August 2023 / MULTI-ASSET

Inflation Globalization

Understanding the drivers of domestic and global inflation.

Key Insights

- Pandemic-induced high inflation exacerbated the 30-year-long phenomenon of increasing synchronization, challenging consumers and investors alike.

- Economy-specific idiosyncrasies will both herald the end of high inflation synchronization and result in novel tactical investment opportunities.

- Inflation trends tend to be shared globally over the long term, and global inflation‑sensitive strategies can be used regardless of investor location.

Understanding the drivers of domestic and global inflation is paramount for an investor to be successful in the current environment. Over the past several decades, inflation correlations across the globe increased as globalization expanded its reach. In recent years, the correlation between U.S. inflation and global inflation reached historically extreme levels after the Covid shock. In the short term, however, we expect inflation dynamics to differ, offering tactical opportunities to distinguish regional exposures. In this paper, we investigate different ways of quantifying the synchronization trends of global inflation, offer some potential reasons behind why these trends have emerged, and discuss investment opportunities in the face of elevated inflation levels.

Is Inflation Synchronization an Increasing Trend or Part of the Cycle?

We begin our investigation into global inflation synchronization by quantitatively examining common inflation drivers and trends across countries.

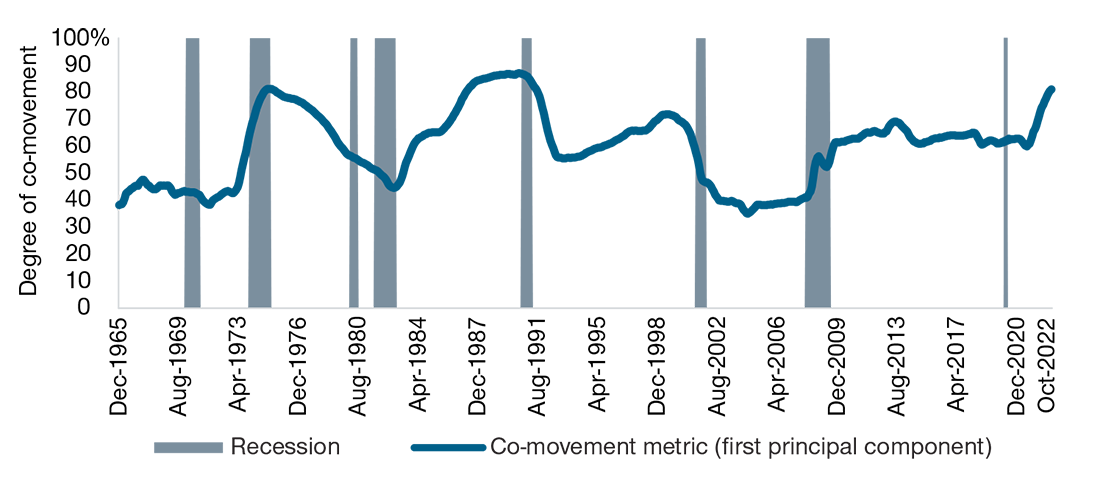

The common drivers of global inflation have followed a cyclical pattern (Figure 1).1 We focus on a five decade sample of consumer price index (CPI) inflation rates for the United States, the United Kingdom, Australia, Canada, Germany, and Japan (G-6), which altogether account for 71% of the advanced economies’ gross domestic product (GDP) and 41% of global GDP.2 Significant moves higher in the explanatory power of the first principal component follow large common inflation shocks in the 1970s (commodities) and in the 2020s (pandemic-related supply chain disruptions and the expansionary policy response). On average, the common inflation factor produced using principal component analysis (PCA) explains nearly 60% of the variance in G-6 inflation. When large-scale common inflation shocks have occurred in the past, this proportion has reached almost 80%.

Common Component of Global Inflation in G-6 Economies

(Fig. 1) First principal component from G-6 CPI inflation

Note: Using year-on-year percentage change in headline inflation from the G-6 from December 1965 to January 2023, we calculate the proportion of variance explained by the first principal component in a 10-year rolling window over all countries available for an entire 10-year time horizon. Shaded areas are NBER recessions.

