retirement planning | august 27, 2025

How laws governing Inherited IRAs may mean changes to your legacy plan

Many non-spouse beneficiaries may be subject to a 10-year rule.

2:26

Key Insights

Rule changes for Inherited IRAs as a result of the SECURE Act of 2019 could have a significant impact on investors with sizable balances in their Traditional IRAs.

Many non-spouse beneficiaries will be subject to a 10-year rule.

It is important to understand the nature of the changes and how they might affect your own plan and situation.

Judith Ward, CFP®

Thought Leadership Director

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 created three categories that apply to beneficiaries of retirement accounts whose original owners die after December 31, 2019—eligible designated beneficiaries (EDBs), non‑eligible designated beneficiaries (NEDBs), and non-designated beneficiaries (NDBs). The act also limited the option to stretch withdrawals from some Inherited individual retirement accounts (IRAs) over the lifetime of the beneficiary. Many non‑spousal designated beneficiaries are now subject to a 10-year rule, meaning they must withdraw the full balance of their Inherited IRA by the end of the 10th year following the death of the original account owner. This change could have a significant impact on the financial plans of investors with sizable balances in their Traditional IRAs.

What is an Inherited IRA?

An Inherited IRA is a legally registered individual retirement account established by the beneficiary when the original IRA owner passes away and leaves the assets to a beneficiary. It has its own unique set of rules and implications. In most cases with an IRA inherited from someone other than a spouse, the tax‑advantaged assets are simply moved from the deceased original owner’s account into the beneficiary’s Inherited IRA. A spouse as a beneficiary has the option to move such assets into a newly established Inherited IRA or to treat the assets as their own and move them directly into their own IRA.

Understanding the rules for Inherited IRAs and how they work

The rules governing distributions from Inherited IRAs can lead to some complex planning. There are different distribution provisions depending on factors such as the beneficiary’s relationship to the original owner and whether the original owner had reached their required beginning date (RBD). The RBD is the date that required minimum distributions (RMDs) must start. It is currently set at April 1 of the year following the year in which the IRA owner reaches age 73. In 2033, the age will change from 73 to 75 for individuals who are born in 1960 or later. Of course, beneficiaries can always withdraw more than the RMD at any time.

The assets in an Inherited IRA carry over the tax treatment of the original account.

If the assets were originally held in a tax‑deferred account such as a Rollover IRA or a Traditional IRA, withdrawals from the Inherited IRA would generally be treated as taxable income to the beneficiary owner at ordinary income tax rates.

Similarly, assets originally held in a tax‑free account such as a Roth IRA will usually maintain their tax‑free withdrawal status when distributed from the Roth Inherited IRA by the new beneficial owner.

Understand who can do what with an Inherited IRA and if they need to start taking RMDs

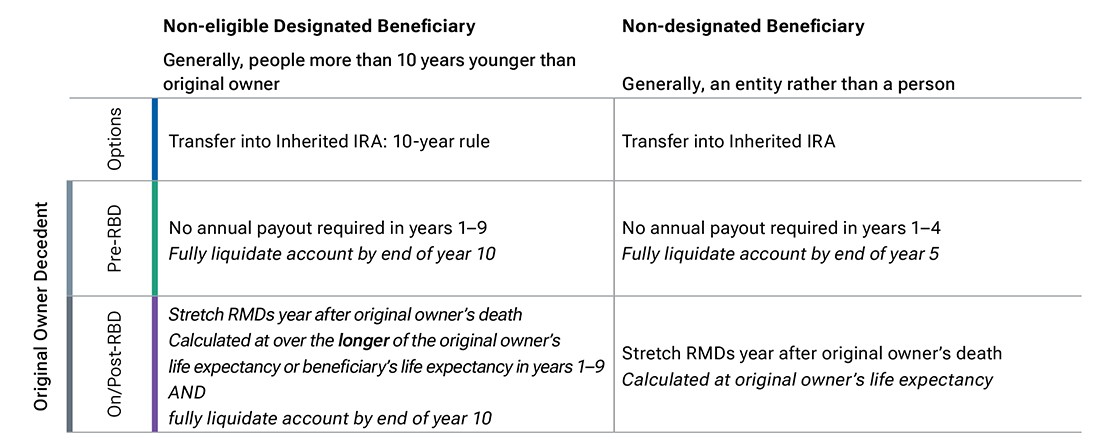

Successfully incorporating an Inherited IRA into your financial plan begins with understanding how the payout options differ among the various beneficiary categories. (See the “Who can do what with Inherited IRA assets?” chart.)

