retirement planning | july 16, 2025

Consolidating retirement accounts: Should you streamline your savings?

Consolidating retirement accounts can make it easier to stay on track.

1:56

Key Insights

Streamlining your retirement accounts can allow for a more holistic view of your financial picture and the progress you’re making toward your goals.

Many financial firms offer benefits such as lower fees to investors who consolidate accounts.

By increasing transparency into your overall portfolio positioning and gaps, consolidation can provide time and cost savings, potentially improved investment outcomes, and greater peace of mind.

Lindsay Theodore, CFP®

Thought Leadership Senior Manager

Whether you’re still accumulating assets, preparing to transition into retirement, or already retired, you’ve probably wondered whether it would make sense to consolidate and streamline your investments. The primary benefit to consolidation is that having a clear picture of your financial holdings can help you more easily monitor and manage them. After all, investment management can prove time‑consuming and, oftentimes, overwhelming, especially if your accounts are divided among multiple providers.

According to the Bureau of Labor Statistics, younger baby boomers (those born between 1957 and 1964) held an average of 12.7 jobs through age 56.1 Multiple employers may mean several workplace retirement accounts to manage and maintain. Streamlining those accounts by consolidating them could be an important step toward getting your financial house in better order and keeping it that way.

Advice that meets you where you are

Not sure what your goals are yet? That’s okay. Explore advice tailored to your needs — and discover what matters most to you along the way.

T. Rowe Price was named one of the best financial advisory firms of 2025*

The benefits of consolidating accounts

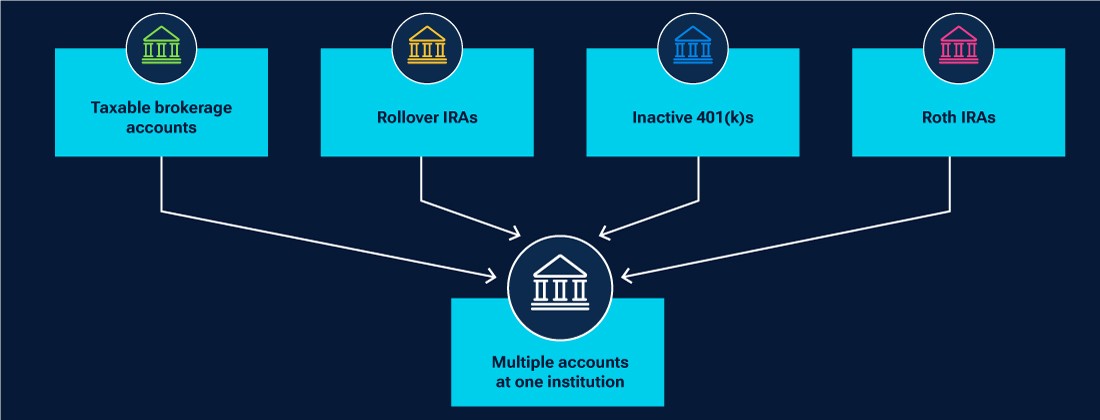

Consolidation typically involves rolling over assets from an old workplace retirement plan—such as a 401(k), 403(b), or thrift savings plan (TSP)—into a Rollover or Traditional individual retirement account (IRA) or combining assets from multiple IRAs or nonretirement accounts into accounts held with one company or investment firm. It is also usually possible to roll assets from an old workplace plan into an active employer plan, but the process and requirements are typically plan‑specific. The benefits of streamlining include:

1. Easier monitoring

Consolidating your accounts will mean fewer statements to reconcile and review at the end of each time period. This, in turn, makes it easier to understand your overall balances, asset allocation, individual performance contributors (and detractors), and potential opportunities for improving your portfolio positioning. Another bonus is that fewer accounts and year‑end tax forms will mean a simpler tax preparation process—a common objective for retirees and preretirees alike.

Manually compiling your balance details (and performance information) from multiple account statements by entering them into a tracking spreadsheet can prove cumbersome. Not only that, it may result in erroneous or incomplete data entries.

