February 2024 / INVESTMENT INSIGHTS

Emerging markets poised for a year of interest rate cuts

Inflation continues to fall, paving the way for more interest rate cuts from emerging markets.

Key Insights

- Inflation and monetary policy: Inflation continues to fall in emerging markets (EM), paving the way for more countries to cut interest rates in 2024.

- Growth and fiscal: Persistent headwinds in China’s economy mean that it’s unlikely to be a growth engine for EM.

- Rates, credit, and currencies: The outlook for EM local rates is constructive, while signs of frontier issuers regaining market access should support EM external debt.

What does 2024 hold in store for emerging markets (EM)? Coming off the back of fairly strong performance in 2023, there is potential for some pullback early on as markets are currently priced for the perfect soft‑landing scenario. But this, of course, is not guaranteed, and how this global backdrop evolves over the next few months will have important implications for sentiment toward EM assets.

Inflation and monetary policy

Coast is clear for more rate cuts

Inflation has come down quickly with the supply shocks from the coronavirus pandemic and the war in Ukraine largely settled. Within central and Eastern Europe, core inflation continues to trend lower, while in Asia—where inflation problems were generally not as deep—core prices have drifted back toward their low historic pattern. In Latin America, there are signs of core prices meeting some resistance after a rapid deceleration, but more data are needed to ascertain if a trend is emerging here. Broadly, though, progress on bringing down inflation means that the coast is clear for more interest rate cuts.

EM central banks are leading developed markets in this turn in the interest rate cycle. We have already seen cuts in a handful of Latin American and central and Eastern Europe countries and expect this to continue and broaden to more developing countries in 2024. There appears to be little in the way to stop EM central banks from cutting, especially as the Federal Reserve also looks set to start easing. This potentially lowers the rate floor for EM central banks and should help alleviate concerns of them cutting too far ahead of developed markets and risking currency instability.

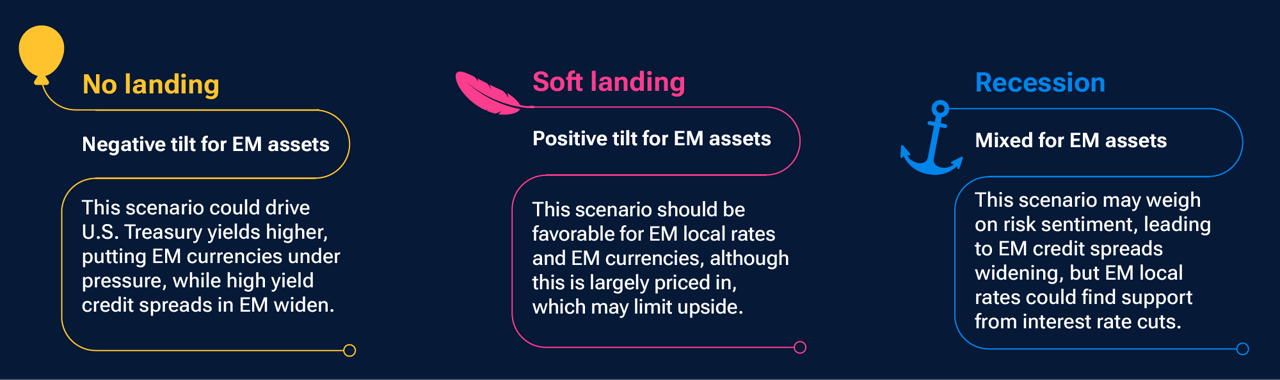

Global backdrop matters for EM

(Fig. 1) How EM could perform in different global economic scenarios

As of January 2024.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

Source: T. Rowe Price.

Growth and fiscal

China unlikely to act as an EM growth engine

There is potential for a modest pickup in EM economic growth this year, led by central and Eastern Europe. But those hoping China could provide a further boost are likely to be disappointed. The world’s second‑largest economy continues to face structural headwinds from weak income growth, a downsizing property sector, and local government fiscal issues. Against this backdrop, it is unlikely that China can be the growth engine that it has been in the past, so EM countries will need to find new drivers, potentially from their own domestic demand, green energy, or other sources.

