June 2023 / INVESTMENT INSIGHTS

Disruption Is Losing Its Ability to Surprise

Are we heading for a “decade of the incumbent”?

Key Insights

- Ten years ago, the market underestimated the impact of disruptive technology. When the impact became clear, it fueled a boom in growth stocks.

- Incumbent firms that have been disrupted by new technology may now be underestimated by the market as many are responding by innovating themselves.

- Investors should consider disrupted firms as well as disruptors, paying particular attention to those that may be undervalued by the market.

While change may be constant, the pace and rapidity of change is not. In recent years, rapid technological development, fueled by the extraordinary growth of computing power, availability of data, and increased connectivity, has unleashed widespread innovation (and change) throughout the economy. Several companies have leveraged their innovation to create new markets and, in the process, generate outsized shareholder returns.

Netflix, for example, has reshaped how video entertainment is watched, and Amazon has redefined the shopping experience with its e‑commerce offering and its investment in a logistics network for fulfilment purposes. Tesla has reshaped the auto industry by introducing into the market electric vehicles that can compete with high‑end luxury cars in terms of features, price, and driving range. Apple, Google, and Microsoft have leveraged their core products to create an ecosystem that provides a differentiated experience for their personal and commercial users. These companies delivered average returns of more than 30% per annum over the decade to March 31, 2023.

Given that disruption is one of the primary residuals of innovation, it is not surprising that there has been significant disruption within a number of industries that has occurred alongside innovation. Many of the companies that have been the most disrupted and most negatively impacted by innovation are those that would be characterized as “value” stocks. Accordingly, the innovation that we have seen within our economy has been a strong tailwind for growth investing and a significant headwind for value investing. It has been a confusing time for those investors focused on valuation in that many of the disrupted companies have appeared cheap but, in retrospect, were in fact properly valued or even overvalued given deteriorating fundamentals. Looking forward, while innovation will continue, we believe disruption is better understood today and will therefore be less of a headwind for value investors in the years to come.

The Impact of Disruption Was Underestimated

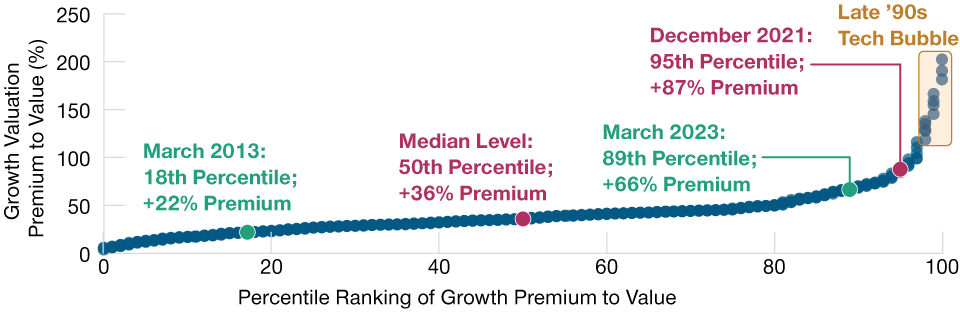

(Fig. 1) Innovation fueled a boom in growth stocks

As of March 31, 2023.

Past performance is not a reliable indicator of future performance.

Chart shows forward price‑to‑earnings ratio (weighted average) of Russell 1000 Growth Index divided by Russell 1000 Value Index, December 31, 1984 to March 31, 2023 (monthly observations).

Sources: Thomson Reuters, © 2023 Refinitiv. All rights reserved, and T. Rowe Price

calculations using data from FactSet Research Systems Inc. All rights reserved.

The Market Underestimated the Impact of Innovation

Ten years ago, the market underestimated the impact of innovation in two main ways: First, it underestimated the longer‑term growth and profitability of the new technologies, and second, it underestimated the residual impact of innovation on incumbent firms. As a result, as the true extent of the impact of innovation (and disruption) has become clear, growth stocks have significantly outperformed value stocks—the Russell 1000 Growth Index outperformed the Russell 1000 Value Index by 5.46% per annum over the past decade.

