July 2021 / MARKETS & ECONOMY

Central Bank Digital Currencies May Bring “Helicopter Money” Closer

More efficient money transfers will likely bring down rates

Key Insights

- Digital currencies will help to broaden the monetary toolkit of central banks.

- Central bank digital currencies (CBDCs) may enable central banks to administer a form of “helicopter money” through direct transfers and push down the lower bound for policy rates.

- Over the long term, CBDCs are likely to lower term premia, keeping rates permanently lower.

Central bank digital currencies are the next big evolution of the current payment system. As well as addressing long‑standing issues with the fiat money system and boosting financial inclusion, CBDCs will also help broaden the monetary policy toolkit of central banks. This may enable central banks to boost economic activity by facilitating direct transfer of funds to consumers and businesses more efficiently and push down the effective lower bound for interest rates—carrying major implications for bond and currency investors.

Bridging the Gap

CBDCs will likely bring central banks closer to consumers and businesses

For illustrative purposes only.

In this second article in a series of articles on CBDCs, we discuss the impact they could have on how monetary policy is implemented in advanced economies.

CBDCs Could Lead to New Policy Tools in Developed Economies

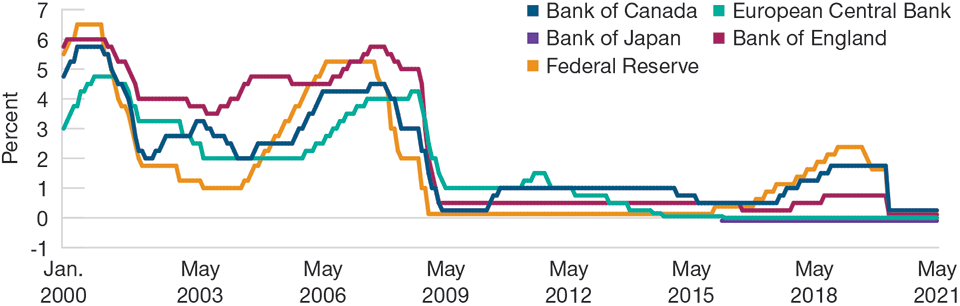

Since the global financial crisis, policy rates in G‑7 economies have hovered close to their effective lower bounds (Figure 1). Central banks have responded to this by deploying alternative monetary policy tools such as quantitative easing (QE) and liquidity polices aimed at stimulating bank lending.

The introduction of digital currencies may enable central banks to use some of these alternative monetary policy tools more effectively. Although the concept of central banks offering some retail banking services is not new (the Bank of England allowed members of the public to hold retail accounts with it from the 1800s until the early 2000s), retail deposit accounts have not previously been used for monetary policy purposes.

If introduced, CBDCs will change this by allowing central banks to stimulate economic activity in times of crisis by transferring funds directly into retail accounts on its balance sheet, akin to “helicopter money” (increasing the money supply by distributing large amounts of money to the public). This can be done by transferring a one‑off high interest rate payment on CBDC holdings. The recent issuance of stimulus checks by the U.S. government to individuals is similar in practice; however, it was only possible due to a unique cross‑party consensus, and its implementation suffered from delays due to operational challenges. The speed and efficiency benefits of digital currencies support an immediate transfer of funds from the central bank to CBDC retail accounts.

Furthermore, the independent status of many central banks means they are better placed to respond quickly to economic shocks and are less influenced by political pressure. Central banks can also dial back stimulus quickly if these new instruments lead to a significant inflation target overshoot. A further benefit of CBDCs is that central banks could also perform targeted transfers to help specific sectors of the economy during a crisis, for example, by transferring funds to CBDC accounts held by high‑contact services firms that have been negatively impacted by the coronavirus.

Printing and redistributing money via a central bank’s balance sheet is likely to be politically controversial, but there are at least three ways in which an independent central bank could transfer funds to account holders without creating new money: First, it could deposit seigniorage (the profit made by a government from issuing currency) straight into retail bank accounts held at the central bank; second, it could use the deposited digital currency to purchase positive‑yielding government debt and pass on part of the positive interest rate to deposit holders; and third, during times when the policy rate is negative, the bank could redistribute fees charged on commercial bank deposits to retail account holders. We estimate the macroeconomic stimulus derived from these measures would be between 0.5% and 1.5% of gross domestic product, sufficient to counter small to medium‑sized recessions.

Developed Market Policy Rates Are Near Their Lower Bounds

(Fig. 1) The coronavirus pandemic has kept rates anchored close to zero

As of May 31, 2021.

Sources: Bank of Canada, European Central Bank, Bank of Japan, Bank of England, and the Federal Reserve Board.

However, these transfers will not stimulate demand if households and firms save rather than spend. Programmable features of digital currencies could allow the central bank to set conditions on CBDCs, such as a negative interest rate or an expiry date on transferred funds, to encourage individuals to bring forward consumption and investment.

CBDCs Should Make Current Policy Tools More Effective

Central banks’ heavy reliance on QE as a policy tool over the past decade has been primarily due to the presence of an effective lower bound for interest rates, which in many countries is zero. Although some countries have lowered the deposit rate below zero, concerns about hitting the reversal rate—below which cuts to the policy rate become contractionary—mean that moves into negative interest rate territory have remained modest so far.

In modern banking systems, banks hold most of the reserves, which are reimbursed at the policy rate. When the banking system is already weak and averse to passing on negative interest rates to customers, further reductions in the policy rate will likely reduce banks’ net interest margin and profitability. If interest rates are cut too far into negative territory, banks may therefore attempt to raise lending rates to ensure that they remain profitable. A rise in loan interest rates in response to an expansionary monetary policy would be highly counterproductive in stimulating aggregate demand.

