T. Rowe Price

T. Rowe Price

Global Structured Research Equity

An active, global equity portfolio seeking to provide long-term capital appreciation with low tracking error.

What is the Global Structured Research Equity Strategy?

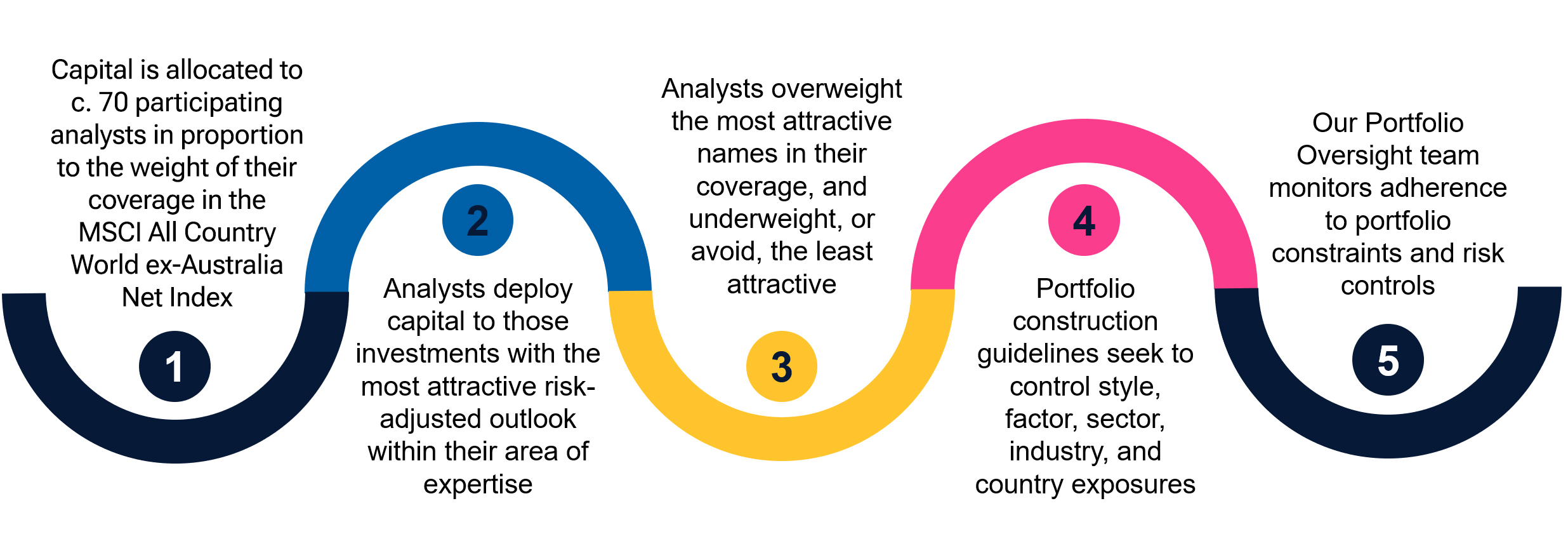

The Global Structured Research Equity Strategy (GSRS) is a core equity strategy designed to provide clients with broad exposure to the core segment of the global equity market. This actively managed portfolio leverages analyst-driven stock selection, typically involving around 70 analysts, seeks to achieve diversified global exposure with low tracking error relative to the MSCI All Country World ex Australia Net Index. The strategy holds between 750 and 1,000 stocks and operates under the oversight and discretion of portfolio managers, aiming to consistently add value through fundamental stock selection across a wide range of market environments.

Risk-managed alpha

Aims to offer low tracking error alternatives to passive allocations, providing benchmark-like risk characteristics with added opportunity for alpha generation.

Consistent performance

Pursues performance across different market environments with less exposure to extreme style or sector leadership changes.

Deeply researched

Provides access to the fundamental company insights of our c.70-strong world-class equity research team in the purest form.

How does it work?

The strategy utilises a clearly defined investment process which involves our industry-focused investment analysts making buy and sell decisions within their individual areas of expertise, subject to the oversight and discretion of the Portfolio Managers.

Ways to invest

The T. Rowe Price Global Structured Research Equity Strategy is available as both hedged and unhedged solution.

