June 2023 / VIDEO

Asset Allocation in an Uncertain Environment

We believe high yield bonds offer an attractive risk/reward trade-off in the current uncertain economic environment.

Key Insights

- Despite lingering economic headwinds, “the most anticipated recession ever” has, so far, failed to materialize.

- In an environment of economic resilience amid an uncertain outlook, we believe high yield bonds offer an attractive risk/reward trade-off.

Transcript

A year ago, in the face of runaway inflation, an extremely hawkish Fed, geopolitical turmoil, and rapidly deteriorating economic data, many investors were bracing for what seemed like an inevitable recession. In fact, so many investors were bracing for this scenario some commentators began calling it “the most anticipated recession ever.”

Surprisingly, that widely anticipated recession has not yet materialized even though many of the economic headwinds of 2022 remain firmly in place. As a result, a new name for the impending slowdown has emerged: “The Waiting for Godot Recession,” a reference to the Samuel Beckett play in which two characters await the arrival of a man named Godot, who ultimately never arrives.

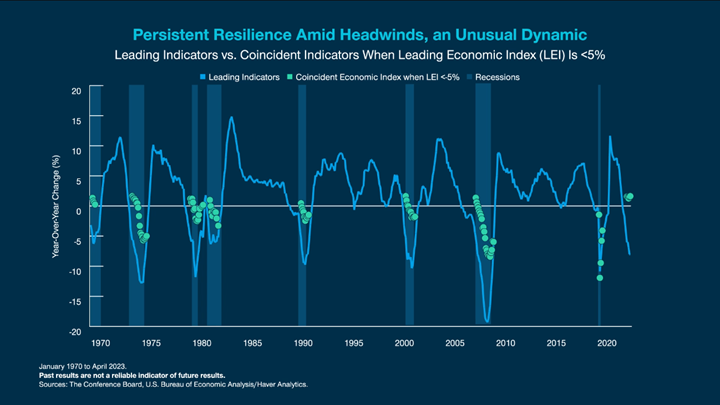

One way to illustrate the surprising resilience of the U.S. economy is to compare the year-over-year changes in The Conference Board’s Leading Economic Index and its Coincident Economic Index.

The Leading Economic Index, which includes components like building permits, manufacturers’ orders, and unemployment claims, is designed to give an indication of how the economy will behave in the next three to four months. Meanwhile, the Coincident Economic Index, which includes components like unemployment rate, manufacturing hours worked, and wages, is designed to give an indication as to how the economy is currently behaving.

Typically, as the Leading Index deteriorates, the Coincident Index follows the same trajectory only a few months later. But that has not been the case in 2023. The Leading Index has been falling sharply since July of last year, while the Coincident Index has remained stubbornly positive.

We can see just how unusual this dynamic is by isolating those periods when the Leading Index fell by 5% or more over the preceding 12 months and plotting what the Coincident Index did during the corresponding period. This shows that in every period since 1970 where the Leading Index fell sharply, the Coincident Index deteriorated as well-except for the current period.

