December 2023 / GLOBAL MARKET OUTLOOK

Navigating Macroeconomic Fog

The COVID pandemic and the subsequent recovery continue to distort the economic data, forcing economists who rely on traditional recession signals to continually revise their assumptions. As a result, the most anticipated global recession in history has become the most delayed recession in history.

To be sure, there are reasons for caution regarding the global economic outlook. Europe looks likely to endure stagnant growth in early 2024 before recovering in the second half. In Asia, China’s economic outlook remains gloomy, with few signs of improvement in the country’s property market. Commercial real estate sectors remain fragile in several other countries as well.

Meanwhile, the U.S., Japan, and Europe are at different stages in the balance between growth and inflation, meaning the Fed, the European Central Bank, and the Bank of Japan (BoJ) are likely to pursue increasingly asynchronous monetary policies in 2024, adding to the potential for increased market volatility.

Geopolitical uncertainty also could bring further volatility, particularly if conflicts in the Middle East and Ukraine cause a resurgence in energy prices. Recent election victories for far‑right populist candidates in Argentina and the Netherlands raise the question of whether further wins for populist parties could occur elsewhere, especially in the U.S., where the November 2024 election will be the most consequential currently known political event of the year.

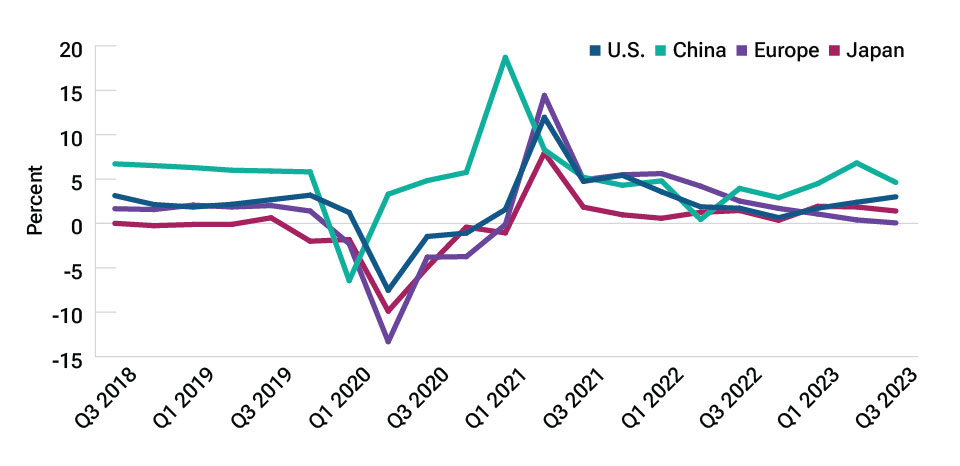

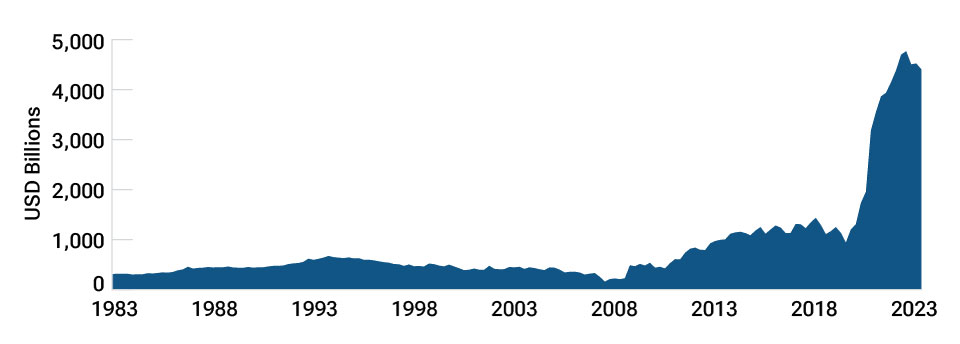

As of late November 2023, most global economies were showing surprising resilience to higher rates (Figure 2), and the U.S. economy was performing better than expected. The unprecedented levels of cash generated by pandemic support and other fiscal stimulus measures have been a key support for U.S. household and corporate balance sheets. Excess consumer savings should continue to provide support for U.S. economic growth going forward (Figure 3).

Consumer spending has been the most resilient driver of growth, due to the strength of the U.S. labor market. At the end of September 2023, there were 9.6 million open jobs available for the 6.4 million unemployed workers in the U.S. labor force.

Major global economies have shown surprising resilience

(Fig. 2) Real GDP growth at 2010 prices.

As of September 30, 2023.

Sources: U.S. Bureau of Economic Analysis, Statistical Office of the European Communities, Cabinet Office of Japan/Haver Analytics. T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

U.S. consumers are still flush with cash

(Fig. 3) Checkable deposits and currency holdings of U.S. households.