There are apps and services that summarize your accounts across different financial institutions. These tools, known as aggregation services, can be helpful but are not always seamless. For example, they may lack analysis features and require frequent re‑input of login information. And when it comes time to execute withdrawals or other transactions, the accounts are still separate, which can make enacting changes difficult. When it comes to retirement planning, simplicity is often a key contributor to getting and staying on track.

2. Comprehensive portfolio management

Since a consolidated portfolio allows for more visibility into your investment positioning at the individual and household level, it can enable you to make more intentional and informed decisions when it comes to your asset allocation and holdings. Consolidation can help you identify and reduce duplication of underlying securities or concentrations in one geographical region, asset class, sub‑asset class, sector, or company. Additionally, there may be potential for more effective tax‑efficient asset location, which can lead to improved after‑tax returns. Once accounts are consolidated, your trusted financial professional will gain greater transparency into your household’s full planning picture and can therefore provide more holistic guidance.

3. Lower fees, greater benefits

Many asset management and advisory firms offer discounted fee structures for households with higher combined asset levels. The higher tiers of assets within these programs often receive additional benefits. For instance, at T. Rowe Price, a higher asset level in qualifying accounts allows investors preferred access to lower‑cost mutual fund share classes and closed funds. (See The T. Rowe Price Summit Program) Other benefits might include a dedicated advisor and servicing team, as well as enhanced planning support and tools.

The T. Rowe Price Summit Program

Consolidating your accounts could put you in a higher benefits tier.

By consolidating your accounts, you place all those assets on one firm’s investment recordkeeping platform, which allows them to be counted toward any available benefits program. One such program is the T. Rowe Price Summit Program.

The Summit Program is a tiered benefits program based on the amount of assets held in qualifying accounts with T. Rowe Price. The program’s benefits include preferred access to I Class shares, the lower‑cost share class for T. Rowe Price mutual funds.

Summit Program members with qualifying balances also gain preferred access to closed funds in their eligible accounts.

The program counts qualifying balances of members of a household who share the same address and last name and/or are co‑owners of a joint account.

4. Simplified accumulation strategy and retirement income plan execution

Streamlining your accounts makes it easier to track your savings progress during the accumulation phase. It also makes planning and executing your withdrawal strategy simpler as you approach and transition through various stages of retirement. Not only will your required minimum distributions (RMDs) involve a more straightforward calculation, but you will probably enjoy a simpler process for satisfying your RMDs in the manner you wish. Whether you plan to live on your RMD income, make qualified charitable distributions, transfer the proceeds to a taxable account, or some combination, coordinating these actions can be easier after consolidation.

Before or after RMD age, you can simply be more strategic about which account types you use to fund your lifestyle (and when) if you’re drawing from a consolidated portfolio versus planning across multiple firms and representatives.

Another important note: Upon withdrawal, many employer plans require prorated withdrawals by source and investment type. For instance, if you hope to withdraw only from Roth sources or your money market in your old workplace plan, your plan rules may not accommodate this level of specificity. A Rollover IRA can.

5. Streamlined estate planning

Your surviving spouse and/or heirs may find it easier and less time‑consuming to execute your estate plan if you consolidate, particularly in terms of retitling and managing accounts after you’ve passed away. There will also be less risk that one of your accounts goes unaccounted for or is forgotten about altogether.

Your advisor can more effectively partner with your estate attorney, accountant, trustees, executors, or other trusted parties to ensure that your wishes are met and your assets are passed along in the manner you envisioned.

Advantages and disadvantages of consolidation

The many advantages of consolidation come along with a few disadvantages and limitations

| Advantage | Disadvantage |

|---|---|

|

|

Our experienced advisors are non-commissioned.

They are paid a salary and annual bonus based primarily on quality of client interactions, leadership skills, and personal development progress—not sales.

If you’re considering consolidating at T. Rowe Price or elsewhere, please call us to discuss the benefits (or drawbacks) of expanding your relationship with T. Rowe Price. We value your business and are here to help.