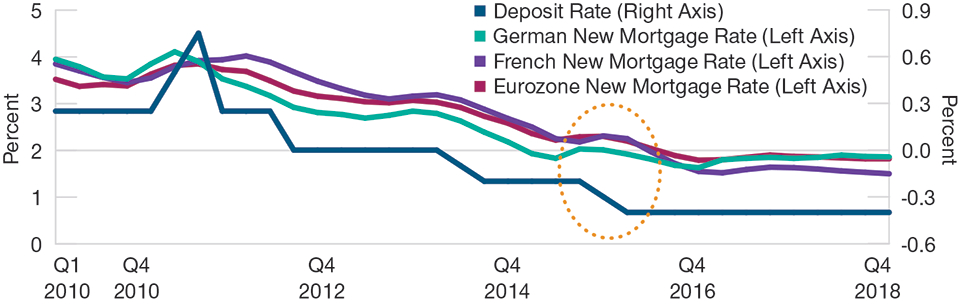

The European Central Bank’s (ECB) experience with negative interest rate policy illustrates these challenges: When it lowered the deposit rate to ‑0.40% in early 2016, lending rates on mortgages in France and Germany initially rose. These rates only fell again after the ECB began to lend to banks at the negative deposit rate through the targeted longer‑term refinancing operations (TLTRO) program, thereby offsetting the pressure on banks’ profit margins (Figure 2). CBDCs could help to lower the banking system reversal rate—and hence the effective lower bound for policy interest rates—by allowing households direct access to the central bank’s balance sheet.

A Negative ECB Policy Rate Led to Higher Lending Rates in 2016

(Fig. 2) Lending rates fell when the ECB passed negative rates onto

banks

Analysis is through December 31, 2018.

Source: ECB.

The pressure from negative/low rates on bank profit margins would be smaller if banks had to hold less reserves. The main reason for the large amount of reserves in the banking system today is that central bank asset purchases need to be financed with an equivalent amount of reserves. If central bank asset purchases were financed by issuing CBDCs directly to retail customers instead, there would be less reserves for central banks to hold and hence less pressure on private banks’ profit margins.

Similarly, banks with stronger balance sheets are more likely to absorb costs from negative interest rate policy. In the medium term, the introduction of CBDCs could also boost the resilience of banks. At present, commercial banks’ large holdings of retail deposits make them too systematically important to fail. Moving a significant fraction of retail deposits to central bank balance sheets will likely reduce the systemically importance of commercial banks.

If commercial banks became less systemically important, they could lose the implicit backing of the state, which in turn would mean they would face a higher cost of debt and greater disciplinary pressure from investors, while financial markets will likely require banks to hold more equity against their assets. This should make individual banks more resilient to shocks to their income stream, such as being hit by negative rates on their reserve holdings at the central bank. This disintermediation process from banks to central banks would have to be slow and carefully managed to avoid unintended financial stability consequences. However, this is the likely direction of travel in our view, even if it takes years.

Incentivizing Firms and Households to Use CBDCs

The arguments previously stated rest on the assumption that households and firms would be willing to hold CBDCs. Private banks will likely be able to offer a higher interest rate than CBDCs, not only out of necessity to attract deposits, but also as a reflection of their ability to make riskier (hence higher return) loans. Firms and individuals will therefore require an incentive to hold CBDCs. Given the safety of holding large amounts of funds at the central bank compared with the limited protection offered by deposit insurance schemes, firms would be strongly incentivized to choose the former option. For households, CBDCs would need to offer benefits that offset the disadvantage of lower interest rates, for example, greater security and lower transaction costs. In particular, many smaller retail businesses may only allow small transactions in CBDCs since the transaction may be uneconomical if the more expensive retail payment network is used.

To summarize, firms and households would likely accept a negative interest rate on CBDCs as long as there are some features that make them more convenient to use than regular bank accounts. The size of this “convenience yield” will ultimately determine by how much CBDCs can help to lower the reversal rate and hence the effective lower bound for policy rates.

The presence of CBDCs on a central bank’s balance sheet will also have important implications for the size of the central bank’s asset holdings. Since CBDCs are a liability to the general public, the central bank needs to have a counterpart on the asset side of its balance sheet. Given that CBDC liabilities will likely be significant in size, the asset side of the central bank’s balance sheet will need to be permanently larger. The natural asset for the central bank to hold against a CBDC is government debt as it is a risk‑free asset in developed economies. Since the central bank will always be, to a degree, active in government bond markets, the probability of more QE can therefore never be fully priced out. In this very indirect way, the introduction of CBDCs could therefore contribute to permanently lower term premia.

Implications for Currency and Bond Investors

Whatever policy avenues central banks pursue through CBDCs (and we have only scratched the surface in this article), it is clear that bond and currency market investors need to understand the changes to the depth and breadth of monetary policy that these new instruments will bring if implemented. With lower reversal rates, central banks will have greater credibility when discussing the prospect of reducing policy rates, which will have negative consequences for currencies. On the other hand, the ease of implementation of “helicopter money” may also mean that yield curves steepen earlier in the recession than in the past. Finally, permanently larger holdings of government bonds as the asset counterpart to CBDC liabilities will likely lower term premia, meaning that long‑term interest rates will likely be lower, all else equal. The implications for emerging market central banks are very different—and we will explore those in a forthcoming article.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

July 2021 / INVESTMENT INSIGHTS

July 2021 / INVESTMENT INSIGHTS