September 2023 / IMPACT INVESTING

Narrowing the Health Care Gap

The Challenge

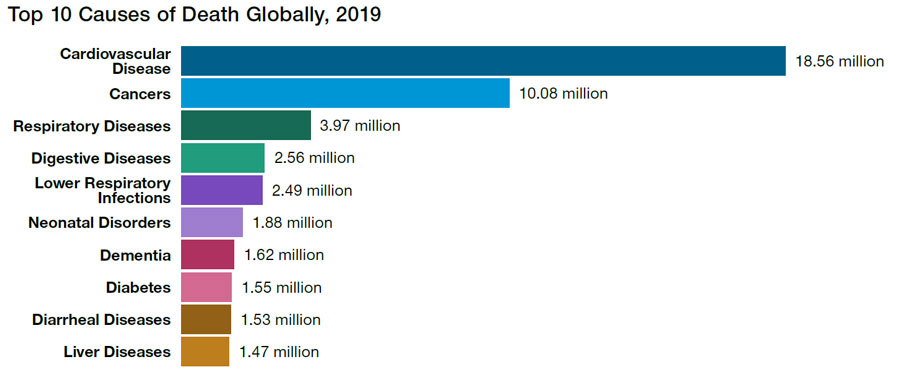

Healthy lives and societal well-being are intrinsically linked to sustainable development. The coronavirus pandemic brought into sharp focus the critical importance of global health care investment, innovation, and access. While tremendous progress has been made since the United Nations (UN) announced its Millennium Development Goals, which focused on child mortality, maternal health, HIV/AIDS, and malaria, many of the other top 10 causes of death globally have increased in frequency over the past 20 years. These include cardiovascular disease, cancers, Alzheimer’s disease, and diabetes.1 Since the pandemic, mortality rates of respiratory-related disease have also increased sharply, reversing a long-term trend of decline.

Noncommunicable diseases continue to create a significant burden globally, but particularly in developing nations where disease can be a significant factor leading to deprivation. The UN estimates that the cumulative economic losses incurred by low- and middle-income countries from cardiovascular disease, cancer, chronic respiratory disease, and diabetes alone are likely to surpass USD 7 trillion by 2025. While Social Security networks typically help to provide health care for many in the developed world, it is often not the case in the emerging world. Meanwhile, aging populations are creating distinct health care burdens that must be met in an affordable way, with innovation in therapeutic treatments and investment in infrastructure.

Addressing the issue—the role of investment

Better health care outcomes require the alignment of many stakeholders, including government, philanthropic bodies, and private research. One of the most remarkable outcomes from the pandemic was the speed at which the global scientific community responded, applying a magnitude of research and development (R&D) that yielded the fastest vaccine delivery in history.

At the heart of the timeline—between the Chinese government sharing the genetic sequence of COVID-19 (January 2020) and the outcome of mass trials of COVID vaccines (December 2020) by Moderna and Pfizer/BioNTech—was a new level of alignment in terms of government and private sector interests. This helped significantly compress the timeline of drug development to release from the average 10 years estimate.2 While the pandemic was exceptional, much can be learned from this collective effort and potentially applied to address the global health care needs of an expanding and aging society.

Treatment and therapy

There is significant debate about whether the pandemic either catalyzed or crowded out research into new therapies. But there is no doubt the pandemic had an incredibly disruptive impact on normal health care routines, including screening, identification, and prompt treatment of disease.

With many of the largest causes of death still rising, the need to invest and further the efficacy of treatment has increased sharply. Here, we see real cause for optimism in many areas. For example, considerable progress is being made in antibody drug conjugate treatment for cancer by companies such as Daiichi Sankyo and AstraZeneca, enabling more targeted chemotherapy delivery for patients.

Breakthroughs in drug development for diabetes and Alzheimer’s by Eli Lilly are also highly encouraging, with potential to treat vast numbers of sufferers globally. Finally, with a backlog of medical procedures for health care systems to contend with, technology is playing a significant role in helping to treat patients with scale and efficiency. Here, the potential of robotic surgery is being explored and developed by companies like Intuitive Surgical.

Narrowing the insurance gap

According to the World Health Organization (WHO), universal health coverage is defined as the ambition for “all people to have access to health services they need, without financial hardship.” However, approximately 100 million people are pushed into extreme poverty each year because of out-of-pocket health expenses, which partly underlies the WHO’s goal of “1 billion more people benefitting from universal health coverage.”

Arguably, the largest unmet need is in the developing world where the absence of public health care systems and lack of insurance protection has been exacerbated by rapid population growth. The private sector, however, is playing a critical role in tackling coverage issues. AIA Group in Asia (case study to follow) is one of the largest entities helping to provide both health and life insurance to individuals across Southeast Asia.

The benefits of better health care coverage are universal, however. According to a study published by Lancet Public Health in 2022,3 states in the U.S. with Medicaid expansion have 11.8 fewer deaths per 100,000 adults per year than those without. UnitedHealth is one such company that is helping to address the gap in coverage. The company is one of the largest health care insurers in the U.S. and an operator for Medicaid services. By expanding its value- based case and in-home clinical care, UnitedHealth is broadening out health care access at a lower cost to many more Americans.

Enabling innovation and impact

Mobilizing global health research and development is a significant goal for WHO. R&D in health care is essential to achieve many of the targets set by the UN Sustainable Development Goals, notably those within Goal 3, “Good Health and Well-Being.” It is estimated that the annual investment gap to achieve the objectives within Goal 3 is approximately USD 140 billion.4 This will require publicly listed companies to plug the funding gap and provide the products and services that can accelerate progress.

Despite many technological breakthroughs over the past 20 years, there remains real complexity in safe drug development, necessitating investment by a network of companies that research and produce small molecules, biologics, and gene therapies. The enablers of these technologies, such as Thermo Fisher Scientific, Agilent, Lonza, Sartorius, Evotec, and Danaher, are leading the charge in mobilizing global health R&D and enabling the health care industry to innovate better and become more cost efficient.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

September 2023 / MARKETS & ECONOMY