the past 80+ years exacerbates such concern. It is within this current environment of heightened uncertainty that the T. Rowe Price Fixed Income Division just finished its March Policy Week where one high-level key takeaway emerged. For right now, while dire headline risk has accelerated as the U.S. economy shows signs of slowing and equity volatility escalates, the underlying key fundamentals remain generally sound across most sectors in the view of our research analysts.

Credit spreads have widened in recent weeks but fundamentally remain generally supported. Many in the Fixed Income Division hold a broadly sanguine view on spread sectors if the economy remains strong enough to support demand for attractive absolute yields. Our sector specialists continue to weigh the risk and return trade-offs for credit sectors in the current environment as spreads remain historically compressed. Still, active security and sector selection should gain importance from here amid rising uncertainties.

Other Policy Week Highlights

One aspect of Policy Week is to identify concerns that our investment professionals have within the existing investment environment. Following increased volatility driven by higher-than-expected inflation data to start the year and significant policy shifts seen from the Trump administration, the largest concern coming out of Policy Week was around future growth. Growth concerns narrowly eclipsed inflation worries last month, but this month the gap between the two widened considerably.

While the U.S. economy has materially slowed, its longer-term growth trajectory remains positive for now. There is also divergence between the service and manufacturing sectors that drive the U.S. economy, with services growth trending below neutral while manufacturing activity has accelerated in recent months and now screens well above neutral. A point raised during Policy Week was that tariff uncertainty factors may be driving some of the recent strength in manufacturing as companies front-load shipments ahead of potential tariffs.

In China, weak economic data driven by continued struggles in the property sector and weakness in consumption activity appear to be stabilizing. This stabilization is now bolstered with fiscal support. Meanwhile, the eurozone saw a significant shift, with the U.S. signaling its intent to wind down its global defense spending, as Germany announced new economic policies that include around EUR 500 billion focused on defense spending. This additional spending could lead to a 20% rise in Germany’s debt-to-GDP ratio over a 10-year horizon. The scale of this policy shift is historic and has not been seen since German reunification late last century.

Domestic Inflation

The March 12 consumer price index (CPI) print surprised to the downside. Some of this deceleration represented a reversal of January’s elevated inflation trend. Overall, core CPI was up only 0.23% month over month and 3.1% year over year. Interestingly, shelter prices seem to be trending lower where nationwide property prices have not only stalled nationally but are retreating in popular housing market states such as Texas and Florida. Outside of shelter, most of the deceleration in services came from transport services and its volatile airfares component. Goods price pressures were broadly unchanged as a slowing in used car prices was offset by an uptick in other categories.

The Fed and 10-Year Rate Perspective

While the recent CPI print was benign and trended lower, the translation from core CPI to core personal consumption expenditures (PCE) counterintuitively points to a slightly firmer core PCE (the Fed’s preferred inflation measure) for February, which is one reason for the Fed to be cautious in cutting policy rates too soon from here. With the Fed’s existing policy rate being restrictive, our economist team still expects two Fed rate cuts in the second half of 2025.

And while future policy easing is anticipated, 10-year and longer-maturity U.S. rates are expected to rise from current levels as questions remain on who will buy the elevated U.S. Treasury supply that is expected to follow the eventual resolution of the U.S. debt ceiling. To this point, it was telling on March 12 when longer-maturity U.S. Treasury yields rose in the face of a benign inflation print. Our economics team expects a potential range of 4.00% to 4.50% or higher for 10-year U.S. Treasury yields in the near term but maintains a bias that yields could be materially above 4.50% beyond the next 12 months.

A Weaker U.S. Dollar

The narrative of the continuation of U.S. exceptionalism and strong domestic growth that this year opened with has reversed. Against the backdrop of slowing growth and increased uncertainty, the U.S. dollar has materially weakened since mid-January and has room to weaken further, in our view.

As an aside, from a theoretical perspective, if the Trump administration understands the holes in the global financial system that exist because of Triffin’s Dilemma, it is interesting to see the administration’s support in the cryptocurrency space. This connection is accompanied by a swift push for regulatory inclusion of cryptocurrency within financial infrastructure, including the banking system. These developments are being watched closely at T. Rowe Price by Blue Macellari and the digital assets strategy team she leads.

Bottom Line

Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, the T. Rowe Price Fixed Income Division is qualified to actively manage the array of strategies that compose its investment platform through an investment environment that looks to be volatile in the months ahead.

Alpha generation doesn’t occur by following consensus

Right now, the global economy is arguably growing just enough to avoid concern. China’s consumption economy continues to flounder, which negatively impacts Europe’s export-based economy. Emerging markets, meanwhile, offer a mixed bag from an economic perspective but are still proving to be resilient overall in the face of global uncertainty, which leaves the health of the world’s largest economy (the United States) as having heightened importance in the current environment. Fortunately, the U.S., driven by artificial intelligence tech-oriented and onshoring investment supported by aggressive fiscal policy, has proven to be “exceptional” when viewed on the global stage. This is good news as “favorable enough” global growth, anchored by the U.S., serves as a foundation for global equities despite the furious news flow and uncertainty that has accompanied President Trump’s second term in office.

While the current global growth story referenced above is good, it comes with an important disclaimer as it relates to the U.S. In recent years, and including last summer, there has been skepticism surrounding the durability of U.S. economic exceptionalism. With this said, the T. Rowe Price Fixed Income Division, based on fundamental research informed by our global fixed income and equity research platforms, has looked through the recent noise that has clouded the conversation around the health of the U.S. economy.

