October 2023 / MULTI-ASSET

The Inflation Battle May Not Be Over

An uptick in some prices could mean higher rates for longer

Key Insights

- U.S. inflation has declined from its June 2022 peak, leading some to speculate that the Fed could soon switch to a more accommodative monetary stance.

- We believe that an upward trend in some inflation categories, such as energy, could mean higher interest rates for longer than expected.

The U.S. Consumer Price Index (CPI) has trended steadily lower since peaking at 8.93% in June 2022. Despite higher readings in July and August 2023, core CPI—which excludes the volatile food and energy categories—has continued to decline. This has led to some speculation that the Federal Reserve could soon switch from raising interest rates to cutting them.

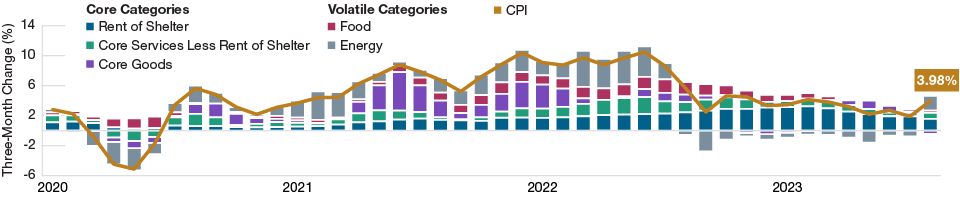

CPI data are reported on a year-over-year basis to help limit seasonal effects and the impact of short-term events that may prove temporary. While these readings have been encouraging, shorter‑term trends that typically offer more information about the current state of inflation are concerning. The three-month CPI moving average from July to August rose from 1.90% to 3.98% (Figure 1).

Short-Term Trends Show That Progress Has Been Moderating

(Fig. 1) Contribution to CPI* by category—three-month moving average

January 2020 through August 2023.

Past results are not a reliable indicator of future results.

Sources: Bureau of Labor Statistics/Haver Analytics. Bloomberg Finance L.P.

*Consumer Price Index (CPI) measures the monthly change in prices paid by consumers and is a widely used measure of inflation.

A moving average is a statistic that captures the average change in a data series

over time.

Oil Prices Could Remain Elevated

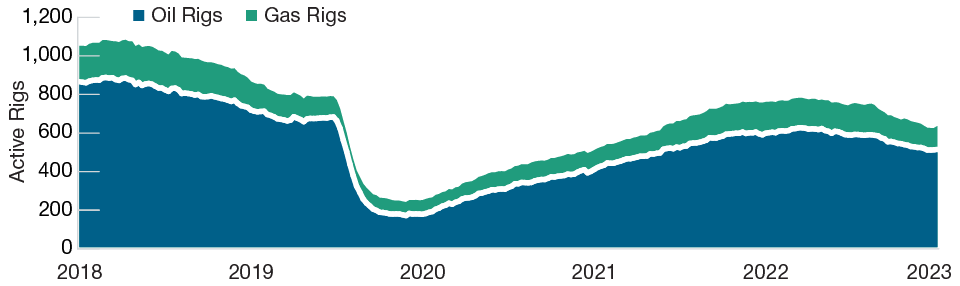

(Fig. 2) Active U.S. Oil and Gas Rigs

September 15, 2018, through September 15, 2023.

Source: Bloomberg Finance L.P.

Notably, inflation from the shelter category, which made up 34% of the U.S. CPI basket as of August 2023, has been declining, and forward-looking indicators imply a continuing downward trend. However, other categories are facing upward pressure in the near to medium term. In particular, the energy category’s 12-month streak of negative contributions turned sharply upward in August after oil prices spiked higher.

Energy sector fundamentals point to elevated oil prices. The global supply response to higher oil prices has been modest. Meanwhile, the number of active U.S. oil and gas rigs—a useful predictor of energy supply trends—has been decreasing. Oil inventories also have been falling rapidly, and there are early indications that productivity gains in the U.S. oil patch may have peaked after increasing for more than a decade (Figure 2).

Going forward, we believe that the tug of war between easing shelter prices and rising costs in other categories, such as energy, could pressure the Fed to keep rates higher for longer than many investors expect. As a result, our Asset Allocation Committee recently added to real assets, which include a large allocation to energy-related equities, and decreased the position in long-term U.S. Treasury bonds, which could face headwinds if interest rates remained elevated for an extended period.

Additional Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

October 2023 / VIDEO