SECURE 2.0

Could Boost the Financial Wellness Landscape

Optional provisions in new law could help improve retirement outcomes.

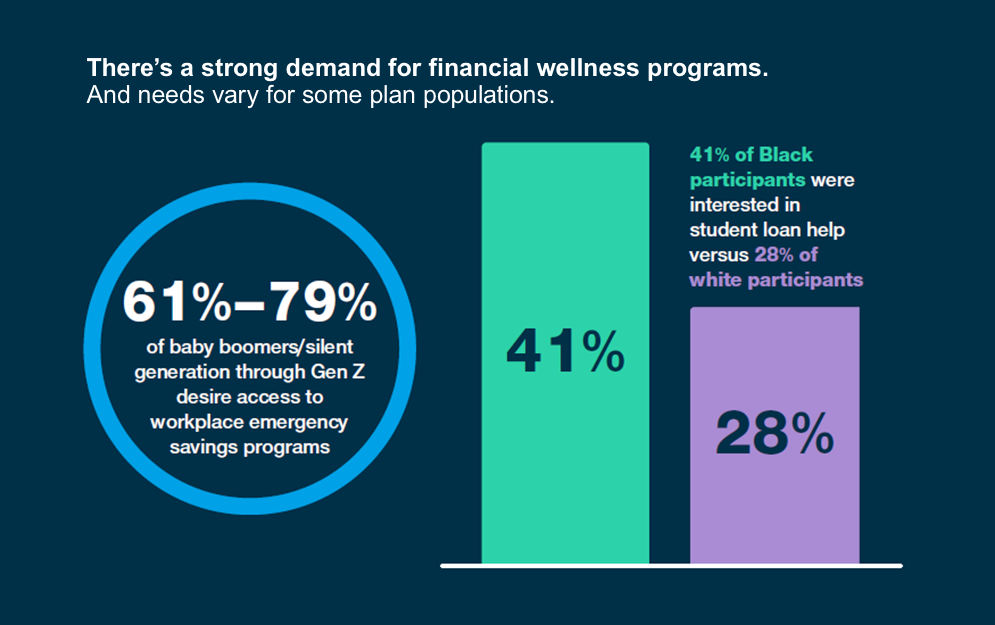

The demand for financial wellness solutions is strong among employees, especially programs that can help with emergency savings, financial education, and debt.

What are participants struggling with?

Retirement plan participants who took more than two loans per year have 60% lower account balances.

What can employers do?

See T. Rowe Price’s thoughts on next steps:

Participants are seeking financial wellness

Here are ways to help--in and out of the retirement plan.

The T. Rowe Price Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2022 survey was conducted between June 24 and July 22. It included 3,895 401(k) participants, full-time or part-time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute and have a balance of $1,000+. The survey also included 1,136 retirees who have retired with a Rollover IRA or left in plan 401(k) balance. NMG Consulting conducts this annual survey on behalf of T. Rowe Price.

*T. Rowe Price recordkeeping platform. Data represent participant behavior 2018–2022.

202306-2928749

There's so much we can do together to help you build your business—connect with us and let's discuss the possibilities.