May 2021 / INVESTMENT INSIGHTS

Why Central Bank Digital Currencies Will Revolutionize Banking

CBDCs should boost financial inclusion and improve efficiency.

Key Insights

- Central banks across the world are exploring the introduction of digital currencies to address long‑standing issues with the fiat money system.

- In advanced economies, central bank digital currencies (CBDCs) will likely have a revolutionary impact on the payment system by fostering greater financial resilience, promoting efficiency, and reducing costs.

- In emerging markets, greater financial inclusion through CBDCs may help mitigate business cycle volatility and reduce interest rate risk premia.

Private sector cryptocurrencies—digital assets used as a medium of exchange—have received a lot of public attention in recent years. Now, central banks across the world are exploring the introduction of central bank digital currencies (CBDCs) to address long‑standing issues with the fiat money system and to boost financial inclusion.

CBDCs will likely lead to structural changes in the way that individuals and businesses access the banking system, potentially improving financial resilience and reducing business cycle volatility. These changes will have investment implications, particularly in emerging markets where we believe CBDCs will bring the biggest benefits. The differing pace of CBDC implementation, and the potential benefits for each economy, will also create relative value opportunities.

In this first article in a series, we discuss the technology behind cryptocurrencies and explore the economic consequences of this monetary evolution.

Long‑Standing Problems Solved With New Technology

Fiat money has three main economic purposes: first, to facilitate economic transactions by providing a universal means of exchange; second, to store the value of savings; and third, to provide a unit of account for all goods and services in the economy. The money provided by central banks and facilitated by commercial banks into the wider economy already fulfills these purposes well, as had been the case for most of the 20th century.

There are several flaws with the current system, however. One is that the fast retail payment system in most advanced economies involves temporary counterparty risks. Another is that payment system inefficiencies can lead to retail banks charging excessively high fees for clearing payments. A third flaw in the current system is that individual citizens and businesses can be financially excluded because a retail bank account is necessary to participate in the system. By adopting CBDCs, central banks hope that these long‑standing issues can finally be addressed.

A CBDC is a digital form of money issued by the central bank denominated in the national unit of account and has the same underlying value as existing fiat money. Like fiat money, it is a liability on the central bank’s balance sheet and can be used as a medium of exchange and store of value. However, unlike fiat money, a CBDC can utilize distributed ledger technology (DLT) for intermediation rather than relying on the traditional banking system.

DLT allows transactions to be settled in real time through direct access to the central bank’s balance sheet rather than commercial bank money. An example of DLT is blockchain technology, which has a specific set of rules and is used as the platform for bitcoin. Different rules can be applied to distributed ledgers to suit the needs of the users. In the case of central banking, direct access to the central bank’s balance sheet can support greater financial inclusion and make a significant contribution to greater payment system stability.

We believe that major private sector currencies like bitcoin or Ethereum are not useful for these purposes as their high price volatility makes them less suitable as a means of exchange. However, asset‑backed currencies such as stablecoins, some of which are directly anchored to fiat currencies and are intended to be stable in value, satisfy the medium of exchange and store of value definition of money. If stablecoins become a widely accepted medium for transactions, this will effectively lead to private sector competition for the central bank’s monopoly on the money supply.

For all these reasons, central banks are acting rapidly to introduce the new technology into their payment and financial systems. A survey of 65 central banks conducted by the Bank for International Settlements shows that 86% are engaged in some form of CBDC research, with 60% conducting experiments or proof of concept while 14% are in the development and pilot arrangement stage.1 Wholesale CBDCs would be exclusively available to financial institutions that hold deposits with the central bank, whereas retail CBDCs would be issued for use by the public. In this article, we are focusing on retail CBDCs as they are the main focus for central banks.

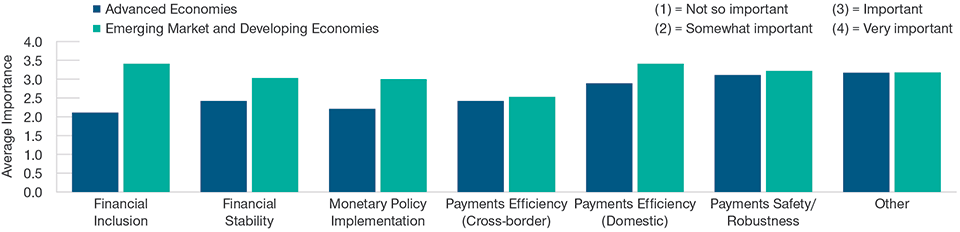

Financial Inclusion Is a Key Reason for CBDCs in Emerging Economies

(Fig. 1) Payment safety is the main reason in OECD countries

As of December 31, 2020.

Source: Bank for International Settlements.

CBDCs Will Likely Revolutionize the Payment System

CBDCs will likely have a revolutionary impact on the payment system by fostering greater financial resilience, promoting efficiency, and reducing costs. Current payment systems often involve transfers of commercial bank money, which are then settled on the central bank balance sheet. Although the payment is cleared instantly, the settlement between banks on the central bank balance sheet is not instant. Credit exposures between banks accumulate due to the delay, which leads to credit and liquidity risk. It is only when the transfers are made in the central banks’ accounts that all claims are finalized.

