FROM VISION TO REALITY

Visualize Retirement

Explore a new way to help clients visualize and prepare for the nonfinancial aspects of retirement.

Visualize the nonfinancial side of retirement

Retiring well is about more than just a number. And while it's important to make sure your clients are financially prepared, many preretirees have a retirement planning need that goes largely unaddressed: the lifestyle and emotional changes that retirement brings.

Complement your financial offer with Visualize Retirement

Program Overview

Visualize Retirement helps preretirees prepare for the nonfinancial aspects of retirement, focusing on the key drivers of retirement happiness and success—lifestyle, health care, and meaning. It starts with helping them explore and define their retirement vision through the five "W's."

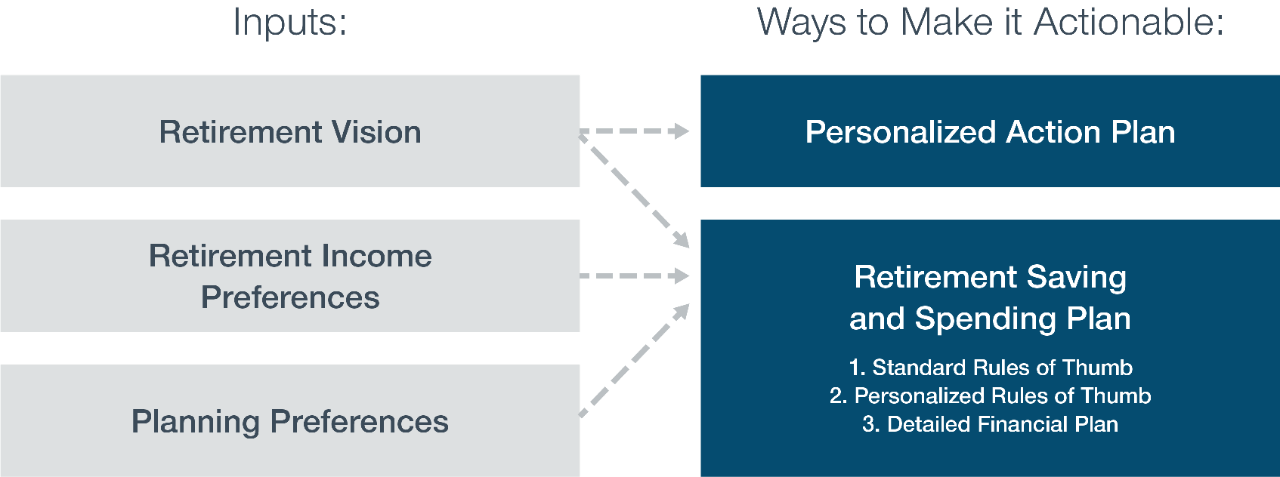

And then uses the retirement vision as an input—along with details about their retirement income and planning preferences—to help connect their vision to actionable next steps and the financial decisions needed to support that vision.

The program provides:

- a repeatable, scalable framework providing a full suite of materials focusing on the nonfinancial aspects of retirement

- a modular design that enables you to connect the program to the work you're already doing

Presentation

A presentation that walks preretirees through a three-step process to help make their retirement vision a reality.

Program Guide

Can be completed during the workshop or at home, either independently or with a spouse/partner to compare and contrast responses.

Preretiree resources to help make their vision a reality

Our Visualize Retirement materials are designed to go beyond the usual retirement clichés and get preretirees thinking about how their day-to-day lives, relationships, and health could look during retirement and working toward making their vision a reality.

Preretiree Workshop

A presentation that walks preretirees through a three-step process to help make their retirement vision a reality.

Preretiree Workbook

Can be completed during the workshop or at home, either independently or with a spouse/partner to compare and contrast responses.

Preretiree Checklist

A checklist that walks preretirees through age-triggered action steps and keeps them on the path toward realizing their vision for retirement.

Contact your T. Rowe Price representative to find out how we can take your plan to the next level.