Eligible designated beneficiaries

The individuals in this group have the most flexibility in how they choose to handle the IRA assets they inherit, and they can still choose to stretch RMD payments.

The term “stretch” refers to a financial strategy that allows beneficiaries to extend the tax‑deferred benefits of IRA assets by recalculating their RMDs based on their own life expectancy. The most common beneficiary in this category is a spouse.

Spouses

With the most options of any beneficiary, spouses can do the following:

If the spouse is the sole primary beneficiary, they can move the IRA assets they’ve inherited into their own IRA and treat them as their own.

This strategy resets the clock on any RMDs and means the assets won’t need to be withdrawn until the surviving spouse’s RBD. This is especially beneficial if the surviving spouse is younger than the decedent.

If the deceased spouse had reached their RBD, their final RMD will need to be satisfied upon moving the assets to the surviving spouse’s own IRA.

The surviving spouse can transfer the assets into an Inherited IRA with the option to begin taking withdrawals even if they are younger than age 59½.

There is no 10% early withdrawal penalty on distributions from an Inherited IRA.

RMDs would eventually start at the original owner’s RBD—or immediately, if the original owner had already passed their RBD.

The RMDs would be based on the longer of the surviving spouse’s life expectancy or the age‑based life expectancy of the deceased original owner.

Note that a surviving spouse could elect to be treated as a beneficiary of the Inherited IRA and then roll over the assets into their own IRA later, but they cannot do the opposite.

The stretch IRA option was a popular planning technique for passing on tax‑deferred assets to heirs. Some investors may want to reexamine their legacy planning as a result of the SECURE Act.

The stretch IRA option was a popular planning technique for passing on tax‑deferred assets to heirs. Some investors may want to reexamine their legacy planning as a result of the SECURE Act.

- Judith Ward, CFP®, Thought Leadership Director

Who can do what with Inherited IRA assets?

(Fig. 2) A look at beneficiary options if the original owner’s death occurred in 2020 or later

1Persons older than or less than 10 years younger than decedent (e.g., siblings, friends, parents). Disabled or chronically ill persons as defined by IRS.

2Once the surviving spouse elects to roll over the assets as their own, it cannot be undone.

3The surviving spouse can have access to funds prior to age 59½ without early withdrawal penalty and with the ability to roll over assets to their own IRA at a later time.

4If the surviving spouse chooses the 10-year rule and then subsequently rolls in to their own IRA before the end of the 10-year period, and they reached their own RBD during that period, they may have to take “hypothetical RMD” amounts prior to the rollover as if they had occurred.

Reminder:

—If the original owner died on or after their RBD, their final RMD will need to be satisfied upon moving assets to heirs.

—Inherited Roth IRAs are subject to pre-RBD rules for each beneficiary category.

The charts summarize the RMD rules for beneficiaries of IRAs under the IRS final RMD regulations issued in 2024. The charts are intended as high-level summaries only. These charts do not address every aspect of the RMD rules and are not a substitute for discussion with a tax and/or legal professional.

Other eligible designated beneficiaries

The eligible designated beneficiaries group includes minor children of the deceased, disabled persons, chronically ill persons, and beneficiaries who are older than the original owner or less than 10 years younger than the original owner (such as siblings, parents, or friends), among others.

Like spouses, they are generally not subject to the 10‑year rule, but they must transfer the assets into an Inherited IRA—they cannot move the assets into their own IRA.

Most beneficiaries in this group must begin taking RMDs in the year after the death of the original owner, but they can stretch those RMDs over their own life expectancy.

Beneficiaries who are minor children of the original owner have a slightly different set of options.

Until they reach age 21, they must take RMDs based on their life expectancy.

They then must follow the 10-year rule, continuing RMDs and having to fully distribute the account by the end of the year they turn age 31.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Non-eligible designated beneficiaries

The group known as non-eligible designated beneficiaries represents most non‑spouse beneficiaries who are more than 10 years younger than the original owner and aren’t minor children of the deceased account owner. Most commonly, this group consists of adult children of the original owner.

Individuals in this group must withdraw the full balance of the Inherited IRA by the end of the 10th year following the death of the original owner. (See the “Potential tax impact for Inherited IRA 10-year drawdown” examples.)

Annual withdrawals are only required if the original owner had already reached their RBD. In that case, the RMDs are based on the beneficiary’s single life expectancy, and the account still needs to be liquidated fully by the end of the 10th year following the original owner’s death.