T. Rowe Price Global Structured Research Equity Fund- I Class

APIR: ETL4238AU

| Inception date | 29 July 2025 |

| Benchmark | MSCI All Country World ex Australia Net Index |

| No. of holdings | 750–1000 |

| Management fees and costs^ | 0.50% pa |

| Distribution | Annual |

Fund literature

^The Management Fee for the T. Rowe Price Global Structured Research Equity Fund - I Class is 0.50% p.a. and the Indirect Cost is 0.05% p.a. The indirect costs component is based on a reasonable estimate of the costs for the current financial year to date, adjusted to reflect a 12 month period. Full details of other fees and charges are available within the Fund's Product Disclosure Statement and Reference Guide.

T. Rowe Price Global Structured Research Equity Fund (Hedged)- I Class

APIR: ETL0944AU

| Inception date | 29 July 2025 |

| Benchmark | MSCI All Country World ex Australia Net Index (Hedged to AUD) |

| No. of holdings | 750–1000 |

| Management fees and costs^ | 0.52% pa |

| Distribution | Annual |

Fund literature

^The Management Fee for the T. Rowe Price Global Structured Research Equity Fund (Hedged) - I Class is 0.52% p.a. and the Indirect Cost is 0.05% p.a. The indirect costs component is based on a reasonable estimate of the costs for the current financial year to date, adjusted to reflect a 12 month period. Full details of other fees and charges are available within the Fund's Product Disclosure Statement and Reference Guide.

Quarterly Analyst Spotlight Webinar

Investment Analyst Vineet Khanna dives into the Utilities sector

Our Analyst Spotlight webinar series allows you to hear directly from the experts behind our Structured Research Equity strategies (SRS). For the last session of 2025, Portfolio Specialist Tamzin Manning was joined by Investment Analyst Vineet Khanna.

During the conversation with Tamzin, Vineet articulated his investment framework, discussed key themes such as artificial intelligence (AI), data center growth and electrification, and shared current perspectives on positioning and favored names within his investment sleeve.

Hi, I'm Tamzin Manning, Portfolio Specialist for the T. Rowe Price Structured Research or Equity Research Strategies.

Thanks so much for taking the time to join our webinar today.

At T. Rowe Price is often said that our number one competitive advantage of the firm is our research team.

Something that makes our research managed strategies compelling is that they provide access to the thinking and the insights of that world class research team in its purest form.

That's because it's a team of our research analysts, all experts in their respective industries that are the decision makers for a sleeve of the overall portfolio capitals allocated to this team of analysts in proportion to the weight of coverage at the benchmark.

And it's these participating analysts that decide which names they want to own, which they don't want to own and they make relative weighting decisions based on the risk reward profile that they anticipate.

The goal is to outperform the index via these fundamental stock decisions while tightly controlling risk.

We implement rules based portfolio construction and risk management to maintain industry sector and portfolio characteristics that are similar to the benchmark, therefore isolating our analyst stock selection skill at the alpha driver.

This also means that by design the strategy have the ability to outperform in all market environments, providing relative protection from market volatility and style Jifts.

This results in a smoother experience for the investor, compounding value over time.

And that's why I'm excited to be hosting today's webinar in our series that gives you the opportunity to hear directly from one of these analysts.

This quarter, I'm joined by Vineet Khanna, who's responsible for a sleeve of the portfolio focused on US utilities, which we've been joking has suddenly become the poor kid on the block thanks to AI and power needs.

So we'll certainly cover that topic today along with the other key topic of affordability.

So Vineet, thanks so much for joining us today.

Perhaps you can start by sharing your background path to T. Rowe Price and how that shaped your thinking on investing in utilities, power and clean tech.

Yeah, sure.

And, and thanks so much for having me.

You know, I've, I've spent my entire working career as an investor 7 here, seven years here at T. Rowe and then 14 years in the industry.

You know, over that time I've covered a wide swath of sectors, industrials, real estate, and then most recently for the last five years, I've been covering sort of the utilities, power and and clean energy sector.

And, you know, just taking a step back and, and thinking about some of the, the things that I've seen in my career that have sort of formed how I think about fundamental stock picking.

Really a lot of it comes down to cost curves and supply and demand.

So you could say all I needed was a Econ 101 class.

But you know, very quickly though, on the on the utility side, given they're regulated, it's quite different.

And there I like to use sort of this framework that I've built that's called the utility flywheel.

And, you know, flywheel is a interesting term, but I always like to say that the, the way to think about investing in utilities is the utilities that outperform typically have a construct where they have happy customers, which is a relative term, happy regulators and politicians.

And that feeds into supportive capital markets, then sort of allow for the utilities to kind of perpetuate, you know, satisfying customers.