I believe, however, there are reasons that this dynamic could be changing. Innovation will continue, but going forward, innovation will occur in a market that is now expecting it. As a result, the ability of innovation to surprise investors has diminished substantially. As such, it is more difficult to make the case that disruptor firms are currently being underestimated—if anything, their potential may be overestimated. At the same time, disrupted firms may be underestimated by the market as many are responding to disruption by innovating themselves.

What does this mean from an investment perspective? Most investors balance valuation and fundamentals, but the weight they will place on these factors will vary. Value investors place more emphasis on how a company is valued relative to its fundamental strength; growth investors pay more attention to a company’s growth potential than its current valuation. However, a good company is not always the same thing as a good stock. For a stock to perform well, the fundamentals of the company typically need to exceed the expectations implied by the current valuation.

Does a “Decade of the Incumbent” Lie Ahead?

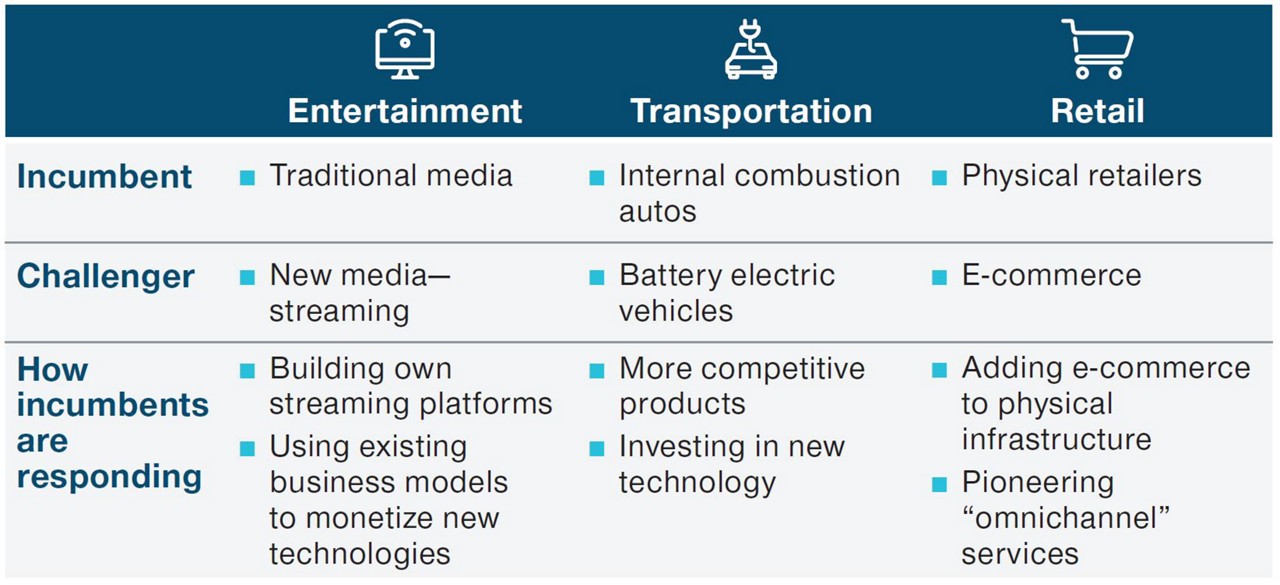

While the past decade could be characterized as the “decade of the disruptor,” we think it is possible that the next decade could be the “decade of the incumbent.” In certain industries, including media, automobiles, and retail, expectations for companies that have been disrupted appear too low.

Companies Rarely Stand Still in the Face of Disruption

(Fig. 2) Key disrupted industries are responding by innovating themselves

For Illustrative purposes only.

Source: T. Rowe Price.

Within media, we acknowledge the strength of the Netflix brand and the remarkable success that the company has enjoyed as a first mover in video streaming. New competitors in streaming have dented Netflix’s fundamentals in recent years, and we are likely to see continued competition for streaming subscriptions.