On the external front, current account balances are in relatively good shape in large EM countries. Deficits are not out of control like in some developed economies and should remain fairly stable this year, although they remain somewhat elevated versus history. Elections could be an important part of the dynamics, because there’s a risk of some fiscal erosion in large EM countries, such as Mexico and India, heading to the polls.

Rates, credit, and currencies

Constructive on local rates

The outlook for EM local rates is constructive as inflation continues to fall, paving the way for rate cuts. The current cutting cycle is still in its middle phase—more developing countries are likely to take action to cut as the year progresses.

In the EM external sphere, the asset class remains bifurcated. At the overall asset class level, spreads look attractive, but this is largely due to issuers that are either in distress or have defaulted. When these are taken out, spread levels are tight. This year, the main source of total returns is likely to be driven by carry. Any returns beyond that are likely to hinge on the potential of frontier issuers to regain market access and/or if there’s a resolution to outstanding debt restructurings. In terms of the former, there are some encouraging signs on this front already as both the Ivory Coast and Kenya have returned to the global capital markets to raise financing in 2024 so far.

For EM currencies, it’s likely to be a story of interest rate differentials in 2024 unless there’s a meaningful growth uplift that can shift focus away from that. For some time now, rate differentials have favored Latin American and central and Eastern European currencies over Asian currencies, but this should start to reverse as cuts come through in the former regions, while Asian countries largely stay on hold.

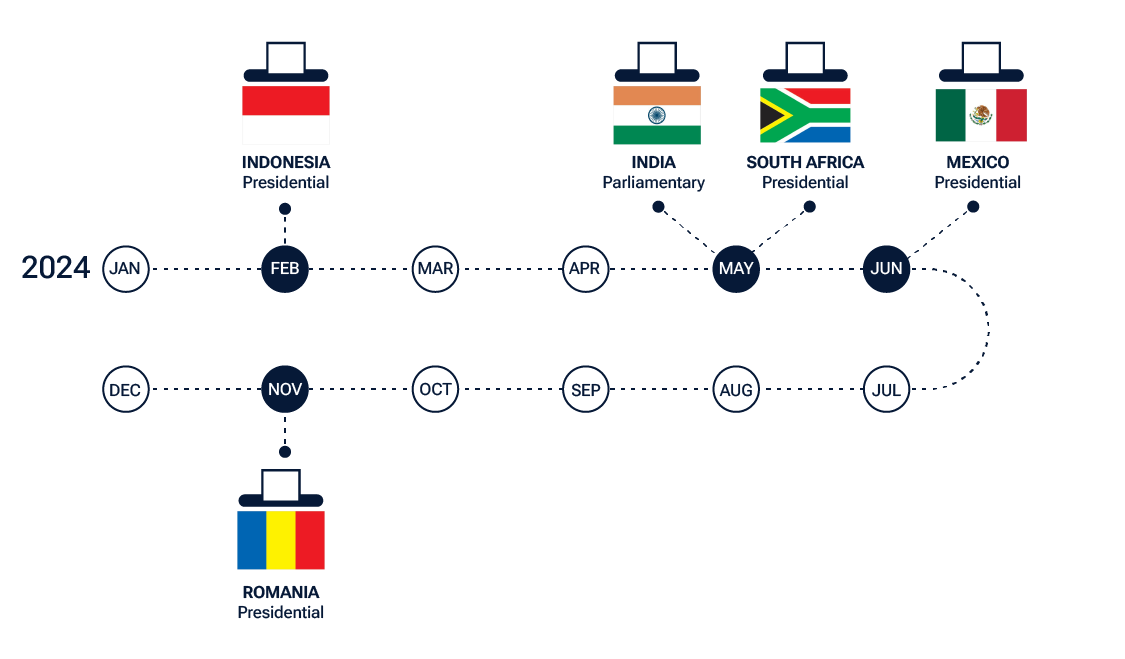

Overview of key EM elections in 2024

(Fig. 2) Elections can test the confidence of markets and provide insights into policy direction

As of January 31, 2024.

The flags and national emblems depicted are not intended to imply any affiliation, authorization, sponsorship or endorsement.

Election dates are provisional and may be subject to change. Analysis by T. Rowe Price.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

February 2024 / GLOBAL EQUITIES