October 2023 / TARGET DATE INVESTING

Is Your Target Date Portfolio Diversified Enough?

Every component in our portfolio design has a purpose for our clients.

Key Insights

- Because of their greater diversification, we believe our target date solutions are more durable than the relatively simple solutions many competitors offer.

- The primary goal of our design is to mitigate the multiple risks that retirement investors face. Highly diversified building blocks are critical for doing so.

- We believe the return and risk-mitigation potential added by our purposeful design can lead to better outcomes for investors.

Highly diversified portfolios are fundamental to helping target date investors achieve successful retirement outcomes. At T. Rowe Price, this view is not only at the core of our design process and investment approach, but also what we believe investors need to help mitigate the many risks they will face over a lifetime of investing. Achieving adequate portfolio growth is critical, and so is planning for the bumps that can and will happen along the way.

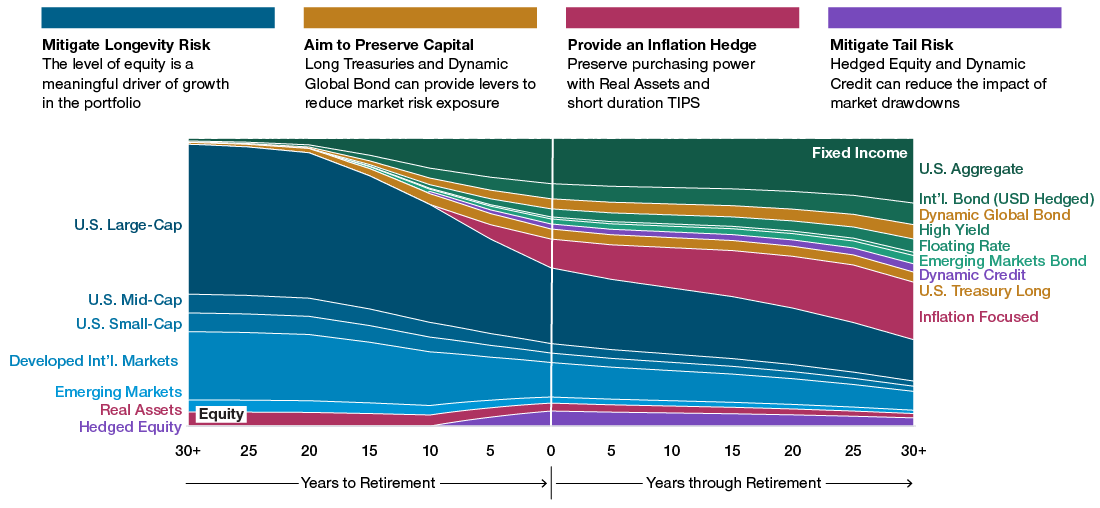

Purposeful Diversification Helps Drive Growth and Mitigate Risks for Our Investors

(Fig. 1) Diversification within T. Rowe Price target date strategies*

Source: T. Rowe Price. For illustrative purposes only.

*Equity level is representative of the glide path for the T. Rowe Price Retirement Funds.

We take care to ensure our underlying building blocks are selected with purpose and that each asset class fills a specific role, either supporting growth or mitigating risk (Figure 1). Our extensive research helps us to assemble them in a way so that all pieces complement each other and work collectively to drive retirement outcomes for our investors over time.

- Within equities, our focus is on seeking to build the best portfolio for long‑term growth. We believe the impact of domestic and international stocks—because of the different economic cycles and drivers of return—can dramatically increase portfolio diversification. Additionally, investing across capitalizations as well as equity styles such as growth and value also enhances diversification. By utilizing a range of equity building blocks in our portfolios, we believe we can help retirement investors mitigate against longevity risk while driving growth to help support spending needs in retirement.

- We think about the fixed income elements as the ballast in our portfolios, which are intended to mitigate against different risks faced along the life cycle. We also consider the fact that segments of the fixed income market can behave very differently from each other. Some have historically had higher correlations to equities, others demonstrated stronger inflation‑fighting properties, and still others potentially can provide relatively uncorrelated returns. We believe that including these different types of fixed income assets, and being strategic about our allocations to them, allows us to more effectively mitigate risk to help investors meet their retirement objectives.

- We also include other diversification levers in our portfolios, such as real assets equities that are intended to mitigate against high, unexpected levels of inflation. We include an equity component that seeks to cushion volatility in significantly falling markets, which we believe can help defend against significant market drawdowns while maintaining exposure to the growth of equity markets over time.

A Rigorous Design Approach

Since we launched our first target date solution more than two decades ago, our target date portfolios have continued to evolve to become more sophisticated and focused on the increasingly unique needs of retirement investors and defined contribution plan sponsors. Those evolutions have been a result of our diligent approach to research and purposeful design principles. Several themes are central to our portfolio construction process:

1. Durable Portfolios: Carefully Choosing the Underlying Exposures

We believe successful retirement outcomes begin with a well‑informed understanding of key objectives, time horizons, expectations, and preferences, and we use this information to prioritize and balance these elements within our portfolio design.