Non‑designated beneficiary

The third category, non‑designated beneficiary, pertains to an entity rather than a person. There may have been no beneficiary named on the account, and, therefore, it is left as part of the decedent’s estate or as an entity such as a charity or non-qualified trust. In these situations, the account must be totally liquidated by the end of the fifth year following the decedent’s death, if the decedent had not reached their RBD. If the decedent had reached their RBD, RMDs would continue based on what would have been the decedent’s life expectancy.

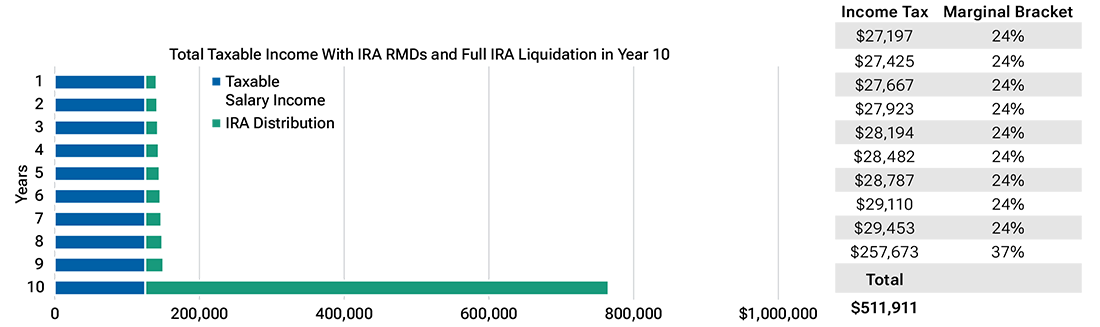

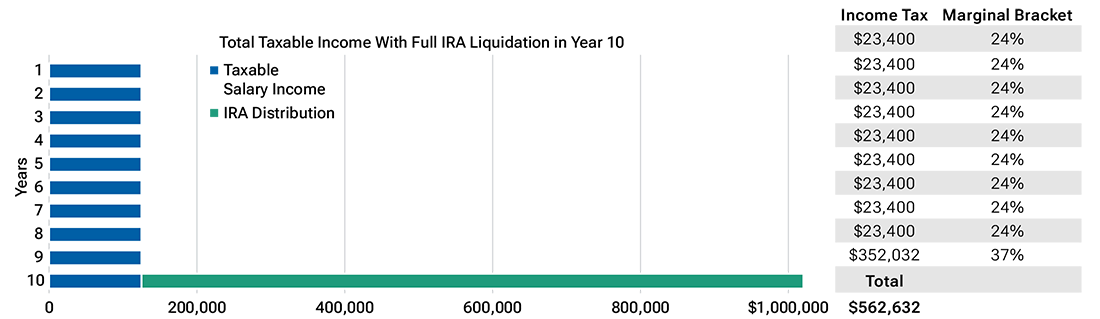

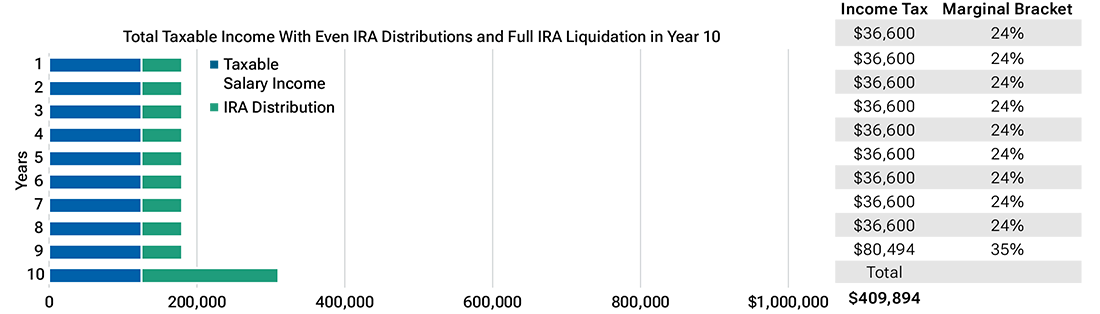

Potential tax impact for Inherited IRA 10-year drawdown

(Fig. 1) Taking larger distributions over 10 years can help even out tax rates and reduce total income taxes owed.

The following charts illustrate the tax impact for three respective Inherited IRA 10-year drawdown approaches. In all scenarios, the beneficiary has inherited $500,000 in pretax IRA assets as a non-eligible designated beneficiary, has $125,000 in taxable income (salary minus deductions), and is therefore in the 24% single filer federal income tax bracket.