Sources: CPI inflation from U.S. Bureau of Labor Statistics, Statistics Canada, Statistisches Bundesamt, UK Office for National Statistics, Australian Bureau of Statistics, Japan Statistics Bureau, Haver Analytics; analysis by T. Rowe Price.

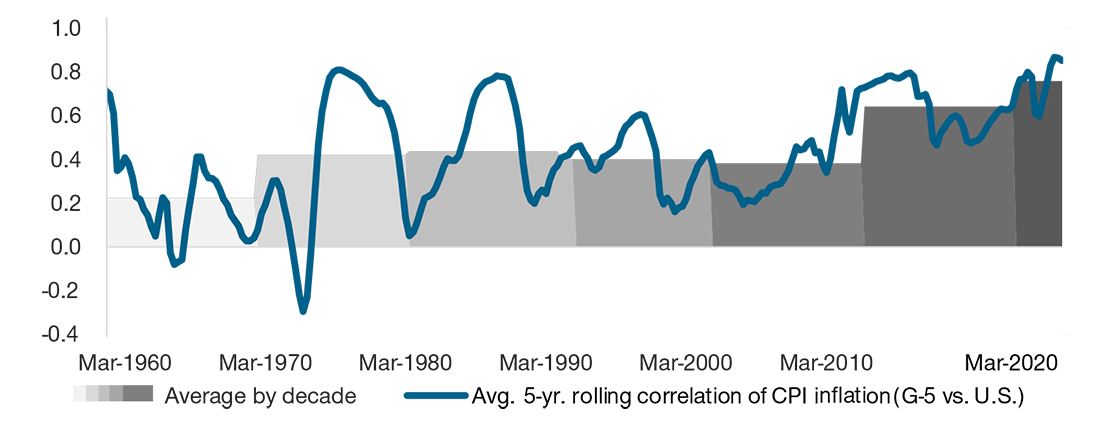

A similar cyclical pattern is evident when looking at the correlation of U.S. inflation and other developed economies’ inflation. The five-year average rolling correlation of U.S. CPI inflation with that of the UK, Australia, Canada, Germany, and Japan oscillated and substantially increased in response to common shocks. However, greater harmony in global inflation is more than just a product of commodity shocks.3 Since the mid-1990s, the trend in the five‑year rolling average correlation of CPI inflation in global economies to the U.S. has steadily increased (Figure 2).