Retirement isn’t a short‑term proposition, and our portfolios reflect that view. When building our portfolios, we maintain a long‑term focus. In doing this, we are mindful that not all aspects of the design may contribute equally in terms of short‑term outcomes. We also understand that the benefits of some aspects may help the portfolio in specific types of market environments by making it more durable.

Durability is important because we believe it leaves a portfolio better positioned for an uncertain future. To help ensure durability, we seek to provide access to a suite of strategies representing a range of perspectives that have the potential to help improve portfolio performance in certain market regimes. By adding exposures to subasset classes that historically have performed well when other assets have not, we aim to help the overall portfolio better weather all types of market environments.

Example: Adding Exposure to Real Assets

Since 2010, our target date portfolios have included a diversified allocation to real assets, such as natural resources, real estate, and metals and mining, that historically had positive sensitivity to inflation—i.e., they tended to yield higher returns when consumer prices or commodity prices accelerated. The impetus for us adding this allocation was not because we expected high inflation in the short term. Rather, we strategically aimed to hedge against the impact a potential rising rate environment could have on client portfolios over time.

We’ve always believed that a small amount of inflation over time could weigh on a retiree’s future spending power and is a risk that should be mitigated over the long haul. We’ve also believed that a hedge against high, unexpected inflation could add value for retirement investors by providing stronger returns in environments characterized by weaker returns for both core stocks and bonds.

We think the acceleration in inflation seen since the second half of 2020, both in the U.S. and globally, has validated our decision to add this level of diversification to our design.

2. Broad but Distinct Components: Thoughtful Selection of Each Building Block

While we seek to leverage the global opportunity set in terms of investible asset classes, we maintain a steady view that every underlying investment must have a defined role in our target date portfolios. This should help improve investment outcomes as each strategy is utilized to reduce risk or enhance return by introducing a diversifying investment exposure, factor, or sensitivity. We thoroughly vet our building blocks and follow a strict due diligence process to determine whether each component is performing its expected role while also complementing others.

By having distinct components under the hood, we can utilize more precise levers in aiming to further enhance returns and mitigate risks in the near term by making tactical adjustments. We harness the insights of our investment platforms through our Asset Allocation Committee, making modest adjustments to our portfolios on a monthly basis that can help drive results.

Example: Enhanced Core Fixed Income

Many other target date providers continue to offer relatively basic designs and forgo some asset classes altogether. For example, they may rely exclusively on U.S. investment‑grade bonds as their core bond allocation. While core bonds play an important role as a lower volatility baseline for a multi‑asset portfolio, they can mean that a very large percentage of the portfolio has direct exposure to the U.S. yield curve and is undiversified from an interest rate exposure standpoint.

Our research suggests that supplementing a core allocation with international bonds, in particular currency‑hedged bonds, allows for additional interest rate diversification that potentially can provide a lower‑volatility allocation in a total portfolio context. Additionally, we include a defensive, unconstrained bond allocation to provide traditional qualities of fixed income with a focus on downside risk management, providing a source of diversification during periods of risk aversion.

We believe including these often‑overlooked asset classes in our target date portfolios allows us to meaningfully diversify a part of the portfolio that many leave undiversified and could positively impact the portfolio in environments when U.S. yields increase materially, as they did in 2022.

3. Robust Construction: Optimizing for an Uncertain Future

Although target date portfolios are designed to provide a simplified investment solution for investors, we believe portfolio constructions should be robust, thoughtful, and utilize a range of analytics to optimize retirement outcomes. Using a narrow set of parameters to drive portfolio design could mean missing important opportunities. That’s why our analysis applies a range of assumptions and techniques rather than relying on a single set of inputs based on the characteristics and preferences of the “average” retirement investor. We also don’t just look at historical returns, volatility, and correlations, or a single set of capital markets assumptions. Rather, we stress test our designs and use scenario analysis to better understand the paths that markets potentially could take.

We aim to challenge our own assumptions and understand the impact each element of our portfolios could have by asking: What could each component add to the total portfolio? What are the potential risks? How are the different components intended to work together? What could cause an allocation to not deliver the expected performance?

Working through this type of analysis helps us to ensure we are purposeful in our selection of asset classes and that our portfolios are not meaningfully altered by a given change in an input, assumption, or objective.

Example: Adding Long Duration Fixed Income

As part of a rigorous evaluation of our fixed income building blocks in 2017, we added an allocation to long duration U.S. Treasuries. While our modeling showed there could be a trade‑off in the short term (i.e., that long duration allocation could detract from performance as rates rose), we believed that when markets were conditioned to show a decline in equities, a long Treasury allocation would help investors mitigate the impact. Accordingly, we have weighted the allocation more heavily in the early years of our glide paths when equity levels are higher, enabling us to focus more precisely on the elevated equity risk that younger investors could face during those years.