And, and so that's sort of the, the foundation of how I invest in the utility side.

And, you know, on, on the, on the power and clean tech side, as I said before, cost curves and supply and demand are, are really important.

I, I really like to focus on sort of the unit economics where the cost curves are going and then what the incentive price is, right?

What is the price for new build?

And then we'll also want to consider, especially these days, sort of the challenges of, of supply responding to upticks in in demand.

Thanks for that Vineet.

So, you know, let's build on this a bit more.

And can you share how your framework manifests in, you know, how you're managing the sleeve of the portfolio?

Yeah, sure.

So on the, on the utility side, I typically like to think about sort of the bets that I make in, in two buckets, both kind of focused on, on the flywheel 1 is sort of an undervalued or overvalued flywheel where, you know, the, the flywheel is, is relatively static, but you know, working and just thinking about how that flywheel for that utility is valued relative to some of its peers.

The other bucket is sort of betting on utilities where the flywheel is broken for one reason or another, and we're making a bet on the flywheel sort of improving over time, which typically leads to sort of multiple expansion.

And so, you know, examples of this in the portfolio as of late include Excel Energy, PG&E and Sempra.

And then on the power and clean tech side, you know, like I said, inflating cost curves and structurally tight supply and demand.

And so names here are sort of the ones that can monetize the tight supply demand fundamentals that we have today.

And, you know, those include NextEra, First Solar, Vistra and Constellation.

Cool.

Thanks, Vineet.

Perhaps you can share, you know, a little bit more on, you know, one of these.

That's your top idea right now.

And, and what is the thesis there?

Yeah, sure.

I, you know, I'll spend some time on Excel Energy, which is, you know, the top bet in, in the in my sleeve.

And the thinking there is, you know, it's in large part it's a undervalued flywheel.

The company had some wildfires in their service territories over the last few years and you know, we've seen obviously an uptick in extreme weather events.

And so you know, the the market was increasingly concerned about the risks, the risk exposure to wildfires there.

And that sort of overlooked kind of a pretty constructive regulatory environment in the states that excels in alongside just a, a generating fleet transition story that would one, help affordability for customers going back to the happy customers dynamic, but two, also allow for sort of a, an efficient transition away from coal to things like solar, wind and storage.

So that that is sort of a a bet that while some of it is played out, we still think there's the Excel flywheel is still undervalued.

Thanks so much.

You know, it's fascinating to hear how that kind of works in in the portfolio.

So let's kind of go on to, you know, the, the topic of the day right now.

Data centres, you know, are in headlines non-stop, specifically power for data centres.

So how are you thinking about the implications for your coverage and you know what it means for the positioning that you have in your sleeve?

Yeah, I mean, this is just an an unprecedented amount of growth that we're sort of seeing and that's on the horizon from from AI and data centers, but also reassuring and just electrification, you know, EV adoption and the likes.

And what's interesting is, is we haven't seen growth like this since the 1950s and 60s when we had sort of the adoption of electric appliances and, and air conditioning.

And so, you know, thus far, just the, the nature of this growth has, has been so immense that the market has has sort of taken the perspective of a rising tide lifts all boats.

But, you know, I'm increasingly of the view that this will probably shift to more of a bifurcation of, of winners and losers.

And, and the reason for that, you know, kind of setting aside any AI bubble concerns, affordability is sort of the single biggest risk to my coverage and, and the sleeve it, as I've kind of discussed on the flywheel.

And so, you know, the, the utilities, the power companies, everyone needs to be really thoughtful about how they navigate affordability.

And really the the like best outcomes are those where the utilities can work well with sort of the other stakeholders.

And what I like to say is they will leverage the fact that the data center customers have a high willingness and a high ability to pay for electrons today.

And, and the way we really should think about it is, you know, back in the day, we had these economic development rates that were sort of lower rates to attract a, a factory or manufacturer to, to a certain state.

And those would bring jobs and, and the likes.

And there were sort of broader benefits to the community.

Data centers don't bring nearly as many jobs.

They do pay a lot in taxes.

But so the way that we can think about it from the utility side is we sort of have an inverse economic development rate whereby the, the utility actually pays more based on usage and, and premiums for things like clean power.

And that more that they pay can be effectively reduce the amount that other customers would pay.

So you know, how, how does that translate into positioning for the sleeve?

I know, I know that was a mouthful.

You know, simplistically it on the utility side, it just sort of layers on pretty well with regards to sort of affordability, right?

