June 2021 / MARKETS & ECONOMY

The Eurozone Faces an Inflation Roller Coaster

Prices will likely slow next year—before picking up again

Key Insights

- Unprecedented fiscal and monetary stimulus in Europe has prompted a debate over whether higher inflation is ahead.

- Low wages and spare labor capacity will likely mean that inflation will fall next year.

- Changes in wage and carbon policies may then push inflation higher again in 2023.

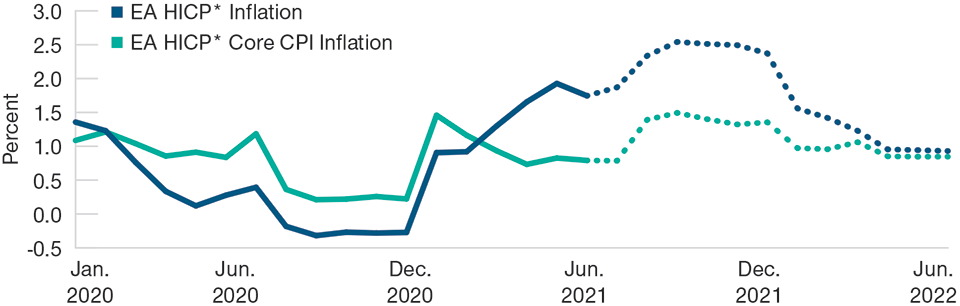

Rising inflation in the eurozone likely has longer to run, but we don’t believe it is permanent. Although the eurozone consumer price index (CPI) was expected to hit 1.6% in April1—its highest level in two years—spare capacity in the labor market should contribute to its decline again in 2022 once the impact of one‑off factors diminishes.

Depending on the outcomes of European elections over the next 12 months, large rises in minimum wages, and the cost of brown energy, eurozone inflation could rise again significantly in 2023. Investors may wish to take this inflation roller coaster into account when planning their medium- to long-term bond strategies.

The Eurozone Faces an Inflation Roller Coaster

Inflation should fall next year before possibly rising in 2023

Two Views of Inflation

European governments have resorted to unprecedented fiscal and monetary policies to support their economies during the coronavirus pandemic. Now, as mass vaccination programs chart the path to a strong recovery, a debate has emerged about whether this large macroeconomic stimulus could result in higher inflation ahead. I believe that the eurozone CPI will remain elevated until at least the end of the year due to changes in year‑on‑year rates, known as base effects. Last year, energy prices fell meaningfully in response to the coronavirus pandemic, and Germany lowered its value‑added tax (VAT) by three percentage points from July to December. These developments resulted in unusually low values being recorded in 2020, leading to higher inflation being recorded in 2021.

Base effects are probably not the only key inflation contributor, however. Global supply shortages of key commodities and semiconductors, which have led to much higher producer prices, are also slowly becoming visible in the European consumer price indices. While this reflects very strong excess demand at present, we expect these higher prices to lead to stronger production in time, therefore, relieving the inflation pressures arising from the current supply shortage. Combined, these effects will likely push eurozone CPI up to around 2.5% in the second half of this year, with German CPI inflation possibly reaching levels close to 4% for a brief time.

The key question facing bond investors is what will happen once base effects drop out of year‑on‑year CPI inflation. Among economists, opinion on this is divided between those who adopt the monetarist view of inflation and those who adopt the Phillips curve view. Monetarists rely on the quantity equation of money: MV=PY (where M is broad money, V is velocity of money, P is prices, and Y is output). If the velocity of money is constant and Y is sticky (either because the economy operates at potential in the long run or is fixed in the short run), then greater M (broad money) must mean more P (inflation).

According to the Phillips curve model, CPI inflation is determined by inflation expectations and spare capacity (in the form of unemployed labor and idle machines). If there is a lot of spare capacity in the labor market or a large number of idle machines, inflation will fall. The inflation expectation component derives from the idea that if people expect higher inflation in the future, they will already adjust prices today. This is why central banks watch inflation expectations indicators like hawks.

Base Effects Are Fueling Inflation

(Fig. 1) Price rises will likely slow when these effects diminish

As of May 24, 2021.

Dotted line represents projected inflation rate.

*Harmonized Index of Consumer Prices.

Sources: Eurostat and analysis by T. Rowe Price.

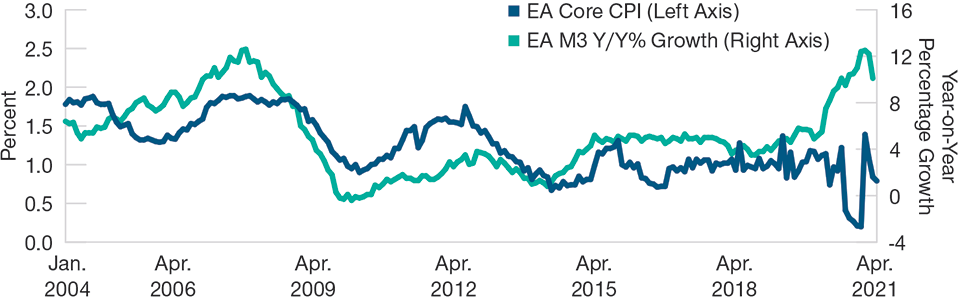

Why I Believe the Monetarist View Is Wrong

After the global financial crisis in 2009/2010, year‑on‑year base money growth exploded, prompting concerns that a large rise in money growth would lead to very strong inflation. However, the relationship between base money and broad money broke down, so the monetarist theory did not really apply as it is based on broad money (M3/M4). This time is different as broad money has risen to double-digit growth rate levels.

