March 2024 / INVESTMENT INSIGHTS

InspiredTalk: The Tipping Point

Recent months have seen some striking gyrations in fixed income markets. In October 2023, the yield on the ten-year US Treasury bond hit 5%, but by the end of the year it had dipped below 3.8%. Investors had moved from general pessimism on inflation and interest rates to sudden optimism that the peak of rates might be behind us and a smooth decline lies ahead.

But have we all gone too far, too fast in anticipating a central bank easing of policy? What does fiscal policy mean for the growth outlook and government bond supply? Have we reached another ‘tipping point’ at which caution is overtaken by FOMO (the fear of missing out)?

In the latest biannual fixed income webinar, Inspired Talk, hosted by Ritu Vohora, Investment Specialist, Capital Markets, Arif Husain, CIO and Head of Global Fixed Income, Kenneth Orchard, Head of International Fixed Income, Samy Muaddi, Head of Emerging Markets Fixed Income and Tomasz Wieladek, Chief European Economist at T. Rowe Price, met to discuss all these questions.

Too far, too fast on interest rates?

As recently as October, market participants were worried about bond supply—and even further interest rate hikes by central banks. But after the Federal Reserve indicated a ‘pivot’ towards lower rates in December, markets raced to price in a ‘soft landing’ for the economy, building in expectations of lower rates in 2024 and 2025.

Arif Husain, CIO & Head of Global Fixed Income, is in the camp of those who think rate expectations after the Fed pivot had become too aggressive. Treasury bonds have given up some of their end-year gains so far in 2024.

“We’ve seen good progress on inflation but recent data has been hotter than many expected,” said Husain.

“So we’ve seen markets walk back from the number of [anticipated] rate cuts,” he said.

Psychological factors may have driven the strength and speed of the late-2023 bond market rally, said Husain.

“When we discuss it internally and talk to other people in the markets, most people actually don’t expect all of those [anticipated] rate cuts to be delivered,” he said.

“I think there’s still a lot of fear in the market that there’s a recession that’s lurking out there on the horizon, perhaps at the end of this year, perhaps in early 2025. And so investors are putting on hedges, and that’s driving down the forward rates.”

Another reason for caution on the speed of future interest rate cuts comes from the stickiness of inflation, said Tomasz Wieladek, Chief European Economist.

“This year inflation will probably go to 2% in the euro area, but I don’t think it will stay there,” shared Wieladek during the webinar.

And if recent deflation in goods prices were to end, this could lead to a further deterioration in the inflation outlook, said Wieladek and Husain. Here, there are two reasons for concern, they said.

First, an end to domestic deflation in China, perhaps as a result of domestic fiscal stimulus, could drive global goods inflation higher. Second, the supply chain disruption they’re seeing as a result of the Gaza conflict could also exacerbate price pressures.