Although long duration Treasuries have not always provided effective diversification against equity risk, such as in 2022, when rapidly rising interest rates caused long duration Treasuries to sell off along with stocks, the addition of a long duration Treasury allocation did prove helpful in mitigating the impact of the equity market sell‑offs that happened at the end of 2018 and again in early 2020. Because we have the ability to tactically increase or decrease the allocation to each underlying asset class, we were also able to soften the impact of the rising rate environment of 2022 with an underweight to long Treasuries, and to selectively add back exposure as some of the shorter‑term headwinds of higher rates abated. With rates normalizing from ultra‑low levels, we believe there is increased potential for long duration bonds to again act as a risk mitigation tool should equity markets decline, but with less diversification “cost” for the asset class as rates have moved closer to their long‑term averages.

4. Active Management: Leveraging the Opportunity for Enhanced Returns

We believe our active management approach allows us to construct more diversified, less concentrated target date portfolios. Diversification benefits can be enhanced when active management is incorporated across multiple market segments (i.e., asset classes, regions, sectors, capitalization sizes, and styles). Investment markets exhibit varying degrees of efficiency, and our skilled, thoughtful managers have the ability and the expertise to potentially add value across all segments of the market. Our fundamental research platforms serve as the foundation for our active managers to identify long‑term investment opportunities. And we believe our hands‑on approach to target date portfolio management allows us to be dynamic while planning for the long term.

Example: High Yield

In our view, an active management approach is particularly valuable in certain fixed income sectors, where credit risk is a primary risk that investors face. This is evident in the high yield bond sector, where it has been difficult for passive strategies to outperform their peer averages. Our world‑class fundamental credit research capabilities help our managers avoid troubled credits among the largest issuers, potentially mitigating default risk.

The potential limitations of passive indexing, such as the inability to use fundamental research to avoid troubled credits, explain why a number of passive‑only target date providers are less likely to include high yield and other “non‑core” sectors in their designs. As a result, this may leave their portfolios relatively concentrated in core sectors, such as U.S. Treasuries and investment‑grade corporates, that historically have been more exposed to interest rate risk.

5. Consistent Reevaluation: Practical Assessment and Evolution of Our Design

We believe that success must be clearly defined, routinely measured, and consistently revalidated to ensure alignment given that investor objectives, long‑term assumptions, and asset class characteristics can evolve over time. As such, our portfolio construction is regularly evaluated, tested, and enhanced to confirm ongoing efficacy, as has been our approach over the past two decades.

Example: A Multi‑Strategy Approach to Risk

Our target date design reflects the evolution of our understanding of the many risks that retirement investors face—and how the relative importance of those risks can change throughout as an investor’s retirement journey.

We recognize that the primary focus of a target date solution is to help an investor accumulate sufficient asset balances over time to help fund what could be a lengthy retirement. We also understand that there is greater sensitivity to market volatility as investors approach, and are in, retirement. Our approach accounts for both objectives: growth of a portfolio by being fully invested in the equity market while also helping to reduce drawdowns that can occur during significant market events. We believe this combination can lead to improved retirement outcomes.

Reflecting this approach, we designed and incorporated a hedged equity strategy in our portfolios. This allocation provides exposure to core equities while employing multiple, complementary hedging strategies that seek to cushion volatility in significantly falling markets. Because our hedged equity allocation takes a broad approach, it seeks to account for a wider variety of significant market downturns compared with a single strategy approach.

Conclusions

Diversification is fundamental to helping investors achieve their retirement goals, and our rigorous approach to designing and managing target date portfolios ensures this is at the fore. Our aim is to provide retirement investors with durable portfolios that can grow and withstand the multiple risks that they may face over a lifetime of investing. By purposefully selecting a wide variety of building blocks spanning a range of asset classes, sectors, styles, and management approaches, we believe our target date solutions can help investors achieve both objectives while helping to deliver better retirement outcomes.

It is important to keep in mind what target date investments are intended to do: provide a single, simplified investment solution. But without the right level of diversification, investors may be missing out on opportunities or taking on too much risk over the course of their retirement journey.

When selecting a target date solution, investors should ask: “Is this approach diversified enough to help me achieve my retirement goals?” We regularly do this for our portfolios and believe our clients deserve no less.

Diversification cannot assure a profit or protect against loss in a declining market.

Investment risks:

The principal value of the target date strategies is not guaranteed at any time, including at or after the target date, which is the approximate date when investors plan to retire (assumed to be age 65). These target date strategies invest in a diversified portfolio of other T. Rowe Price stock and bond strategies and, at times, derivatives that represent various asset classes and sectors and are therefore subject to the risks of different areas of the market. The allocations of the target date strategies among these underlying investments will change over time to reflect the changing emphasis from capital appreciation to income and less volatility as investors approach and enter retirement. The target date strategies are not designed for a lump-sum redemption at the target date and do not guarantee a particular level of income.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

Derivatives may be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions; risks include currency risk, leverage risk, liquidity risk, index risk, pricing risk, and counterparty risk.

Diversification cannot assure a profit or protect against loss in a declining market.

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of October 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2023 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.