Put the power of curiosity behind your investments

We ask smart questions to uncover investment opportunities.

Curiosity drives confident investing

Stand out with us. Here's what sets us apart.

89 years and $1.78 trillion in assets under management

Discover the benefits of working with a premier global asset manager—focused on client success since 1937.

Fortune World’s Most Admired Companies™ list

Recognized 14 straight years of excellence in innovation, management, social responsibility, financial stability, and global competitiveness.

Our curiosity uncovers opportunities others might miss

Asking better questions pushes us to dig deeper, conduct more rigorous research, and manage risk. Giving you sharper insights and an investment edge.

We delivered better returns, outperforming passive competitors

Curiosity keeps us focused on finding long-term opportunities—and delivering better returns for you over many market cycles.

Read more below

Smart questions drive deeper partnership with you

We work to understand you, your challenges, and your goals, so our advice can help you navigate change and achieve better outcomes.

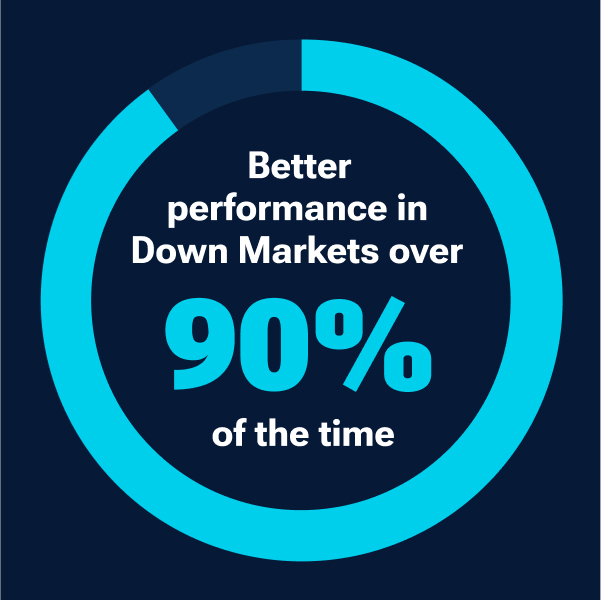

We delivered better returns in up and down markets.

Helping to limit investors’ losses is just as important as delivering growth. That's why we maintain a long-term view that aims to deliver consistently strong performance through market change.

Our U.S. equity funds did better than their benchmarks more than 67% of the time when the market was up and helped reduce losses over 90% of the time when the market was down in trailing five-year monthly rolling periods from December 1995 to December 2024.1

Results Shown After Fees and Expenses

See the impact of our curiosity on your investments

The strength of our active management approach comes from investment professionals with a passion for exploration. Watch how they dig deeper to uncover firsthand insights that lead to better decisions for our clients.

Video

Shopping for potential in Latin America

Equity analyst Paulina Amieva meets directly with managers, suppliers, and even customers, asking better questions to get an information edge and find e-commerce companies poised for growth.

Video

Seeing health innovations firsthand

Portfolio manager Ziad Bakri visits biotech labs in a quest for investing ideas with the most potential–in this case, a firm that engineers a patient’s own cells to fight cancer.

Video

Seeking superior returns and sustainability in waste management.

Equity analyst Vivek Rajeswaran evaluates the infrastructure and operations of efficient and sustainable waste management companies, exploring opportunities throughout the trash life cycle from collection to processing.

How our analysts discover opportunities for you

At T. Rowe Price, over 525 investment professionals go out in the field to get the answers we need.

At T. Rowe Price, investment analysts are curious, independent thinkers with a passion for investing.

With diverse backgrounds—from medicine to geology—they bring unique perspectives to their work and our active management approach.

And today these insights drive their global search for investment opportunities.

They decide which ideas are worth a firsthand look by examining company and security valuations, the competitive environment, industry growth, and much more.

In the field, equity and fixed income analysts often travel together, to study companies, industry sectors, and entire economies from every angle.

They meet with senior executives, front-line employees, and industry leaders. Asking better questions. Getting a deeper understanding of worker productivity, the quality of facilities and products, and the way business gets done.

They measure a company’s effectiveness by talking with suppliers and customers.

And they sit down with legislative, regulatory and other public officials, looking for answers to seek information that could affect the future of a potential investment.

Back at the office, our analysts turn findings from site visits into actionable insights—sharing ideas and debating them, collaborating to identify opportunities that can help give clients an investment edge.

Their insights help us decide what to invest in. But the work doesn’t end there. Analysts keep a long-term view, constantly asking better questions and re-evaluating the case for, or against, an investment.

The analyst’s journey is one of the many ways we help clients reach their most important financial goals. And thrive in an evolving world.

LRN 3290019

Capabilities to meet a full range of investor needs

Asset class figures and retirement percentage shown represent total assets under management of $1.78 trillion as of December 31, 2025. All amounts shown in U.S. dollars and subject to adjustment.

Equity

$879B

Fixed Income

$212B

Multi-Asset

$627B

Alternatives

$58B

Retirement assets are 67% of AUM

Tune in. Fuel for your investment decisions.

Award-winning podcasts. Better questions. Better insights. Hear our best thinking on markets, investing, and retirement.

CONFIDENT CONVERSATIONS® on Retirement

This original podcast equips you with knowledge, tools, and confidence to create the future you imagine. For 40 years, T. Rowe Price has been asking questions to gain a deep understanding of investors’ retirement challenges and goals.

The Angle from T. Rowe Price

The Angle podcast brings you sharp insights on the forces shaping financial markets. With dynamic perspectives from the T. Rowe Price global investing team and special guests, curious investors can gain an information edge on today’s evolving market themes.

Choose your path to confident investing with us

We offer comprehensive support and services tailored to meet the unique needs of all types of investors, ensuring you find the right solutions for you, or your clients', investment journey.

Choose your path to confident investing with us

Personal Investing

I want to explore mutual funds, roll over my 401(k), save for college, get investment advice or open a new account.

Financial Advisors / Intermediaries

I'm a broker-dealer, registered investment advisor, DC–focused advisor, or trust or bank financial professional.

Institutional Investors / Consultants

I'm an institutional investor or consultant looking to review investment strategies and discover timely insights.

Important Information

The performance data shown is past performance and is no guarantee of future results.

1Results based on an analysis of T. Rowe Price’s active, diversified U.S. equity mutual funds (oldest share class). Index, sector, specialized, and institutional clones of our retail funds were excluded. Of T. Rowe Price’s 25 diversified U.S. equity funds, 18 met the criteria for the analysis and are represented within. One of the 18 funds, the Capital Appreciation Fund, also has the ability to invest in fixed income assets but is primarily an equity portfolio and benchmarked to the S&P 500 Index. The funds included in the analysis represented over 75% of total U.S. equity assets in the domestic and global equity mutual funds advised by the firm as of 12/31/24. Results for other time periods will differ.

4220543