We want to make bets on utilities that either, you know, don't have data center growth or do have data center growth, but are seeing sort of an ability to improve affordability for others, right.

So we either want win wins or, you know, it's, it's better to, to steer clear of data center growth where it may be, you know, less good for, for existing customers and affordability.

Well, thanks.

So, you know, you mentioned the $1,000,000 question, you know, the moment the AI bubble bursts.

So, you know, how are you thinking about positioning your sleeve for this risk?

And you know, how does that compare to risk management for the affordability risks that you also mentioned?

Yeah, I know it's, it's a great question.

And, and one that, you know, frankly, I think all of us are, are spending a lot of time on these days.

And, you know, it's, it's sort of a lot of the more kind of traditional thinking about ensuring that you're not explicitly or implicitly making any bets on, you know, data centers being the only thing that matters or, you know, putting all your eggs in, you know, certain baskets, say, you know, nuclear or something like that.

And, and so, you know, one of the things that that I like to highlight from a risk management perspective and affordability perspective is setting aside AI and data centers, utilities just have large investment programs that are just focused on grid hardening and reliability.

The reality is, is we've kind of under invested in the grid over the past few years.

And you know, we, as I said before, we're seeing just an uptake in extreme weather events.

So there are a lot of utilities where they can have a steady good utility flywheel simply by doing kind of this, this blocking and tackling.

And so it unsurprisingly those are cheaper than some of their data center levered peers today.

So it's, it's a great way for, for us to get exposure in the portfolio to utilities that have great fundamental stories, but are sort of under appreciated or under loved by the market these days.

And, and so that I, I think is kind of the, the biggest focus.

But that also being said, as I discussed previously, like we also want to make sure we're making bets on AI data center build out because whether it be AI or just, you know, I guess plain old cloud computing, there will continue to be demand for data centers and really like being in the weeds on regulatory items is a great way to sort of parse out those winners and losers.

Great, thanks so much.

And and then so how are you thinking about the winners and losers, especially around those affordability risks?

Yeah, I mean, I, I think that like one of the things that that we want to be mindful of is, is if we take a step back and look at the utility sector for the past 2025 years, we've had some of these tailwinds, not necessarily specific to the sector, but the sector has benefited from them, right.

And those tailwinds are lower and falling interest rates lower and falling natural gas prices and then a lower corporate tax rate over the past 20 years.

That coupled with, you know, very little load growth and energy efficiency has actually allowed the, the real price of electricity to stay roughly flat the entire time, even though utility, you know, investments and, and profits are up, you know, 2-3, four times over that time period.

And, and so now as we sit here and think about the last few years and what the future looks like, all three of those are, are more likely to be headwinds than tailwinds.

And then we sort of have the addition of, you know, rising extreme climate events along with, you know, appropriately managing AI and data center growth.

And so, you know, affordability is, is kind of a, a tricky word to, to get your arms around or tricky thematic to get your arms around, right?

Because like, what is affordability?

Is it, you know, just having rates that are higher than the national average?

Or is it, you know, having your bill go up 20% year over year?

And, and you know, a lot of the work that we've done is it shows that really if you look at customer satisfaction scores, even in states where they might be relatively more expensive than other states, if the utility is reliable and the likes, you know, they still get pretty good customer satisfaction scores.

And so really it's about managing the magnitude of increases at any given point in time.

And, and so, you know, what we've seen very recently is a couple of of parts of the country, you know, most recently kind of the, the Mid-Atlantic has seen a large increase in the year over year bills, right?

And so now it's kind of become a, a big political issue.

And, and so, you know, how do we kind of think about the, the winners and losers?

I mean, you know, it's, it's some of the, the straightforward stuff, right?

It's look at sort of the stakeholders and see which utilities, communities, regulators and politicians are actually working together to, to come to some sort of agreement on how they can, you know, navigate through the inflationary pressures that they're seeing with or without data centers and AI.

On the flip side of that is, you know, we have parts of the country where, you know, it's, it's really tough for stakeholders to even agree on like what day it is, let alone addressing like affordability or reliability.

And so I, I think, you know, as we look out, you sort of want to think about, you know, where the tail risks is amongst the utilities in particular, right?

Who's going to have elections in the midterms or kind of in the near term?

Who's going to be in for a rate case?

Alternatively, you know, maybe we want to make bets on those that we believe are going to actually lower rates for customers or those that can, you know, stay out and don't really need to go in for for a rate case or anything on the regulatory front, right.