Reasons consolidation may not make sense for you

There are a few reasons an investor may not want to consolidate their retirement accounts. For instance, not all accounts can be transferred, such as active employer plans, certain types of annuities, and some privately held securities. Other types of accounts, such as Inherited IRAs, cannot be consolidated into one account, though they can be held in separate accounts with one firm. Similarly, assets in Traditional IRAs cannot be commingled with Roth IRAs, but both can be moved to the same firm and, in some cases, the same statement.

Rolling over an old workplace plan account may not make sense if you have access to investments that you deem superior (based on performance, fees, etc.) but are unavailable in an IRA or in your new employer plan. Assets in a 401(k) also generally receive greater legal protections. Both 401(k) s and Rollover IRAs are fully federally protected from bankruptcy, but only 401(k) s are protected from seizure in a lawsuit. Similarly, Traditional and Roth IRAs are not federally exempt in a lawsuit, but they are federally protected from bankruptcy up to USD 1,711,975.2 So, be sure to consider your legal exposure and/or liability insurance coverage before conducting a rollover.

In other cases, investors simply aren’t comfortable with the idea of consolidation for one reason or another. Some of the most common objections clients raise include:

1. “I’m comfortable with how my accounts are currently situated.”

If you’re confident in your current strategy and your ability to manage it across several firms and accounts, that’s great. However, if your inclination to maintain your current approach is driven less by contentment and more by the natural tendency to stick with the status quo, you may want to explore the pros and cons further. While it can be tempting to stay with what is most familiar rather than making a change, there may be some less‑than‑ideal implications to that approach. Ultimately, the cost of potential blind spots and missed opportunities (for tax efficiency, growth, risk mitigation, and more effective overall planning) can outweigh the discomfort associated with making a change.

Keep in mind that you’re typically allowed to transfer any publicly traded stocks, bonds, mutual funds, or exchange‑traded funds (ETFs) in kind and electronically when consolidating.3 An in‑kind transfer means that you won’t need to sell anything. It will simply transfer from institution to institution as is. You will therefore have time to decide what changes to make, if any, after consolidation.

2. “I don’t want to put all my eggs in one basket.”

When investors use this phrase in the context of consolidation, they are often referring to a concern about placing all their investments under the umbrella of a single investment company. This concern may be related to the real underlying risk of investment concentration. However, concentration risk stems from investing a large portion of your portfolio in one company’s stock, one investment, one sector, or one asset class. Holding a diversified blend of investments under one umbrella, with one recordkeeper, one set of statements, and a single view of accounts online, does not necessarily add to your underlying investment risks. Those risks would have been the same prior to the consolidation, but by streamlining, you might be better equipped to identify and avoid holding concentrated, duplicated, riskier, or less attractive positions.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

3. “What if the company I consolidate with goes under?”

In the unlikely event that an investment company falters, there are several protections in place to shield account holders. For instance, in the case of a mutual fund company:

Your money is invested in the securities held in the mutual fund, not the mutual fund company.

The securities that make up a mutual fund’s investments are held in a segregated custodial account, which is typically overseen by a bank or fund company in the form of a trust.

If the company managing the mutual fund were to falter, another company would likely assume custodial authority of the assets in that fund. The fund’s net asset value (NAV) is based on the value of the shares held by the fund, not the solvency or share price of the mutual fund company.

Also, keep in mind that most firms, including T. Rowe Price, allow you to hold many mutual funds, ETFs, and individual securities on one brokerage platform. You are not restricted to the mutual funds overseen by that firm.

Additionally, companies are required to carry Securities Investor Protection Corporation (SIPC) insurance coverage if they have a brokerage business. SIPC coverage protects individual investors against the loss of cash and securities (such as stocks and bonds) if the SIPC‑member brokerage firm fails and assets are missing from customer accounts. (Note that this coverage does not protect against the decline in value of your securities or losses related to bad investment advice.)

4. “What if my consolidation destination account gets hacked?”

The unfortunate reality is that the greater the number of accounts you have (with separate logins, account statements, and security protocols), the greater the chance you could be hacked and, worse, potentially not notice.

