December 2022 / MARKET OUTLOOK

Leaning Against the Wind

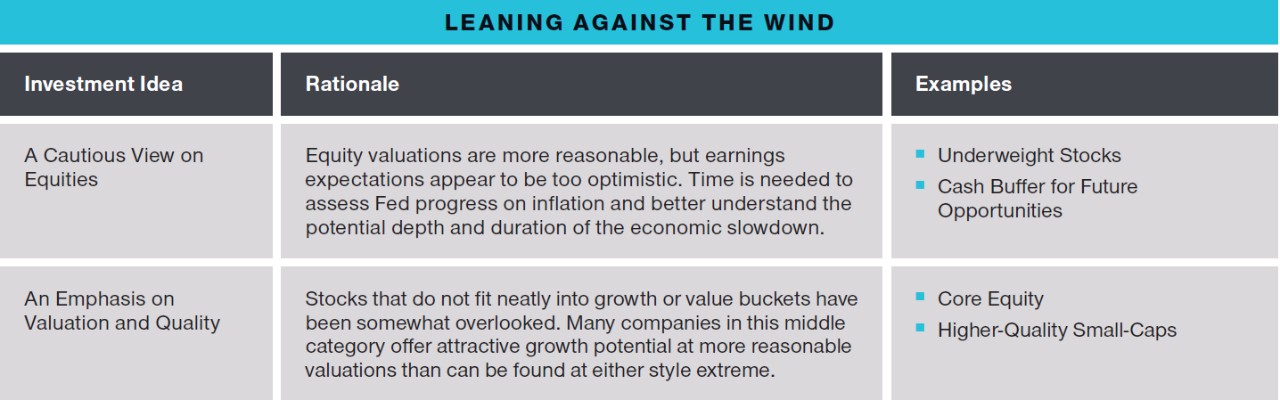

In the face of challenging headwinds, a careful contrarian approach could offer potential for investors.