So, you know, changing tack a little bit here, you know, something that's really fascinating about, you know, these AI trends and you know, what we're touching on here today is that they really have implications across technology, energy, power, real estate, industrials.

Something that's really core to our culture here at T. Rowe Price is collaboration.

So perhaps you can share with, you know, how you work with other SRS analysts, you work with the broader platform just to help inform your own positioning in this space.

Yeah.

You know, I, I love this question.

It really gets to sort of the, the core of of, you know, why T. Rowe has been successful for so long.

And, you know, just some color on it.

I mean, at a high level, and this is probably straightforward, but just having sort of an open ongoing dialogue with sort of the various analysts, portfolio managers kind of throughout the platform.

You know, there's a lot of opportunity to sort of just engage with folks, you know, whether be through e-mail or in person or our investment research meetings.

But you know, most recently, kind of given the AI stuff, we've actually kind of, I don't want to say formalized, but kind of had a more concerted effort to work together and focus around kind of things that sit at the intersection of two or more sectors.

You know, examples are, are backup generation, power demand trends from each GPU generation, you know, real estate and, and, and things like that.

And so, you know, maybe I'll delve a little deeper.

You know, our, our focused effort here is if we kind of think about, you know, what the story is, what the headline is, there's a lot of excitement over the future of AI and, and all that good stuff.

But you know, our jobs as investors and stock pickers, it's a sort of ensure we're making bets where we don't think it's fundamentally priced in correctly.

And so we spent a lot of time as a group here thinking about sort of where the constraints are in, in sort of the AI build out and, and to achieving kind of what what folks expect from AAI.

And, you know, this really just helps us understand where the bottlenecks are, where they're getting worse, where they're getting better.

And then just kind of who has pricing power and, and you know, what's reflected in in the stock market.

So you know, one of the things that we did that I thought was really neat is you know, we were able to kind of take a bottoms up perspective on how much power demand we thought there would be from AI data centers and cloud data centers.

And really the way that we did it is we looked at sort of our forecast for semiconductor sales, storage sales and networking equipment sales, which sort of formed the IT equipment bucket of the data centers.

And then we sort of overlaid our views on the sales for.

You know, cooling requirements for the data center and other non IT equipment needs.

And this allowed us to sort of get a feel for like based on our forecast for various semiconductor sales, what that meant for power demand and land demand.

And you know, the industrial equipment that went behind providing that power.

And so this has really allowed us to kind of have a deep understanding of the various aspects.

And then also it sort of allows us to better kind of focus our attention on who the winners are as opposed to kind of this more recent, you know, rising tide lift all boats dynamic.

Oh, thanks.

Thanks for me.

That's, you know, really fascinating how everyone, you know, works together so closely, you know, on these decisions.

So, you know, last question from me before we, you know, take a couple from our, you know, audience today.

I think it's a it's a big one as well.

So, you know, can the utility and power sectors, you know, keep up with the demands of AI and cloud and also building on that, you know, what role can the federal government play and what does it mean for your bets?

You know, of course, noticing we've seen the headlines of the Westinghouse, Brookfield deal with the US government.

Yeah.

I mean, it's, you know, the, when I think about the constraints, power and interconnecting, whether it be the power of the data centers is certainly a big one.

And then, you know, I think labor and supply chain are also kind of up there.

When I, when I take a step back and I think about the ability of, you know, the US and sort of the global economy to solve some of these issues, I think we've gotten there on supply chain, right, where we're seeing the supply chain wait times come down.

And I suspect we'll get there on the power and interconnection side.

It'll take time, it'll be lopsided, but we'll get there.

The biggest constraint I think is sort of this labor dynamic.

It, it's just the hardest to solve, right?

We, you're sort of dealing with demographics and, you know, more folks historically have wanted to do things outside of kind of the skilled trades.

And, and so, you know, I, I sort of joked that instead of paying AI researchers hundreds of millions of dollars, we should allocate some portion of that to, to the skilled trades, the, the electricians and the welders.

And so, you know, I actually think, and I'll, I'll touch on the Westinghouse Brookfield deal, but an important role for the US government is really just around kind of ensuring we have the workforce that we need, because this is not like a A1 year or two year thing.

You know, this build out is going to take place over 5/10/15 years.

And then just, you know, on, on the Westinghouse Brookfield deal, it was kind of great to see the headline.