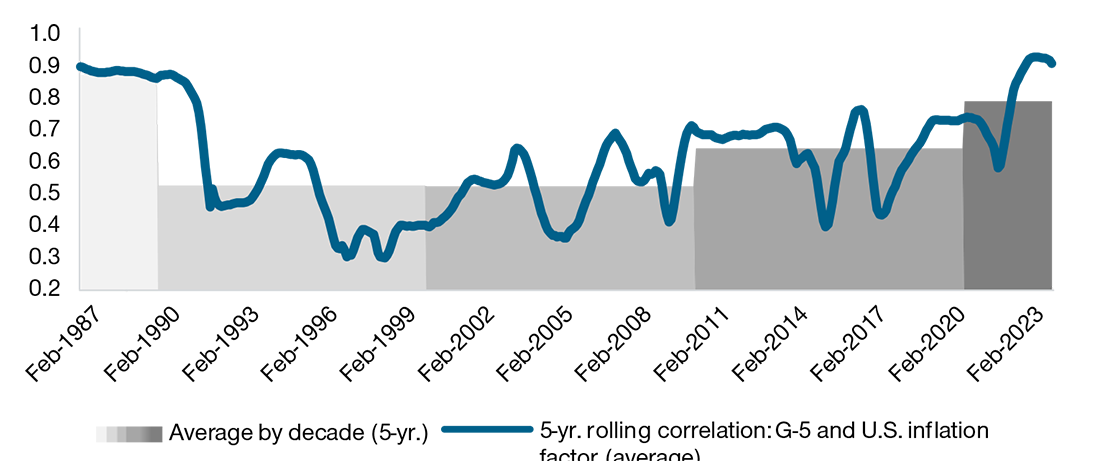

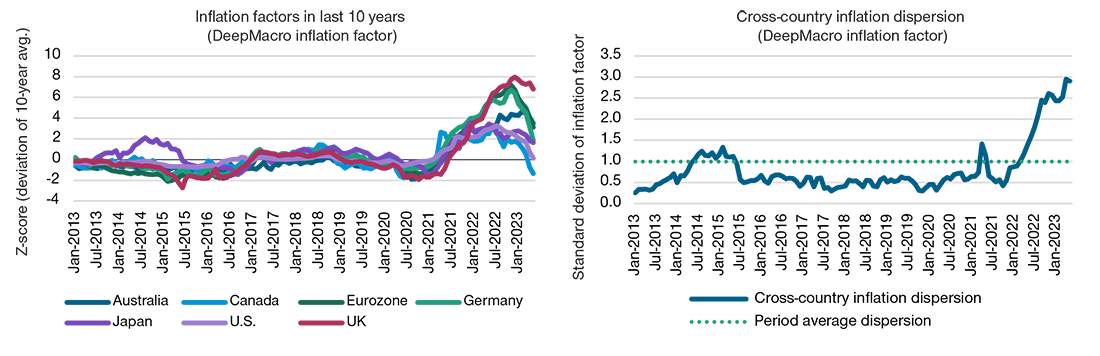

We found a more pronounced inflation synchronization trend, starting in the 1990s, when using a broader inflation metric.4 In this case, the inflation factor not only includes a consumer price inflation gauge, but also one for producer price inflation, trade costs or unit value indices, plus inflation sentiment and expectations. Our analysis indicates, similar to the one with CPI inflation, that there has been a marked and steep increase in global inflation synchronization since the 1990s. The unique post-pandemic global environment and policy responses have added to the heightened synchronization as the correlation is currently at historical highs (Figure 3).

The sustained synchronization in inflation trends among developed markets is likely attributable to globalization and the interconnectedness of economies through trade, global supply chain integration, and international capital mobility, as well as economic policy convergence (please refer to “Drivers of Inflation Convergence”).

Consumer Price Index Inflation Correlations

(Fig. 2) 5-year rolling average correlation of CPI inflation

As of March 2023.

Source: Haver Analytics. CPI year-on-year percentage change; WTI Cushing (average, in U.S. dollars per barrel) year-on-year percentage change. Oil shock included if year-on-year change was greater than 30%.

Correlation of U.S. CPI inflation with that of the UK, Australia, Canada, Germany, and Japan.

Graph shows average over countries. Analysis by T. Rowe Price.

Correlations Based on a Broader Inflation Factor

(Fig. 3) 5-year rolling average correlations of inflation factors

As of April 2023.

Five-year rolling average of rolling correlations of inflation factors for the U.S., UK, Australia, Canada, Germany, and Japan. Inflation factors are machine-learning estimates of the common driver of inflation, expressed as deviations from its 10-year mean.

Source: DeepMacro, LLC; analysis by T. Rowe Price.