At T. Rowe Price, helping to protect our clients’ online security and privacy is a high priority. We use strict security controls to help ensure that your online communications and transactions are safe and reliable. To help protect your information, T. Rowe Price employs a range of security measures, including encryption and extended validation, automatic 10-day hold on withdrawals when crucial account information is changed, dollar limits for withdrawal requests initiated online, and customer-selected security features such as multifactor authentication and customized transaction alerts.

We also offer an Account Protection Program, which provides customers with assurance that their T. Rowe Price account is protected in the event that it is compromised due to fraud. Under this program, T. Rowe Price will restore eligible account losses due to unauthorized activity (as long as basic customer-related security requirements are met).

These types of protections—including firm policies, authentication procedures, and automatic notifications—can be quite effective in protecting your account from fraud. The fewer accounts you have (and the fewer notifications and statements you need to monitor for this activity), the likelier you’ll be to catch fraud. For further information on how T. Rowe Price helps to protect your security and how you can further protect yourself from cybercrimes, see our article: Understanding cybersecurity threats and how to protect yourself from them.

Honestly weigh the benefits against the drawbacks

Under all circumstances, you’ll want to carefully assess your goals and make sure that your accounts are positioned to support them. Of course, consolidation must make sense for your needs and situation and should only be undertaken after thorough consideration of the advantages and potential disadvantages. That said, in most cases, the money you’ve saved is yours and you’re free to move it wherever and whenever you choose. Therefore, even after consolidating, you will always maintain the right to move your hard‑earned savings elsewhere, especially if your expectations are not being met.

Streamlining and consolidating your accounts offers clear benefits in terms of easier monitoring, performance tracking, risk/opportunity identification, and enactment of critical changes along the way. If consolidation ultimately allows you to manage your financial plan (and the investments that support it) more seamlessly, informatively, and successfully, the benefits may well outweigh the potential drawbacks.

*On April 28, 2025, T. Rowe Price was named as one of the best financial advisory firms of 2025. The ranking of the best registered investment advisory firms (RIA Firms) was determined using a methodology that considered recommendations by clients, industry experts, and financial advisors, as well as the development of Assets under Management (AUM). Recommendations were gathered through an independent survey of over 30,000 individuals, with self-recommendations prohibited. AUM development was analyzed using publicly available data, with short-term development assessed over a 12-month period from January 2024 to January 2025, and long-term development over a five-year period from 2020 to 2025. The final score was calculated by weighting recommendations at 20% and AUM development at 80%, with a 30/70 ratio for short-term and long-term AUM growth. The data used for the analysis was collected up to January 2025. The award was presented by USA Today and Statista Inc., a leading statistics portal and industry ranking provider that tabulated the rating. T. Rowe Price is not affiliated with USA Today or Statista. T. Rowe Price provided no compensation either directly or indirectly in connection with obtaining or using this rating.

1Bureau of Labor Statistics News Release, August 22, 2023.

2Federal law protects Traditional and Roth IRAs from bankruptcy up to a total of USD 1,711,975 per person (across all accounts). SEP-IRAs, SIMPLE IRAs, and Rollover IRAs are fully protected in the event of bankruptcy, as are 401(k) accounts. Unlike 401(k)s, IRAs are not federally exempt in a lawsuit.

3Employer‑sponsored plans may require liquidation of investments prior to the rollover. If executed as a direct rollover, the sale of those investments will not trigger a taxable event.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

The views contained herein are those of the author as of May 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates. All investments are subject to market risk, including the possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market.

Consider all available options, which include remaining with your current retirement plan, rolling over into a new employer’s plan or IRA, or cashing out the account value. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses, availability of services, and distribution rules (including differences in applicable taxes and penalties).

Depending on your plan’s investment options, in some cases, the investment management fees associated with your plan’s investment options may be lower than similar investment options offered outside the plan. All investments involve risk, including possible loss of principal.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

View investment professional background on FINRA's BrokerCheck.

202506-4540729

Next Steps

Learn how you can consolidate existing 401(k)s and IRAs into one easy-to-manage account with a 401(k) Rollover or Transfer IRA.

Contact a Financial Consultant at 1-800-401-1819.