You know, it's, it's always exciting when you know, you see the US and and others kind of doing big, you know, deals that should help solve the problem.

And, you know, I, I think it was actually a pretty smart of the US government to sort of insert itself into the supply chain and just kick start the order of some of the long lead time items on the supply chain.

But now we kind of need to see the, the rest of it play out, which is sort of, can we get the project finance?

Can we get some utilities on board to potentially own this thing or to, to build it?

And then can we get some off takers, right.

And, and the baseline assumption is whether it be the government or the, you know, hyper scalers will have some sort of off takers.

But it is exciting and you know, interestingly enough, and, and I think is the right way to do it, the government is kind of thinking about 8 to 10 reactors, not just two more.

And the reason for that is just sort of the learning gains and the cost savings that you see when you build 8 to 10 sequentially.

And this is something we've seen play out in Korea.

And you know, the Koreans are sort of involved in this partnership.

So, you know, to answer your first question, can they keep up in the long term?

You know, I'm, I'm optimistic and hopeful.

We'll certainly have some, you know, pains and constraints along the way, but, you know, nothing that we can't sort of work through.

Thanks, Vineet.

Do you think there are opportunities for utilities to partner with tech companies to help manage demand and affordability or, you know, are these sectors mostly competing interests?

Yeah, I know it's, it's a wonderful question because you know, I, I think over the course of the last two to three years, the, that relationship has changed meaningfully for the better part of, you know, 10-15 years, the the hyper scalers, the data center companies didn't really need, need to have good working relationships with the utilities because there was an abundance of power out there and there was an abundance of land, right.

So it was a lot like easier to get the data center to get the power so on and so forth.

But that is obviously changed over the last couple of years.

And in addition to that, sort of the, the urgency of getting these AI data centers online has also kind of stepped up meaningfully.

And so we've seen sort of the AI data center companies kind of go from not caring to engage with the utilities to being seeing it much more as a partnership where, you know, the, the, the tech companies will say, hey, this is our, our plan for data center build out over the next 1020 years.

Is this something we can work on together?

Right.

So it's kind of some of that basic blocking and tackling.

But then what you're also seeing is kind of coming out of the the venture community, that the tech community is just all these startups that are, are finally, you know, ironically, bringing AI to the grid in a way that should allow the utilities and, and the tech companies to sort of benefit from unlocking, you know, excess capacity in, in ways that they might not have been able to do previously.

So, yeah, I, I suspect that that kind of working relationship will only get stronger and, and better in the future.

Great.

And so I think we can go to some questions from the audience now.

We'll, we'll try to get through a few of these because there's some, you know, really good ones here.

So, you know, let's go with, you know, given the historically low interest rates and now rising rate environments, how do you see the cost of capital impacting utilities, ability to invest in clean tech and infrastructure?

Yeah, I mean the, you know, the the rise in interest rates kind of more recently will definitely be a headwind to affordability all else equal.

And then you layer on the fact that we're we're sort of just having an increase in in capital requirements around investment.

The one thing I will say is that when we think about kind of the the last 10 or 15 years when rates were falling the the authorized RO ES returns on equity that that the regulators provide for the utilities, they did not fall as much as kind of the broader rate interest rates did.

And so in the same sort of vein on the way back up, I would expect that the authorized RO ES will sort of they'll be a lag in, you know, how quickly they rise.

That being said, you know, we've, we've quite recently seen scenarios where regulators sort of in the name of affordability will actually lower RO ES, even though rates have risen since the the rates were the set.

And so, yeah, this is something that like we're keeping an eye on and, you know, kind of going back to the flywheel, ensuring that like the utilities and the regulators are on the same page as it pertains to RO ES and investing in the likes.

But, and, and this wasn't your question, but actually, my, my bigger concern is, is just that the, you know, the, the capital markets, this is an unprecedented amount of investment that we're talking about here.

You know, over the next three to four years, the utility sector is going to invest $1 trillion in sort of the US grid, right?

This is, and I know a trillion dollars isn't what it used to be, but in utility land, it's still an immense amount of money.

And so, you know, just to fund all this, I do worry about the capital markets ability to provide the financing and that's even, you know, without the AI driven demand because the extreme weather and the hardening.

And so you know, that's certainly something I keep an eye on sort of the stress on the capital markets.

But you know, I'd be, I wouldn't be surprised if, if over the next few years we saw kind of more exotic investment structures and financing products to sort of help the utilities kind of make these investments.

Well, thank you.