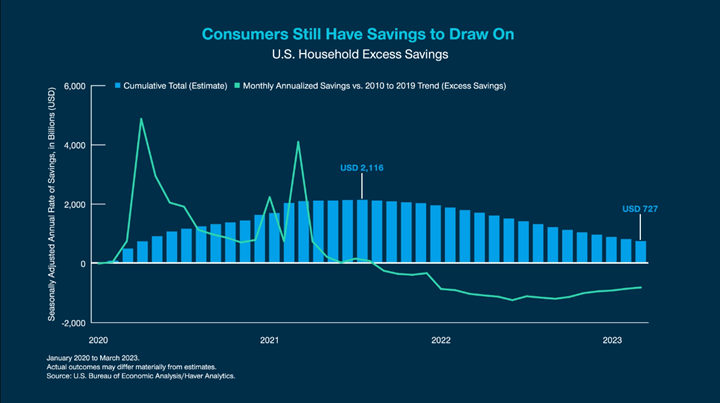

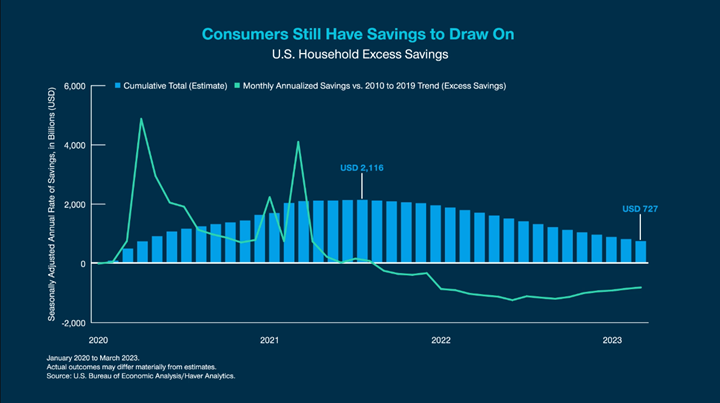

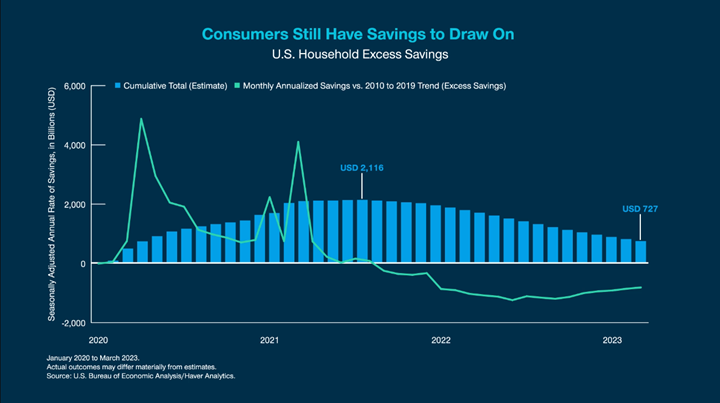

One reason for this anomaly is the strength of the U.S. consumer. While U.S. consumers’ excess savings have declined from pandemic highs, they do still have savings to draw on. They are also benefiting from falling inflation-particularly energy costs¬-and low unemployment.

Another reason is that manufacturing activity appears to be stabilizing. Inventories of manufactured goods were bloated coming into the year and are now back to normal levels. Meanwhile, despite elevated mortage rates, housing construction is picking up again because the number of houses for sale is very low.

However, while the near-term outlook is somewhat encouraging, caution is undoubtedly still warranted as these positive conditions may not last through the end of the year. This is because the lagged effects of higher rates and tighter bank credit conditions will remain significant headwinds to economic activity.

If this does indeed continue to be the “Waiting for Godot Recession,” receiving a healthy current yield while we wait may be a good idea. To that end, high yield bonds provide very attractive yields, but they can also be very economically sensitive. Still, there are reasons to believe high yield bonds would suffer less in a recesssionary scenario than normal.

Notably, the elevated current yield offers a sizable cushion against any bond price declines. Further, the current yield is evenly split between the credit spread and Treasury yield. This is important because in a recessionary scenario, the Treasury yield is likely to fall, as the market would quickly price in interest rate cuts by the Fed. So any increase in credit spreads is likely to be partially offset by a fall in Treasury yields.

It is also encouraging that high yield bond fundamentals remain quite strong. So active security selection could help to identify issuers that hold elevated interest coverage ratios and have low leverage ratios that should help them withstand a period of economic weakness.

In conclusion, given the current resilience of the U.S. economy, but uncertain economic outlook, our Asset Allocation Committee is overweight to high yield bonds as we believe the asset class offers an attractive risk/reward trade-off in the current environment.

Figure 1:

Figure 2:

Figure 3:

Figure 4:

Figure 5:

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.