As of June 30, 2023.

Source: U.S. Federal Reserve Board.

Dealing with regime change

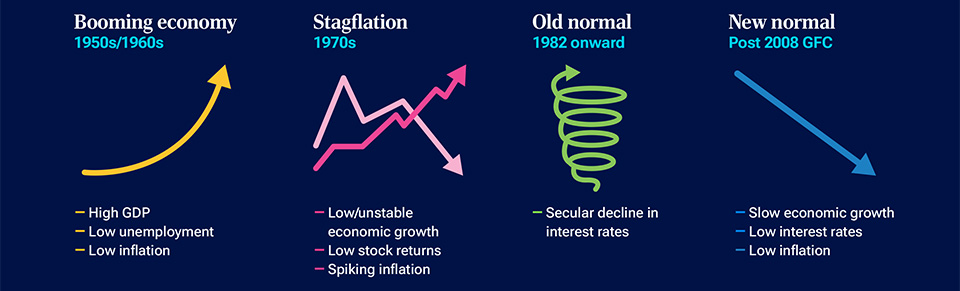

Even if the U.S. economy remains resilient in 2024, we believe investors will need to adapt themselves to a new market regime. To understand the implications of this shift, it is useful to examine the four historical regimes that U.S. markets have experienced since 1955, after the distortions created by World War II and the Korean War had largely dissipated.

While the post‑pandemic regime may not align perfectly with any of these prior periods, it will include some factors that prevailed during those regimes. Given the shift away from the structural forces that supported disinflation and lower rates in the wake of the 2008 global financial crisis (GFC), a return to the post‑GFC “new normal” strikes us as the least likely outcome going forward.

Heading into 2024, inflation risks are skewed to the upside. Energy prices are a concern amid supply‑side pressures. As of third quarter 2023, U.S. wages were still growing at almost a 4% annual rate. If U.S. consumer inflation changes course and reaccelerates while economic growth remains anemic, the risk of stagflation will rise considerably.

Which regime is most likely to prevail in 2024? Recent readings for the fed funds rate and inflation have been closest to the pre‑GFC “old normal.” But the regime second closest to recent conditions isn’t stagflation, it’s the postwar boom.

It remains to be seen how real (after‑inflation) interest rates above 2% will play out in the markets. But we do not believe that high rates will kill the U.S. economy. Rates are high relative to the post‑GFC period, but not relative to capital market history. The federal funds rate exceeded 5% for decades and stock markets still did well. Sticky inflation historically has been good for earnings.

Neutral on risk assets

Historical market regimes and their defining characteristics

For illustrative purposes only.

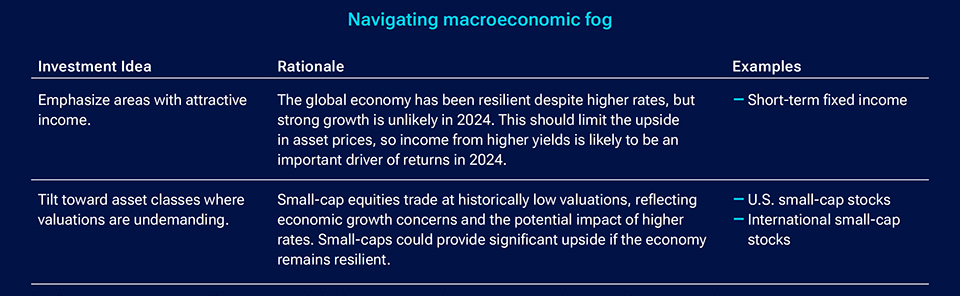

Despite the macroeconomic uncertainties, we see no reason for investors to be excessively bearish. Market segments that don’t trade at nosebleed valuations, such as small‑ and mid‑cap stocks and real assets equities, look appealing on a relative basis. If we see a spike in volatility and a market sell‑off, it could be an opportunity to buy stocks.

However, we also don’t think this is the right time to take large tactical allocation bets. The recent “dis‑inversion” of the U.S. yield curve could augur volatility in both stocks and bonds in the months ahead. We think the best approach heading into 2024 is to remain broadly neutral on risk assets, including equities.

With U.S. interest rates closer to their historical averages, a balanced portfolio could offer diversification benefits as bonds now provide higher income and ballast to stocks. However, interest rates are likely to remain volatile in 2024, so we favor maintaining an overweight to cash or short‑term bonds. These assets currently offer attractive yields with minimal duration exposure and could be potential sources of liquidity if market opportunities arise.

For investors looking beyond the traditional 60/40 stock/bond portfolio, and willing to take on more risk, we also favor alternatives with lower correlations to traditional assets and to areas of the market that could benefit from market dislocations and higher yields, such as private credit.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been independently verified. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

Additional Disclosure

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.