So the next question we have is how do you factor ESG considerations into your investment framework for utilities and clean tech?

Are there any trends or regulations that you're watching particularly closely?

Yeah.

You know, I, I think at a high level, one of the things that I'd say is like worth noting is just that, you know, ESG has sort of had its ups and downs.

But one of the really exciting things is that renewables, in particular solar and storage and wind are now the cheapest form of incremental electrons.

So, you know, economic sort of can overwhelm any, anything else.

And we're now in a position where they are cheaper than new gas, certainly new nuclear, but also operating coal and in a lot of cases operating natural gas.

And the reason I say that is because it, it provides sort of a good foundation for approaching sort of the, the ESG considerations, right?

And, you know, just kind of going through the three like environmental utilities have to have good relationships with the communities that they serve.

And those communities are increasingly kind of feeling the negative effects from coal plants, the the pollution, the coal ash and methane leaks and in, you know, certain cases of pipelines exploding.

And so there's a lot more of a focus on safety and moving in clean forms of power.

And so one area where where I really differentiate myself is, is thinking about not necessarily what the generating fleet looks like today, but who is doing the best job of transitioning that fleet to cleaner, safer forms of electricity generation while also balancing affordability.

And you know, that kind of feeds into the social side just in sort of the the affordability dynamic.

But you know, I'd also note that typically things like gas bands or renewable portfolio standards hit the wallets of mid and lower income customers a lot more than they do kind of other customers.

And so companies need to be mindful of how they're implementing these things.

And then, you know, governance is relatively straightforward, but largely a big focus given utilities are are, you know, quite regulated and they have to engage with a broader range of stakeholders as it pertains to trends or regulations that that I'm watching.

The current administration is certainly kind of loosening some of the rules that were put in place from an emissions perspective in the past.

And so that may have implications for how long utilities keep coal plants or old gas plants online.

And you know, from a clean tech perspective, how much solar, wind and storage adoption we see.

So certainly something I'm watching.

But as I said before, setting all that aside, you know, economics kind of win the day and you know, increasingly getting incremental electrons on the grid, solar, wind and storage are are typically the cheapest option.

Great, thanks.

Thanks, Vineet.

So our next question from the audience focuses in on your flywheel.

So can you summarize the flywheel?

Like in short, what is your utility's flywheel?

Yeah, no, I'm happy to do it.

So, you know, the, the flywheel, the, the way I like to think about it is, you know, it's, it's a flywheel with a, a handful of elements on it.

And, and the elements I always start with is, is sort of the customer, right?

And if you have a happy customer, then that customer will not make noise and sort of, you know, harass the regulators and politicians.

And if the regulators and politicians feel that their customers are being treated well because typically their customers are also their constituents, they're more inclined to come to the table and work amicably, amicably with utilities.

And and so, you know, that sort of allows happy, happy customers flows to happy and friendly regulators and politicians.

And that allows for, you know, constructive regulatory outcomes and constructs that, you know, the capital markets folks like myself and folks on the fixed income side underwrite and view as favorable.

And you know, that sort of provides us with a willingness to continue to contribute capital into the utility sector.

And that lower cost of capital if, if we want to allocate more there typically allows the utility to further invest into providing kind of a, a better product, a a better customer experience.

And so it's, it's that sort of flywheel that how I is how I look at it.

And then just in terms of different investments, yeah, there might be two companies, 2 utilities that have similarly looking flywheels, but one trades at a, you know, a much higher multiple than the other.

And so often times a bed that that I'll make in, in, in the sleeve is just that the one that trades at a lower multiple will come up to, to where the other one is.

The other side of that is, is you know, in some scenarios the, the customers are not happy and so the, the politicians and the regulators aren't happy.

And, and so, you know, you typically need sort of a change agent or change in legislation or, or something that allows the utility to sort of just hit restart and kind of refresh that.

And you know that that was and continues to be sort of the the bet that we've made with some of the California utilities.

Great, thanks that, you know, really clarifies that.

So that that's great.

So one last question because I know we're running off on time, but it's always nice to end with a couple of specific stock ideas here.

So the final question I'm going to cover and if there's any more questions, please reach out to your T. Rowe Price representative and we'll get them asked for you.

But the last one we have time for today is, you know, can you elaborate on which specific utilities or power companies are best positioned to benefit from this data center boom and which ones might be more challenged?

Which ones are you using as a source of funds?

Yeah, no, it's a wonderful question.