The eurozone did experience very high rates of M3/M4 growth in the early 2000s, similar to those of today. This followed the creation of the euro, which allowed banks in peripheral countries to lend to households and firms at much lower interest rates than before, which in turn led to a strong expansion of monetary aggregates in those countries.

Yet despite these conditions, which economic theory suggests are ideal for the monetarist model of inflation to operate, eurozone core CPI inflation only rose temporarily to around 1.5% before falling back again. The most likely explanation for the absence of stronger inflation is the divergence in business cycles across economies at the time: Southern European countries were growing very quickly, while Germany experienced a prolonged period of low domestic demand growth. As a result, the supply of products provided by eurozone core economies was more than sufficient to contain inflationary pressures in peripheral countries. I believe that this experience holds important lessons for today.

As in the early 2000s, M3 growth is very strong again today—this time because of the expansion of the European Central Bank’s (ECB) balance sheet. As this balance sheet expansion represents lending to governments rather than households, its inflationary impact has likely been contained. Furthermore, eurozone economies will likely recover at different speeds, a reflection of both the contact‑intensity of their economies and debt overhang from the recession. As a result, greater supply in the periphery could help to contain inflationary pressures in the core this time around.

The Phillips Curve Looks Set to Prevail

I believe the data show that, once furloughed employees are added to the unemployment rate, the eurozone wage Phillips curve will continue to apply. Overall, wage pressure from spare capacity in the labor market remains low. There would only be some inflationary pressure if the unemployment rate reached the pre‑pandemic level and there were no furloughed workers—and given that furlough schemes in many eurozone countries will remain in place until the end of 2021, this likelihood of all workers returning to work quickly would appear to be low.

Broad Money Supply Has Rocketed

(Fig. 2) ECB balance sheet expansion has fueled M3 growth

As of April 30, 2021.

Sources: Eurostat and the European Central Bank.

However, since many European workers are covered by collective wage agreements, forward‑looking union wage settlements are the key to inflation in Europe. Even in the surging manufacturing sector, 5% to 6% of workers are still on furlough schemes. Indeed, despite the strength of the manufacturing sector, German IG Metall unions agreed on a very low wage settlement for the next two years to save jobs. This means that economy‑wide negotiated wages will likely be low over the next two years as other unions have historically followed the IG Metall settlement. As a result, unit labor costs—CPI inflation due to wages—can be expected to be low in the next two years.

Overall, the evidence suggests that Phillips curve effects will continue to dominate the medium‑term inflation outlook in the eurozone. Given recent low wage settlements (despite a thriving manufacturing sector), it is likely that negotiated wages—a key determinant of domestic wage-driven inflation—will remain low into late 2022. In addition, a large supply of spare labor will likely keep wages low in other sectors too. This suggests that eurozone headline CPI inflation will decline strongly once the VAT and energy base effects drop out in early 2022.

Wage and Carbon Policies Could Fuel an Inflation Spike in 2023

Elections in Germany and France will determine the future of minimum wage and green transition policies, which, if implemented as promised, could lead to much stronger inflation outcomes in 2023. The German Green party, which according to polls will be an important part of any possible ruling coalition, has promised to raise the minimum wage (currently EUR 9.50 per hour) to EUR 12 per hour, which would amount to an 18% increase in the minimum wage by 2023. According to the Federal Statistical Office of Germany, 21% of the German population worked in a job that paid less than EUR 11.05 per hour in 2018 at a time when the minimum wage was around EUR 9 per hour. Given that around a fifth of the German population works in low wage jobs, a significant rise in the minimum wage would likely increase wage pressures more broadly. A similar dynamic might play out in France, as President Emmanuel Macron is due to fight a tight race for a second term as president in April 2022.

The German Green party also wants to raise carbon pricing significantly. Since January, a price of EUR 25 per ton of CO2 emissions has been applied to the heat and transport sectors in Germany. This legislative change alone has contributed to a rise of 0.5%2 in headline CPI inflation through higher energy costs in 2021. The Green party is proposing to raise this charge to EUR 60 per ton, which would likely raise the headline CPI through higher energy costs by another 0.6%. More importantly, if part of government, the German Green party will also try to introduce these changes to carbon charges at the European Union level. Overall, this would also contribute to significantly higher inflation in 2023 relative to 2022.

We believe inflation in Europe is about to go on a roller coaster ride. It will likely continue to rise this year before falling significantly in early 2022, then—depending on political outcomes—may rise again in 2023. The ECB will likely look through the base effect‑driven inflation of the second half of 2022, but it may find it necessary to respond if German wage policies cause much stronger inflation to occur in 2023.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.