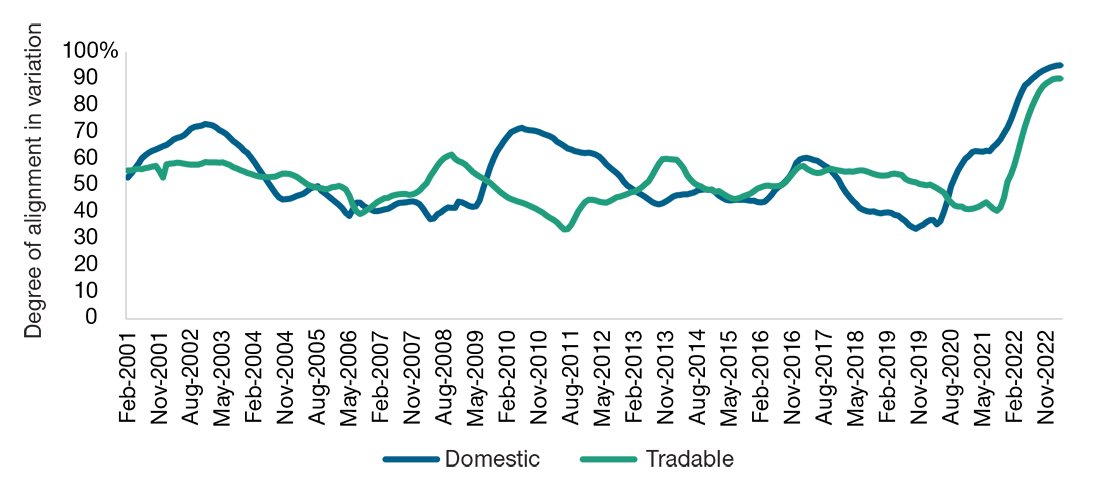

Tradable vs. Non-tradable Inflation

A large portion of global inflation synchronization historically has been driven by tradable goods inflation (food, non-energy commodities, and core goods) as opposed to domestic inflation (locally consumed services) (Figure 4). In the post-pandemic world, both domestic and tradable inflation5 have exhibited rapid increases in cross-country synchronicity concurrent with rising alignment in the co-movement in global headline inflation. This pattern is distinctly different from previous post‑recessionary episodes. During and after the Global Financial Crisis (GFC), for example, the common drivers of domestic and tradable inflation were negatively correlated.

Synchronization in Domestic and Tradable Goods Inflation

(Fig. 4) First principal component of domestic and tradable goods

Note: Using year-on-year percentage change in domestic prices (locally consumed services) and tradable goods prices (food, non-energy commodities, and core goods) from the G-6 economies from February 2001 to February 2023 we calculate the proportion of variance explained by the first principal component in a 10-year rolling window.

Sources: CPI inflation data from U.S. Bureau of Labor Statistics, Statistics Canada, Statistisches Bundesamt, UK Office for National Statistics, Australian Bureau of Statistics, Japan Statistics Bureau, Haver Analytics; analysis by T. Rowe Price.

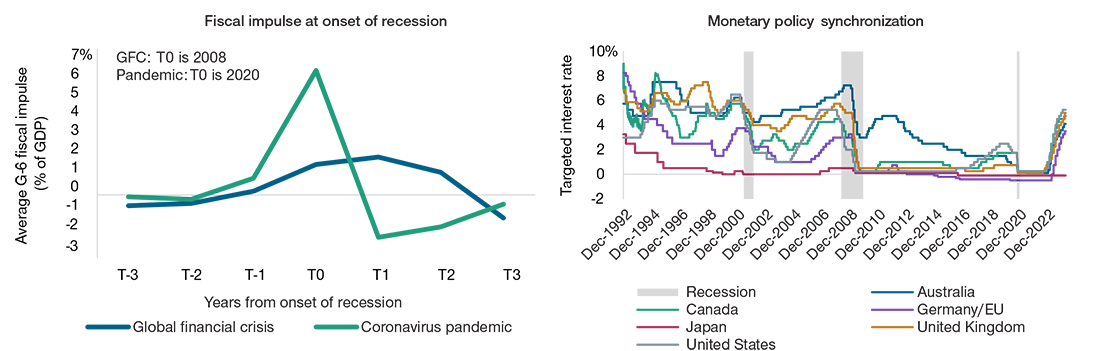

After the Covid shock, countries implemented a “sledgehammer” style response with drastically expansionary monetary and fiscal policies (Figure 5). We also observe that rate cuts during the GFC occurred quickly, but nowhere near as quickly and uniformly as in the coronavirus pandemic. Similarly, rates stayed at zero around the world for significantly longer after the pandemic with much greater uniformity (Figure 5, right-hand chart). These two factors combined with supply side restrictions and labor shortages help to explain the current extreme co-movement not only in tradable goods price inflation, but also in services inflation.

Inflation Divergence Ahead?

As it is commonly said, “What goes up must come down,” We expect to see mean reversion in these extreme correlation figures. Going forward, there is reason to believe global inflation synchronization has peaked and might revert, at least partially. In the short run this could be due to structural differences between economies and the way in which their policy responses unwind. Differential reversion could offer tactical investment opportunities, which we will explore in the next section. Here we focus on why the current state of global inflation could shift to one with greater dispersion of inflation rates across countries.