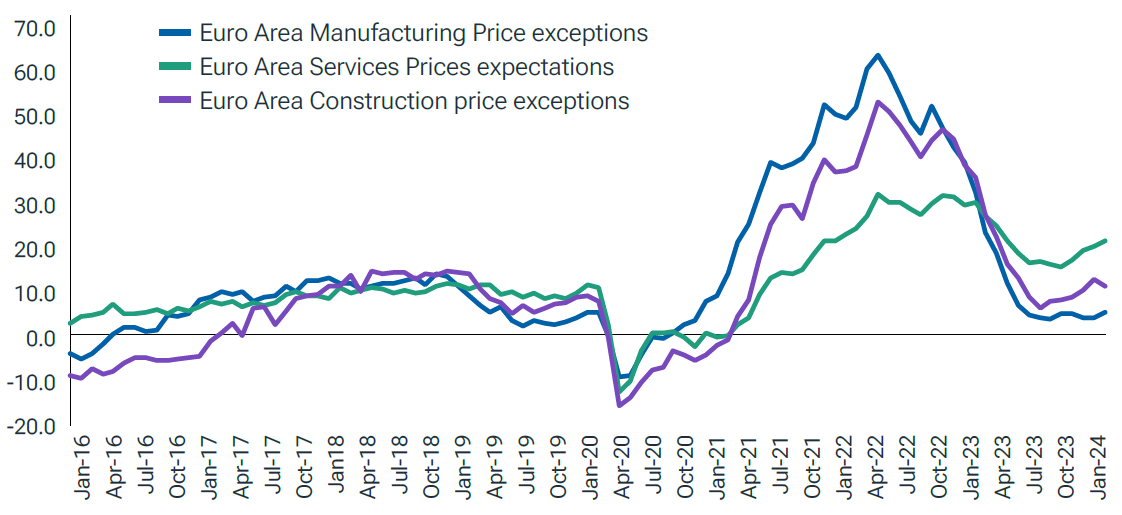

European services inflation expectations are rising

Source: European Commission, as at 8 February 2024

Watch fiscal policy ahead of elections

The bond market’s outlook is driven not just by expectations for interest rates, but by economic growth prospects and their likely impact on the supply of government bonds. In turn, these expectations hinge on fiscal policy, which has been lax in the post-2020 period, said the webinar participants.

“What really drove the animal spirits and kept the COVID party going was fiscal policy”, said Husain.

“I think we’re heading into the afterparty during 2024, which will be fun. We’ve got a lot of elections coming up and, maybe I’m cynical, but I don’t really believe the politicians will be strong enough to be austere ahead of those elections.”

Elections are taking place this year in countries with an aggregate 4 billion population, the webinar participants said. This all adds up to the likely postponement of any fiscal reckoning into 2025, Husain suggested.

“This idea of a soft landing is just a fairy tale. It’s a nice, comforting story to read to your children, but I think a no landing scenario is more likely than a soft landing because of all that [government] spending,” said Husain.

“But, you know, we’ve had the party post- COVID, now going into the afterparty. What comes next is the hangover,” he said.

Supply pressures could therefore have a major effect on bond markets once investors look beyond the 2024 election cycle, Husain suggested.

“If governments keep spending, if politicians keep promising more fiscal support, if deficits keep getting worse, then that [bond] issuance is not going anywhere,” he said.

“We might go through this period of better growth, but the tipping point is when we end up having to pay for it.”