Transfers in CBDCs eliminate credit risk as they involve transferring the direct claims on the central bank from one bank to another rather than holding funds at an intermediary. The transactions would be settled in real time using central bank money rather than commercial bank money. While this difference appears to be just a detail in normal times, we believe that the payment system would be significantly more resilient in a banking crisis or during a cyberattack, when counterparty risks are significantly higher.

Another important potential impact of CBDCs will be to lower the cost of transfers, which is particularly relevant for individuals and businesses in emerging markets. Current digital payment systems can be expensive for small and medium‑sized businesses as costs often involve a flat transaction fee and, depending on volume, a percentage of the value of the transaction.

Greater financial inclusion in emerging market (EM) economies will likely translate to increased access to credit for individuals and businesses in the short term. Since the demand for borrowing will likely exceed the rise in savings, interest rates may initially rise. In the medium term, however, greater financial inclusion should allow firms and households to build buffers in the form of saving and borrowing in response to shocks, which in turn will likely reduce business cycle volatility. Lower growth volatility would result in lower interest rate volatility— potentially reducing the risk premium embedded in EM sovereign yields.

Greater Financial Inclusion May Reduce EM Risk Premia

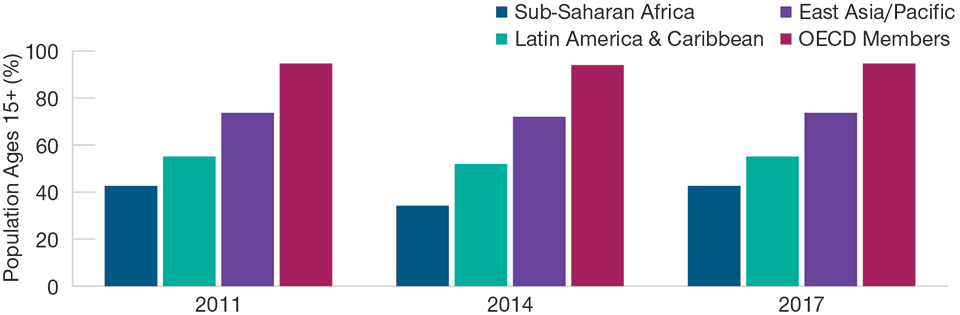

For central banks operating in developing economies, where fewer people have bank accounts than in advanced economies within the Organisation for Economic Cooperation and Development (OECD) “financial inclusion” is cited as the most important motivation for introducing CBDCs (see Figures 1 and 2). Financial inclusion means that individuals and businesses have access to useful and affordable financial productions and services to meet their needs. This includes the ability to make payments, to save, and to access credit and insurance.

A CBDC can help to promote financial inclusion by providing a form of money, issued by the central bank, that can be accessed using a smartphone or a digital card and is accessible to individuals without government documentation or resources that are traditionally essential in accessing financial services, such as a permanent address or a steady form of income. The Central Bank of Bahamas recently introduced a digital currency called the Sand Dollar to provide nondiscriminatory access to financial services and the payment system. Through the Sand Dollar, individuals can open a digital wallet by remotely contacting their preferred financial institution and selecting from the different account options. The record of income and spending can be used as supporting data for micro‑loan applications, potentially providing access to credit to individuals who previously may not have had access.

Bank Account Ownership Is Lower in Emerging Markets

(Fig. 2) In OECD countries, more than 90% have bank accounts

As of June 30, 2018. Most recent data available.

Source: World Bank.

The 2006 Nobel Peace Prize winner Muhammad Yunus pioneered micro‑credit—loans to low‑income people without collateral—through the Grameen Bank, which he established in Bangladesh in 1983. The repayment of Grameen Bank loans is enforced mainly through peer pressure within a local social group, and the outcome of a loan application of one member of the group depends on the repayment history of other group members. CBDCs could help loan applicants to document a steady income and use this information in the loan application process, reducing or eliminating the dependence on peer pressure. CBDCs could therefore help supercharge micro‑credit to financially excluded people without collateral.

CBDCs Are Not Without Risks

Despite these potential benefits, the introduction of CBDCs is not without risks for the banking system. Unlimited direct access by retail clients could lead to large deposit outflows from commercial banks, triggering a banking crisis in the process. In an indirect CBDC model, only intermediaries have access to a central bank’s balance sheet, though this may not be as financially inclusive as the direct option. In reality, central banks have chosen a hybrid approach that allows direct access only below a certain threshold and/or allows commercial banks to serve as the central banks’ interface with retail clients. This is the approach taken in the case of the Sand Dollar, and the limited direct account approach is also the most discussed option for the proposed digital euro. CBDCs can therefore be introduced safely without posing a significant risk to the current financial system.

Improving technology and institutional incentives means that CBDCs will likely be widely adopted in the coming years. In this introductory article, we have only scratched the surface of how central banking is likely about to change. In future articles, we will explore in greater depth how CBDCs can support better financial stability outcomes and the effective implementation of novel monetary policies such as helicopter money or deeply negative interest rates.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

May 2021 / INVESTMENT INSIGHTS