One more recent entrant into video streaming has been Disney. Going forward, Disney is likely to survive and thrive in streaming given the strength of its brands and intellectual property. It also has advantages over other media companies that may be underappreciated. For instance, if Disney creates a hit show through its Disney+ platform, it has additional ways to monetize that hit through its theme parks, toy licensing, and other avenues. As a result, we believe the full power of Disney’s business model is not fully understood by the market.

In the auto sector, Tesla is a technological leader in battery electric vehicles (BEVs) and has achieved a manufacturing scale that will make it challenging for competitors to match its profitability and compete on price. We would argue, however, that much of that advantage is reflected in its valuation. On the other hand, Volkswagen is getting very little credit for the billions it has spent over the years in developing a BEV platform that can compete globally for market share. As a result, we see potential upside to Volkswagen’s stock given low investor expectations.

Going forward, we believe the future of retail is likely an omnichannel one, where retailers offer products in virtual and physical stores. Amazon has achieved tremendous success in internet retail but has yet to achieve success in physical retail, despite years of trying. By contrast, companies like Wal‑Mart and Best Buy have interesting features that give them the potential to succeed in an omnichannel world. Already at scale in physical retail, Wal‑Mart is investing heavily in its e‑commerce capabilities. The wide geographic footprint of the company means it is already close to its customers and could have an edge in “last mile” delivery. Best Buy, meanwhile, has been willing to match e‑commerce pricing and create a compelling value proposition given its service capabilities and in‑house sales expertise. As a result, we believe both companies are well positioned to compete with Amazon in the years to come. Looking back, we might see that it was easier to achieve scale in omnichannel through having a brick‑and‑mortar presence than in starting with an e‑commerce presence.

Expectations for Disruptors May Exceed Reality

Although we ultimately do not know which of the disrupted companies will be successful in competing with the disruptors, we believe expectations continue to be low for the disrupted and high for the disruptors. If expectations of a disruptor firm are not met, the drawdown can be painful—there is no soft landing when fundamentals disappoint and valuations are full. On the flip side, firms that are not expected to succeed but whose fundamentals indicate they have strong potential to benefit from technological change can generate strong investment returns.

This does not, of course, mean that all incumbent firms are undervalued or that all disruptor firms are fairly valued or overvalued. Rather, it means that value investors need to manage disruption risk in a more rigorous and sophisticated way. Specifically, value investors should be open to investing in companies facing secular challenges, especially if the issues are fully priced into the stock. A particularly compelling area in which to invest are those companies where the challenges are misunderstood by the market and improperly being priced into the current stock price.

The secular threat of disruptive technology has not disappeared—it is just likely to occur differently in the future. As value investors, it is important that we continue to consider disrupted firms as well as disruptors and to pay close attention to where embedded expectations are either too onerous or too optimistic. This is harder work than either blindly following the crowd or being reflexively contrarian, but it is likely to deliver better results in the long term.

The stocks mentioned above represented the following allocations in the Equity Income Representative Portfolio, managed by John Linehan, as of March, 31, 2023: Walt Disney 1.34%, Volkswagen 1.08%, Best Buy 0.44%, Wal‑Mart 0.99%, Microsoft 1.56%.

The specific securities identified and described are provided for illustrative purposes only and do not represent recommendations. They do not represent all of the securities purchased or sold for advisory clients, and no assumptions should be made that investments in the securities identified and discussed were or will be profitable. The representative portfolio is an account we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy. Information regarding the representative portfolio and the other accounts in the strategy is available upon request.

General Portfolio Risks:

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Environment, social and governance (“ESG”) and sustainability (“SU”) risk—Due to environmental changes, shifting societal views, and an evolving regulatory landscape related to sustainability issues, the earnings and/or profitability of companies that a portfolio invests in may be impacted.

Equity risk—In general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

June 2023 / U.S. GOVERNMENT POLICY