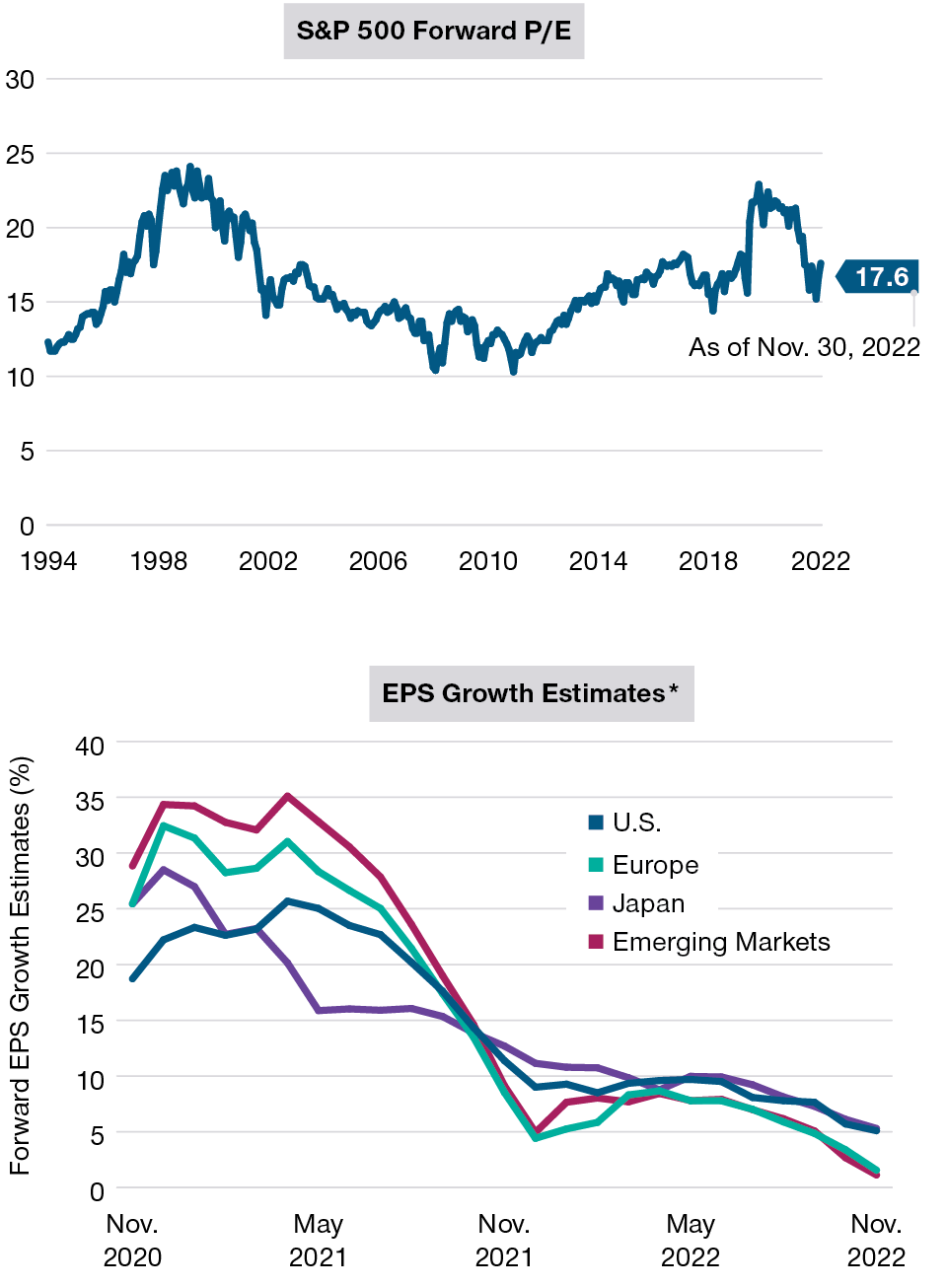

Soaring bond yields largely drove equity bear markets in 2022 by compressing valuation multiples. But in 2023, earnings growth could move to the top of the list of investor concerns.

As of the end of November, forward consensus estimates predicted mid‑single‑digit growth in earnings per share (EPS) for the U.S. and Japan over the following 12 months, and even slower EPS growth in Europe and the emerging markets (Figure 3, right).

Those estimates appear overly optimistic, Page cautions. Past U.S. recessions typically have resulted in 15% to 20% earnings declines for the S&P 500 Index, he notes.

Thomson lays out three possible U.S. earnings scenarios, the first reflecting a soft landing, the second a “normal” recession, and the third a recession plus a reversal in a 25‑year trend toward higher U.S. profit margins.

- In a soft‑landing scenario, recent EPS assumptions for the S&P 500 Index appear reasonable.

- A “normal” recession, based on the last four U.S. recessions (not including the 2008–2009 global financial crisis), could see EPS decline by 19% over the next 18 months.

- A recession with shrinking profit margins could produce EPS losses somewhat worse than in a “normal” recession.

Although U.S. equity valuations declined sharply in 2022, the price/earnings ratio (P/E) for the S&P 500 remained relatively high historically as of the end of November, Page notes (Figure 3, left). Excess liquidity and demand from passive investors could be propping up the index’s P/E, Page suggests, leaving it vulnerable to further compression if earnings disappoint.

Regime Change Brings New Leadership

Thomson notes that growth fears in 2022 boosted the popularity of stocks with relatively low historical exposure to market volatility and of “durable growers”—companies with track records of delivering relatively stable revenue and earnings growth. Both groups now appear overvalued, he says.

The trend toward higher inflation and interest rates, Thomson contends, marks a “regime change,” a structural shift with major implications for relative performance.

Equity Valuations Are Cheaper, but Earnings Growth Estimates Have Decelerated

(Fig. 3) 12‑Month Forward P/E on the S&P 500 Index and One‑Year Forward EPS Growth Estimates

As of November 30, 2022.

Past performance is not a reliable indicator of future performance. Actual outcomes may differ materially from estimates

*U.S. = S&P 500 Index, Europe = MSCI Europe Inde.x, Japan = MSCI Japan Index, Emerging Markets = MSCI Emerging Markets Index.

Sources: Standard & Poor’s, MSCI (see Additional Disclosures). T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

“We know from history that regime changes nearly always are associated with changes in market leadership,” he says.

The value style should be a long‑term beneficiary of this rotation, Thomson predicts. “I think we’re probably still in the early innings of this value cycle.”

As a group, value stocks historically have outperformed growth stocks in high‑inflation periods, Page notes. One reason: Higher inflation tends to push up interest rates, fattening lending margins for banks, which carry a heavy weight in the value universe.

Value also appears historically inexpensive relative to growth, Page adds, even though U.S. value benchmarks significantly outperformed their growth counterparts in 2022.

U.S. small‑cap stocks also could offer relative performance advantages if the U.S. economy doesn’t fall into deep recession in 2023. On average, small‑cap earnings have recovered more quickly than large‑cap earnings in past economic recoveries, Page points out. U.S. small‑cap valuations also appear cheap, both in historical terms and relative to large‑caps, he adds.

Thomson, however, cautions against painting the small‑cap universe with too broad a brush. “It’s a diverse asset class,” he notes. “The more cyclical parts should do well coming out of a recession. But small growth is likely to do less well.”

Tailwinds for Non‑U.S. Markets

Regime change—the economic kind— also could boost the appeal of non‑U.S. markets in 2023, Thomson argues.

- Value stocks, particularly banks, are less heavily weighted in the major U.S. indexes than in most non‑U.S. markets. So high interest rates and value leadership should favor the latter.

- Sectors that historically have proven resilient to inflation, such as energy and materials, are better represented in many non‑U.S. equity markets, especially emerging markets (EMs).

- The “de‑rating” of the big technology platform companies has only begun, Thomson argues. Big tech is underrepresented in most non‑U.S. equity markets, he notes.For USD‑based investors, a reversal in dollar strength would put a tailwind behind local currency returns in non‑U.S. markets.

- For USD‑based investors, a reversal in dollar strength would put a tailwind behind local currency returns in non‑U.S. markets.

Japan could be a less obvious beneficiary of these trends, Thomson says. If higher consumer inflation bleeds through into wage growth, it could shock the economy into a higher level of domestic demand, which would be good for Japanese equities.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

Download the full 2023 Global Market Outlook insights here

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.