Scenario 1 applies to situations in which the original IRA owner had reached RBD prior to death, and, therefore, RMDs (based on the beneficiary’s life expectancy) must begin the year after the owner’s death until full liquidation in year 10. Only RMDs are taken until year 10.1

Scenario 2 assumes no withdrawals until full liquidation in year 10 and applies to situations in which the original IRA owner had not yet reached RBD, and, therefore, no RMDs are required.

Scenario 3 could apply to any non-eligible designated beneficiary. We are assuming $55,000 in IRA distributions each year to spread out taxes (but staying within the beneficiary’s current tax bracket) and then full liquidation of the remaining balance in year 10.

1Assumptions: The beneficiary is still working and has $125,000 in annual taxable income (salary minus deductions) and is therefore in the 24% single filer federal tax bracket. The $500,000 IRA at time of inheritance is 100% pretax. A 6% annual growth rate is assumed for the IRA. IRA distributions are taken at the beginning of each year, except at the end of year 10. Taxes are assumed to be paid at the end of each year and are based on federal rates at 1/1/2023. For illustrative purposes only: No wage increases, inflation adjustments to tax brackets, or any investment income are reflected. For Scenario 1: We are assuming the beneficiary is 55 years old, and their beginning RMD factor is 31.6, -1 for each year thereafter. Annual RMDs range from approximately $15,000 to $25,000 over that time. For Scenario 2: The IRA owner had not reached RBD age before date of death, and no annual distribution is required. Account must be liquidated by the end of year 10.

How to plan for the IRS rule on Inherited IRAs

An inheritance of any amount is welcome, but the IRS rules that eliminate the stretch option for many non-spouse beneficiaries mean that IRAs with large balances can potentially trigger large tax liabilities in the years after they are inherited.

Given that many non‑spouse beneficiaries are adult children in their peak earning years, such a boost in taxable income may have significant tax consequences. Spouses have some flexibility to plan around how they receive their inherited funds, but adult children do not. It is therefore up to the original account owner to understand the implications of the change in laws and to consider adjusting their plans accordingly.

There are a few planning options for the original owner to consider:

Seek tax diversification in your contributions. Directing your retirement savings into a mix of accounts with different tax treatments—such as taxable accounts, Roth accounts, and tax‑deferred accounts—can help reduce the size of your tax‑deferred account balance and limit the tax consequences for your beneficiaries, particularly for any non‑spouse beneficiaries.

Consider executing Roth conversions. While the assets in a Roth Inherited IRA would be subject to the same withdrawal rules as assets inherited from any other type of tax‑deferred account, the eventual withdrawals are generally tax-free. Converting Traditional IRA assets to a Roth IRA would help your beneficiaries avoid a large tax liability from having to liquidate the traditional Inherited IRA within 10 years. The conversion would trigger an immediate tax liability for the original owner, but they could ideally implement a staggered conversion strategy during lower income years.

Take withdrawals from your Traditional IRAs before you reach RMD age. By starting withdrawals earlier than you’re required, you can gradually reduce the balances in your tax‑deferred accounts while spreading out the ordinary income tax implications for your household over a longer time span. If those funds are not needed for income, consider reinvesting them in a taxable investment account. This way, heirs may benefit from a “step up” in cost basis upon the distribution of the estate. (Just be sure, as the original owner, to delay withdrawals until after age 59½ to avoid early withdrawal penalties.)

If you're age 70½ or older and charitably inclined, consider qualified charitable distributions (QCDs). You can distribute up to $108,000 (for tax year 2025) indexed per year from an IRA directly to an eligible charitable organization, and that amount will not be considered taxable income. And at RMD age, that amount will count toward your RMD and will not be subject to tax. Keep in mind, however, that any amount gifted over your RMD in a given tax year cannot be carried forward and counted toward your RMD in subsequent years.

While these funds would not be available for heirs, QCDs may assist you in meeting your charitable goals while reducing Traditional IRA asset balances your beneficiaries might receive.

As with any change in the rules governing retirement accounts, it is important to understand the nature of the rule change and how it might affect your own plan and situation. If your situation seems complex, seeking a professional opinion or estate planning advice may be well worth the time. It would not only be a benefit for your peace of mind, but it would benefit your heirs as well.

These changes underscore the importance of naming beneficiaries to your retirement accounts and understanding how those assets will be distributed.

These changes underscore the importance of naming beneficiaries to your retirement accounts and understanding how those assets will be distributed.

- Judith Ward, CFP®, Thought Leadership Director

Important Information

The views contained herein are those of the authors as of May 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

View investment professional background on FINRA's BrokerCheck.

202505-4504026

Next Steps

Learn more about your IRA options.

Contact a Financial Consultant at 1-800-401-1819.