May 2023 / INVESTMENT INSIGHTS

Asset Allocation in an Uncertain Environment

High yield bonds could offer an attractive risk/reward trade-off

Key Insights

- Despite lingering economic headwinds, “the most anticipated recession ever” has, so far, failed to materialize.

- In an environment of economic resilience amid an uncertain outlook, we believe high yield bonds offer an attractive risk/reward trade-off.

Many investors were bracing for a recession in 2022 as they muddled through an array of challenges, including runaway inflation, an extremely hawkish Federal Reserve, geopolitical turmoil, and rapidly deteriorating economic data.

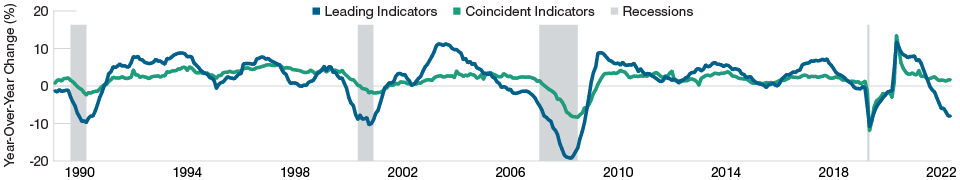

Despite these headwinds, the U.S. economy has remained surprisingly resilient, and the widely anticipated recession has not yet come to pass. The breakdown in the normal relationship between the year-over-year changes in the Conference Board’s Leading Economic Index and its Coincident Economic Index captures this unusual dynamic (Figure 1).

The leading index is designed to gauge how the economy might behave in the next three to four months. Typically, when this forward-looking indicator deteriorates, the coincident index, which reflects current economic conditions, follows the same trajectory within a few months. This time has been different. While the leading index has been falling sharply since July 2022, the coincident index has remained stubbornly positive.

The U.S. Economy Has Been Resilient

(Fig. 1) Leading indicators vs. coincident indicators

January 31, 1990, through April 30, 2023.

Past performance is not a reliable indicator of future performance.

Sources: The Conference Board, U.S. Bureau of Economic Analysis/Haver Analytics.

Key factors that have supported the economy remain in play. U.S. consumers still have excess savings to spend. They have also benefited from falling inflation—especially in energy costs—and low unemployment. Manufacturing activity also appears to be stabilizing, as bloated inventories have declined to normal levels. Further, despite elevated mortgage rates, housing construction is picking up in response to low supply.

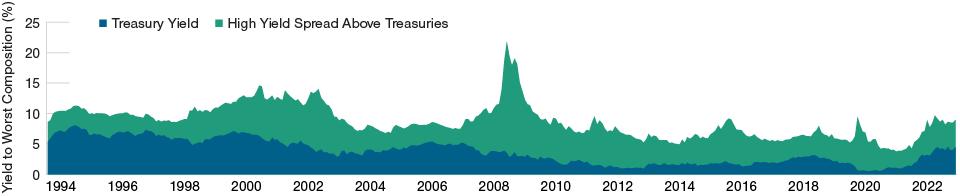

Still, caution is warranted. The lagged effects of higher interest rates and tighter bank credit conditions could weigh meaningfully on economic activity. In this uncertain environment, the healthy yield offered by high yield bonds could provide a buffer for investors (Figure 2).

High yield bonds tend to be sensitive to economic events. However, they currently offer attractive yields, and active security selection could help to identify issuers with elevated interest coverage ratios and low leverage ratios that might suffer less in a recessionary scenario. As a result, our Asset Allocation Committee is overweight to high yield bonds. We believe the asset class offers an attractive risk/reward trade-off in the current environment.

High Yield Bonds Currently Offer Attractive Yields

(Fig. 2) Yield composition of Bloomberg U.S. Corporate High Yield Index

January 31, 1994, through May 23, 2023.

Past performance is not a reliable indicator of future performance.

Index performance is for illustrative purposes only and is not indicative of any

specific investment. Investors cannot invest directly in an index.

Credit Spread—Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar maturity, high-quality government security.

Source: Bloomberg Index Services Limited. Please see Additional Disclosures.

Additional Disclosures

Bloomberg® and Bloomberg U.S. Corporate High Yield Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend T. Rowe Price. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to T. Rowe Price.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.