Skepticism and opportunities in global fixed income markets

Importantly, this conviction in U.S. economic resilience has allowed the platform overall to maintain a bias toward credit markets, which have performed well in recent years. This tailwind from solid credit performance, when combined with prudent duration management, can be supportive for fixed income investors. One phenomenon to note here is that the market’s reticence toward the U.S. economy amid significant noise can be viewed as an opportunity for our fixed income investment professionals to go against the “consensus grain.”

And while the T. Rowe Price economics team remains constructive on the U.S. economy coming out of the February Fixed Income Policy Week, the team has modestly lowered its conviction rating on the world’s leading economy for one primary reason, which is that market consensus now seems to overwhelmingly believe in the unrelenting strength of the U.S. economy. This consensus shift is helping drive spreads across risk sectors to historically tight levels. In other words, some parts of U.S. fixed income (and equity) markets are now “priced for perfection,” which leaves room for an active fixed income approach to question such unbridled enthusiasm.

Against this backdrop and an environment of stretched valuations, members of the T. Rowe Price Fixed Income platform are asking questions and prudently repositioning portfolios where warranted. Highlights from the division’s February Policy Week include:

- U.S. inflation: The U.S. January inflation print released on February 12 was elevated with its 0.4% month-over-month and 3.3% year-over-year pace. While this inflation is alarming on its surface and for a market seeking affirmation that rate cuts may be coming, the owners equivalent rent (a primary factor in driving elevated inflation trends in recent years) has stabilized. Meanwhile, there may also be a “seasonal” element to the January data. Stay tuned as the Fed’s March Summary of Economic Projections and new “Dot Plot” will offer an opportunity to see through the concerning January inflation results.

- Fed funds: With an economy growing north of 2%, an unemployment rate of 4.0%, and core personal consumption expenditures inflation in a range of the Fed’s target at 2.81%, the U.S. economy appears to represent a “Goldilocks” scenario for now. To maintain such a Goldilocks moment, monetary policy should be set toward the central bank’s neutral rate. In today’s less globalized world, neutral fed funds may be 3.75% or higher. Against this backdrop, our economics team expects the Fed to be on hold through the first half of 2025, but it still expects two 25 basis-point rate cuts before the end of this year.

- An economic “sequencing” headwind may reinforce the need for two Fed rate cuts this year: While the U.S. economy remains resilient, its rate of growth is decelerating right now. And while the U.S. consumer story remains constructive, questions about the future rates of change in capital expenditures as well as fiscal spending have emerged. Consider fiscal spending in the U.S., for example, where the Trump administration is seeking to diminish the remaining life of Biden-led policies—such as the CHIPS and Science Act, the Inflation Reduction Act, and the Infrastructure Investment and Jobs Act—which will likely be replaced with Trump administration policies. The scale of such a transition may not be seamless, in our view.

- U.S. 10-year yield: For right now, the U.S. 10-year Treasury yield appears rangebound in an approximate range of 4.40% to 4.80%. Future inflation trends will test this range in conjunction with Treasury supply. For now, U.S. deficits largely remain funded with Treasury bill issuance. Once a looming debt ceiling debate gets resolved in Washington, D.C., more coupon supply coming at a time of less foreign sponsorship for the asset class may also test this range.

- Divergent monetary policy: While the Fed is on hold, our economists expect the European Central Bank to be aggressively cutting its policy rate in the months ahead. Meanwhile, the divergence between what is typically a closely connected policy rate in Canada and the U.S. is noteworthy. In addition, many emerging markets policymakers must consider potential currency volatility as they set monetary policy. For this reason, as well as the increasingly less globalized nature of today’s world landscape, many emerging markets policymakers are moving at a different cadence than the Fed.

- Some good geopolitical news: A potential ceasefire between Russia and Ukraine appears to be rapidly forming. Meanwhile, after 15 months of military operations, Israel and Hamas have agreed on a ceasefire deal that was brokered and guaranteed by the United States, Qatar, and Egypt. The six-week truce on its own could provide a much-needed reprieve to the region and would also bolster regional credit stories in the surrounding area. Importantly, this market view and perspective is not intended in any way to discount the human tragedy involved with both of these catastrophic conflagrations.

Bottom line: Through a disciplined investment process, anchored by its Policy Week in conjunction with expanding quantitative capabilities and its ongoing global bottom-up research effort, T. Rowe Price Fixed Income is well positioned to actively manage the array of strategies that compose its investment platform through an investment environment that looks to be volatile in the months ahead.

An Uneasy Equilibrium Drives Global Fixed Income Opportunity in 2025

In the wake of the January Policy Week for the T. Rowe Price Fixed Income Division and conflicting recent signals where a hot U.S. nonfarm payrolls number was quickly followed by a benign U.S. inflation print delivered on January 15, T. Rowe Price Chief U.S. Economist Blerina Uruçi summarized the complex current U.S. economic and rate narrative well with her following take:

“The U.S. economic situation is one of ‘Goldilocks’ where strong labor market data and a resilient U.S. economy consistently growing beyond 2% is not pushing inflation up (for now…). While a constructive and sustainable backdrop, this current U.S. economic state represents an uneasy equilibrium.