And you know, I think just to hone in on a couple, one of the companies that I think is particularly well positioned both from a utility side and a power side is Next Era Energy.

So Next Era is sort of the owner of Florida Power and Light, one of the largest single utilities in the country.

Florida Power and Light is very well run, you know, just benchmarks really well against utility peers.

And so you know that business, we're continuing to see growth in Florida, population growth and the likes.

And so that business should continue to hum along and they will see some data center growth.

But the thing that I like there is a lot of that element of the thesis is really just about kind of organic population growth and not really data center growth.

That is 70% of their business.

The other 30% of their business is energy resources.

And you know, the simple way to think about that business is it's their unregulated power side of the business.

So, you know, they provide electrons and sometimes molecules, natural gas to customers in any shape or form.

And so they are world class and in building out renewable projects, but they've also built out a lot of natural gas power plants and the likes.

And they are the best positioned to leverage that skill set to partner with data center companies, hyperscalers, you know, you name it, to allow them to get sort of the power that they need.

And the other attributes that they need is, is is cheaply and as quickly as as possible.

Another one that that I sort of like and view as a winner is First Solar.

And First solar, you know, can benefit from the AI driven demand, but the company's also benefiting from tailwinds outside of that, namely, just as I've mentioned before, solar getting cheaper and they're being more interest in solar, but also this kind of onshoring that we're seeing in this America first kind of mindset that we're seeing.

And so First Solar manufacturers, the mass major, the vast majority of their panels here in the US and customers are willing to pay up for that in particular because that typically unlocks higher tax credits in, in the US here on.

On the flip side, you know, I, I think one of the nuances is the sector's growth rate is certainly moving higher as a result of all these exciting things.

But you know, at the end of the day, a lot of the sector is regulated and some of the companies are, are really quite large.

And so, you know, I, I think about Duke Energy, which is a, the biggest underweight in, in the sleeve.

And you know my thinking there is, is simply that while they do have exposure to some of the data center growth and the likes that we're seeing, it is a very large company.

And so simply to sort of move the needle requires just so much more of everything, CapEx, demand growth and the likes to sort of get a higher growth rate.

That kind of coupled with the fact that like they have a below average balance sheet sort of leads me into a position where it feels like it won't keep up on the AI data center side, on the growth side.

And also in sort of a economic downturn, it may also just sort of not be able to hold muster as well as some of its other peers.

Right.

Well, thanks so much.

So I guess with that, you know, I'll wrap things up.

Thanks to everyone in our audience today for joining and for the questions.

And thanks so much, Vineet.

I think you've done such a great job of demonstrating the benefit of having the absolute expert on each stock making the decisions in the portfolio with this kind of depth that you have here.

So thanks so much, and I'll look forward to seeing everyone again next quarter.

Thank you.

View our latest insights

Jun 2025

From the Field

Jun 2025

From the Field

Restoring America’s nuclear energy capacity—Digging in to potential impacts and implications

Jun 2025

In the Spotlight

Jun 2025

In the Spotlight

The Power of Alternative Data in Company Analysis

May 2025

From the Field

May 2025

From the Field

Dynamic markets may favor a hybrid of active and passive investing

Additional Disclosures

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

To the extent the Fund invests in another commingled vehicle(s), such vehicles may apply additional exclusions on top of what is stated in the PDS. Currently, the Fund will either hold securities directly or gain exposure by investing in the T. Rowe Price Funds SICAV Global Structure Research Equity Fund, which has additional exclusions relating to controversial weapons, coal, assault-style weapons, adult entertainment, gambling and conduct-based. More information around these exclusions, can be found on the Exclusion Policy on our webpage at troweprice.com.

Important Information

Available in Australia for Wholesale Clients only. Not for further distribution.

Equity Trustees Limited (“Equity Trustees”) (ABN: 46 004 031 298, AFSL: 240975), is the Responsible Entity for the T. Rowe Price Australian Unit Trusts ("the Fund"). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN: 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This material has been prepared by T. Rowe Price Australia Limited ("TRPAU") (ABN: 13 620 668 895, AFSL: 503741) to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither TRPAU, Equity Trustees nor any of its related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a guarantee or a reliable indicator of future results. You should obtain a copy of the Product Disclosure Statement, which is available from Equity Trustees (www.eqt.com.au/insto) or TRPAU (www.troweprice.com.au), before making a decision about whether to invest in the Fund named in this material.

The Fund’s Target Market Determination is available here. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

202507-4690755