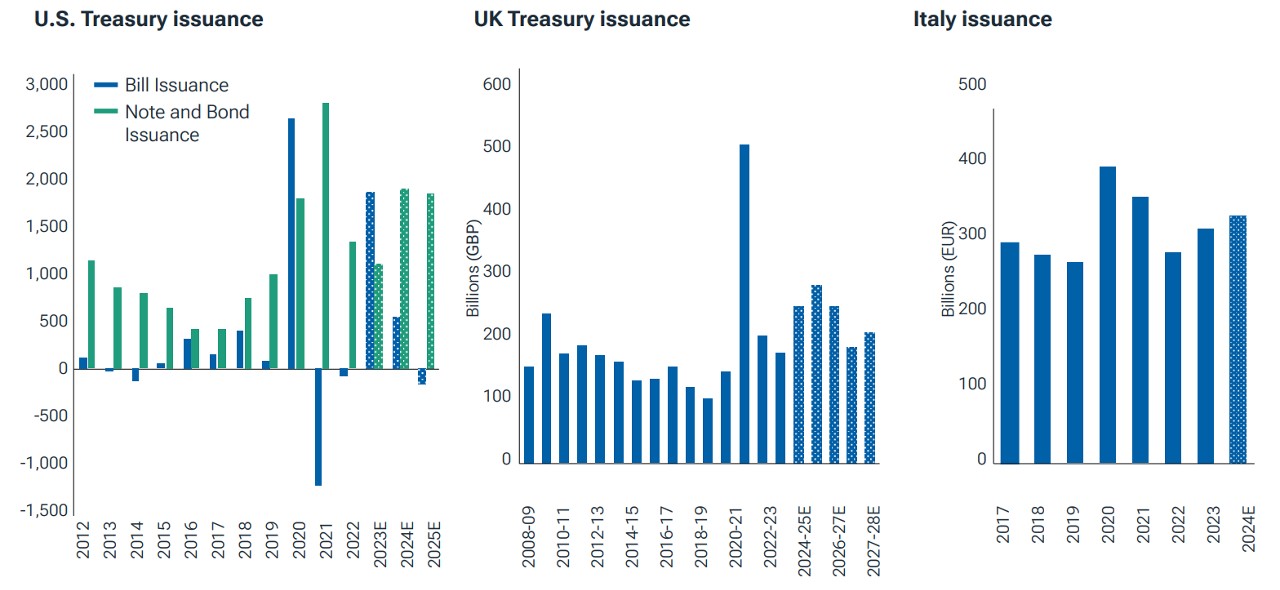

Watch out for government bond supply.

Supply still heavy before global election season

Actual outcomes may differ materially from estimates. Estimates are subject to change.

Figures show gross issuance

Source: Morgan Stanley, OBR, J.P. Morgan, Bloomberg Finance L.P. Analysis done by T. Rowe Price.

Imminent elections may allow some governments to postpone a budgetary reckoning. But in one country, Germany, the bill for past lax spending has already fallen due.

After COVID, the German government used special spending facilities to support the country’s economy. But a recent Constitutional Court ruling has prohibited the further use of such facilities, implying an imminent tightening of fiscal policy, with potentially severe knock-on effects for the economy.

“It’s a huge fiscal adjustment, roughly €150 billion. It’s just massive,” said Wieladek.

“It comes at a time when the German economy is already struggling. It contracted last year. I think it will contract again in 2024 partially as a result of this. Clearly everyone has to deal with debt levels, but dealing with it this way is probably counterproductive.”