At present, the broader cross-country inflation dispersion metric6 is three times higher than the average for the last 10 years (Figure 6). This highlights two phenomena: The recent rise in inflation is out of the norm for most countries, and this level of shared extremeness is unlikely to persist given structural and geopolitical shifts within economies and differentiated outcomes and policy responses.

In Europe, Russia’s sudden invasion of Ukraine changed the gas and energy services supply model of the Continent and remains a risk for energy price stability going forward. Moreover, the United Kingdom is facing resilient inflation prints associated with unique labor shortages and higher trade costs due to Brexit.

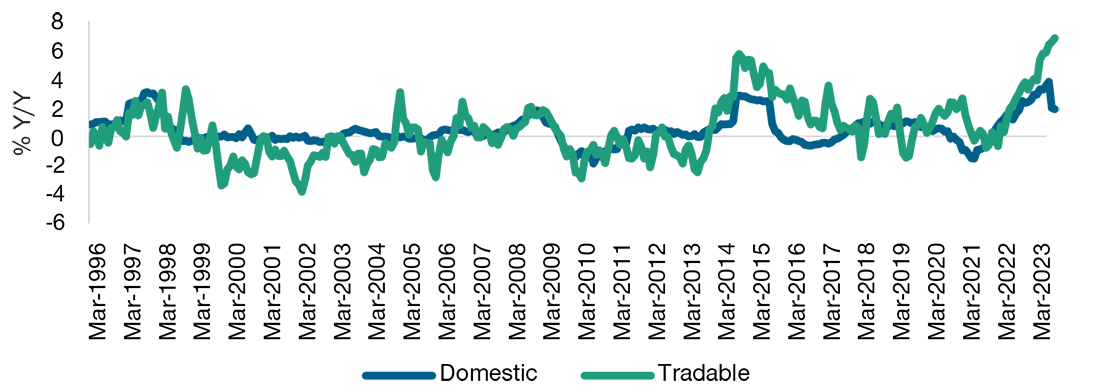

Japan’s monetary policy remains highly accommodative. It is the only country in our sample with a negative interest rate amid relatively lower, but still rising, inflation. The government introduced temporary subsidies for gasoline and electricity, which will continue to help contain the impact on headline inflation.7 Going forward, the threat to price stability is tradable goods inflation, which continues to steeply increase and is showing no signs of easing (Figure 7). Under this scenario, it is likely that the Bank of Japan will be forced to change its monetary policy stance.

Canada’s inflation is moderating faster than in other developed markets, as the Bank of Canada started its rate hiking cycle earlier. We expect Canada, as well as the U.S., to ease its monetary policy stance sooner than the other countries. In the near term, we expect the opposite for Australia. Inflation is expected to remain elevated and sticky. Gasoline and energy inflation will continue to be a large fraction of headline inflation, and the Reserve Bank of Australia has a long way to go in playing catch-up with a fast rise in wage growth.

Going forward, we may see more idiosyncratic policy and inflation responses, suggesting that the current high synchronization across the G-6 has peaked, offering geographic diversification of investment opportunities. These differences could be expressed through different positioning on duration, currency, and inflation-sensitive assets.

Tactical Investment Opportunities

Given signs of short-term inflation divergence, potential tactical investment opportunities are expected to emerge. Inflation is coming down faster in Canada, the U.S., and the eurozone. This could mean that their central banks start easing monetary policy sooner and that long‑term bonds in these countries experience the earliest rallies. In the medium term, the sovereign bonds of the countries with the most favorable inflation dynamics could potentially provide a better inflation-adjusted yield return potential, as well as potential for a larger capital gain.8

Policy Synchrony

(Fig. 5) G-6 fiscal and monetary policy responses during different recessions

Sources: (Left-hand chart) Haver, IMF; analysis by T. Rowe Price. Fiscal impulse is defined as the mean across our G-6 sample of the year-over-year change in the cyclically adjusted primary balance as a percent of GDP times minus one such that a positive year-over-year change in the primary fiscal balance indicates stimulative fiscal policy. (Right-hand chart) MacroBond, Federal Reserve, Royal Bank of Australia, Bank of Japan, Bank of England, Bundesbank, ECB, Bank of Canada. Before January 1999, we proxy the EU rate using the German Bundesbank rate.