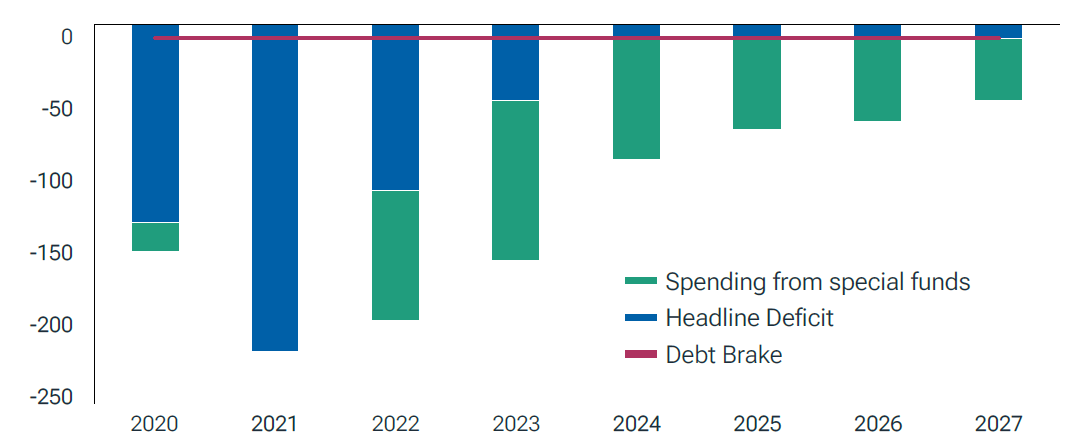

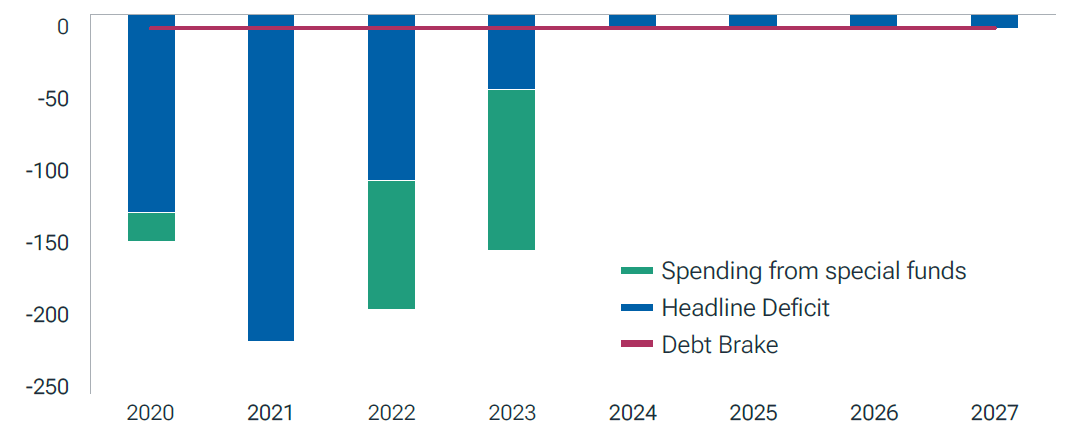

Germany is tightening fiscal policy

The German government used special off balance sheet funds to cushion the economy from shocks

As of 8 February, 2024

A court ruling forbade this strategy, which means that Germany needs to drastically consolidate its fiscal position in 2024 and beyond

As of 8 February, 2024

Source: DeStatis and analysis done by T. Rowe Price. Actual outcomes may differ materially from estimates.

Estimates are subject to change.

Implications for portfolio positioning

All in all, the outlook for monetary and fiscal policy is therefore far from clear. Bond markets may be treacherous to navigate this year as a result.

But investors need to position their fixed income portfolios here and now. What should they do?

“The thing that shocks me is that people are willing to front-run and invest at lower yields than cash,” said Husain, pointing out that yield curves are currently quite inverted, which long bond yields substantially lower than money market rates.

“So for me, the answer has to be, am I getting paid to move out of cash?” Husain said.

There’s a lot of cash sitting on the sidelines today and a lot of investors about where they put it in and whether this is the tipping point to start relocating that, particularly in fixed income. Given that markets may have got ahead of themselves in anticipating rate cuts, Ken Orchard, Head of International Fixed Income and Samy Muaddi, Head of Emerging Markets Fixed Income shared some thoughts for portfolio construction.

“I have a preference for credit over rates or duration,” said Orchard, “and specifically, it’s short-duration income and short duration credit.”

“I think that’s the most attractive prospect for the next several years,” he said.

“And if investors aren’t ready to invest today—we said that there may be a bout of turbulence in the second half of 2024— don’t be scared of that and use it as an opportunity in order to get into the market,” said Orchard.

Meanwhile, emerging markets and sustainable bonds currently offer a number of opportunities, said Muaddi, despite what he described as the most significant cycle of emerging market sovereign credit stress in the last 20 years.

“If you disengage from the sovereign market, you can build a very robust and diversified portfolio,” he said.

“I think the corporate market is what really excites us,” he went on, giving two examples.

“Soap operas in Brazil is a recession-proof industry, and that business has a 9% yield on the debt and net negative leverage.”

“And in China, diaper and baby formula manufacturer is another recession-proof industry. It doesn’t matter what is happening in real estate, those products get sold.”

Emerging market blue bonds—which finance clean water or clean ocean initiatives, in line with the United Nations Sustainable Development Goals 6 and 14 —are another area of focus, said Muaddi.

“We still see a lot of opportunity for both a commercial return and a measurable impact in an area that historically has been quite underfunded,” he said.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Risks

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Emerging markets are less established than developed markets and therefore involve higher risks.

IMPORTANT INFORMATION

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. Investment involves risks. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

March 2024 / INVESTMENT INSIGHTS

April 2024 / INVESTMENT INSIGHTS