Cross-Country Inflation Dispersion Has Increased

(Fig. 6) Analysis based on DeepMacro's inflation factor

As of April 2023.

Source: DeepMacro, LLC; analysis by T. Rowe Price.

On the other hand, for countries like the UK and Australia, where inflation seems to be more resilient, inflation-linked bonds could act as a good hedge against higher inflation.

What Does This Mean for Inflation‑Hedging Strategies?

Although we have highlighted some tactical opportunities in the near term to benefit from increasing divergence in local inflation trends, we believe that any portfolio should have a strategic allocation to asset classes that are reactive to inflation impulse. While there will always be idiosyncratic opportunities in the short term, the key finding of this paper is that it doesn’t matter where you are based since inflation trends tend to be shared globally over the long term. Hence, we believe that inflation-sensitive strategies that invest globally can be used effectively by investors in any location.

Japan’s Tradable vs. Non-tradable Inflation

(Fig. 7) Japan: domestic and tradable CPI

Note: Year-on-year percentage change in domestic prices (locally consumed services) and tradable goods prices (food, non-energy commodities, and core goods) for Japan from March 1996 to March 2023. Data from Japan Statistics Bureau, Haver Analytics; analysis by T. Rowe Price.

Based on our proprietary research, our multi-asset approach uses two strategic allocations to combat both expected and unexpected inflation regimes. Within the broader fixed income allocation, we use a dedicated allocation to inflation-linked bonds. Within equities, our research suggests that a diversified real assets portfolio may be an effective way to address both expected and unexpected inflation while simultaneously balancing risk and return considerations. This is due in part to the strong pricing power traditionally enjoyed by companies operating in the real assets space and also their inflation-sensitive earnings, which can help to counter some of the negative impacts from inflation.

In a traditional moderate-risk portfolio composed of 60% stocks and 40% bonds, this approach would generally result in 3% to 6% of the broader portfolio being allocated to real assets.

The Drivers of Inflation Convergence

- Globalization and supply chain integration: The increasing interconnectedness of economies through trade and financial flows has led to greater integration and interdependence. The integration of global supply chains has increased efficiency and lowered production costs. However, shocks in one part of the world can quickly spread to other regions, affecting inflation dynamics and leading to greater synchronization in this era of globalization.

- Economic policy convergence: Many countries have adopted similar economic policy frameworks, such as inflation targeting and flexible exchange rates, which aim at price stability and the anchoring of inflation expectations. As more countries pursue similar objectives and adopt comparable monetary policy strategies, their inflation rates tended to converge, contributing to global synchronization (see Figure 5).

- Capital mobility: Increased capital mobility has allowed for the swift movement of funds across borders. This has implications for inflation because capital flows can influence exchange rates, interest rates, and asset prices—all of which can have inflationary consequences.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward-looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. The historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements.

Keller, C., et al. (March 2, 2017), "The Future of Globalization," Barclays Live, https://live.barcap.com/PRC/servlets/dvsearch?docviewID=2295908&sourceArea=LB.

Uruçi, Blerina, et al. (2018), "Protectionism to intensify cost pressures in tradable goods sectors."

Baldwin, R. (2009), "The great trade collapse: What caused it and what does it mean?", Centre for Economic Policy Research.

Venditti, F., et al. (2021), "Globalization and inflation: Insights from the ECB Strategy Review," Centre for Economic Policy Research.

Bernanke, B.S. (1999), "Inflation Targeting," National Bureau of Economic Research.

Flood, R.P., & Rose, A.K. (2010), "Inflation targeting and business cycle synchronization," Journal of International Money and Finance.

Diwan, R., et al. (March 29, 2021), "Capital flow surges and rising income inequality," Federal Reserve Bank of San Francisco Economic Letter.

Benigno, G., et al. (May 2022), "The GSCPI: A New Barometer of Global Supply Chain Pressures," Federal Reserve Bank of New York Staff Reports.

Di Giovanni, J., et al. (July 2022), "Global supply chain pressures, international trade, and inflation," National Bureau of Economic Research Working Paper 30240.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.